Shares of this Chinese, small-cap, “brand-focused,” e-commerce company trade in the US (on the Nasdaq) as an ADR (American Depositary Receipt), and they are currently priced attractively, especially considering the continuing powerful growth expectations for online commerce and for this company in particular. Rather than purchasing shares outright, this report review an attractive options trade that generates high upfront premium income (that you get to keep no matter what) and it gives you a chance of picking up shares of this attractive business at an even lower price (if the shares get put to you before expiration on January 15th). We believe this is an attractive trade to place today and potentially over the next few days—as long as the underlying share price doesn’t move too dramatically before then.

Baozun (BZUN)

The stock we are referring to is Baozun (BZUN)—a leading, brand-focused, e-commerce solutions company in China. Specifically, Baozun helps brands execute their e-commerce strategies by selling their goods and by providing services such as digital marketing, warehousing, fulfillment, customer service, information technology and store operations. Baozun generates all of its revenue from China, but the shares trade in the US on the Nasdaq as an ADR (BZUN). The share price has recently pulled back, thereby helping create an attractive setup for the trade in this report. For your reference, you can read our previous full report on Baozun here.

(Purple Line: Baozun share price)

The Trade:

Sell Put Options on Baozun (BZUN) with a strike price of $32.00 (approximately 10.7% out of the money—the current share price is $35.82), and an expiration date of January 15, 2021 (4-weeks away), and for a premium (upfront cash in your pocket) of at least $0.50 (or $50 because options contracts trade in lots of 100). This is a cash return of approximately 20.3% on an annualized basis ($0.50/$32.00) x (52-weeks / 4-weeks). Note: you have to keep $3,200 cash in your account ($32 x 100) if you don’t want to use margin.

And this trade not only generates attractive income for us now, but it gives us the possibility of owning shares of attractive Baozun at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own Baozun for the long-term, especially if it falls to a purchase price of only $32.00 (as described in our full Baozun article linked above, Baozun is an attractive business trading at an attractive price).

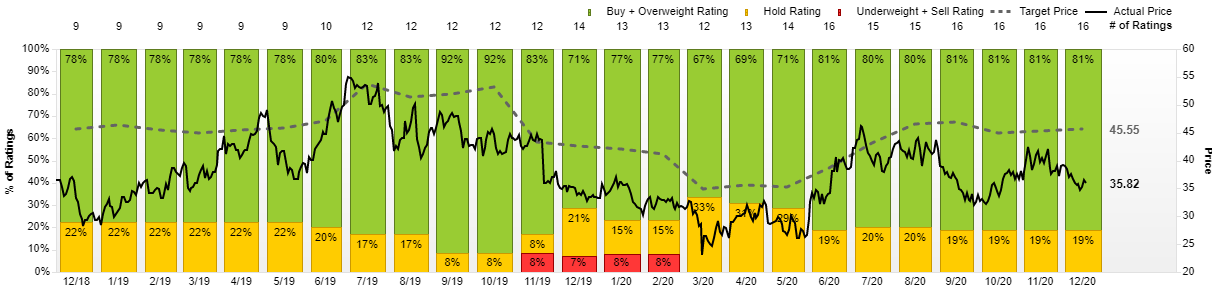

For a little more perspective, here is a look at the average price target ($45.55) of the 16 Wall Street analysts covering the stock and reporting to Factset.

These analyst believe the shares are already 21.3% undervalued (i.e. the shares have 27.1% upside—in their view). We think they’re right, and over the long-term the upside is even greater).

Your Opportunity:

We believe this is an attractive trade to place today and potentially over the next few days as long as the price of Baozun doesn't move too dramatically before then, and as long as you’re able to generate premium (income for selling, divided by put sale strike price) that you feel adequately compensates your for the risks.

Note: Depending on how badly you do (or don’t) want the shares put to you, you can adjust the strike price of this trade. For example, the upfront income increases if you raise the strike price to $33, but that also increases the chance that the shares get put to you before expiration in 4 weeks.

Our Thesis: Bauzun (BZUN)

Our thesis is simply that we believe Baozun is a very attractive business, and we’d be happy to pick up shares at the lower price of $32. Specifically, Baozun is a play on growth in online sales (as consumer purchasing behaviors continue to shift). The company (with its end-to-end offerings) is very well positioned to benefit from this shift (especially considering the opportunity is so large). And in our view, the recent share price decline (over the last few days) and low valuation provide an attractive opportunity for long-term investors. If you are not quite ready to pull the trigger on a long-term purchase—this trade puts some high upfront income in your pocket today and gives you a shot at picking up these attractive long-term shares at an even lower price.

Important Trade Considerations:

Two important considerations when dealing with options contracts are earnings announcement dates and dividends. However, neither is an issue for this trade because Baozun is not scheduled to announce earnings again until early March (well after this options contract expires) and it does not pay a dividend (if it did, we’d have to consider how that impacts the trade).

Conclusion:

When fear and volatility spike, so too does the upfront premium income available in the options market. And in the case of Baozun, the share price pull back in recent weeks has increased near-term volatility and fear—thereby increasing the upfront premium income on this trade. If the shares get put to us at our $32 strike price within the next 4-weeks (when the trade expires)—we’re happy to own them as a long-term investment. And if the shares do not get put to us, then we’re still happy to keep the attractive upfront premium income generated by this trade (we keep that premium income, no matter what).