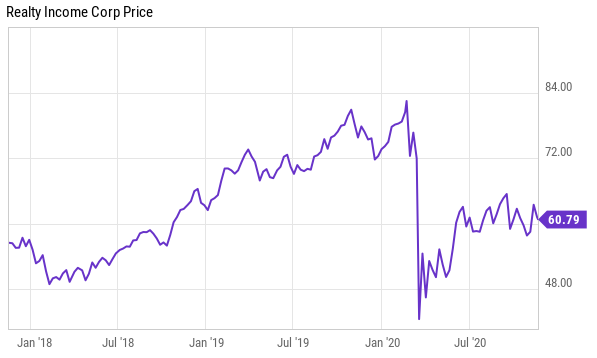

Yes—Realty Income is Poised to Sail Through the COVID Pandemic. The shares are on sale.

Realty Income is one of the most renowned dividend stocks. Its monthly dividend track record has earned it the nickname ‘The Monthly Dividend Company’. It has made 604 consecutive monthly payments and raised its dividend for 94 quarters in a row. Since March 2020 (when COVID-19 hit the world), the company has raised its dividend twice. This highlights the recession-resistant nature of its property portfolio and superior management skills. The company will sail through this crisis as well like it has in the past. From a pure income and capital preservation perspective, Realty Income is an outstanding option for investors to consider. This article reviews the health of the business, valuation, risks, dividend safety, and concludes with a few thoughts on investing.

Overview:

Realty Income Corp (O) is REIT focused on acquiring and managing commercial real estate properties. The company is a member of the S&P 500 Dividend Aristocrats index for having increased its dividend every year for the last 25 consecutive years. The company’s portfolio consists of 6,588 properties that generate rental revenue from long-term lease agreements with commercial tenants. The property portfolio is well diversified with 600 tenants across 51 different industries in 49 states in the US. Nearly 85% of its rental revenue is from traditional retail properties. It boasts of high-quality tenants, such as FedEx and Walmart.

(source: Company Data)

Business Resilient Amid COVID-19

We are impressed by the company’s resiliency during the ongoing pandemic despite heavy dependency on retail properties. Rent collection across its portfolio has remained stable. During Q320, it collected 93.1% of contractual rent due, and collected 92.9% of contractual rent for the month of October 2020. The uncollected rent continues to be primarily in the theater and health and fitness industries. These industries put together account for 12.7% of total contractual rent – Theater at 5.7% and Health & Fitness at 7.0%. Of these two, theater has been the hardest hit. Only 8% of rent due from Theater tenants was collected in October, while nearly 82% of rent due from health & fitness tenants was collected.

(source: Company Data)

Thus, essentially the maximum risk from this group is only for ~5.7% of the total rental portfolio. Management has been proactive in recognizing the risk and has already set aside ~$17.2 million in reserves for 37 theaters out of total of 78 theater assets where in deems the chances of rent collection to be very low. These 37 theaters represent nearly 2% of total annual rent (or $33.3 million). Management during the recent Q3 earnings call highlighted that it does not expect to lose the entirety of rent associated with these properties longer term, even in the event of potential closures.

With COVID-19 cases rising again in the US, the company noted that its tenants are better prepared to handle lockdown situations if they arise. Noting the following in the recent investor call:

“But look, if we go into a big shutdown, I do think that some of the other industries that were impacted, casual dining, day care centers, etc., they are much better equipped to handle a prolonged shutdown today than they were in the month of April. And we feel better about their ability to continue to use some of the avenues that they have created, i.e., click and collect, drive-throughs, etc., as a method to continue to operate their businesses in a way where they can continue to pay us rent.

Dividend Dependable Despite a Challenging Environment

Realty Income is a monthly dividend paying REIT and has a history of raising the dividend every year since 1994. Over this period, it has paid 92 consecutive quarterly dividend increases and increased the dividend 108 times. Realty Income increased its dividend four times during 2020 so far with the most recent increase coming in September 2020. The current monthly dividend of $0.234 per share represents annualized dividend per share of $2.808 and an annualized yield of 4.6% based on its recent market price of $61.19. We believe the dividend is very strong and sustainable given the history of continuous FFO per share growth. Additionally, the payout ratio for the company is around 82% which further bolsters its ability to continue paying dividends. This means even if Realty Income experiences reduced payments from some tenants, it has extra cushion to not only keep paying dividend but also consider an increase.

Further, Realty Income boasts of a strong balance sheet with low leverage which provides ample flexibility to raise funds in case of any dividend shortfall. It ended Q3 2020 with net debt to adjusted EBITDA of ~5.3x which is well within its target leverage ratio. The overall debt maturity schedule remains in excellent shape as the weighted average maturity of bonds is 7.2 years, and less than $80 million of debt (excluding commercial paper) through the end of 2021.

(source: Company Data)

Well Diversified Portfolio - Insulated from Changing Consumer Behavior

The portfolio is diversified across tenants, industries and geographies. Within its overall retail portfolio, nearly 96% of rent comes from tenants with a service nondiscretionary and/or low price point component to their business. These type of businesses can operate in a variety of economic environments and are protected against e-commerce threats from the likes of Amazon. Additionally, the top 20 tenants—which account for ~53% of total rent—fall into at least one of these categories (non-discretionary, low price point, service retail or non-retail), thereby insulating them from shifts in consumer behavior.

Also, the company’s tenant profile has become far superior compared to the last financial crisis of 2009. We believe O it is far better positioned to handle the current crisis amid the COVID-19 outbreak. For instance, in 2009, Realty Income’s investment grade tenants in the top 15 were just 3.2% of revenue and the company had high exposure to highly cyclical sectors such as casual dining and quick service restaurants (QSRs). Today, 29% of its top 15 revenue comes from investment-grade tenants, and the share of defensive and less cyclical sectors such as convenience stores and drug stores has increased considerably.

While the ongoing COVID-19 pandemic will have a negative impact on Realty Income, through its inherent portfolio strength we expect the damage to be limited and the bounce back to be much quicker

Valuation:

We compare Realty Income to other retail-focused REITs. Specifically, on a Price to Adjusted Funds from Operations basis (“AFFO”) basis, Realty Income is trading at ~17.9x TTM AFFO, a premium to the average of its peer group. In our view, this is quite justified given its large size, strong balance sheet and proven ability to successfully ride over previous economic downturns. We note the relatively high dividend yield offered by the company which makes it attractive for income-seeking investors.

(source: Blue Harbinger Research, Yahoo Finance)

Risks:

Interest rate risk: Even though we expect interest rates to remain relatively tame, dramatically rising rates could create challenges. As REITs are often seen as an alternative to bonds, higher interest rates could mean decreased demand for REITs, thereby causing a decline in the share price. Also, higher interest rates put downward pressure on earnings as interest costs rise.

Tenant bankruptcies: Realty Income could be impacted by bankruptcies that continue to hit the retail sector. Though, the company has a diversified tenant base which is weighted towards non-discretionary and low-ticket items, and as such is more immune compared to some of its other peers. Still, given the current situation due to COVID-19 crisis, it remains a risk.

COVID-19 impact: With COVID-19 cases rising, the chances of a V shaped recovery is less apparent. This may well hit consumer spending and confidence and in general could be negative for retail-focused REITs. However, here again we point out the resilient nature of Realty Income business due to its high percentage of rent generated from non-discretionary (drugs) and low-ticket items (Dollar Stores). Furthermore, positive news on the vaccine front is highly encouraging.

Conclusion:

Realty Income has trademarked itself as ‘The Monthly Dividend Company’. We are impressed by its steady dividend track record (604 consecutive monthly dividend payments—more than 50 years) which is supported by a stable business model and disciplined execution. The company has successfully navigated through past economic downturns without cutting the dividend. This shows the resilient nature of company’s portfolio, conservative approach, and strong management skills. This all gives us confidence that Realty Income will outperform peers as we progress through the pandemic. In the current environment, where survival is the primary strategy, and investors are looking for safety, we believe Realty Income—with its proven track record—is a very solid choice to park your money for safe income and a continuing rebound in share price as the pandemic eventually will be brought under control. We are currently long shares of Realty Income.