If you are not exhausted from recent stock market swings—congratulations! You either have nerves of steel or you’ve been wisely “Rip-Van-Winkling” the sensationalist media pundits as a sage long-term investor should. As you can see in the chart—the market has been very volatile this year. This report highlights some of the best investment opportunities now. We also review our current holdings and recent portfolio performance.

As you can see in the chart above, we’ve seen strong separation between the tech-heavy Nasdaq (particularly “social-distancing-friendly” tech stocks), the S&P 500 and small cap stocks (many of which have been harder hit by the coronavirus than their large cap business counterparts). And worth mentioning, energy stocks have been dramatically underperforming (again).

Portfolio Performance: Portfolio Tracker

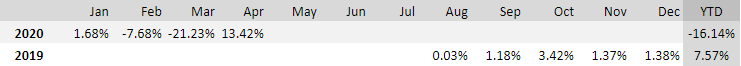

As for the Blue Harbinger portfolios’ performance, April was a fantastic month, and the long-term track records remain strong. You can access our updated Portfolio Tracker Tool here:

Income Via Growth Portfolio

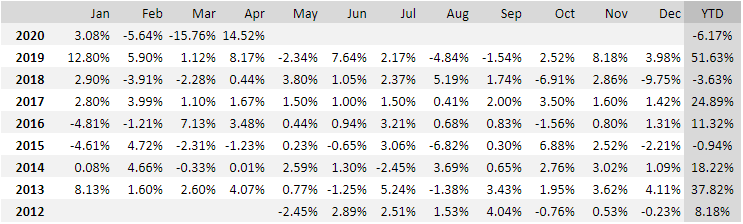

For starters, here is a look at our Income Via Growth (aka Disciplined Growth) portfolio performance, and it has been very healthy relative to the rest of the market.

The Income via Growth Portfolio is divided into two sleeves (i.e. steady growth and pure growth), and it has been the pure growth sleeve that has been performing extremely well. As you can see if you launch the portfolio tracker tool—names like Shopify (SHOP) and ServiceNow (NOW) have been big positive contributors. We also recently wrote members-only reports on Facebook (FB) and Paylocity (PCTY)—two stocks we believe have a lot more upside ahead.

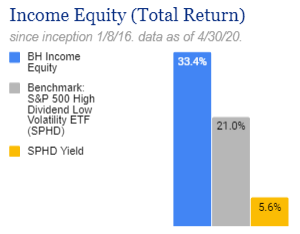

Income Equity Portfolio, Yield: 8.7%

Our Blue Harbinger Income Equity portfolio is focused on generating income, and the yield has mathematically risen this year as the overall market has been challenged. In our view, high-income securities are ripe for the picking, and we have highlighted a list of “Top Buys” in this category in the portfolio tracker tool. We’ll cover a few specific names in a moment, but first here is a look at the portfolio’s performance.

Within the income Equity portfolio, there are several groups of opportunities that are worth highlighting. First, mortgage REITs. In particular, we have recently added Annaly Capital (NLY) and AGNC Corp (AGNC) to the portfolio. Both offer high yields and significant price appreciation potential, as we explained in detail in our recent members-only reports. You can see where these position fit into the portfolio in the portfolio tracker. And for a little more perspective, here is a look at how mortgage REITs have performed relative to the S&P 500 recently. In our view, NLY and AGNC present very attractive buying opportunities.

Next, depending on your views/thoughts on the duration and long-term impacts of the coronavirus shutdown/effects, property REITs have sold off very hard, and continue to present very attractive investment opportunities, in our view. We continue to have a positive long-term view on the group, and continue to own select property REITs within our prudently diversified portfolio. In addition to the full details in the portfolio tracker, here is a chart of a few of our favorites, especially if you like to “buy low.”

We mentioned the terrible performance of the energy sector earlier. It’s been driven by low demand for energy (mainly oil) as economies are on coronavirus lockdown. We have no view on where the price of oil will go next, but we do believe demand won’t completely dry up for a very long time, and one of the best ways to play it is via midstream companies that have long-term contracts with big highly credit-worthy clients. We like (and own) The Williams Companies (WMB) Energy Transfer (ET) and even Phillips66 (PSX) (PSX has an underappreciated midstream business). We believe all these names will continue to rise in price much higher—and they’ll keep paying very nice dividends too.

Another opportunity we like right now is simply small caps. This is a contrarian play and a bet on the long-term resiliency of the US economy. As you’ve likely heard, many small businesses have been hit harder than larger business during this pandemic. This includes not only very small mom and pop businesses, but also simply small cap stocks. One way to play this is simply by owning small cap ETFs. We like iShares Small Cap Russell 2000 ETF (IWN) for example. We also like high yield Small Cap Closed-End Funds from Royce, including (RVT) and (RMT). We own both. FInally, we also like Business Development Companies including Ares Capital (ARCC) and Main Street Capital (MAIN). BDCs were set up by Congress in the 80’s to provide tax incentives to help provide financing to smaller businesses (not mom and pops, but companies with around 10 million to 250 million in annual revenues). BDCs have been hit very hard. We believe they have taken the elevator down and will take the escalator back up, which means they have significant price appreciation potential in the quarters and years ahead (knock on wood—no more big crisis) and they’ll keep providing big dividend payments to investors.

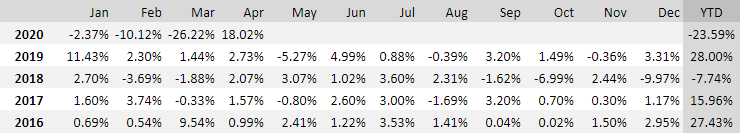

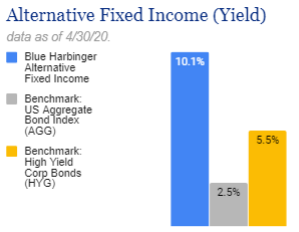

Alternative Fixed Income Portfolio, Yield: 10.3%

April was a rebound month for AIF as the portfolio was up 13.4%, and the yield sits at an attractive 10.3%. This portfolio consists of mainly fixed income (bonds) Closed-End Funds (CEFs) and preferred stocks.

Within AIF, we have been sharing members-only reports on attractive preferred stocks (such as Alterna Infrastructure (ALIN.PB), NuStar (NS.PC) and even preferred stock CEFs such as (JPS) and (JPI)). Many preferred stocks are trading below their customary $25 “face values” because of marketwide fear, but they will most likely eventually return to higher prices—and they’ll keep paying big dividends. This is a good time to pick up attractive big-dividend preferred stocks at discounted prices.

Further, as we have been writing about for our members, we believe Bond CEFs from PIMCO (such as (PCI)) and BlackRock (such as (BIT)) also continue to trade at attractively discounted prices (because of too much market fear/panic) and they pay big monthly dividends to investors. Again, this is an outstanding time to pick up big dividend payers at discounted prices to be added to your prudently diversified long-term portfolio.

Important Takeaways:

The market has been terrible this year and the pandemic has changed lives and businesses. It’s really not possible to overstate the real life pain the virus has caused for many people. However, the market will get better. And if you are a long-term investor, now continues to be an outstanding time to “buy low.” Of course there will be more volatility in the months and years ahead (that’s just how the market works), but long-term this market is going higher. The resiliency of America is incredible, and it’s not wise to bet against the American people. Be greedy when others are fearful. “Buy when there is blood in the streets.” Don’t let the lame stream news cycle dupe you into making bad investment decisions. Stick to your goals. Disciplined, prudently-diversified, long-term investing has proven to be a winning strategy over and over again throughout history, and it will this time too.