“Trade Wars,” interest rate cuts, an eerily calm VIX, and the longest bull rally in history is leading many investors to believe we’re due for a market wide sell off (perhaps a big one) that could arrive any day now. We are not in the businesses of “fear mongering,” but being prepared for very bumpy roads ahead is just good investing. This week’s Blue Harbinger Weekly discusses two critical things you can do with your investment portfolio to be prepared for the next big market sell off. The first is to simply pick good investments (and we will review a few in this write-up). The second has to do with picking the right kind of investments—which we will explain in more detail.

Beware of Investment Charlatans

First and foremost, no one knows what the market is going to do today, tomorrow, next month or next year. And if anyone tells you they do know—don’t walk away… run! The investing world is full of conflicts of interest and people just trying to get a piece of your hard-earned nest egg. For example, “sales guys” that get paid when they sell you a particular investment product, media pundits that generate advertising revenue when you click on their next “the sky is falling” newsflash, and ordinary stock brokers who often don’t add anywhere near enough value to warrant their high fees.

The Best Investment Solution

The best investment solution, over and over again throughout history, has been to select a prudent goal-oriented mix of investment and to hold them for the long-term. That doesn’t mean you can’t do a little opportunistic buying and selling around the edges, but be cognizant of the costs that trading generates (both implicit and explicit fees), and never lose sight of your long-term goals. Long-term “goal-oriented” investing is the second thing you can do to be prepared for the next big market sell off. We don’t know when that sell off is coming (no one does) but picking the right mix of investments is absolutely critical.

Long-Term Goal Oriented Investing

Long-term goal-oriented investing can sound boring to some, but it is absolutely critical if you want to be a successful investor. Specifically, long-term goal-oriented investing involves selecting a mix of investment that is prudent to your goals. By “mix” we mean add a little diversification to your portfolio. Putting all your eggs in one single basket is usually a very bad idea. By “goal-oriented” we mean, for example, if you are an income-focused investor (i.e. you need to generate income from your investments) then don’t put all your money in zero-dividend aggressive growth stocks. When the next sell-off comes, aggressive growth stocks will likely sell off much harder than other investments. For example, blue chip low volatility dividend-payers might be a much better option for you. At the same time, don’t stick your head in the sand and put all your money in a zero-interest-paying savings account (reserve that kind of thing for money you need to spend in the very near future). There are few things more painful that watching someone who needs their money for some big expense instead choose to throw it in the stock market right before a big prolonged market wide sell off. That’s just a bad situation.

The point here is to select a prudent mix of investments (usually stocks, bonds and cash) that meet your personal goals. Specifically, if you have a long-term horizon then you probably want to own more stocks because even though they’re generally more volatile in the short run, they also generally provide much higher returns in the long run. And when you factor in years and years of compound growth, the stock market is a truly incredible wealth building machine. And on the other hand, if you are too old to deal with all that volatility—then you may want to consider owing a few more lower volatility dividend-paying investments to help you sleep well at night. We will review a few in the next section.

Pick Good Investments

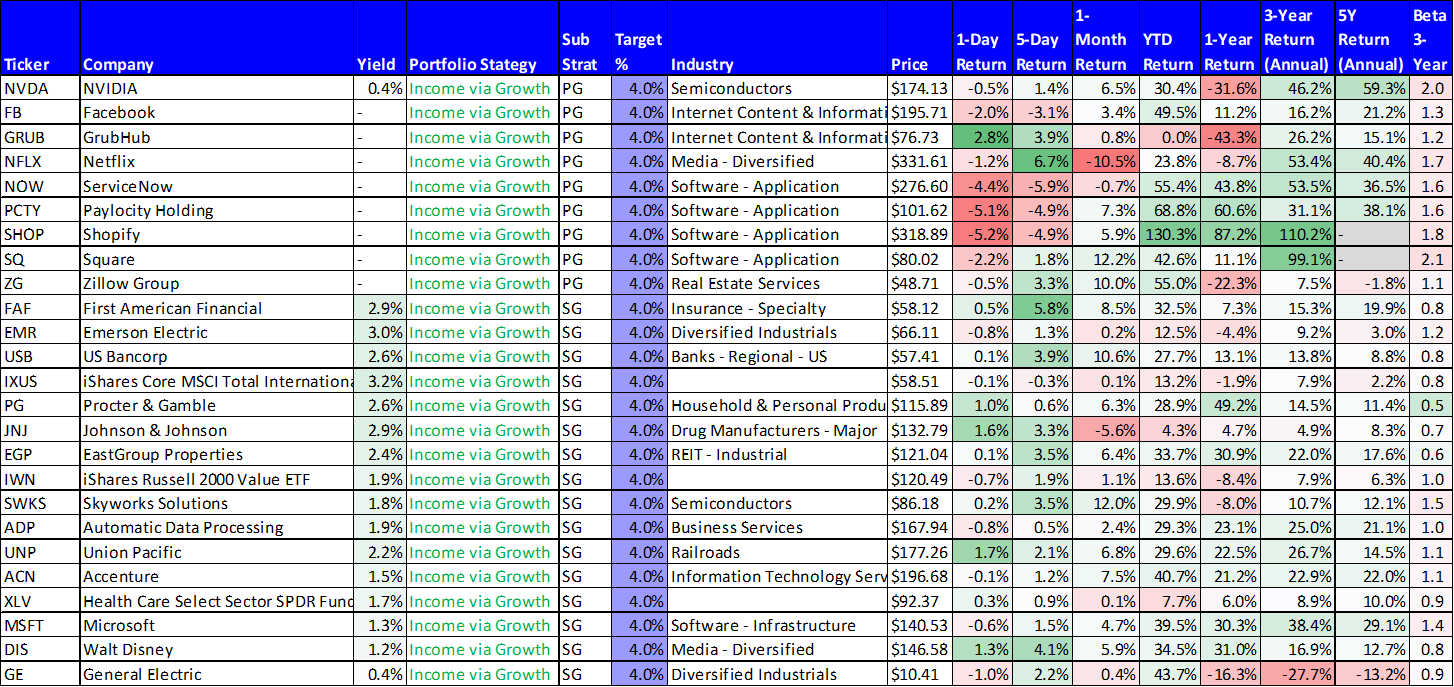

That may sound easier said than done, but it is very reasonable and very doable. Once you determine your “goal oriented” investment strategy (as described in the paragraph above, then pick a good mix of good investments. We have highlighted multiple examples of good investments and segregated them into different goal-oriented strategies. Specifically, we have broken out attractive investment opportunities into our Income Equity portfolio, our Income Via Growth portfolio, and our Alternative Fixed Income portfolio. Here is a snapshot of the holding within each strategy as well as the recent performance for each position (as of mid-day Monday 7/29/19).

These are not rapid trading portfolios, but rather they are diversified long-term goal-oriented strategies. We don’t trade often, but rather we do do some opportunistic buying and selling on the margin. We also do a little rebalancing once in a while so the weight of any position doesn’t get too large. And considering the stock market has performed so well for so long, it’s probably worthwhile for you to check your own investment portfolio now to make sure no positions have gotten too large (i.e. you don’t want to be putting too many of your nest eggs into one basket).

The Bottom Line

As you can see in our growing long-term performance track records for each strategy, the returns and income produced continue to be very good. Not only do we continue to avoid the silly short-term mistakes that so many fall victim to thanks to the myriad of investment charlatans and fear mongering media pundits, but we continue to believe these strategies are very well positions for more highly attractive long-term returns and income ahead. And if you are afraid that the next big market wide sell off may be right around the corner, all you need to do is understand your goals (e.g. long-term growth? near-term income?) and stick to your strategy. Also worth considering, we’ve recently identified a few attractive high-income investing opportunities, if you have a little money to put to work, here: