If it’s mainly big steady income payments you seek, this report reviews two fixed-income closed-end-funds (CEFs) that offer attractive yields of 9.1% and 7.7%, respectively. They both pay monthly (MOPAY), and trade at very attractive prices. This report shares the important details for you to consider.

The two CEFs we are referring to are:

PIMCO Income Opportunity (PKO), Yield: 9.1%

DoubleLine Yield Opportunities (DLY), Yield: 7.7%

We last reviewed CEFs here (BTZ and PDI), here (BIT and PCI) and also earlier this year during the depths of the coronavirus crisis in late March, when we wrote Buy! Buy! Buy! (we took a lot of flak for taking such a strong view back then, however share prices (total returns) have rebounded dramatically since then as we predicted they would).

We still believe the space is attractive if you are a high-income-seeking investor. And in particular, PKO and DLY and worth considering. For your review, here are the things you are going to want to consider if you are going to invest in these two high-income CEFs.

What Do They Own?

For the most part, both of these CEF invest in fixed-income (bond) investments. According to DoubleLine’s website:

The Fund’s investment objective is to seek a high level of total return, with an emphasis on current income. The Fund may invest in debt securities and other income producing investments of issuers anywhere in the world, including in emerging markets, and may invest in investments of any credit quality.

And according to the PIMCO website, PKO seeks:

Seeks current income as a primary focus and also capital appreciation. The fund has the flexibility to build a global portfolio of corporate debt, government and sovereign debt, mortgage-backed and other asset-backed securities, bank loans and related instruments, convertible securities, and other income-producing securities of U.S. and foreign issuers, including emerging market issuers.

We encourage you to click on the links provided above to learn more about these funds as the website information is organized helpfully. For example, both funds are well-diversified within their fixed-income markets, and the investments they hold have well laddered maturities, as you can see if you scroll down on the links we provided above. This is important because it helps reduce the risks associated with any one holding within a fund “blowing up” because each position is relatively very small (PKO owns ~820 securities and DLY owns ~407).

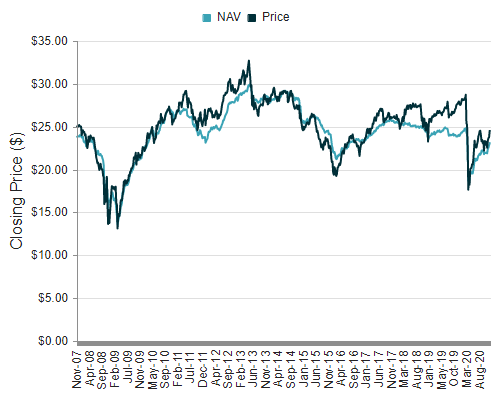

Market Prices vs Net Asset Values

One of the most interesting and important things to consider when investing in a closed-end fund is the current market price versus the fund’s net asset value (NAV is the aggregate value of all the individual underlying holdings). Unlike a mutual fund or an exchange-traded fund, the market price of a closed-end fund can vary significantly from its NAV (because the market price is based on supply and demand, and there is no immediate mechanism to bring the two into alignment as there is with mutual funds and ETFs). Here is a look at the current and historical market prices of PKO and DLY:

PKO NAV vs Price:

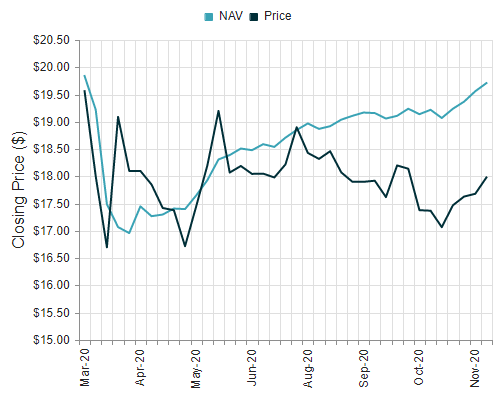

DLY NAV vs Price:

Note: DLY is a new CEF as of this year, so the history is less than 1 year.

We generally prefer to buy and own CEFs that are currently trading at a discount to NAV (as is currently the case for DLY and not PKO) because it means we are getting a chance to buy the assets “on sale,” and because it means we get to buy the income stream they produce (in this case quite high) at a discounted price.

However, there is more to it than simply premium versus discount. For starters, there is no guarantee that discounted price CEFs will ever rise back up to their NAV price (the discount could get bigger), and there is no guarantee that premiums will ever revert either. In fact, in the case of PKO, it trades at a premium (for a variety of reasons we’ll get into in a moment), but the premium is reasonable (and in some cases smaller than) recent history (and a lot of PIMCO CEFs tend to trade at much higher premiums—which could bode well for PKO).

Another thing worth considering is the price of the underlying holdings versus their par values. Specifically, bonds generally mature at a par value of $100, but PKO’s holdings current have an average price of only around $96.41 and DLY’s around $94.11. This can bode well for future price appreciation of the underlying holdings (assuming most of them will mature at their $100 par value, which they almost always do).

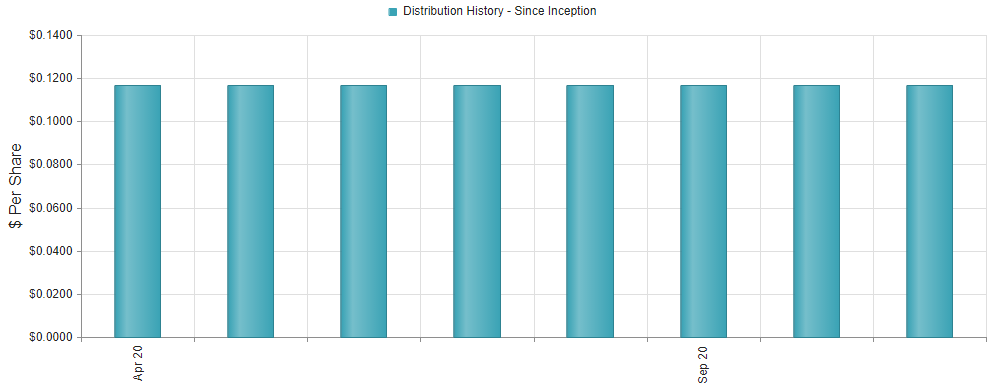

Distribution History: They Both Pay Monthly

If it is steady income payments you seek, you might be happy to know both of these CEFs pay income to investors monthly. And as you can see in the following charts, this income has been steady (even slightly rising):

PKO Monthly Distribution History:

DLY Monthly Distribution History:

You might also note these CEFs do occasionally pay special “extra” dividends, depending on the performance of the underlying asset valuations (PKO in particular).

Important to note, both funds aim to pay income based on the income produced by the underlying holdings. But in rare cases they can generate some of those big steady income payments with capital gains and/or a return of your own capital. While many investor prefer to see distributions come from 100% income of the underlying holdings, it is acceptable in our view for some distribution payments to be generated from other sources as described above so long as it is minimal and the overall distribution strategy is sustainable—which we believe it is for both PKO and DLY (so far, it’s a new CEF this year). Note also that there are slight tax differences in income payments (ordinary income rate) versus long-term short-term capital gains and return of capital (return of capital reduces your cost basis, which can result in more capital gains taxes when you do eventually sell). We are comfortable with the distribution composition (basically all income) for both PKO and DLY.

Leverage (Borrowed Money):

Many CEFs use borrowed money as part of their normal operations. While this can increase risk and volatility, we approve of the leverage in PKO and DLY because they do so prudently, they adhere to regulatory limits, they do so at a lower cost (and with more discipline) that you or I could do, and the leverage helps increase the monthly income payments and total long-term returns. Leverage is concerning to some, but it’s not unlike the leverage corporations use on their balance sheets, homeowners use when they get a mortgage, or the borrowing Warren Buffett does at Berkshire Hathaway. Furthermore, the types of bonds these fund invest in tend to have somewhat lower volatility in the first place, so the leverage is less concerning (and totally normal).

As you can see on the webpage links we provided earlier, PKO’s current leverage ratio is around 39.69% and DLY is approximately 48.34%. Generally, bond funds are to stay below 40% leverage. So for DLY to be above that number suggests some extra risk (that they’ll need to bring under control), but also some potential extra reward (as they continue to bring the leverage ratio under control). For your reference, CEF Connect is another very good resource for CEF information.

Fees and Expenses:

Fees and fund expenses are another important consideration when investing in closed-end-funds. And in the case of fixed income funds that use leverage (such as PKO and DLY), the cost of borrowing money is important to be aware of so you don’t misjudge the fee. For example, PKO charges a management fee of around 1.06% which is very reasonable for PIMCO and approximately normal for most bond CEFs. And when you add in PKO’s other expenses (including the cost of interest on borrowing), the aggregate expense ration rises to ~2.73%. That is significant, but in the case of PIMCO acceptable considering the strong management team and company resources, plus the firm’s long track record of success. For comparison, DLY’s management fee is less, 1.86%, according to its recent annual report (and this number includes interest expense).

Like PIMCO, DoubleLine is another highly reputable (although relatively smaller) firm with strong resources and a track record of success. However, unlike PIMCO, DoubleLine is known for it founder (and one of two portfolio managers on DLY), Jeffrey Gundlach.

Keep in mind also that the management fees are higher on fixed income funds because it is arguably more “involved” to pick and manage fixed income portfolios than say publicly-traded stock portfolios. Overall, we believe the fees on these two funds are significant but acceptable if you are looking for strong management teams to deliver steady monthly income payments in markets (fixed income) that are much harder for you as an individual (or even professional) to invest in.

Conclusion:

We like both of these funds (PKO and DLY) for their attractive high monthly income payments (MOPAY), and their discounted prices (the underlying holdings of both CEFs trade at a discount to par). In comparing the two, we view DLY as riskier (because it is new this year, the price has been very bumpy, and it trades at a wider discount in terms of both underlying holdings vs par and in terms of price discount versus net asset value). However, we also believe this higher level of risk with DLY also brings the potential for higher rewards as the underlying holdings rebound towards par and as the discount to NAV will likely shrink (DoubleLine’s other two CEFs—DSL and DBL—trade at prices much closer to their NAVs). In terms of Bond CEFs, we currently own BIT and PCI, but believe PKO and especially DLY (if you can handle the risk and near-term bumpiness) are worth considering for a spot in your income-focused portfolio.