If you like attractive high yield investments, your search can take you to all corners of the market. This week’s Blue Harbinger Weekly compares the post dividend cut 4.6% yield of Kraft Heinz to the 8.8% dividend yield of PIMCO’s popular closed-end fund, PCI.

Kraft Heinz Company (KHC), Yield: 4.6%

The supposedly iconic brands of the Kraft Heinz Company are dying as consumer preferences and shopping habits are changing (Kraft and Oscar Mayer were just written down by $15.5 billion). The company also just announced a 36% dividend cut, earnings results that fell short of expectations, and an SEC probe related to accounting practices. Yuck! With all this negativity, is there any reason to believe Kraft Heinz is anything other than a value trap at this point?…

…In our view, Yes.

Overview - Kraft Heinz Company:

Kraft Heinz has now experienced two consecutive quarters of ORGANIC revenue growth. That means NOT through acquisitions, but rather the business is growing. What is more impressive about the company is they have, by far, some of the best margins in the industry, which means they can finally start focusing on marketing and brand value improvements like their peers do, instead of being only laser focused on cost cutting (which, by the way, they are very good at, thanks to discipline and scale).

In our view, the dividend cut was a smart move (and highly unexpected by the market). Rather than trying to be super machismo (and protecting the dividend at all costs), management cut the dividend to free up cash to better manage debt and growth (Kraft Heinz debt is lower investment grade with a BBB rating). This is a company that could have supported the higher dividend, but chose to proactively free up cash for long-term value creation (and there are plenty of opportunities to create value considering the organic growth, the very strong margins, the improved liquidity profile, the opportunities for brand marketing and improvement, and (dare we say it) the smart, proactive, and bold management).

The SEC accounting probe (read more about it here) is a wild card, it is dangerous, and investors should be concerned. However, at this point, it appears to be one-time-only and not expansively material (knock on wood).

From a valuation standpoint, we liked Kraft Heinz before the latest earnings cut and earnings miss (read more here) but we decided (at that time) to stay on the sidelines for a better entry point. We believe Kraft Heinz remains a viable long-term business with organic growth and significant share price appreciation potential. And if you are an income-focused investor, here is one way to play it…

Due to heightened near-term volatility and fear, rather than purchasing shares of KHC outright, consider selling income-generating put options.

The Trade:

Sell Put Options on Kraft Heinz (KHC) with a strike price of $30.00 (~13.2% out of the money), and expiration date of April 18, 2019, and for a premium of $0.43 (this comes out to approximately 8.6% of extra income on an annualized basis, ($0.43/$30.00 x (2/12) months). This trade not only generates attractive income for you now, but it gives you the possibility of owning shares of Kraft Heinz at an even lower price if the shares fall even further than they already recently have, and they get put to you (and you should be happy to own big-dividend paying Kraft Heinz (the yield is still juicy, especially considering the lower share price), especially if it falls even further to a purchase price of $30.00 per share).

Note: If you want a higher chance of owning the shares (i.e. having them put to you) and significantly higher upfront income, consider the $32.50 strike price.

Your Opportunity:

The above trade idea uses intra day data from Friday (the first trading day after the negative news hit), however we believe this will be an attractive trade to place when the market opens back up on Monday as long as the price of KHC doesn't move too dramatically at that time, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 8-10%, or greater.

Note: The premium income available on big dividend Kraft Heinz is usually quite low, however the premium income available currently is much higher than normal (for KHC) because of all the volatility, fear and uncertainty.

Our Thesis:

In addition to the information we shared in our overview, our thesis in a nutshell is that Kraft Heinz remains a viable long-term company (even more so than it was yesterday thanks to the extra cash and adjusted share price following the dividend cut). The market fear and volatility has made the premium income on this trade very attractive, in our view.

Important Trade Considerations:

Kraft Heinz is expected to go ex-dividend on March 9th, before this options trade expires. This will impact the share price, and is an important consideration for this options trade. We believe this trade remains attractive even after considering the upcoming dividend payment's impact on the share price.

Asset Allocation and Risk Management:

This trade produces attractive upfront income and gives you the chance to own the shares at an even lower price (if the share price falls and the shares get put to you). However, unless you feel like borrowing money in your account, you’ll need to keep enough cash on hand in your account to cover the purchase price of the shares IF they get put to you before this put option contract expires in April. Also, remember that put options are bought and sold it units of 100 (each options contract is based on 100 shares of the underlying stock), so make sure to size your trade so you’d be comfortable purchasing and owning the shares if they get put to you. For example, if you sell one put option (based on 100 shares), and if the contract is executed and the shares are put to you then you’ll own $3,000 worth of Kraft Heinz (i.e. 100 shares x $30 per share).

The Bottom Line on This KHC Trade:

If you already owned shares of Kraft Heinz (like Warren Buffett does--it's one of his largest holdings) the dividend cut announcement is painful. However, if you don't already own shares, the stock is more attractive today than it was yesterday thanks to the improved operating cash that will be available, the ramping organic growth, and the valuation. However, rather than purchasing the shares outright, we have elected to sell income generating put options because the premium income is currently attractive.

If the shares get put to us (at an even lower price) we're happy to buy and own them for the long-term considering the very attractive valuation, attractive yield, and ramping organic growth prospects. And if the shares don't get put to us before the option contract expires in April then we're happy to simply keep the high premium income we just collected for selling these puts.

PIMCO Dynamic Credit & Mortgage CEF (PCI)

Yield 8.8%

The PIMCO Dynamic Credit & Mortgage Fund (PCI) is a popular closed-end fund that we currently own. We are highlighting it this week because it provides a good high income contrast to the Kraft Heinz idea we highlighted above. Specifically, while Kraft Heinz is trading very inexpensively relative to its own historical standards, PCI is a little expensive right now relative to its own historical price (particularly as compared to its net asset value), but remains very attractive nonetheless.

We have written about the attractiveness of PCI in the past (for example here), and you can also view a bunch of the latest relevant fund data here (including holdings, expenses and discount/premium to net asset value, to name a few). However, the two stats we’d most like to highlight about PCI are its current price relative to its net asset value and its current price relative to credit spreads.

PCI’s Share Price Relative to Its NAV:

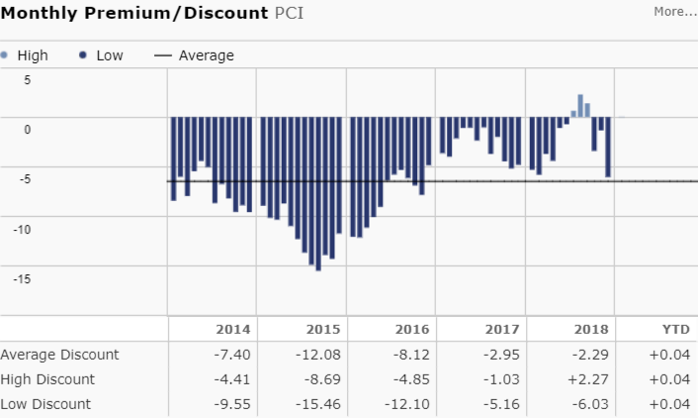

Here is a look at PCI’s current price relative to its net asset value.

Note PCI currently trades at a premium (+0.04) relative to its NAV. And in actuality this data is updated monthly, and the actual current premium (per the Morningstar CEF quickrank link we provided earlier) is actually +0.22. And as you can see in the blue bar chart above—PCI is expensive relative to its historical premium/discount to NAV (it rarely trades at a premium, but it currently does). For some perspective, most of PIMCO’s fixed income Closed-End Funds trade at enormous PREMIUMS to NAV. We’ll cover this in more detail in a moment, but first the other metric worth pointing out is PCI versus credit spreads…

PCI Relative to Credit Spreads:

Here is a look at the historical price of PCI relative to credit spreads (credit spread is the difference in yield between low risk treasuries and higher risk bonds with a lower credit rating).

The relationship should be obvious: as credit spreads widen, PCI’s price falls, and vice-versa. This is an important stat because even though credit spreads widened significantly around the turn of the calendar year, but have since narrowed, they’re still not unusually low. No one knows with certainty what will happen next with market risk and credit spreads, but we like that the spread is NOT unusually low because it is a general indicator that PCI’s price is not unusually high.

Is PCI A Forever CEF?

In our view, PCI remains attractive as one source of high income (paid monthly) within a diversified investment portfolio (we currently own shares). However, for more perspective on the continued attractiveness of PCI, we are sharing another recent CEF write-up from CEF investor, Yield Hunting, where he highlights similar points to those we described above, but he also provides more perspective on a wide variety of additional high yield CEFs. Within the write-up (below) he describes PCI as basically the closet thing possible to a “Forever CEF” (i.e. he likes PCI too). Without further ado, here is the member-only guest CEF write-up, including more details on PCI…

Conclusion:

If you are seeking attractive high yield investments, there are lots of places to look. And in fact, as an income-seeking investor, it’s a good idea to obtain your high yield from a variety of sources (for diversification and risk management purposes). For example, if you are a contrarian value investor, then the 4.6% post-dividend cut yield on Kraft Heinz (KHC) may be worth considering (it’s one of Warren Buffett’s largest holdings, and he probably wishes he bought the shares now (at the lower price) instead of when it was trading significantly higher). And if you are a little more exotic, you might consider selling income-generating put options on Kraft Heinz, as described in this article. Or, if you’re are seeking and attractive high yield (paid monthly) from a fixed income (bond) closed-end fund, you might consider PCI (we own it).

For reference, you can view all of our current holdings here.