The preferred shares of many companies are now trading at attractively discounted prices as the COVID-19 pandemic has stoked fear among investors. And in many cases, this fear is unwarranted. One attractive way to play this opportunity is through closed-end funds (“CEFs”) that focus primarily on preferred stocks. This article highlights two compelling closed-end funds, offering big monthly income payments to investors (they yield 7.6% and 7.8%, respectively), and they’re currently trading at attractively discounted prices (thereby providing an opportunity for some price appreciation—in addition to big monthly income).

The CEFs, both offered by Nuveen, are:

1. Preferred Income Fund (JPS), Yield: 7.6%

2. Preferred Income Term Fund (JPI), Yield: 7.8%

The two CEFs we are referring to (JPS and JPI) both offer attractive monthly income by investing at least 80% of their assets in preferred securities. If you don’t know, preferred shares are ahead of ordinary common shares in the capital structure, which means they are less risky. For example, sometimes when financials are tight, companies will cut the common share dividend just to free up more cash to support the preferred shares (also, preferreds have a priority claim on the company’s earnings and assets in case of adverse events such as bankruptcy). The objective of both funds (JPS and JPI) is to provide high current income consistent with capital preservation.

Primarily Investment Grade:

The funds focus primarily on high-quality issues, with ~77% of portfolio rated investment grade for JPS and ~65% for JPI. Further, as we’ll cover momentarily, many of the top holding are attractive.

(source: Nuveen)

Perpetual vs Term:

Important to note, JPS is a perpetual fund meaning investors can remain invested in the fund until they decide to sell their shares. On the contrary, JPI is a term fund which has a specified termination date at which time the fund’s portfolio is liquidated. Investors who own shares when the fund terminates receive a cash payment equal to the NAV per share at that time. JPI has a 12-year term and intends to liquidate on or before August 31, 2024.

Holdings Breakdown:

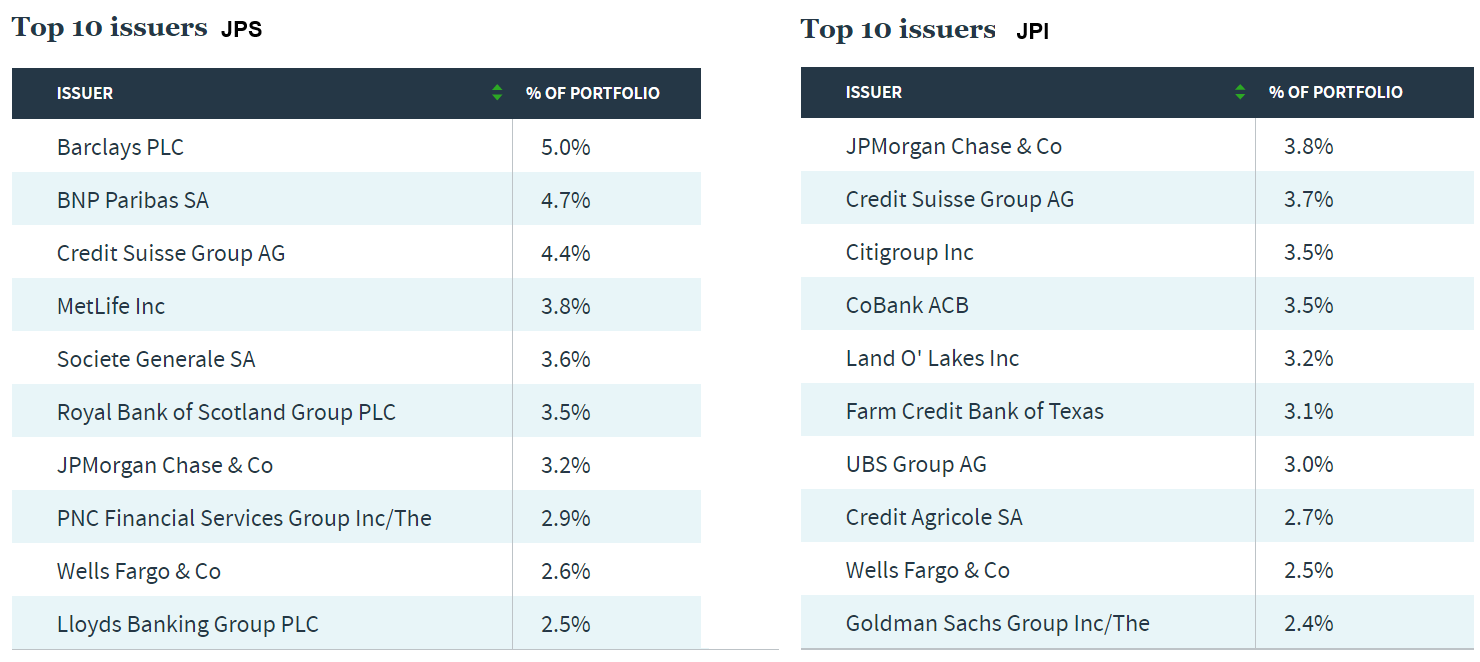

The top 10 holdings for both CEFs consist entirely of the financial services sector (banks and insurers) as seen in figure below. While a large concentration in one sector may cause skepticism among investors, we note that the highly regulated nature of the financial services sector coupled with investment grade ratings significantly mitigates concentration risk. Also, as can be seen below, most the top 10 holdings fall under the ‘Too Big to Fail’ category and as such there is negligible bankruptcy risk. Despite the large allocation to the financial services sector, both funds are relatively well diversified. While looking at the individual weights of each security in which the fund is invested, we see that the largest position accounts for just 5% of portfolio for JPS and 3.8% for JPI.

(source: Nuveen)

Fear Creates Opportunity:

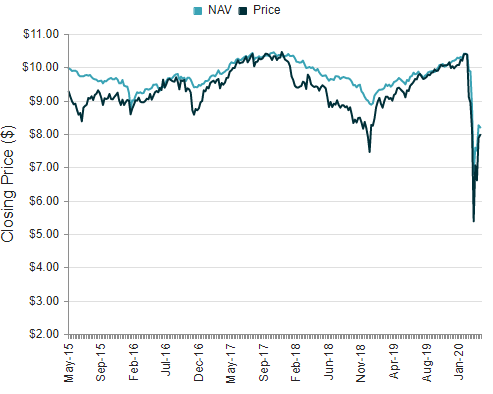

Many preferred stocks have experienced price declines during this COVID-19 pandemic, and we view this as a buying opportunity considering we don’t expect mass bankruptcies for the underlying companies issuing the preferred shares. Rather, we expect the overwhelming majority of the underlying companies to keep paying the big preferred dividends, and we expect the share prices to rebound higher to normal levels. We view this as a buying opportunity, and for perspective you can see the historical price charts of JPS and JPI below.

JPS Price vs NAV:

JPI Price vs NAV:

Leverage:

Another important consideration when selecting CEFs is their use of leverage (or borrowed money). Many CEFs are able to generate higher returns than individual securities by using leverage. For example, JPS and JPI use 41.3% and 39.1% leverage, respectively. This can magnify returns in the good times, but also magnify losses in the bad times. Important to note, these funds are generally able to borrow at lower rates than most individual investors, and they also have disciplined limits and procedures in place to manage the leverage. In our opinion, we are very comfortable with the use of leverage by JPS and JPI.

Discounts to NAV:

Also attractive, both JPS and JPI are trading at discounts to their Net Asset Values (or NAVs). The NAV is the market value of all the individual holdings in the fund. However, because the price of CEFs trade based on supply and demand (i.e. buying and selling pressure) they can trade at discounts or premiums to their NAVs. We greatly prefer to buy CEFs at a discount to their NAV because it means we are getting the underlying holdings (and all their dividend and income payments), on sale. You can get a flavor for the size an d variability in the size of the discounts for these funds in the tables below (and also in the price versus NAV charts provided earlier).

Fees:

Fees are another factor that should be considered when investing in closed-end funds. Keeping fees low is important fore investors because lower fees means higher net returns. In the case of JPS and JPI, we are comfortable with their fees (1.24% annual for both funds). This is the cost to have Nuveen build and manage these portfolios. Also, if we add in the cost of leverage (borrowed money) the fees for the funds rise to 3.02% and 2.72%, respectively. Again, we are comfortable with these fees, especially given the high income, and the current potential for price appreciation.

Conclusion:

If you are looking for a way to play the current attractive high-income opportunities that exist in the preferred space, JPS and JPI are worth considering. They both offer high income (paid monthly) and the potential for some share price appreciation (thanks to panicking investors that inappropriately hit the sell button thereby driving down the prices). Preferred shares are generally less volatile than common shares, and the space is currently trading at attractive levels (we don’t expect mass bankruptcies by the underlying preferred share issuers, rather we expect the preferred share prices to rise back to normal levels). In addition to the handful of attractive individual preferred stocks that we currently own, we also own these two attractive CEFs (JPI and JPS), and we are looking forward to price gains and ongoing big monthly dividends in the months and years ahead.