The energy sector has been volatile (most recently thanks to the Saudi Arabian oil field attacks and associated fears), and from volatility comes opportunity. But perhaps more important to many investors, there are a variety of big safe yields currently available in the volatile energy sector. This week’s Blue Harbinger Weekly reviews our Top 5 big safe yields within the energy sector

But before we get into the list, here are a few data tables that we believe may be of interest.

First, here is simply a table of recent performance of the major sector ETFs. And as you can see, Energy has been the absolute laggard over the last year. And whether you think this is a temporary thing, or a big secular change to the way supply and demand works, there are still attractive big safe yields in the energy sector, and we will review multiple top ideas later in this report.

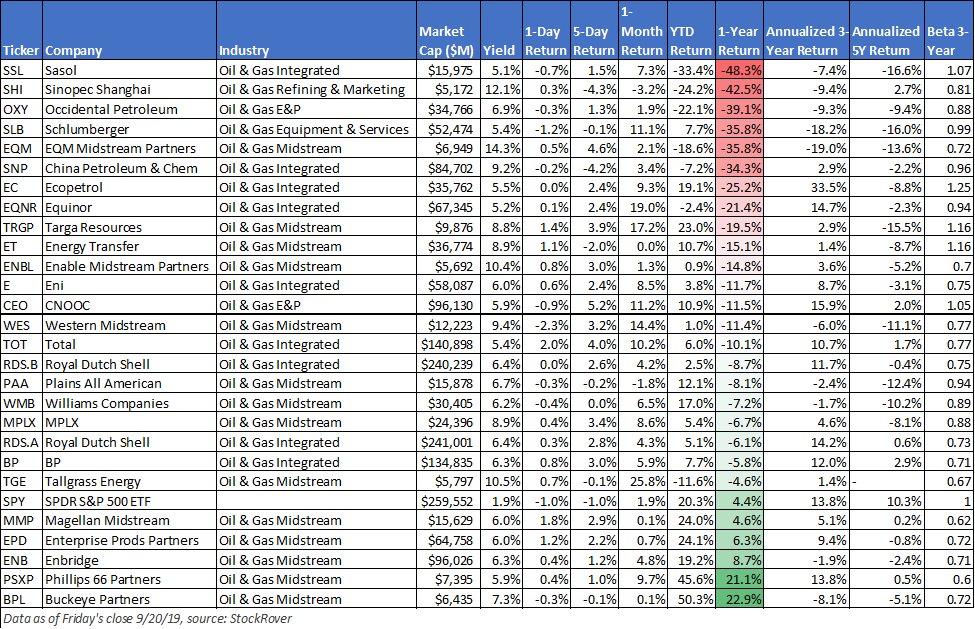

This next table shows the recent performance of a variety of big yield equity securities within the energy sector. There are multiple investor favorites on this list. However, the list is intended to also highlight additional relevant data including how different industries within the energy sector have performed (for example, there are plenty of higher yielding midstream companies on the list).

Finally, to get to our top ideas, they are listed below. However, please keep in mind, we prudently diversify all of our members-only investment portfolios (Income Equity, Income Via Growth, and Alternative Fixed Income) across sectors and styles, because we know that prudently diversified, long-term, goal-oriented investment portfolios have proven to be a winning investment strategy over and over again throughout history. We’re not suggesting you can’t opportunistically adjust your investment portfolios around the edges, but for goodness sake—don’t ever lose sight of your long-tern goals (for example, don’t put 100% of your next egg into energy stocks because you think now is a good time to “buy low”).

Without further ado, here is our ranking of the top 5 big safe yields within the energy sector.

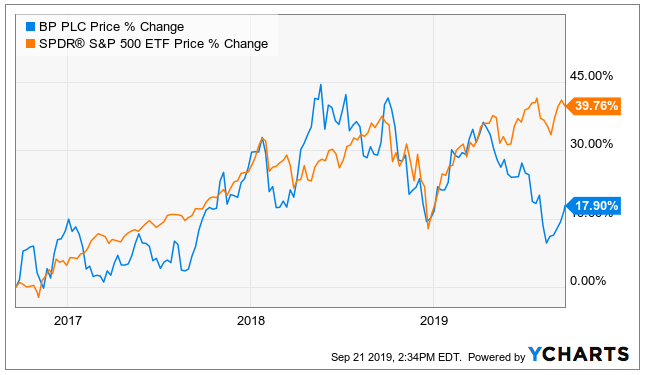

5. BP, PLC (BP), Yield: 6.3%

BP most certainly has its history of volatility and truly horrific wildlife damage. But with dramatically improved safety measures in place, combined with its very low (attractive) share price, it’s absolutely worth considering on a standalone basis. In fact, we have written in great detail about BP’s attractive qualities, and you can access our full BP report using the link below.

However, we’ve added BP to our Top 5 list for a different reason. Specifically, unlike all the other names on our list (which are straight “buys”), we are highlighting BP as an attractive opportunity to generate upfront income by selling income-generating, out-of-the-money, cash-secured, put options. Specifically, we highlight a trade gives you the opportunity to generate attractive upfront income (that you get to keep no matter what), and it also gives you the opportunity to own BP and an even lower price, if the shares fall even further than they already have, and they get “put” to you before the options contract expires. Here are the details for this income-generating opportunity:

BP Options Trade (Income-Generating):

Sell Put Options on BP (BP) with a strike price of $37 (approximately 5.1% out of the money), and expiration date of October 18, 2019, and for a premium of $0.23 (this comes out to approximately 7.5% of extra income on an annualized basis, ($0.23/$37 x 12 months). This trade not only generates attractive income for us now, but it gives us the possibility of owning shares of BP at an even lower price if the shares fall even further than they already recently have, and they get put to us (and we’d be happy to own BP, especially if it falls to a purchase price of $37 per share).

As a reminder, we generally like to share one attractive income-generating options trade idea with our readers each week (for example, last Monday we did big-dividend REIT HCP, and you can view the headlines for all of our recent members-only options trades here). Overall, we like this BP options trade because of the income and because we like BP as a long-term big yield investment opportunity. You can read our full BP report here.

4. Royal Dutch Shell (B-Shares) (RDS.B), Yield 6.4%

Similar to BP, Royal Dutch Shell is attractive because it offers a big safe dividend in the volatile energy sector. And considering the fed keeps lowing rates, a safe dividend (6.4% yield) is really saying something. We first shared this idea with our members-only a couple weeks ago when the dividend yield was even higher than it is now (the share price has since risen), but we continue to view the shares as very attractive. Here is how we concluded that previous article:

Royal Dutch Shell’s ‘B’ shares at a 6.7% dividend yield present an attractive risk-reward for income-oriented investors. The company has consistently grown dividends to shareholders despite the swings associated with oil and gas prices via a focus on improving efficiencies, asset portfolio and careful use of leverage. We expect the company to continue returning cash to shareholders in the form of dividends and buybacks in the near to medium term.

The full report gives a lot more detail on why the stock is attractive and why we like the b-shares in particular. You can access the full report here.

As a reminder, the Top 3 big safe energy sector yields are reserved for members-only, and they are available here. For a little more color, we currently own all three of the top three, and they currently offer yields of 6% to 9%. Members can access the top 3 ideas (including a full detailed report for each) here:

3. Adams Natural Resources CEF (PEO), Yield: 6.0%

The Adams Natural Resources Fund (PEO) is an attractive closed-end fund that’s been paying dividends (technically “distributions”) for over 80 years. However, it won’t show up on many of the energy sectors screens investors often run (such as the ones we’ve included earlier in this report) because it’s a “CEF.” Furthering PEO’s “under-the-radar” status, many financial websites list its yield as lower than 6% because they incorrectly omit this fund’s large Q4 distribution that is coming up soon (it doesn’t trade “ex-dividend until mid to late November, so there is still time, if you are so inclined).

We currently own shares of PEO, and we wrote in great detail about this attractive fund recently. You can read that full report here:

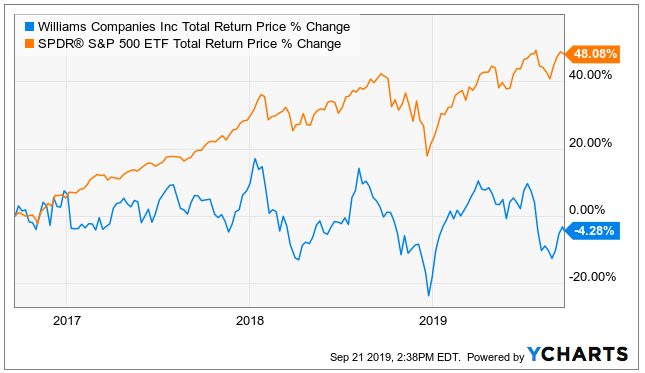

2. The Williams Companies (WMB), Yield: 6.2%

We’ve owned this one since it was Williams Partners (WPZ) (technically WPZ was acquired), but we continue to believe the WMB entity is very attractive for its improved business model and steady distributions to income-focused investors. Specifically, after a challenging period involving financial and operational reorganization, the company has emerged financially stronger and set to grow its distribution.

More specifically, WMB is well positioned to grow its EBITDA, cash flows and distribution while maintaining its credit metrics. We currently own shares of WMB, and you can read our recent full report here:

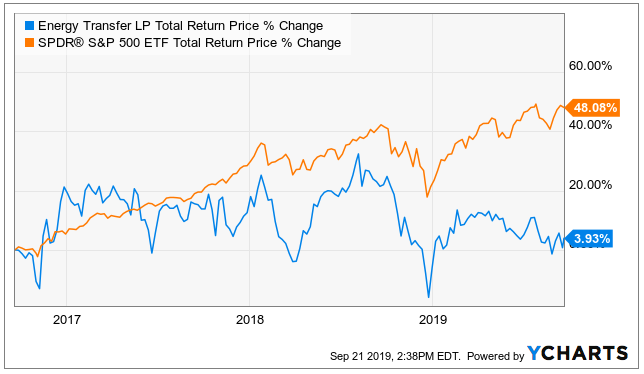

1. Energy Transfer (ET), Yield: 8.9%

Energy Transfer, LP (ET) is a stable, cash flow generator that operates energy oriented transportation, storage and midstream assets in major production basins in the United States. Specifically, Energy Transfer offers investors an attractive, stable income vehicle in the energy sector.

As a midstream MLP, the majority of the company’s cash flows are based on fee and tariffs tied to volumes rather than prices which leads to cash flow stability despite swings in oil and gas prices. The company is set to improve its balance sheet and cash flows which will help reduce the company’s valuation gap relative to its peers. ET’s 8.9% yield is highly appealing given improving fundamentals and the defensive nature of its cash flows. You can read our full Energy Transfer report here:

Conclusion:

If you are looking for stable yield, despite volatile markets, the energy sector is ripe with opportunities, such as the top 5 we’ve highlighted in this report. However, before you go haphazardly chasing after the energy sector with an obnoxiously large portion of your nest egg, remember this phrase:

“prudent diversification."

Specifically, “prudently diversified,” long-term, goal-oriented investing has proven to be a winning strategy over and over again throughout history. It’s okay to make changes to your investment portfolio opportunistically and/or for rebalancing purposes, but for goodness sake don’t ever lost sight of your long-term goals. Each of our Blue Harbinger portfolios are prudently-diversified long-term investment portfolios that continue to achieve their respective long-term goals. You can view them all here.