The Vix (VIX), also know as “The Market Fear Index,” is elevated, thereby suggesting it could be a bumpy ride for stocks in the weeks ahead. However, despite the potential volatility, one thing that has worked well throughout history is to simply buy good stocks and then hang on—for the long-term. That may seem easier said than done, but in this report we attempt to help. There are certain themes and companies that are poised to grow dramatically in the years ahead—no matter what happens with near-term volatility. And in this report, we rank our top 10 growth stocks for you to consider.

Before we get into the ranking, it’s worth mentioning, we ran a Top 10 Growth Stocks report last month, and many of those stocks are up big time. Of course, 1-month is a short timeframe, and any gains or losses during that period can have a lot more to do with noise than actual fundamentals. Nonetheless, a few stocks from last month’s list are up a lot since we released the report, such as Exact Sciences (EXAS) (up 15%), Magnite (MGNI) (up 30%) and Paylocity (PCTY) (up 13%). Additionally, a few names from last month’s report remain in the top 10 again this month, although some of the rankings have changed (for example, there is a new #1).

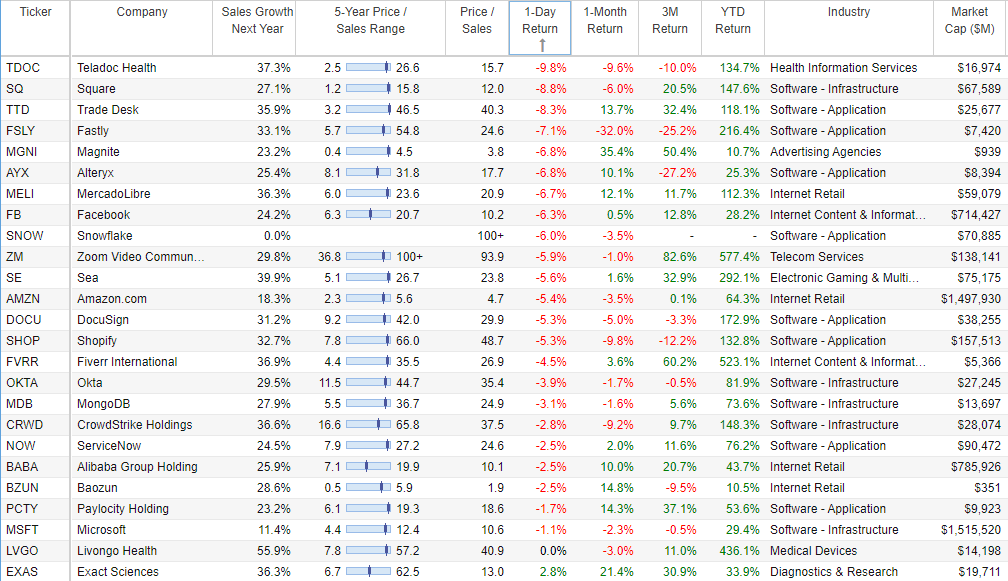

One theme to keep in mind as you review this list is sales growth versus valuation. In particular, all of the names on the list have very high expected future sales growth rates (and the leadership and big market opportunities to back them up) combined with attractive valuations (as compared to their long-term growth potential). For perspective, here are some growth and valuation (price-to-sales) metrics on a handful of top growth stocks.

(source: StockRover, see also: Top Growth Stocks)

And despite what many short-term valuation naysayers will decry, if you’re going to “talk the talk” of being a long-term growth investor, you also need to “walk the walk,” which means having the conviction and nerves of steel to hang on through any short-term volatility, because in the long-term, the bumpy ride will be forgotten, and only the long-term price gains will be remembered.

Without further ado, here is our latest ranking of top 10 growth stocks, starting with an “honorable mention” and then counting down from #10 to our #1 top idea.

Honorable Mention: Snowflake (SNOW)

Snowflake recently completed its initial public offering at $120 per share on September 18, 2020. However demand was so strong that the shares immediately began trading at more than double that price, and they have since risen even further.

If you don’t know, Snowflake provides a cloud-based data platform, addressing the rising data management needs of enterprises. Specifically, the company’s platform stands out for its ability to streamline, share and analyze data to get meaningful insights. The platform is “cloud-only,” and it operates on public cloud infrastructures provided by Amazon Web Services (AMZN), Microsoft Azure (MSFT) and Google Cloud (GOOGL). The growth potential of this business is truly enormous, but we’ve only included it as an honorable mention in this report because its valuation is extremely high (even for a top growth stock list, such as this one), and we’re waiting for a few quarters of operation as a public company, and hopefully a better entry price. You can read our new full report on Snowflake here:

10. Alibaba (BABA)

Alibaba is one of the largest e-commerce platforms in the world (it has an ~$850 billion+ market capitalization), and it controls almost 50% of the Chinese online commerce market. It has consistently delivered strong top-line and bottom-line growth since its listing in 2014, benefiting both from growth in the Chinese internet as well as company specific growth initiatives.

The company has multiple sources of growth as it rides the cloud trend plus secular growth in global e-commerce in the foreseeable future. We believe the current valuation and business model present an attractive opportunity for long-term investors. You can read our recent full report on Alibaba here:

9. Paylocity (PCTY)

Paylocity was ranked #7 on our top 10 growth stock report last month, but it has fallen to #9 this month as the shares have rallied a healthy 15% since last month’s report was released.

As we mentioned last month:

Paylocity is in the right business, at the right time, and with the right strategy. This is a cloud-based, payroll processing company that has been (and will continue) benefiting tremendously as an increasingly number of businesses move towards digital cloud-based automation for simplicity and cost-savings purposes.

We’ve owned these shares since late 2015, when they were trading at ~$29 (here’s a report we wrote way back then), and the stock has not disappointed in the gains department (as you can see in the chart above). We believe this one still has a lot more growth in the years ahead (if it doesn’t get acquired at a hefty premium before then), and we continue to own the shares going forward. You can access our more recent previous Paylocity report here:

8. Fiverr (FVRR)

This “global online freelancer marketplace” company was #9 on our ranking last month, but has risen 1 slot to #8 as the share price is back near where it started, but the newly released earnings results were positive.

In particular, Fiverr beat earnings and revenue expectations (revenue was up 87.8% year-over-year), and raised revenue guidance for the full year. We recently wrote in detail about this company (including our thoughts on a specific income-generating options trading strategy), and you can access that report here:

7. Magnite (MGNI)

This small cap digital advertising company was ranked #6 last month, but has fallen to #7 this month as the shares have gained ~+30% since the previous report.

Magnite appears to be getting its ducks in a row after the recent Telaria merger, and it also has a massive total addressable market (i.e. it’s in the right place at the right time). You can read out recent Magnite report (which was previously only available to members) here:

6. Sea Limited (SE)

Sea Limited is a powerful consumer internet company, operating a leading digital entertainment business, as well as an e-commerce platform and a digital financial services operation, in Southeast Asia (i.e. some of the fastest growing economies in the world). And Sea is benefiting significantly from the tailwinds of global “Stay-at-home” orders.

Sea is also one of the hottest stocks in terms of sales growth (sales growth is expected to be just over 100% this year, and 39.9% next year), and especially considering it has a very large total addressable market (see our full Sea report, linked below). The shares currently trade at a price-to-sales ratio of 25.8x which is frightening to some investors, but it shouldn’t be when you consider the large total addressable market (i.e. big long-term growth potential).

We currently own shares of Sea, but considering the highly volatile nature of this stock (and the overall market), you may want to consider selling out-of-the money puts (instead of buying the shares outright) because it generates very high upfront income (thanks to expected market volatility) and it gives you a chance to buy the shares at a lower price (if they fall below your strike and get put to you before expiration). In fact, this is the exact strategy we wrote about in our recent full report on Sea Limited.

5. Fastly (FSLY)

High growth, on sale. That our view on this new entry to this month’s top growth stock list. Despite the company’s recent challenges from TikTok, this stock continues to have a lot of growth potential.

Fastly offers an “Edge Cloud Platform” that allows developers to place their applications on the edge of the internet, closer to customers. The platform allows for improved digital experiences in terms of speed, security and reliability. And the value of the platform has become increasingly obvious during the global pandemic and as the global digital transformation continues to modernize the internet.

The shares declined further this past week after missing quarterly earnings estimates, despite delivering revenue at the higher end of its guidance range. And the business has very high margins and a lot of room to grow (even without TikTok). You can read our recent Fastly report here:

4. Baozun (BZUN)

Powerful small cap growth at an attractive valuation. That is our view on this Chinese internet company.

Specifically, Baozun helps brands execute their e-commerce strategies by selling their goods and by providing services such as digital marketing, warehousing, fulfillment, customer service, information technology and store operations. And the shares of this high growth stock trade at an attractive valuation. You can read our latest report on Baozun here:

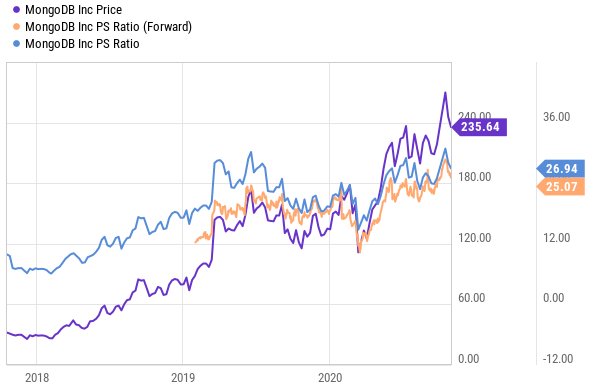

3. MongoDB (MDB)DB

This young high-growth software company has become a solution-of-choice for developers and organizations alike within a relatively short span of time. The company has achieved a five-year annual revenue growth rate of ~59% through a proven “Land-and-Expand” business model, an endeavor to fill the platform’s functionality gaps, a rapidly expanding market, and a solid management team.

The company’s stock lost significant amount of its value in the COVID-19 induced market turmoil earlier this year, but has strongly recovered since then and is currently trading at almost 28x Price-to-Sales multiple.

As a long-term investor, the high current valuation is somewhat irrelevant because we expect the share price to eventually go much higher than it currently trades at today. You can read our recent full report on MongoDB here:

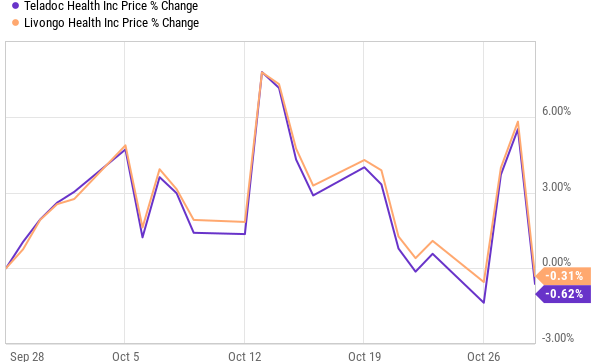

2. Livongo / Teladoc (LVGO) (TDOC)

Last month’s # 1 stock has fallen to #2. But make no mistake, we like these shares even more now than we did last month as the price has fallen but the recently announced earnings update was very good.

The soon to be merged Teladoc-Livongo combo reported impressive earnings results this past week, both beating estimates and raising guidance. We like this business, and continue to own shares of both. You can read what we wrote last month (and access our previous report) below:

Livongo is one of the fastest-growing health tech companies and among the select few that have seen their value propositions become dramatically more evident as a result of the COVID-19 outbreak. And in very big news last month, Livongo has agreed to merge with another rapidly growing health tech company, Teladoc. Both companies continue to grow rapidly and have very large total addressable markets. And for a little perspective, Livongo sales are expected to grow at 75.1% this year and 56.3% next year. These are HUGE numbers. And with a very strong showing in its own right, Teladoc revenues are expected to grow 63.7% this year and 37.2% next year. These are both amazing companies in the right place at the right time as the global digital transformation has been accelerated by the coronavirus and work-from-home practices.

1. CrowdStrike (CRWD)

Despite incredible growth, high margins, strong leadership and a massive total addressable market, the price of CrowdStrike shares fell over the last month—thereby making them even more attractive, in our view, and bumping the stock up to #1 on our list this month.

CrowdStrike is a cybersecurity company (it provides endpoint detection and response (EDR) solutions), the business is in the right place at the right time (the need for cybersecurity grows and evolves constantly), and it is growing very fast (with A LOT more room to run).

For a little perspective, CrowdStrike’s revenue is expected to grow at an astounding 70.3% this year (thanks in large part to the pandemic-induced dramatic rise in work-from-home), and its revenues are expected to grow at 36.6% next year. But what makes this opportunity so great, is that the market opportunity is so large, and CrowdStrike is proving to be a clear leader, that it can grow at a rapid pace for many years into the future.

It currently trades at a price-to-sales ratio of around 43.1x, which is terrifyingly expensive to some investors that don’t understand the business, and are used to investing in lower growth old school large caps (such as Procter & Gamble or Johnson & Johnson for example, both great businesses in their own right—just not fast growers). However, relative to the long-term growth opportunity, CrowdStrike is still dramatically UNDER-valued by the market. For example, here is a chart of the average Wall Street analyst price target for CrowdStrike versus its current price, and as you can see even these overly conservative analysts believe the shares have a lot of upside.

However, these analysts are chronically too short-term focused (their price targets generally just reactively follow the actual share price around), and they never accurately capture the true long-term value of powerful long-term growth stocks such as CrowdStrike. For a more detailed analysis of this business, and why I like it, here is my recent CrowdStrike report.

The Bottom Line

The type of high growth stocks described in this report are NOT for the faint of heart. They will likely be highly volatile with enough violent ups and downs to make a lot of people sick. But if you are truly a long-term investor, with the fortitude to hang on despite the volatility, you’ll likely be very grateful in the years ahead. These are stocks with a lot of upside, and except for Snowflake and Fiverr, we currently own all of them in our Blue Harbinger Disciplined Growth portfolio. You can attempt to wait for a better price on all of these stocks, but a very successful long-term strategy (that has worked extremely well) is simply to buy and hang on. And with the attractiveness of these businesses—your future self might thank you for sprinkling a few into your portfolio.