Trying to call a bottom to the current energy and coronavirus-driven market sell off is a fool’s errand. No body knows. It could end soon or it could be long and drawn out. However, it’s okay to be a bit opportunistic during the current market sell off, so long as it is consistent with your long-term investment goals (e.g. “be greedy when others are fearful,” and “buy when there is blood in the streets.”). One such opportunistic strategy that’s become particularly attractive now, is selling out-of-the-money income-generating put options on stocks you’d like to own for the long-term. This article shares one such example, Phillips 66 (PSX).

For perspective, the strategy (selling out-of-the-money. income-generating puts) has become much more attractive now because as volatility spikes, so too does the upfront premium income available in the options market. Further, the big risk of this trade is that the shares fall even further than they already have, and they get put to you at an even lower price. However, if it’s a stock you want to own for the long-term (such as big safe dividend-payer, Phillips 66) then that is actually a very good outcome. You get upfront income that you keep no matter what, and you get a chance to own an attractive long-term stock at a significantly lower price.

About Phillips 66

We’ll dive deep into the Phillips 66 details later in this report, but briefly, PSX is an energy manufacturing and logistics company. It has a diversified business model that reduces earnings volatility and delivers steady cash flows. It’s also a powerful dividend grower (it currently yields 5.5%, thanks to the recent indiscriminate market sell off).

The Trade:

Sell Put Options on Phillips 66 (PSX) with a strike price of $55 (11.4% out of the money), and an expiration date of April 17, 2020, and for a premium of $3.60 (this comes out to an enormous +62.9% of extra income on an annualized basis, ($3.60/$55) / (38 / 365 days). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of PSX at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own PSX, especially if it falls to a purchase price of $55 per share).

Your Opportunity:

We believe this is an attractive trade to place today, and potentially over the next several days, as long as the price of PSX doesn't move too dramatically before then (which is a tall order in this market), and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 35% to 45%, or greater. Importantly, given the current high levels of volatility, prices are moving quickly, and it makes sense to select a strike price at which you’d be comfortable having the shares put to you, so long as the premium income you generate is also compelling (and the premium income will likely be very high at most strike prices considering the high levels of fear and volatility in the market right now). Also important, we like PSX as a long-term investment.

Our Thesis:

Our thesis is simply that PSX shares have sold off inappropriately considering the company will continue to generate steady cash flows (in the short and mid-term) given the longer-term contract nature of its business. And over the long-term, energy markets will move back towards stability and PSX’s assets and business will continue have significant value. PSX should not have sold off as much as the rest of the energy sector, it remains a valuable long-term investment, and the very high premium income available in the options market is attractive (we’ll have much more to say about the business later in this report).

Important Trade Considerations:

Two important considerations when selling put options are dividends and earnings announcements because they can both impact the price and thereby impact your trade. In this particular case, they are both largely a non-issue because PSX isn’t expected to announce earnings again until April 29th (after this contract expires), and it won’r go ex-dividend again until May (also well after this contract expires). Had either of these events been scheduled for before this options contract expires, we’d need to be comfortable with the added risks (i.e. we’d need to receive more upfront premium income on the trade).

A Deeper Dive into Phillips 66:

Phillips 66 has a diversified business model that reduces earnings volatility and delivers steady cash flows. As such, it has been able to raise its dividend every year for the last seven consecutive years. The stock offers a solid dividend yield of 5.5% (thanks to the recent sell off, it’s mathematically increased significantly), along with a high probability of dividend increases and price appreciation. In the paragraphs below, we dig deeper into the sustainability of the dividend, the health of the business, the strength of the balance sheet, the company’s growth prospects, valuation, risks, and our opinion on why this is an attractive business and trade opportunity if you are a long-term income-focused investor.

About the Business:

As mentioned, Phillips 66 is a diversified energy manufacturing and logistics company engaged in processing, transportation, storage and marketing of petrochemical products. Phillips 66 was spun off from ConocoPhillips in 2012. The company operates via four segments:

Refining segment refines crude oil and other feedstocks into petroleum products such as gasoline, distillates and aviation fuels.

Midstream segment which gathers, processes, transports, and markets crude oil, natural gas, and other petroleum products in the U.S. The segment has a 50% stake in the general partnership (“GP”) of DCP Midstream Partners (DCP), and a 55% stake in Phillips 66 Midstream Partners (PSXP);

Chemicals segment manufactures and markets petrochemicals and plastics worldwide. It consists of its 50% equity investment in CPChem.

Marketing & Specialties segment markets refined petroleum products such as gasoline, distillates and aviation fuels, mainly in the United States and Europe.

Refining accounted for nearly 60% of PSX’s pre-tax earnings last year making it by far the most important segment of the company. However, refining can be a volatile business as it is tied to commodity prices. In contrast, the other non-refining businesses (chemicals, midstream and M&S) provide much more predictable returns on capital and cash flow, thereby helping to smooth out volatility from the refining segment. This is where PSX’s diversified business model is extremely advantageous, especially as compared to other energy (refining) businesses that PSX is often mistakenly lumped in with.

Strong, Competitive and Growing Dividend

PSX has delivered strong annual dividend growth since its listing in 2012, raising its dividend for the last seven consecutive years. The dividend has grown from $0.90 (annualized) in 2012 to $3.50 in 2019 representing a CAGR of ~21% during 2012-2019. At today’s price nears $62, PSX’s current yield equates to ~5.5%. For perspective, the chart below provides a look at the historical dividend per share over the last seven years.

(*Note: 2012 figure annualized. source: Company data)

The dividend appears extremely healthy in our view. For example, during Q419, PSX generated a solid $1.7 billion in cash flow from operating activities, which was more than enough to cover the $398 million it paid out in dividends. In its Febriary 2020 Investor Presentation, PSX remained confident in its cash flow generation potential and expects to generate nearly $7 billion in operating cash flow in 2020. Backing out cash capex of $3.3 billion (as guided by management), PSX will be left with $3.8 billion which can be allocated to shareholder returns. Thus, for 2020 we are likely to see another year of dividend increases by the company.

In addition to the strong dividend, investors also benefit from PSX’s share buyback program. Since listing, PSX has repurchased and exchanged 202 million shares or 32% of shares initially outstanding. This represents a return of over $16 billion through share repurchases and exchanges. It recently announced a new $3 billion share repurchase program, and may well accelerate the implementation of that program considering the recently depressed market price.

Diversity of Earnings – A Key Competitive Advantage

PSX’s diversification strategy has been a key reason earnings are so stable even though the underlying refining business can be volatile. PSX generated nearly 50% of its earnings from the Refining segment in 2018, which is also its most cyclical and volatile segment (as shown in chart below).

(source: PSX’s 10-k and 10-q)

In order to reduce cyclicality, PSX has been investing significantly in growing its other business, especially the Midstream segment. For 2020, PSX plans to invest nearly $2 billion in its Midstream business, the highest among all its segments. The major Midstream capital projects for 2020 include Sweeny Fracs 2, 3 and 4, the Red Oak and Liberty crude oil pipelines and the South Texas Gateway Terminal. While Refining continues to be an important and significant source of cash generation, we can clearly see the impact of the growth investments (see chart below). 2015 and the last 12 months through third quarter 2019 had very comparable realized crack spreads in Refining. Over this time period, operating cash flow increased from $5.7 billion to $7.3 billion, with a significant portion of the increase coming from Midstream growth. Additionally, the company plans to take the surplus FCF from refining and use that to fund growth in other businesses.

(source: Company Presentation)

Strong Balance Sheet

PSX’s balance sheet is very strong with no major debt maturities on the horizon, plenty of available liquidity and low leverage. PSX’s debt maturity profile extends almost 30 years. The debt maturities are very manageable, without significant refinancing risks in any given year. In fact, the company intends to pay off the 2020 and 2021 maturities without refinancing.

source: Factset

As of the end of Q4, PSX had access to significant liquidity, including over $1.6 billion in cash and short-term maturities, $8.5 billion in short-term receivables, and another $5 billion plus of capacity under its revolving credit facilities. This provides flexibility to continue to pursue its aggressive expansion plans across business segments.

source: Factset

Additionally, leverage is low and allows PSX the flexibility to expand the balance sheet if any opportunity arises. The consolidated debt to capital ratio has been in the range of 25%-30% for PSX since 2015.

source: Factset

The investment grade credit rating A3 (Moody’s) and BBB+ (S&P) provides PSX with easy access to capital markets and plenty of capital at lower rates. The chart below highlights PSX’s low leverage.

(source: Company Presentation)

Robust EBITDA Generation and Peer Leading ROCE

Over the last 3-years, PSX’s adjusted return on capital employed (ROCE) was 12%, well above its peer group average. It is important to note that this comparison is not only against just other refiners but a broader peer group including Chemical and Midstream players.

Further, PSX generated a powerful $7.6 billion of adjusted EBITDA in 2019. And its highly diversified portfolio provides it with a competitive advantage versus peers and allows the company to generate strong EBITDA through the market cycles. In particular, the continued growth of fee-based earnings from the Midstream business enhances the stability of the results

source: Investor Presentation

Further, PSX expects to increase its EBITDA by over $2 billion to reach $11 billion by 2022 driven by various growth and return projects.

(source: Company Presentation)

IMO 2020 – Tailwind for Refiners

PSX noted that IMO 2020 will be a tailwind for refining margins. IMO 2020 which went into effect from January 1, 2020 is a new UN regulation that lowers the maximum sulfur content of shipping fuel to 0.5% from 3.5%. Thus, shipping companies are forced to buy more heavily refined, lower sulfur fuel for their ships. This regulation will significantly benefit high complexity refiners such as Phillips 66 relative to low complexity refiners. The crack spreads are widening which should improve profitability. The diesel crack which has averaged about $13 a barrel over the last 10 years is now indicating almost $18 a barrel crack for 2020, almost 4.5 a barrel wider. Every $1 per barrel change in the diesel crack is about $300 million a year of incremental EBITDA for PSX’s Refining segment.

History of Outperformance

In a hat tip to the strength of the business and the management team, Phillips 66 has meaningfully outperformed its peer group as well as the S&P 500 since becoming a publicly listed company in May 2012.

(source: Company Presentation)

Valuation:

We believe the market is incorrectly valuing PSX more like a refiner (which has volatile earnings and lower valuation multiples) rather than an integrated and diversified downstream energy business (which has more stable earnings, and deserves higher valuation multiples). Management has been focused on pursuing aggressive expansion of other businesses (Midstream and Chemicals). While Refining is expected to continue to generate a significant share of operating cash flow, we expect contributions from Midstream and Chemicals will increase over time. As it happens, we expect the market to assign a higher multiple to PSX. This means that investors can expect share price gains as management delivers on its strategy.

In recent history, PSX has traded at an EV/EBITDA multiple in the range of 6x to 13x, and the current 7.2x ratio suggest there is room for multiple expansion, especially considering it should be valued at an even higher multiple anyway considering its more diversified less volatile business.

(source: Thomson Reuters)

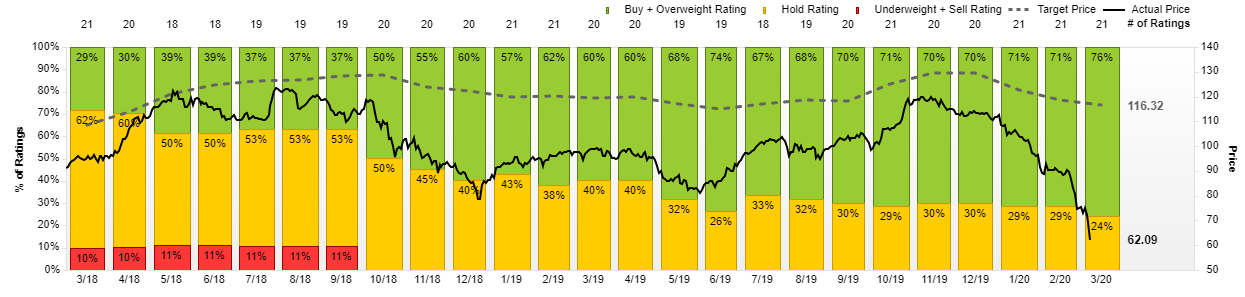

For added perspective, of the 21 Wall Street analysts covering the shares (and reporting to Factset), the average price target is significantly higher, and most analysts rate it a Buy, as you can see in the graphic below. Specifically, the shares currently trade almost 50% lower than the average analyst price target And although we expect some downward revisions in the coming days, nothing nearly as dramatic as the stock’s current very low share price.

Risks:

Delays in Projects: PSX undertakes any capital project with the expectation that it will deliver an acceptable level of return on the capital invested. The project economics are based on best estimate of future market conditions. Most large-scale projects take several years to complete. During this multi-year period, market conditions can change from those forecasted earlier, and it may not be able to realize the expected returns. This could negatively impact results of operations, cash flows and the overall return on capital deployed. And we could see somewhat significant impacts to projects based on this week’s plummeting oil prices.

Execution risk: The company is in undertaking an ambitious and aggressive growth program. This includes expansion plans across its business segments primarily Midstream and Chemicals. PSX’s future earnings and cash flows are therefore dependent on the ability of management to execute. Investors should be encouraged by the fact that management has done a commendable job so far (i.e. they have a track record of proven success). Also encouraging, the company has plenty of excess cash (as discussed earlier) even if there are changes to projects and execution.

Conclusion:

Phillips 66 is an attractive long-term investment for income-focused investors thanks to its steady cash flows, differentiated business, and its attractive 5.5% dividend yield. The shares have sold off inappropriately, and it is worth considering as a buy for your income-focused portfolio. However, if you are concerned about ongoing near-term market volatility, you might consider taking advantage of the very large upfront income currently available in the options market. Specifically, selling out-of-the-money put options (as described earlier) is particularly attractive now because, as fear and volatility have spiked, so too has the upfront premium income available also spiked. Not only does this trade provide very attractive upfront income, but it also gives you a chance to own this very attractive dividend-growth stock at a very compelling low price.