During afterhours on Wednesday, shares of this fast growing company fell dramatically as it released preliminary third quarter revenue numbers that were below expectations. This particular business provides an “edge cloud platform” designed for the “modern internet” thereby allowing digital applications to process quickly, reliably and safely—on the edge of the internet. This report reviews the business, its massive long-term growth opportunity, its newly revised rapid growth trajectory, valuation, risks, and concludes with our opinion on why the shares are worth considering.

Overview:

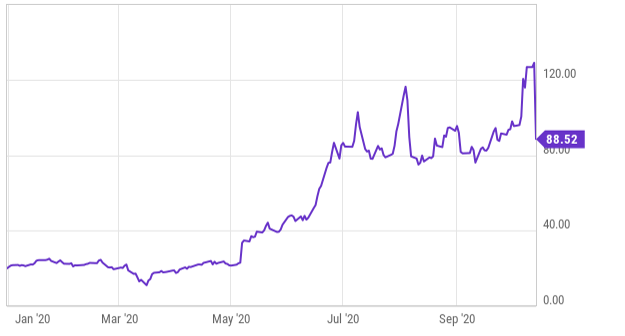

Fastly offers an “Edge Cloud Platform” that allows developers to place their applications on the edge of the internet, closer to customers. The platform allows for improved digital experiences in terms of speed, security and reliability. And the value of the platform has become increasingly obvious during the global pandemic and as the global digital transformation continues to modernize the internet. For perspective, traditional internet infrastructure platforms are configured further from customers thereby reducing speed and adding layers of programming complexities.

(image source: Investor Presentation)

Furthermore, the global digital transformation, and Fastly’s business, have been accelerated by the COVID pandemic, as customer internet needs are different, as shown in the following graphic.

(image source: Investor Presentation)

Fastly’s growing list of customers includes many of the world’s most prominent companies, including Vimeo, Pinterest, The New York Times, and GitHub.

(image source: Investor Presentation)

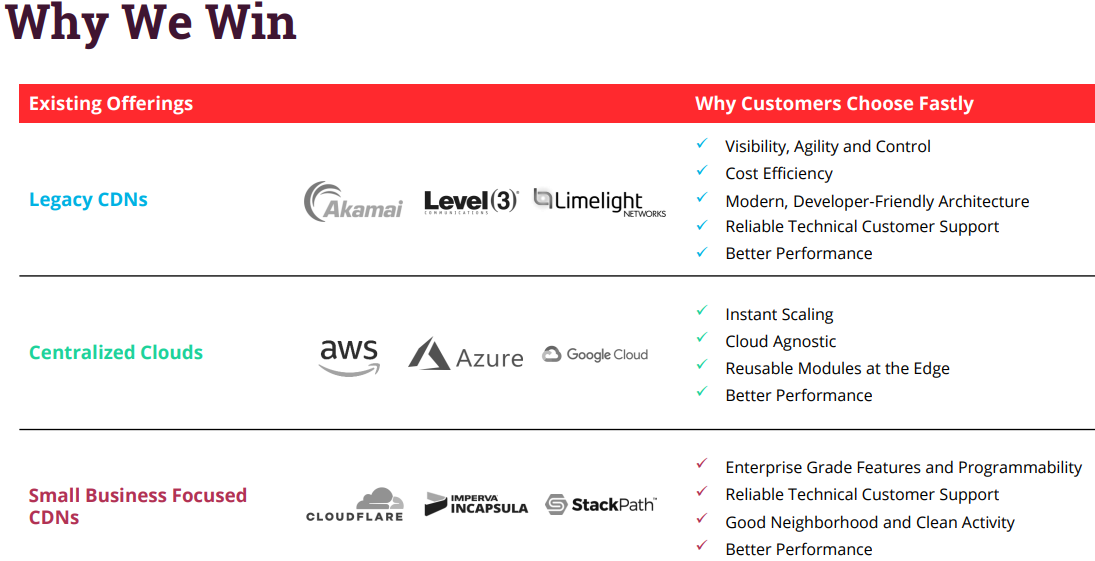

Recent Share Price Performance

Fastly’s share price has performed extremely well this year, particularly following the onset of the global pandemic, as shown in the following chart.

(image source: CNBC)

However, as you can see on the rightmost side of the chart above, the shares sold off hard in afterhours on Wednesday (down ~28.0%) following the revised revenue release.

According to the press release:

“Fastly now expects third quarter 2020 total revenue of $70.0 to $71.0 million, compared to its previous guidance of $73.5 to $75.5 million.”

These revised numbers still reflect dramatic revenue growth (as we’ll see in the next section). However, according to the company, the revised numbers are:

Due to the impacts of the uncertain geopolitical environment, usage of Fastly’s platform by its previously disclosed largest customer did not meet expectations, resulting in a corresponding significant reduction in revenue from this customer.

During the latter part of the third quarter, a few customers had lower usage than Fastly had estimated.

The “largest customer” mentioned above is TikTok. And in case you haven’t heard, TikTok has been in the news for geopolitical reasons. However, regardless of the TikTok situation, Fastly’s business has a lot of room to keep growing rapidly and for a long time, as we will cover in the next section (Oracle and Walmart have agreed to purchase parts of TikTok). And worth noting, TikTok was approximately 12% of Fastly’s revenues in the first half of 2020—prior to the TikTok geopolitical developments.

Revenue Growth and Total Addressable Market:

Here is a look at the company’s recent rapid revenue growth.

(image source: Investor Presentation)

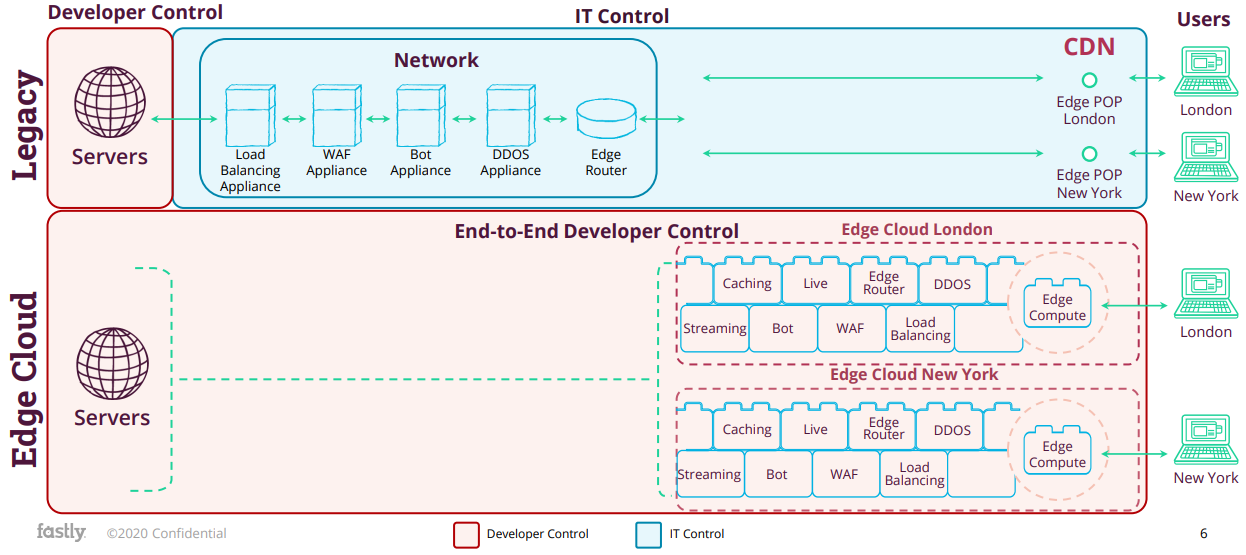

And here is a look at Fastly’s large and expanding total addressable market (compared to the company’s 2019 revenue of $200.5 million, there is an enormous amount of room to keep growing).

(image source: Investor Presentation)

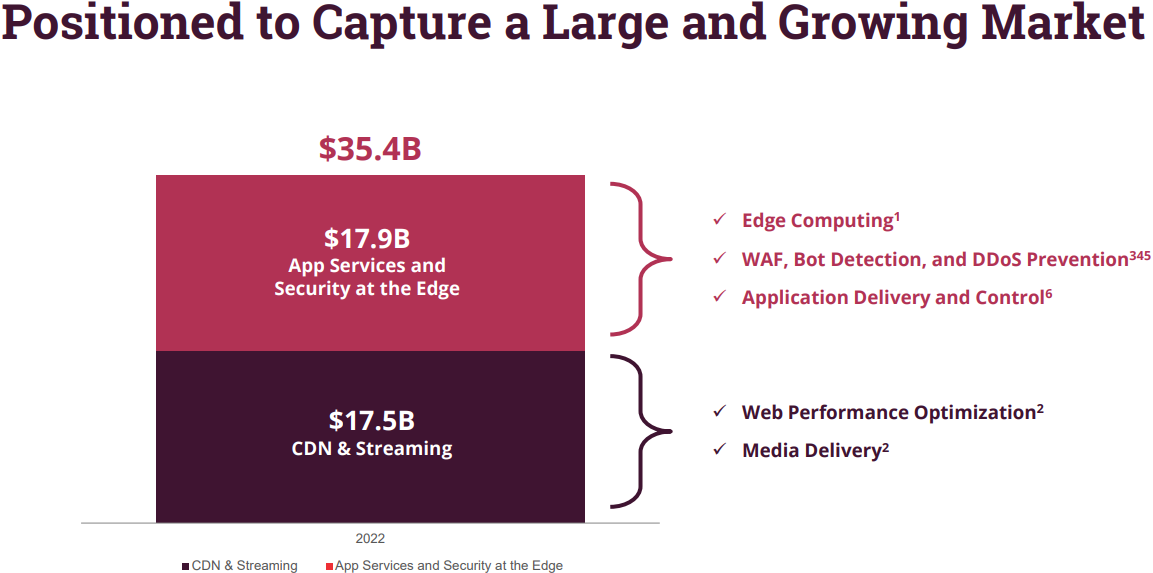

And as mentioned previously (and described in the chart below), Fastly has advantages over the competition, such as flexibility, performance and cost efficiently.

(image source: Investor Presentation)

As further evidence of Fastly’s strong competitive positioning, the business has very high customer retention rates, nearly 100%.

(image source: Investor Presentation)

In fact, the company has been very successful in implementing its “land and expand” strategy with customers, whereby once they land a customer they are able to expand the relationship and grow revenues.

(image source: Investor Presentation)

Further, Fastly can continue to grow rapidly through platform expansion, growing its partner ecosystem and moving outside the US.

(image source: Investor Presentation)

Overall, Fastly has been growing rapidly, and the business has a lot of room to keep growing rapidly (to improve the modern internet), regardless of the disappointing preliminary revenue numbers (we say disappointing because they were below expectations, but the growth rate still remains very high and has a lot of momentum).

Signal Sciences Acquisition

Worth mentioning, Fastly has also improved its offering via its recently completed Signal Sciences acquisition (after all, it is this acquisition that led the company to release revised preliminary revenue numbers in the first place). Preliminary Sciences is a security platform for web applications.

And the acquisition allows Fastly to offer a more comprehensive solution.

(acquisition presentation).

In particular, the combined entity will create enhanced product capabilities for Fastly, while continuing gross margin momentum (more on this later) and improving the overall operating model.

(acquisition presentation).

Noteworthy, Fastly acquired Signal Sciences for approximately $775 million in cash and stock. Fastly current market capitalization is approximately $13 billion.

Valuation:

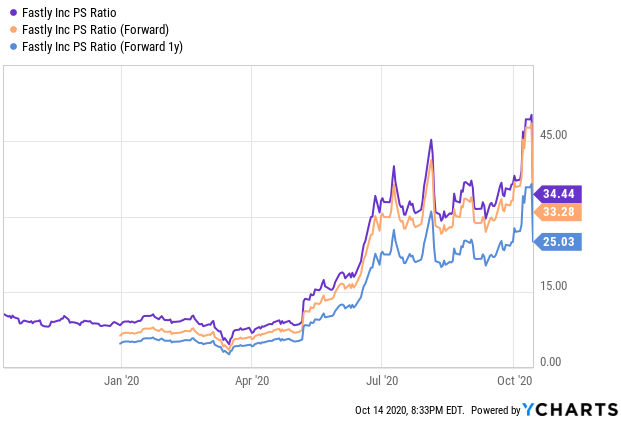

Price-to-sales is a common short-hand valuation metric for fast growers like Fastly, and here is a look at Fastly’s recent numbers.

However, given the new revenue guidance and market price, the price-to-sales ratio has now fallen to a more palatable number for some investors, especially considering the long-term opportunity. Specifically, if Fastly were to grow its sales at just 25% per year for the next few years (conservative based on its current trajectory) then its current valuation quickly becomes much more reasonable.

And what make the rapid revenue growth so attractive (beside the huge total addressable market and the company’s leadership position) is the very high gross margins (as shown below), which have room for continued improvement (especially following the Signal Sciences acquisition).

(source: Investor Presentation)

Some investors express concern over the company’s lack of free cash flow profitability (see graphic below), but the business is moving in the right direction (rapid revenue growth) as economies of scale continue to kick in, and we actually prefer to see the company focusing on the long-term growth opportunity instead of trying to maximize near-term profits. This will maximize long-term value for investors.

(source: Investor Presentation)

Overall, we believe the company has strong topline revenue growth, expanding gross margins, significant operating leverage and a disciplined path to profitability (i.e. the company’s leadership position and the large total addressable market).

(image source: Investor Presentation)

Risks:

Digital Transformation Pace: The pace of the global digital transformation is one risk Fastly has to deal with. We believe the digital transformation is an unstoppable force that will benefit Fastly and it is still in its very early innings. However, given the rapid acceleration of this transformation brough about by the global digital transformation, some investors believe sales growth could be very lumpy. In our view, the pandemic has brought forward future revenue that will result in slower growth down the road, but rather growth has been accelerated and the higher level of revenue is permanent. Management agrees to a large extent, as per this recent quote from Fastly CEO Joshua Bixby:

“The current global environment has in some ways fueled our business, but has also created areas of uncertainty. While our preliminary third quarter results reflect the challenges of a usage-based model, we believe the fundamentals of Fastly’s business remain strong, as does demand for our platform.”

Geopolitics: The recent sale of specific TikTok assets (TikTok is Fastly’s largest customer) has created some near-term risk for the business as spending from that customer has faced uncertainty. The geopolitical risks from TikTok and regulators in general, adds a degree of risk to the business.

Valuation and Volatility: Fastly trades at high price-to-sales multiple, it is not yet cash flow positive and the share price is very volatile. These risks make the shares un-investable for some investors, however the recent sharp share price decline makes the opportunity more attractive for long-term investors that can handle volatility and lumpy returns. Fastly’s business has a very large amount of long-term growth potential.

Conclusion:

Fastly is in the right place at the right time. The company is a leader in its industry and within the global digital transformation, which is massive and just getting started. Furthermore, the Covid pandemic has accelerated the transformation and highlighted Fastly’s growing strength. The Signal Sciences acquisition has improved Fastly’s offering, and the subsequent preliminary revenue announcement has created some additional margin of safety for buyers as the shares have sold off hard (on what we consider near-term noise). The ride won’t be smooth, but if you can handle the volatility, Fastly presents a tremendous long-term growth opportunity, and the shares are worth considering for a spot in your portfolio, particularly on this most recent price pullback.