In case you’ve been living under a rock, the market has been volatile this year, and income investments have performed extraordinarily poorly. To some, this is an exciting opportunity to look for undervalued gems to add to your portfolio (and we’ll share a variety of attractive opportunities in this report). But it’s also a good time to consider the dramatic ongoing changes to the way businesses operate, and to take a long hard look at where you’re going to invest your nest egg to generate the best income to support your needs going forward.

Growth versus Income and Value:

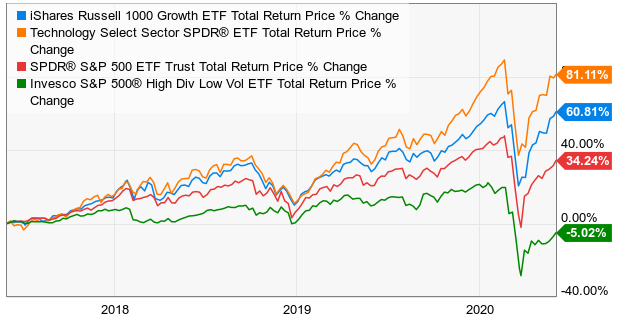

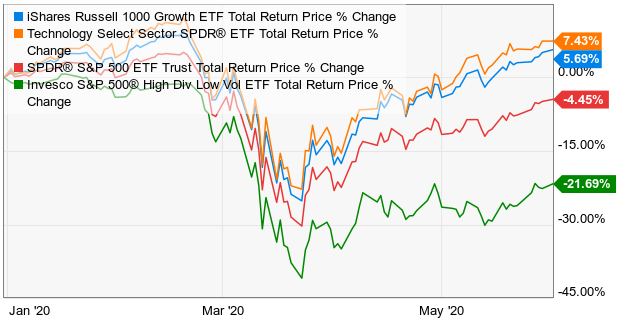

For starters, here is a look at the performance difference of Growth Stocks (Russell 1000 Growth), Technology (XLK) and High Dividend stocks (SPHD) in recent years.

As you can see, growth stocks (which tend to pay much lower dividends) have dramatically outperformed, and that includes this year to date, especially. This phenomenon may remind some investors of the tech bubble of the late 1990’s that ultimately burst in the early 2000’s and left many “dot com” investors without two nickels to rub together. This is a valid concern for investors today (considering growth stocks still don’t offer much in the way of dividend income), but they do offer something today (in 2020) that many of them did not offer in the year 2000. And that is revenue. Lots of revenue. Rapidly growing revenue with lots of room to keep growing. The internet was still young in 2000, but it has matured dramatically since then, and it has fundamentally changed the way the economy works. We are not suggesting anyone sell all their income investments, and dump everything into growth stocks (that would be ridiculous). But we are suggesting that investors consider investing some of their nest egg in investments that generate their high income from growth. We’ll have specific examples later in this report, along with specific examples of highly attractive traditional dividend investments too. But first, a quick performance review.

Performance Review:

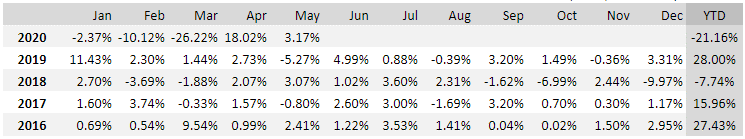

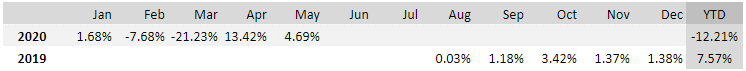

If you are new to Blue Harbinger, we hope you have discovered our Portfolio Tracker Tool by now. It includes all of our current holdings, along with ratings, such as “Buy,” “Top Buy,” “Hold,” and “Review.” And in case you are wondering, these rating are driven by the % difference between the current stock prices and our “Buy Under” prices (the prices update in real time (with up to a 15 minute lag) when the market is open). For example, one instance of a current “Top Buy” on the list right now is W.P. Carey REIT. This is a traditional “old school” big dividend investment, and we just shared an update on it at the end of last week (here is the link). But before we get into more specific opportunities, here is a look at the performance of our strategies through the end of May (these are excerpts from the Portfolio Tracker Tool):

Income Equity (Yield: 8.0%):

Disciplined Growth (aka “Income Via Growth”):

Alternative Fixed Income (Yield: 9.5%):

As you can see, this year has been volatile, the portfolio strategies were up again (for the second month in a row) in May (the big down month this year was March).

We include the performance of our “Income Via Growth” strategy to support the notion that growth stocks can generate income too, as mentioned earlier (if you invest in them through the right vehicle and if you sell some of your winners to generate spending cash). Here are two examples of “income via growth” stocks that we really like right now:

Income Via Growth Stocks:

TriplePoint Venture Group (TPVG), Yield: 13.7%: If you are looking for a differentiated source of high income, TriplePoint Venture Growth is a BDC that is worth considering. Not only does it provide a differentiated source of high income compared to traditional high income sectors and industries, but it trades at significant discount to it’s net asset value, even after it’s big rally in May (it was up nearly 25%). You can read our previous write-up on Triple Point here.

Automatic Data Processing (ADP), Yield: 2.5%: ADP is basically a payroll processing (and human resources) company, and it only offers a modest 2.5% dividend yield. However, because of it’s large size, it works with so many large companies in the US (and around the world), that it is basically a bet on the US and global economy. And that is a bet we are willing to take (we own the shares) because we believe the economy will continue to grow over the long-term, and ADP will grow right along with it. Plus, the shares are down 14% this year, thereby providing an attractive “buy low” opportunity for this long-term dividend growth juggernaut.

Adams Diversified Equity Fund (ADX), Yield: >6.0%: ADX is a closed-end fund that trades at a discounted price, offers a big dividend yield, and provides attractive diversified exposure to many sectors of the US economy (such as it’s 21% allocation to Top tech stocks—a sector many traditional income investments don’t provide). Just watch out for the big Q4 dividend (ADP pays three smaller dividends each year, followed by a big one in Q4 based on the longer-term performance of it’s holdings. This is a good one for many income investors to own, and you can read more about it here.

Facebook (FB), Yield: 0.0%: Facebook is a pure growth stock (zero dividend) with a lot of room to continue its rapid long-term growth (it generates almost all of its revenues through advertising, and it is basically a money printing machine). Even though this stock provides zero dividend income, it has the potential to provide a lot of long-term spending cash if you periodically sell some of your shares at a gain. This type of “income via growth” investment is not for everyone, but it can be a good way to add more diversified balance to your portfolio, and generate some powerful long-term gains (that can be spend by selling some of your shares periodically to generate cash).

Traditional Income Investment Opportunities:

However, we also appreciate that many investors are simply looking for attractive income-producing investments, so here are more details on a few specific attractive opportunities that we really like right now.

Fixed Income Closed-End Funds (BIT) and (PCI), Yield: 10.4% and 11.1%: We really like these two fixed income CEFs right now because they provide attractive and high monthly income payments, and because the shares have upside price appreciation potential. They both trade at discounted prices (i.e. their NAVs are too low) because panic in the fixed income markets caused a fear-driven sell off in March. The shares have slowly been making their way higher since then as the Fed works to pump an unlimited amount of liquidity back into the system, and both BIT and PCI have significantly more price appreciation potential in the months ahead (and that’s in addition to their big monthly income payments to investors). BIT is the BlackRock Muti-Sector Income Trust and PCI is the PIMCO Dynamic Credit and Mortgage Income Fund.

Ares Capital (ARCC), Yield: 10.5%: Ares is another big dividend BDC that we recently wrote about in great detail. It provides lending to smaller middle-market businesses, and many of these business have been particularly hard hit by the coronavirus. However, the fear this has created has caused the share price to trade at too low of a price, in our view. We believe ARCC has the financial wherewithal to weather the storm and come out stronger in the post-pandemic reality. Said differently, these shares have attractive price appreciation potential, and that is in addition to their big dividend yield.

Royce Small Cap CEFs (RVT) and (RMT), Yield: 8.9% and 9.4%: We like these two small cap close-end funds as a contrarian play. The Royce Value Trust (RVT) and Royce Micro Cap Trust (RMT) invest in smaller market capitalization stocks, and those stocks have been hit particularly hard by the pandemic. However, in our view, this has created an attractive buying opportunity as small business will come back. The saying is to be greedy when others are fearful, and fear has created an attractive buying opportunity in RVT and RMT.

AGNC Corp (AGNC), Yield: 10.9%: We’ve written about the attractive opportunities in select mortgage REITs multiple times recently, and AGNC is exceptionally attractive because it owns almost all government agency back mortgage securities (the ones issues by Freddie and Fannie, for example), and these are very safe (other than US treasuries, these are the safest). Nonetheless, market fear (particularly among mortgage REITs) has indiscriminately driven this share price lower, thereby creating an attractive buying opportunity. We expect these shares to rise higher in the quarters ahead, while they also keep paying you a big safe dividend yield.

Realty Income (O), Yield: 4.9%: Realty Income is an attractive monthly dividend paying REIT, and you’ll probably be kicking yourself in the future if you don’t take advantage of its current low price. It owns properties that have been hard hit by the pandemic, but as social-distancing restrictions recede, these shares will go higher. Realty Income is a “Top Buy.” Hold your nose, and buy—and you’ll be very happy with the long-term result.

The Bottom Line:

The market has been really volatile this year, and high-income investments have been hit particularly hard. We believe this has created a variety of attractive “buy low” opportunities as we have highlighted above. However, we also think it can be a good idea for long-term income-focused investors to sprinkle a few “income via growth” stocks into their portfolio too. Not only do they have the potential to provide high growth that you can “cash in” and spend, but if you let your winners run—growth stocks gains can compound over time, thereby increasing the size of your nest egg further.

Every investor has to decide what makes the most sense for their own personal investment portfolio—based on their individual goals and needs. We’re just pointing out that prudently diversifying your portfolio across attractive opportunities (such as the ones described in this report), can help you lower risks (diversification can reduce volatility and concentration risks), and it can also help you achieve your long-term income-focused goals. And disciplined, long-term investing has proven to be a winning strategy over and over again throughout history. It will this time too.