The market just got pummeled, and there could be significantly more short-term pain ahead. However, long-term, this market is eventually going higher (the US and global economies are just too resilient). And there are some tremendous buying opportunities, right now. This is our monthly performance update, whereby we share updated performance for each of our investment strategies (they’re all still beating their benchmarks handily, and delivering strong income, despite the recent sell off). We also share 4 strong buying opportunities presented by the market (it’s like Christmas to those with cash).

To get right to it, here is the long-term performance track record of each of our investment strategies (they’re all continuing to deliver powerful, benchmark-beating returns and steady high income... lots of +8% yield opportunities!).

And for a deeper dive, here is the long-term monthly performance (including newly added February numbers) for each strategy (keep in mind the S&P 500 was down over 8% in February!). And importantly, the strategies continue to pay very big dividend yields without interruption (more on this later).

The long-term performance is exceptionally good and growing, but February was a challenging month, and therein lies the great opportunity. Specially babies (quality investments) are being thrown out with the bathwater (i.e. selling off inappropriately) thereby creating tremendous buying opportunities.

Before we get into the five strong buys as mentioned in the title of this article, it is important to remind investors… Don’t panic. And don’t go on a crazy trading spree. It’s okay to be a little bit opportunistic, but don’t lose sight of your long-term goals. As you can see in our earlier performance tables, we’ve had down months in the past, but over the long-term discipline pays off. In fact, disciplined, long-term investing has proven to be a wining strategy consistently through out history (long before we launched our portfolios), and it will continue to be a winning strategy long into the future.

4 Strong Buys:

1. Attractive Preferred Stocks are on Sale

Preferred stocks were down nearly 5% last month (as you can see in the following table). They should not have been.

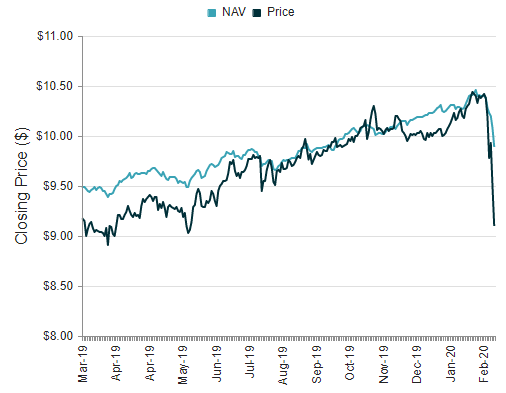

Predictably, when the market sells off so indiscriminately like it just did, preferred shares (whose prices generally hover around their redemption prices of $25 per share (+/- a couple bucks) tanked a bit. For example, we like the Nuveen Preferred & Income (JPS) Closed-End Fund (“CEF”) because it yields a healthy 7.4% and it sold off harder than it should have last month. It also now trades at an attractive discount to its net assets value (as you can see in the chart below), which makes it even more attractive.

We have more examples of highly attractive “Strong Buy” individual preferred stocks later in part 2 this report (when we get into all the details of our current holdings).

2. Healthy Business Development Companies (“BDCs”) Are On Sale

BDCs generally provides financing (usually mostly loans and sometimes equity) to smaller (middle market) companies. And because of the perceived risks of these middle market companies they predictably sell off hard when the market sells off. However, some very healthy BDCs have recently sold off hard and they should not have. One specific example is Main Street Capital (MAIN). We wrote about this one in our recent article here. There are additional attractive BDCs that we own and we will get into later in part 2 of this report. However, Main Street is one attractive example, that is a very attractive buying opportunity.

Main Street (MAIN) Price:

3. Wildcard “Income via Growth” Stocks

For diversification purposes, we share with our readers a handful of stocks that can generate attractive long-term income via capital gains (i.e. selling some of your winners for profits). Last month’s featured “growth stock ideas” included Nvidia (NVDA), Microsoft (MSFT), and ServiceNow (NOW). During the month of February (when the S&P 500 was down over 8%) these three stocks returned +14.3%, -4.57% and -3.59%, respectively. Oddly, many growth stocks outperformed the market last month (this is not normal during a sell off, from a long-term historical standpoint), and this is why it can be good to have some “income via growth” stock diversification in your portfolio. You can see in the following table (1M=February performance), growth stocks performed better than income and value stocks in February. And we have more examples of attractive “income via growth” stocks in part 2 of this report.

4. Energy Stocks Got Slaughtered

As you can see in the above table, the energy sector was the worst performer during February, and it has created some extremely attractive big-dividend opportunities. For example, we recently wrote about Exxon Mobil (XOM) here, and we have even more highly compelling energy stocks ideas in the second part of this report where we share details on all of our individual holdings across our investment strategies. There are many attractive strong buys in the energy sector right now, such as Exxon Mobil.

Part 2:

To get right to the point, here is our updated Portfolio Tracker Tool. You can view the rankings for all of our current holdings, including all of the Strong Buys. We believe the opportunities created by the current indiscriminate market wide sell off are attractive and rare. However, we also believe strongly that its okay to be a little but opportunistic during this sell off, but do NOT lose site of your long-term goals. If your are an income-focused investor, don’t go dumping 100% of your nest egg into volatile growth stocks because you think we are due for a rebound. Stick to your strategy. Don’t panic. Stay disciplined. Be smart.

Current Strong Buy Highlights:

As you can see when you view the holdings tab of the tracker tool (link provided above) there are a variety of strong buys. A few worth highlighting are as follows.

1. Attractive Preferred Stocks are on Sale

As described earlier, preferred stocks have sold off inappropriately, and we like a variety of individual preferred stocks here. For example, we have rated the 11.2% yield Teekay Offshore Preferred (TOO.PB) as a Strong Buy. However, we also like several additional energy and shipping preferred stocks as described in our holdings, considering their prices have sold off hard based on indiscriminate market wide selling more so than having anything wrong with their individual business. It makes sense for the common shares of these business to have sold off somewhat, but the preferreds have sold off further than they should have (in our view) and currently present highly attractive buying opportunities for income-focused investors that prefer less volatility.

2. Healthy Business Development Companies (“BDCs”) Are On Sale

As described earlier in this report, BDCs have a tendency to sell off particularly hard during market wide sell offs, and we believe the most recent sell off has created some very attractive buying opportunities. In addition to Main Street (MAIN) (as described earlier), we also really like (TPVG), (HRZN) and (ARCC), and we rank them all as Strong Buys because of their attractive prices and very high yields (as described in the tracker tool).

3. Wildcard “Income via Growth” Stocks

In additional to the names described earlier, we’ve also included a variety of attractive “income via growth” stocks in the tracker tool, and we believe they continue to be compelling given current market conditions, and the value of diversifying into a few growth stocks in general.

4. Closed-End Funds Trading at Big Discounts

We also rate a variety of attractive closed-end funds ("CEFs") as Strong Buys. In addition to (JPS) as described earlier, we also really like (PEO), (RVT) and (RMT). Not only are they attractive in their own right (as we have written about in the past, PEO for energy, RMT and RVT for small cap), but they are also trading at compelling discounts to their net asset values (as often happens to CEFs, due to strong selling pressure during indiscriminate market sell offs, such as the current one). You can check the most current discounts to NAV for each one by entering their tickers at CEF Connect.

5. Energy Stocks Got Slaughtered

As described earlier, energy was the worst performing sector last month, and it has created many attractive Strong Buys. Energy has sold off for a variety of reasons including lower commodity prices, fossil fuel divestment activities, and the threat of reduced near-term demand resulting from a potential coronavirus-induced global economic slowdown. The good new is that demand cannot be meaningfully reduced for decades (alternative energy isn’t yet competitive) and many of these dividends are very safe. We currently rate the following energy stocks as Strong Buys, as described in our tracker tool:

Energy Transfer (ET), Exxon Mobil (XOM), Phillips 66 (PSX) and Williams Companies (WMB). We’ve written in more detail about all of them recently, and they all offer highly compelling yields. If you want to take advantage of the current market sell off, these stocks represent highly attractive ways to do it. The dividends are safe, and the share prices are likely going higher.

Conclusion:

We say it all the time, and we’ll say it again: Don’t Panic. Stick to your long-term plan. Disciplined long-term investing has proven to be winning strategy over and over again throughout history. It’s okay to be a little bit opportunistic (we share many more "Strong Buys" in the members-only part 2 of this report), but do NOT lose sight of your long-term investment goals. We believe the opportunities presented in this report at extremely attractive high income opportunities, but for goodness sake don't do anything rash and don't lose sight of your long-term investment objectives and goals. Be smart.