This week’s Weekly shows the recent and historical performance of all of our current holdings across strategies (as well as the names on our Contenders List), and also highlights what has been working, and where we’re seeing the best opportunities going forward. The week’s theme is the ongoing disruption and opportunities the US-China “Trade War” (it’s really just a “skirmish”) is creating for selective disciplined investors. We highlight specific opportunities.

source: StockRover, data as of Friday’s close (24-May-2019)

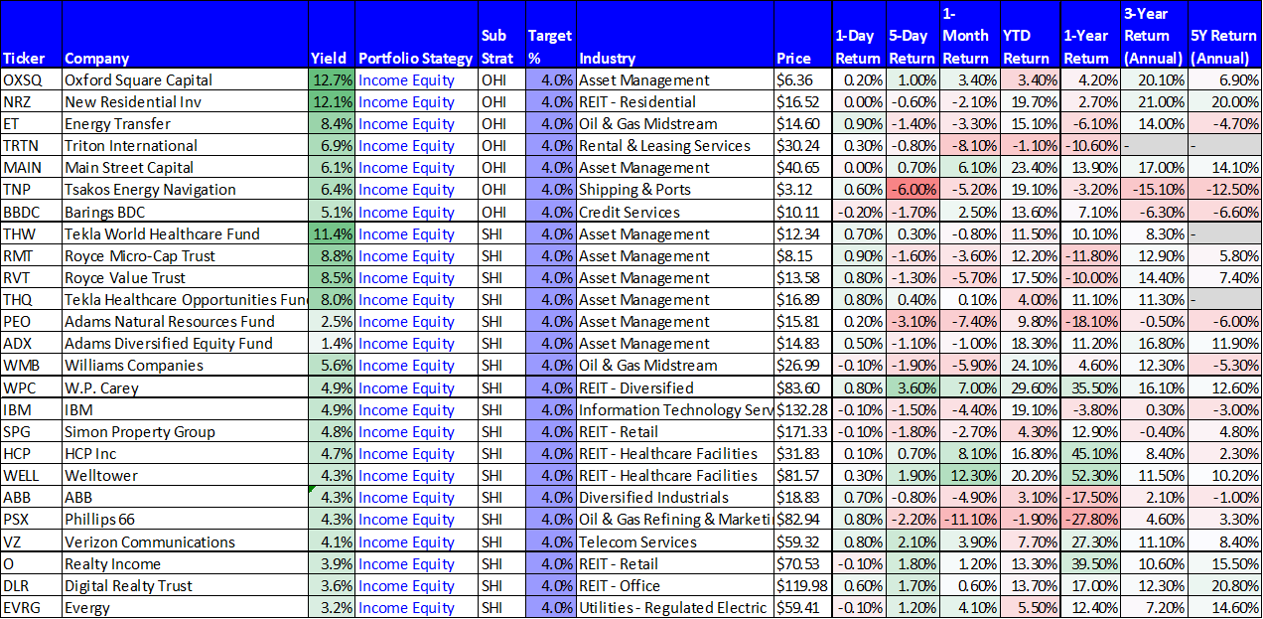

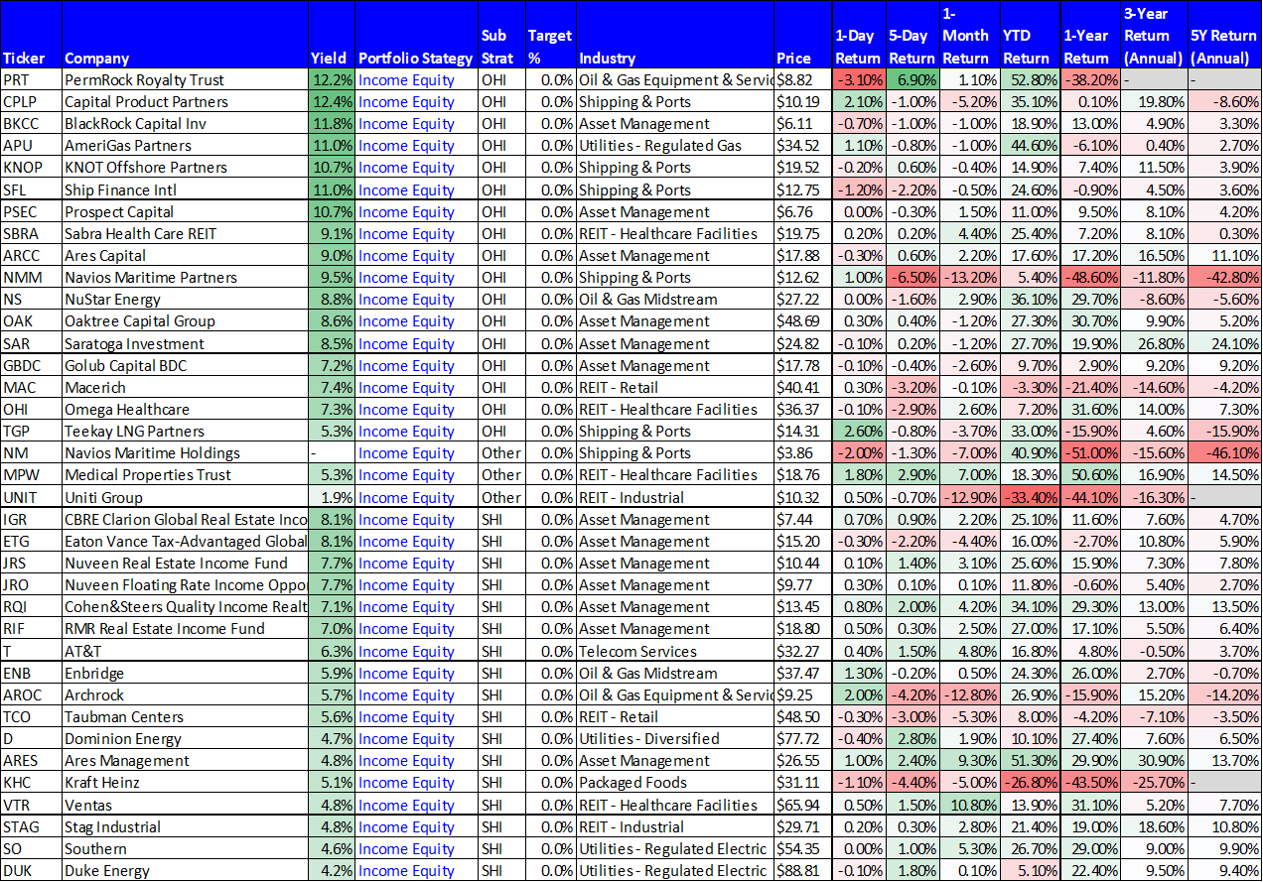

Our Current Holdings and The Contenders:

For starters, here are our current holdings and contenders by investment strategy:

source: StockRover, data as of Friday’s close (24-May-2019)

source: StockRover, data as of Friday’s close (24-May-2019)

source: StockRover, data as of Friday’s close (24-May-2019)

source: StockRover, data as of Friday’s close (24-May-2019)

source: StockRover, data as of Friday’s close (24-May-2019)

source: StockRover, data as of Friday’s close (24-May-2019)

Worth noting, the target weights in each strategy are exactly that—targets. Our actual holdings are very close to those weights, but vary up or down based on market performance/movements. We share the weights of our actual holdings (along with portfolio performance) one per month (shortly after month end). The targets are a guideline for investors considering implementing their own investment strategies. As a reminder, diversification is important to reduce risks, but over-diversification usually results in only average performance (or worse). We like the target weights and our actual holdings.

Trade War

As long-term investors, we hate media narratives because they’re generally sensationalized, often incorrect, and usually way too short-term focused. Nonetheless, we’d be remiss not to acknowledge disruption in some security prices resulting from concerns over the trade war. And for clarification, by “Trade War” we mean the ongoing trade negotiations and tariffs mainly between the US and China, but also the intended tougher stance by the US with other countries around the world.

Maritime Shipping Companies (Tsakos, Teekay)

The two main areas where the “trade war” is impacting our current holdings and our contenders is “maritime shipping companies” and “chipmakers.” With regard to shipping companies, they’re generally the enormous boats through which products are shipped/traded with international partners. And because of concerns with the potential for growing trade challenges—these container ships are down significantly, including Tsakos (TNP) Navios Maritime (NMM), Teekay Offshore (TOO), and the various big-dividend preferred shares these companies have issued. To be clear, there are other things going on here besides just the “trade war.” For example, increased environmental regulations pertaining to the ships as well as volatile energy prices have both been impacting price volatility.

Overall, we view this shipping sector volatility as ongoing, as we believe being selective and diversified is prudent. Specifically, we don’t own 100% shipping companies (that would be crazy), but we continue to own Tsakos (TNP), Teekay Offshore Preferred (TOO.B), Teekay LNG Preferred (TNP.B), and some Tsakos Preferred (TNP.E), and we like their big yields and potential for price appreciation going forward.

Semiconductor Companies (Skyworks and Nvidia)

Semiconductors is another sector being significantly impacted by the “trade war.” For example, Skyworks (SWKS), a name on our contenders list, is down 22% over the last month thereby making it increasingly attractive from a “buy low” perspective. However, instead, we continue to own high end chipmaker Nvidia (NVDA) because the long-term prospects for it GPU chips are just so much more attractive thanks to its business in video games, data centers, autonomous vehicles, and artificial intelligence. We believe that Nvidia shares continue to trade at an extremely attractive price if you are long-term investor.

The Overall Market (S&P 500)

Relative to what happened during the financial crisis of 2008-2009, the S&P 500 has not been very volatile at all over the last year. However, starting in the 4th quarter of 2018 through today, the S&P has been experiencing heightened volatility and fear compared to the previous several years where the markets had been steadily improving.

source: StockRover, data as of Friday’s close (24-May-2019)

source: StockRover, data as of Friday’s close (24-May-2019)

Note: View the above tables in an Excel Spreadsheet format here.

Despite strong gains year-to-date (+13.6%), the S&P 500 is down over the last month (-3.2%). We’re certainly not making any attempts to predict where the market is headed next week or next month (that’s a fool’s errand, and anyone who tells you they can do that is… well… wrong). However, over the long-term, the market will likely be high—and probably much higher. Many low-volatility dividend and non-dividend investments are now on sale relatively to their own recent historical prices. And the economy remains strong (healthy GDP growth, low unemployment).

Now remains an attractive time to buy, but only in accordance with your long-term strategy. For example, if you are an income-focused investor—don’t go plowing 100% of your nest egg into growth stocks right now because the market is down and the economy is strong. Be disciplined. Stick to your strategy.

Buying Opportunities: Stocks that we own, and that appear to be trading at particularly attractive prices right now (thanks in large part to their recent price declines) include:

Adam’s Natural Resources Closed-End Fund (PEO), Yield +6% annually

Phillips 66 (PSX), Yield 4.3%

Nvidia (NVDA), Yield 0.4%

Teekay Offshore Preferred Stock (TOO.PB), Yield: 12.2%