This is part 2 of our free public article titled Top 10 Big Yields, however unlike the public version, this members-only version includes the top 5.

Over the last year, interest rate expectations have gone from expected rate hikes by the Fed to rate cuts, and it’s got people scared and confused. Increasingly confounding to many, rates in many regions around the world are now negative. According to Wikipedia, a Zero Interest Rate Policy (ZIRP) is for extraordinary circumstances. But let’s forget ZIRP for a moment, and instead consider attractive big yield opportunities for income-focused investors. This article focuses on Business Development Companies (BDCs), Closed-End Funds (CEFs) and Real Estate Investment Trusts (REITs). Specifically, we count down our Top 10 Big Yields from those categories. Without further ado, here’s our Top 10.

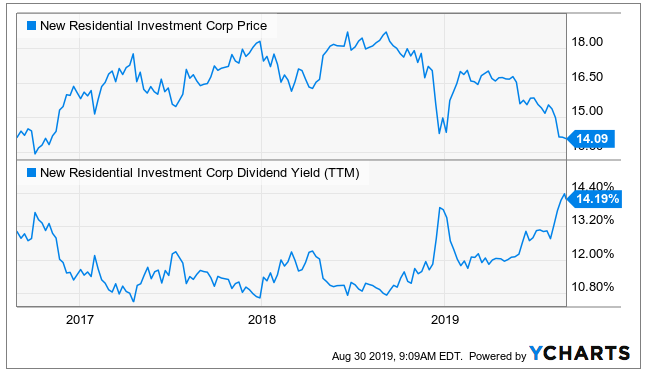

10. New Residential (NRZ), Yield: 14.2%

New Residential is a big dividend REIT that invests in mortgage-related assets, and the shares have sold off very sharply in recent weeks, mainly because its previously coveted Mortgage Servicing Rights (“MSR”) assets actually decrease in value when interest rates decline.

We have previously written in great detail about New Residential and how it makes money (for example here). However, we’re most recently attracted to the shares because of an attractive high-income generating options trade that exists, and you can read about that opportunity using the link below. But before clicking the link, it is worth noting that based on current market conditions, we currently like selling the October put options with a strike price about 5% - 10% out of the money because it generate very attractive upfront income for us now (that we get to keep no matter what), and they give us the opportunity to pick up shares of NRZ at an even lower price (if they fall below the strike price before expiration), and we’d be happy to own the shares at the lower price because we think the current selloff is overdone and the shares present an attractive investment opportunity. View the details of the trade here…

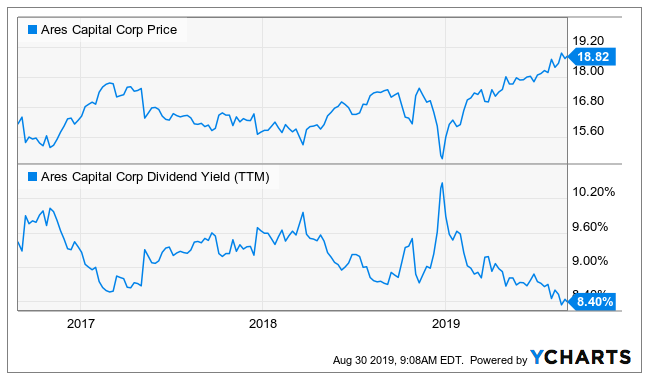

9. Ares Capital (ARCC), Yield: 8.5%

Ares Capital Corporation, part of the $142 billion Ares Management, L.P. is the largest BDC in the US by assets. The company holds a well-diversified, low risk portfolio of assets and has provided sustained income to investors since its IPO in 2004. We believe the company’s 8.5% dividend yield is reasonable (for example, within the historical range) and the stock presents an attractive risk reward opportunity given ARCC’s stable and consistent income generation. You can read our full ARCC report here….

8. Royce Value Trust (RVT), Yield 8.4%

If you like to generate high income from your investments, this disciplined small cap CEF yields 8.4% and it is currently attractive in multiple ways. For example, its discount to NAV, its well-seasoned management team, its attractive style tilt, its US economy-focus, its impressive long-term track record, its long-term total return potential, and its ability to help you diversify away from the traditional high income sectors (where so many income investors have over concentrated their risks), all while using great discipline to pay you the steady high income payments you need. If you’re managing your own investments, this CEF can be an attractive addition to your diversified, long-term, high-income-focused, investment portfolio.

Also interesting to note, Michael Burry (of “The Big Short” fame) believes there are attractive small cap value opportunities in the market now due to a large cap ETF bubble. According to Bloomberg:

"Now, Burry sees another contrarian opportunity emerging from what he calls the “bubble” in passive investment. As money pours into exchange-traded funds and other index-tracking products that skew toward big companies, Burry says smaller value stocks are being unduly neglected around the world."

You can read our full RVT report here…

7. Main Street Capital (MAIN), Yield 5.6%

If you’re looking for an attractive way to generate stable income and an interesting way to participate in the lower middle-market, then Houston based BDC Main Street Capital (MAIN) is worth considering. It delivers a consistently growing dividend per share, under average debt to equity and above average ROE and ROA, and it has significant oppurtunities for continuied NAV growth per share. You can access our Main Street report here…

6. Saratoga Investments (SAR), Yield 8.7%

Saratoga Investment Corp (SAR) is a diversified, business development company and a CLO manager that has experienced strong portfolio and dividend growth over the last several years. In particular, it manages a growth oriented portfolio and offers an attractive dividend yield. Plus, given the dry powder available to the company as well as potential for additional funding from SBIC program, SAR is well positioned to grow its dividend and earnings while continuing to maintain strong dividend coverage. You can access our full SAR report here…

5. Triple Point Venture Growth (TPVG), Yield 8.9%

One of the common mistakes of income-focused investors is to concentrate too much of their investment portfolio in the traditional income-focused sectors of the economy. However, this is not the case with TPVG. Growth stocks usually don’t pay much in the way of dividends, but TPVG is focused on growth opportunities and it offers a juicy dividend yield. This California based BDC gets you access to venture growth stage opportunities in high growth industries, and it is currently trading at a very reasonable price. For perspective, the fund has provided loans to venture-backed companies such as Facebook, Square, YouTube, and Workday, and in some cases owns shares through the exercise of warrants. You can access our full report on this opportunity here.

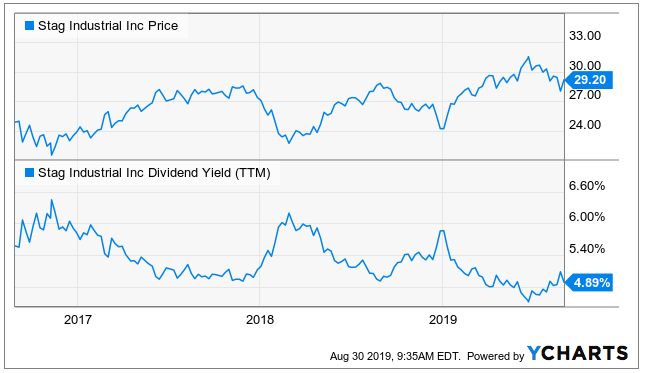

4. STAG Industrial (STAG), Yield: 4.9%

Stag is an industrial REIT that has tremendous long-term growth potential, but it tends to rise and fall a little more in the short-term that other REITs (It’s not dramatically volatile, but its beta is a little higher than other REITs). The price is currently attractive, and we have recently written in detail about Stag Indistrial (including an attractive options trade idea) here.

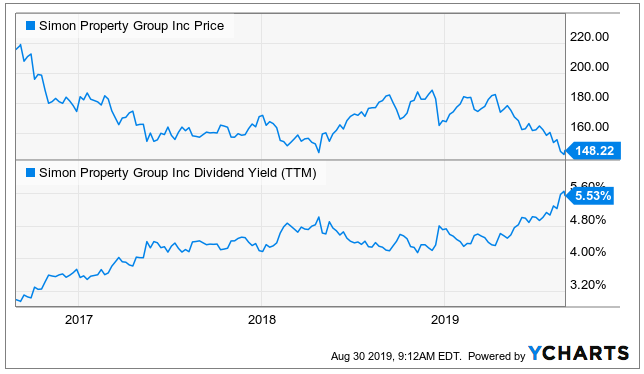

3. Simon Property Group, Yield: 5.5%

Simon Property Group is hated because it is a shopping mall REIT, and the market fears all malls will get killed by internet shopping. That narrative is simply incorrect. SPG is an A-class mall (these malls are fairing much better than the B-class malls), it continues to set income records, and it has plenty of financial wherewithal to keep paying its big dividend. And by the way, the yield is higher than normal because false narrative selling pressures have driven the price much lower than it should be. What makes Simon more interesting is that recent ongoing flair ups of market volatility have been creating opportunities to generate attractive income by selling out-of-the-money put options. We generally like selling with a strike price 5% to 8% out of the money, and with a about one month to expiration, so long as you can generate decent income (which is usually available right after each small volatility-driven market sell off). You can read our recent full report on Simon here.

PIMCO Dynamic Credit and Mortgage Income Fund (PCI), Yield: 9.7%

With interest rates in the US low, but still higher than many other developed markets around the world, we could see rates go even lower in the US. And when rates fall, bond prices go up. Further, this fixed income fund is actively managed by one of the most resourceful companies in the industry, PIMCO. We currently own shares of this high income closed-end fund, and you can read more about it here.

1. Adams Natural Resources Fund (PEO), Yield: 6.0%

Energy prices continue to struggle in recent years as new technologies and supply keep the prices from going too high. Nonetheless, many of the major integrated oil and gas companies continue to generate plenty of income to cover their dividend payments to investors, and the dividend yields have gotten juicy because the share prices have fallen. One of our favorite ways to play this opportunity is through a very attractive closed end fund that has been around for many decades, the Adams Natural Resources Fund (PEO). You can read more about this attractive timely opportunity in our recent write-up, here.

The Bottom Line:

Despite low and declining interest rates, attractive big yield investment opportunities remain, and this article has highlighted a handful of them from the BDC, CEF and REIT categories. Importantly, there are attractive income-producing investment opportunities across other categories, and it is important to consider them for risk-reducing diversification reasons. You can check out our current holdings across all of our High Income Opportunity portfolios, here.