Stocks and bonds are fundamentally different types of investments. However, if you are seeking the traditionally very-safe income provided by investment-grade bonds, you’re probably very disappointed by our ongoing “near-zero” interest rate environment. Traditionally speaking, stocks are simply too risky for bond investors. However, not all stocks are created equally, and in this article we review the very-safe yield provided by a specific blue-chip stock that has been increasing its dividend for over 6 decades, while its share price has also steadily increased too. Specifically, we review the company’s business, dividend safety, valuation and risks, and then conclude with our opinion on investing.

Procter & Gamble (PG), Yield: 2.3%

The company/stock we are talking about is Procter & Gamble (PG). PG has increased its dividend for 64 years in a row, and it is highly secure (which increases its attractiveness in our current uncertain macro environment). For example, despite the global pandemic, P&G’s dividend payout ratio is below 60%, leaving plenty of room for continued dividend increases each year. Additionally, PG’s generous share buyback program (~$7-$9 billion for FY21) adds to investor returns.

Overview:

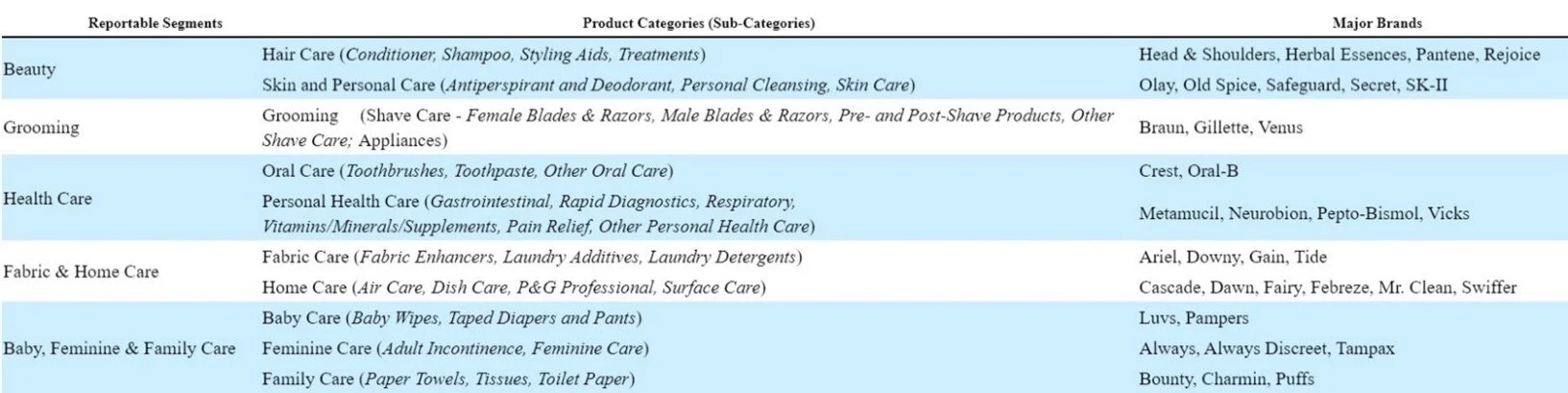

The Procter & Gamble Company (NYSE: PG) is a global fast-moving consumer goods (FMCG) company which sells branded consumer packaged goods in more than 180 countries. It owns some of the most well renowned consumer brands such as Gillette, Tide, Charmin, Pampers, Head & Shoulders, Oral-B, and many more. PG generated ~$71 billion in revenues in 2020 and $19.3 billion in Q121. It primarily conducts its operations via five business segments.

Beauty (~19% of revenue): segment includes hair care and skin & personal care portfolio;

Grooming (~9% of revenue): segment includes male and female shaving portfolio. Brands include Gillette, Venus, Braun.

Health Care (~13% of revenue): segment includes oral care and personal health care portfolio.

Fabric & Home Care (~33% of revenue): segment includes laundry detergents, fabric enhancers, dish care and others.

Baby, Feminine & Family Care (~26% of revenue): segment includes baby wipes, diapers, paper towels, tissues, feminine care portfolio.

source: 10-K Filing

Procter & Gamble has significant competitive advantages given its strong and market leading brands. The business is largely recession proof as the majority of its products fall under “essentials.” Also, it’s a highly profitable and cash generative business. P&G’s operating margins and after-tax profit margins are toward the top of its peer group range.

P&G at Top End of Its Peer Group Metrics:

source: Company Presentation

FY 2021 Guidance Raise Reflects Better Market Growth and Cash Flow Prospects

P&G recently reported strong Q1-21 numbers, and also raised its guidance for the full fiscal year 2021. For example, Q1 organic sales grew 9% YOY, the highest quarterly rate in more than a decade. This was driven by growth of premium home, health, and hygiene products. Against a strong Q1, PG is expecting meaningful improvement in top line and bottom line growth for full year FY 2021.

The company also raised its organic sales growth guidance for full fiscal year 2021 to a range of 4% to 5% (earlier 2% - 4%) and core EPS growth guidance to a range of 5% to 8% (earlier 3% - 7%). As earnings improve, free cash flow is likely to increase as well. As a result, P&G expects to a return $15 to $17 billion of cash to shareholders this fiscal year – nearly $8 billion via dividends and ~$7-$9 billion via stock repurchases (these are good things for investors).

P&G’s guidance raise, this early in the fiscal year, reflects confidence on the durability of consumer behavioral changes regarding cleaning and hygiene habits.

source: Company Presentation

Dividends: Safe, Backed by Strong Free Cash Flow

P&G has increased its annual dividend for 64 consecutive years now. The most recent dividend of $0.79 per share results in annualized dividend of $3.16 and a yield of 2.3%. The dividend is backed by solid free cash flow and earnings growth. For example, based on expected fiscal 2021 earnings, P&G has a payout ratio of just below 60%. This leaves more-than-ample room for future dividend increases. In Q1-20 alone, P&G generated free cash flow of ~$4.1 billion, which gives us plenty of confidence that the company will be able to easily meet its full-year goal of a $8 billion in dividend payout. For perspective, management explained the following in its Q1-21 earnings call:

“Fiscal 2021, we'll continue our long track record of significant cash generation and cash returned to shareowners. We're raising our target for adjusted free cash flow productivity from 90% to around 95%. We continue to expect to pay approximately $8 billion in dividends.”

source: Company data

And in addition to the dividend, PG has a history of repurchasing shares which further adds to returns for investors. For fiscal 2021, P&G has increased its outlook for share repurchases to a range of $7 billion to $9 billion (earlier $6 to $8 billion). In combination (dividends plus share repurchases), PG plans to return $15 billion to $17 billion of cash to shareowners this fiscal year.

Valuation:

From a valuation standpoint, P&G currently trades at ~25.2x forward earnings (based on its FY 2021 EPS estimate of $5.43). And the current price-to-earnings ratio is ~26.2x. Over the past decade, the median P/E multiple for PG shares has been ~21x. This suggests that the shares are currently fully valued and the improved growth prospects for fiscal 2021 also appear to be priced into its valuation. However, given the low payout ratio, it does leave room for healthy dividend increases, and over the long-term we expect the shares to eventually trend higher and with significantly less beta risk than other stocks (P&G’s 3-year beta was recently ~0.46—well below the market average of 1.0). Furthermore, investors looking for a defensive stock with less volatility risk (particularly if covid continues on track for a resurgence), could be well served by the capital protection qualities offered by P&G.

Risks:

Macro weakness: PG is dependent on the consumer to generate demand for its products. Any macro weakness or recession (due to high unemployment or lack of stimulus benefit)s could negatively impact consumer sentiment and reduce product demand.

Consumer preferences: Continued success for the business depends on meeting dynamic consumer needs. For example, the success of new products depends on the company’s ability to correctly anticipate consumer trends and buying habits. Failure to adequately meet changing consumer needs could negatively impact the company.

Increasing competition: The consumer products industry is highly competitive. And PG competes across all its product categories and against a wide variety of global and local competitors. It also faces competition from private label brands.

Conclusion:

Procter & Gamble is an attractive, dividend-paying, blue-chip stock. It’ll never give you the skyrocket returns of some super aggressive growth stock, but it won’t give you the volatility and headaches either. Instead, P&G will give you steady income payments that are competitive with bond market yields. However, unlike bonds, P&G’s income payments will grow over time, and P&G’s share price will also likely grow over the long-term too. We are not suggesting anyone purchase one stock (such as P&G) in lieu of an entire bond portfolio, but we are suggesting that if you are looking for steady growing income and long-term price appreciation, P&G is an attractive investment to consider for your prudently diversified portfolio.