Unity Software provides tools to videogame developers. The company recently completed its initial public offering in September. The business is healthy, revenue is growing rapidly, and it has a large total addressable market. In this report, we analyze Unity’s business model, its market opportunity, competitive position, valuation, risks, and finally conclude with our opinion on investing.

Overview:

Unity is a software development company that provides technology solutions to video game publishers. Co-founded in 2004 as Over the Edge Entertainment in Copenhagen by David Helgason (ex-CEO), Nicolas Francis (ex-CCO) and Joachim Ante (CTO), Unity raised $5.5 million through its Series A funding in 2009 from investors including Sequoia Capital and finally got listed in 2020 at a market valuation of $13.6 billion. The company was launched with the aim of democratizing the gaming development process. It developed a game engine available at affordable prices that could be used to facilitate seamless creation of video games. The company released its first game development engine in 2004, and since then, Unity has evolved significantly to become the most popular third party game engine and has been used for developing more than 50% of the top 1,000 mobile, PC and console games available in the market.

image source: Unity.com

Unity provides a set of tools that enables developers or publishers to quickly create 2D and 3D content (primarily video games) and efficiently deploy it across platforms including App Store, Play Store, Consoles or PCs. After disrupting the game development industry through its market leading technology, the company is now taking initiatives to develop the platform for generating content for augmented and virtual reality. Unity conducts its business through 3 primary operating segments:

Create Solutions: These include tools that developers, artists, designers, engineers, or architects use to create 2D or 3D content. The basic product is available free for customers, however for advanced features, customers need to enter into longer term subscription contracts generally ranging from 1 to 3 years. In the quarter ending September 2020, create solutions contributed 31% of the total revenue of the company.

Operate Solutions: These include a set of tools that help creators manage, optimize and monetize their content through advertisements or in-app purchases. Solutions also include hosting services for multi-player games and other live games as well as voice chat communications between players. Operate solutions can be used by even those creators which have not used Unity’s create solutions platform for game development. Revenue is earned primarily through a revenue sharing model whereby Unity retains a percentage of revenue generated from content monetization, whether through advertisements or in-app purchases. Thus, growth of operate solutions is directly aligned to the popularity of content created by its customers. This segment has been a major growth driver for the company contributing 60% of the total top-line in Q3 2020.

Strategic Partnerships: Unity has also entered into multiyear strategic agreements with hardware, operating system, device, game console, and other technology providers to enable inter-operability of content created by its customers without the need to write platform-specific codes. Revenue is earned primarily through fixed fee royalty contracts. In Q3 2020, 9% of the total top-line was earned via strategic partnerships.

Unity’s business is well diversified across geographies with EMEA (Europe, Middle east, and Africa) being the largest, contributing 34% of the revenue, followed by US contributing 27%.

Unity has a large and diverse customer base comprising of amateur game designers as well as some of the largest global game development companies such as Electronic Arts, Nintendo, Take-Two Interactive, Zynga, Tencent, Niantic, Ubisoft etc. The company generally focuses on larger customers that generate more than $100K of TTM revenue each. As of Q3 2020, Unity had 739 customers contributing over $100K in annual revenue of the company.

Large and expanding addressable market

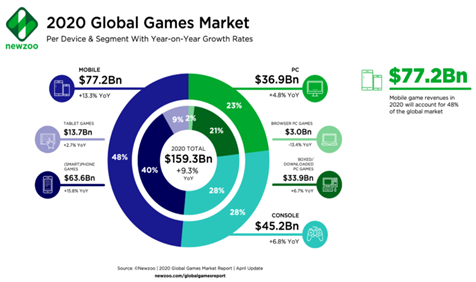

Unity operates in the gaming industry which is one of the fastest growing markets in the world and has more than doubled in the last 10 years. As per a recent study conducted by NewZoo, Global games market is forecasted to generate revenue of $159 billion in 2020 which represents a strong growth of 9.3% on a YoY basis. The outperformance this year is primarily driven by increased interest in gaming as people stay at home due to COVID-related lock down restrictions coupled with new generation of gaming consoles slated to be released in the holiday season. While growth was observed across all platforms in recent quarters, mobile gaming grew the fastest. In 2020, mobile gaming segment is expected to register yearly growth of 13.3%.

Source: NewZoo

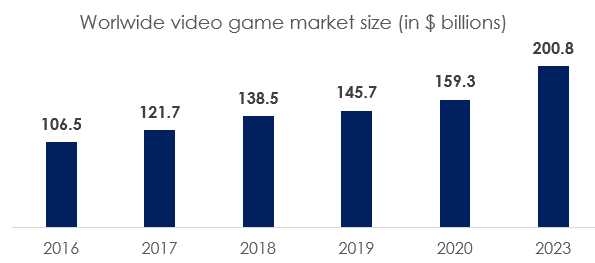

Video games industry is expected to continue its strong upward trend in the coming years growing at a CAGR of over 8% to reach over $200 billion by 2023 with mobile gaming consistently outperforming other platforms.

Source: Statista

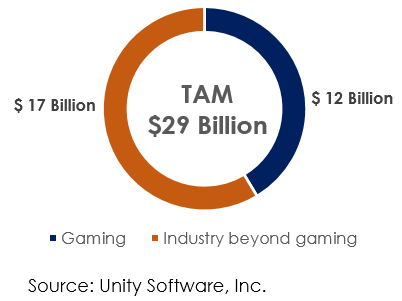

As per company estimates, total addressable market for its create solutions and operate solutions in the gaming industry, stood at $12 billion in 2019 across 15 million potential creators and is expected to reach over $16 billion in 2025, thereby growing at a CAGR of 5%. Moreover, Unity’s market opportunity also lies in industries beyond gaming. The company is consistently investing to expand its platforms to cater to new industries such as architecture and engineering 3D designs, automotive designs, 3D film and animation creation etc. Although only 8% of its large customers are from industries beyond gaming, non-gaming markets can be a large opportunity for the company longer term. Unity platform is used by 8 out of the top 10 architect, engineering design and design companies in the world including Skanska, as well as 9 out of the top 10 automotive companies including Honda, Volvo, and BMW. As per company’s estimates, market opportunity for its solutions in non-gaming industries stands at approximately $17 billion and is expected to grow further as Unity expands its product offerings.

Overcoming competition through superior product offering

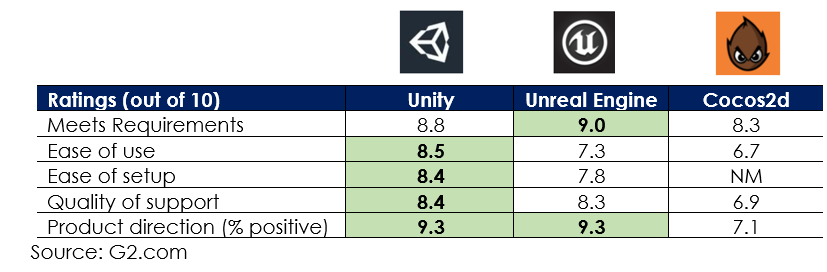

Unity operates in a highly competitive industry where it competes with proprietary in-house game engines created by large game studios as well as 3rd party game development tools providers such as Unreal Engine by Epic Games and Cocos2d by Chukong Technologies. Having said that, through consistent research and development, Unity has secured a market leading position, becoming one of the most popular game engines in the world offering a wide range of tools and features that can be easily accessed even by less sophisticated game developers. Besides, its freemium business model helps attract and lock-in small creators who may later upgrade to premium offerings when their content becomes popular. We accessed independent user reviews from G2.com and found that Unity platform was one of the most popular product amongst its peers.

Unity platform has over the years become the industry standard gaming content creation tool. As per company’s estimates, 53% of the top 1,000 mobile games in Apple’s App Store and Google Play have been created using Unity’s solutions. Additionally, its platform has been used to develop nearly 60% of the AR and VR content. 90% of the content on emerging AR platforms is made using Unity engine. 94 of the top 100 global game development companies including the likes of Sony, Nintendo, Microsoft, Electronic Arts, Tencent, Activision Blizzard etc. are Unity customers.

Robust subscription as well as revenue sharing earnings stream

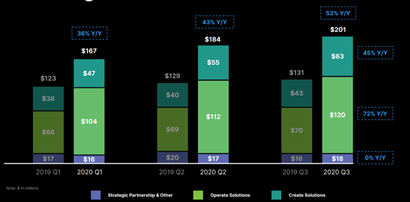

The superiority of Unity’s solutions as well as recent COVID-related tailwinds are evident in the company’s recent financial trends. In Q3 2020, the company reported total revenue of $201M, which represents strong growth of 53% on a YoY basis. Revenue from create solutions was up by 45% on a YoY basis, in part driven by Finger Food acquisition in Q2, slightly offset by impact of COVID-19 on the sales cycle. Strong growth was observed in operate solutions segment due to higher level of user engagement and higher in-app purchases during the quarter as people stayed at home due to COVID-19 shelter-in-place orders.

Source: Unity Software, Inc.

The strong top-line growth is primarily driven by increases in large customer count as well as consistent upselling within its existing customer base. The number of customers generating over $100K in annual revenue has increased from just 506 in Q1 2019 to 739 in Q3 2020. These customers now contribute 72% of the total top-line of the company. Besides, high dollar based net expansion rate of over 140% in recent quarters suggests that Unity has been successful in upselling its solutions to its existing clients. Given the secular growth in gaming industry anticipated in the coming years, Unity is expected to continue its strong momentum in the near to medium term.

Source: Unity Software, Inc.

Steadily moving towards profitability as business scales

Unity is a high gross profit margin generating company, however, it has not been able to achieve profitability on the operating level as it continues to invest in R&D as well as marketing to scale its business. In Q3 2020, company’s adjusted operating margin significantly improved by 17 percentage points to -4% as compared to -21% in the same quarter last year. Apart from improved operating leverage through strong top-line growth, this margin expansion was also as a result of controlled operating expenditure in the restrictive pandemic economy. While company’s spending patterns will return to normal as we exit the pandemic, Unity is expected to continue improving its operating profitability in the longer term as it scales its business.

Strong financial position with enough liquidity

Unity has not reached free cash flow positive status yet, however the company has been consistently reporting a reduction in its free cash flow loss margins. For the first 9 months of 2020, the company reported an FCF of -$24M which is a significant improvement from -$85M in the same period last year. FCF loss margin also improved from -22% to -4% YTD 2020, primarily driven by improving operating leverage as well as favorable shift in working capital. Unity ended the most recent quarter with liquidity of $1.8B, including $1.3B raised through IPO in September. With no debt on its balance sheet, we believe that the available liquidity will provide enough firepower to fund growth capital needs in the near to medium term.

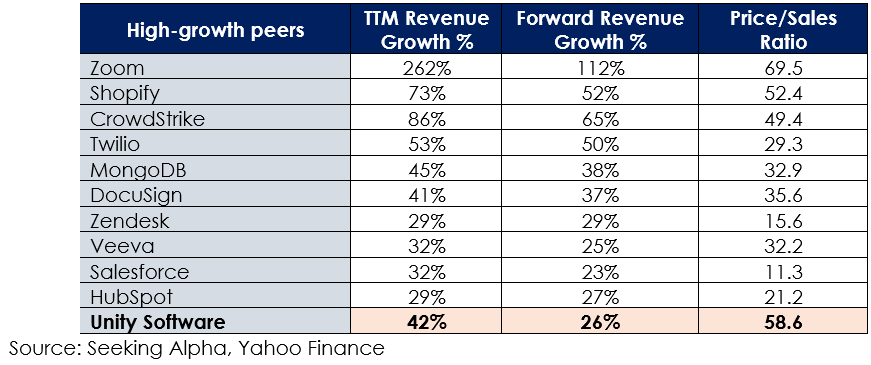

At current premium valuation multiples, near term opportunities priced in

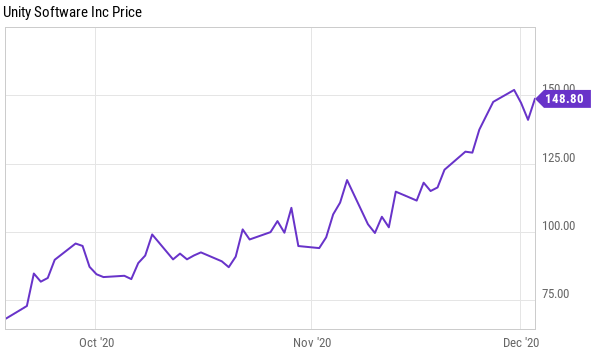

Unity’s stock price has more than doubled since its recent IPO. It is currently trading at a price to sales multiple of over 58 times which is significantly higher than most of its high growth technology peers. While the company boasts immense long-term growth potential with robust business fundamentals, its valuation multiples at current growth rate look stretched.

Competitive Risks

Unity operates in the highly competitive and dynamic gaming industry. It needs to consistently innovate and upgrade its product offerings to maintain its market leading position in its target industry. Having said that, Unity has a clear advantage at the moment given its large market reach in its core market

Conclusion

Unity has consistently delivered impressive performance over the quarters with strong top-line growth along with improving margins. The company has well positioned itself as the market leader in the fast-growing gaming industry and is starting to gain traction in non-gaming industries as well. While we are optimistic about Unity’s long-term growth potential, we wouldn’t recommend more than a very small position (0.5% or less of your portfolio) for now, and perhaps investors may be better served to wait patiently for a better entry price. We currently have no position in this stock, but it is high on our watch list, and it may be a good candidate for a future income-generating options trade (i.e. selling out-of-the-money puts). You can access all of our current portfolio holdings here.