If you’d have been invested in 100% “aggressive growth” stocks over the last two months (for example, young software companies with very high sales growth), you’d have gotten absolutely slaughtered. A bloodbath. Whether you call it a “rotation” or a long overdue “correction,” is irrelevant. The mistake we are talking about is, of course, the failure to prudently diversify your portfolio. We’re not suggesting anyone be a “closet index fund,” but for goodness sake, don’t put all your eggs in one basket. In fact, don’t even put most of them in one basket. You’re too darned old for that crap. And if you don’t know what we’re talking about, for your reference, check out these 7 Deadly Sins of Long-Term Investing (too many eggs in one basket is on the list).

This report is our monthly performance Update. But before getting into the performance details for our three portfolios, here is a list of some timely top investment ideas that we put together:

Performance Update:

Now on to performance. All three of our strategies continue to perform extremely well over the long-term, and the important takeaway this month (at least one of them) is don’t put all your eggs in one basket (you’ll see why in a moment, but it’s basically the mistake you’re too old to make).

Without further ado, here is the update for our investment strategies:

As you can see, our big-dividend (currently a 6.2% yield), 25-stock, Income Equity Portfolio continues to outperform the S&P 500 since inception back in 2016, and it continues to yield roughly 3 times the yield of the S&P 500. To put up those types of numbers with that type of yield is very impressive (yes, we are tooting our own horn). And as you can see in the following table, the strategy was up 3.2% in September (while the S&P 500 was up only approximately 1.7%).

We will share the recent performance of every single position in this portfolio later (in the members-only section) of this report.

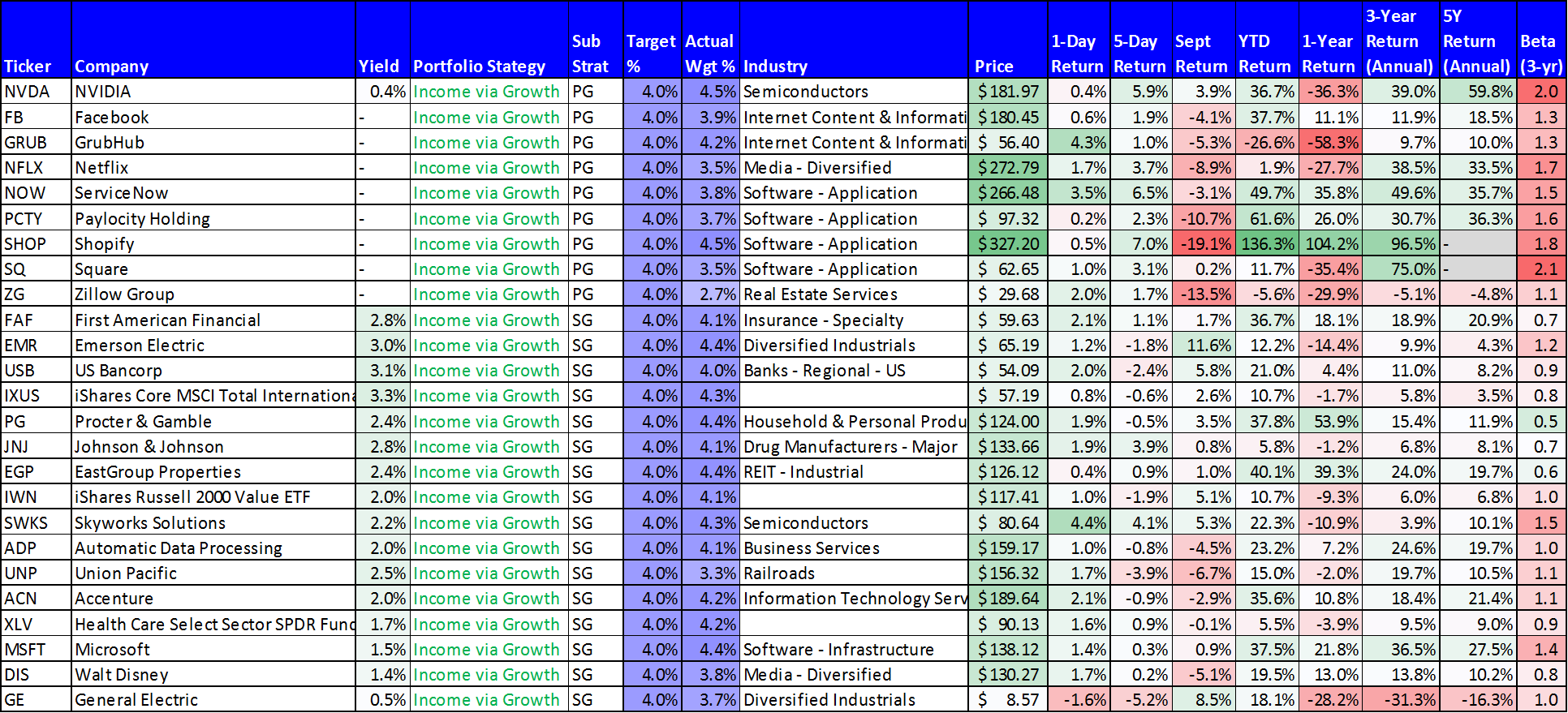

Next up is our Income Via Growth strategy which also continues to crush the S&P 500 over the long-term.

And as a reminder, this strategy is designed to generate income for us through long-term capital gains (the strategy’s dividend yield is less than that of the S&P 500). As another reminder, we allocate some of our investment dollars to this strategy because we don’t want to put all of our investment eggs into the higher yielding Income Equity strategy because there are times (e.g. months, or longer) when that strategy does not do well, and we like to have the diversification benefits of owning some Income Via Growth Stocks too.

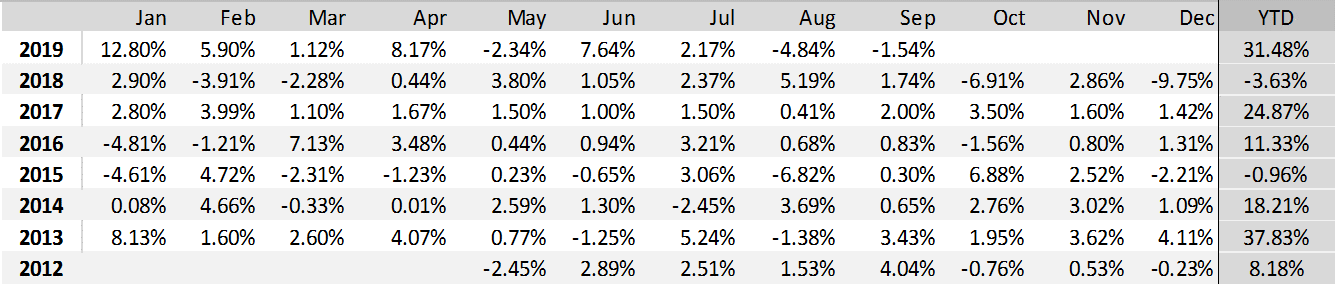

And even though the Income Via Growth strategy continues to “beat the pants off” the S&P 500 over the long-term (it’s inception is 2012, and yes we are bragging—again), it had a weak month last month, as you can see in its long-term monthly performance table, below.

In fact, the lagging performance over last month is because we do hold a few aggressive growth stocks (the kind that can do extremely well over the long-term, but happened to get crushed last month) for diversification and long-term return purposes. And obviously (it goes without saying, but we’ll say it anyway) you can invest your own money in whatever the heck you want—we just share our investment holdings to give you some ideas as you manage your own darned investments!).

Alternative Fixed Income:

Next, our Alternative Fixed Income portfolio ended the month with a 7.7% yield. It holds 15 “non-stock-market) securities (they’re preferred stocks and fixed income Closed End Funds). And the strategy was up 1.2% over the last month (September). Members can see all of the holdings in this strategy, as well as the performance over a variety of time periods in a downloadable spreadsheet (we also share our target weights and actual weights for each position in each of the three portfolios).

Bottom Line (Part 1)

Before we get into the members-only part 2 version of this report (where we share performance for each of our holdings--and a few additional insights that we hope are helpful), we want to share an important takeaway. And that takeaway is simply that you’re too darned old to NOT be prudently diversified. And we know you’re too old because if you’re old enough to be investing in the market, you’re old enough to know better. And this is an especially important point if you are already retired or near retirement. Because can you really afford to get a significant portion of your next egg wiped out by a market rotation or an overdue pullback? And just as it happened to aggressive growth stocks (e.g. software stocks with high growth rates), it can happen to other sectors that you don’t expect. For example, big-dividend REITs have been one of the best performing sectors so far this year, and they are not immune to a potential big sell off. We could say a ton more about REITs here (in fact, we have in recent past reports, and we will again in new reports in the near future), but the bottom line is simply that you’re too darned old for your investment portfolio to NOT be prudently diversified. Be smart.

Part 2: Individual Portfolio Holdings Updates

To get right to it, here is a look at the holdings and recent performance of every position in each of our three strategies.

And here is a downloadable Excel spreadsheet of all of these individual positions (including the names on our contenders lists (aka watch list). All data as of Friday close (04-Oct-2019), except Sept Return. Source: StockRover.

And a few important things to point out about the holdings. First…

Shopify and Paylocity:

Don’t put all your investments into one narrow investment category (for example, software stocks with high sales growth). For example, as you can see in our Income Via Growth portfolio, a few names sold off very hard in September. Specifically, Shopify and Paylocity were two of our worst performers in September, and they are both largely software as a service companies with very high sales growth. We own them because they’re very attractive long-term investments. However, we diversify our portfolios among many different styles and sectors because… well… we know better than to put all of our eggs in one basket. That kind of volatility, from a couple zero-dividend-paying stocks, is not attractive to a retired income-focused investor for example, especially if they were counting on capital gains (instead of dividend payment) to generate spending cash.

New Residential (NRZ)…

is a big-dividend mortgage REIT that had a huge gain in the month of September. But take that gain with a grain of salt because is had been having a rough spell before September. NRZ actually gets hurt when interest rates go down because it’s bad for the value of the company’s various mortgage servicing rights assets. If you’ve been looking for an opportunity to reduce your exposure to NRZ (because you think the lower interest rate expectation will be bad for the company), now might be a decent time to do that (e.g. perhaps you want to consider selling some of your shares after the big up month). We however, will continue to hold our shares of NRZ (i.e. we’re not selling).

Our Alternative Fixed Income portfolio…

had a fairly steady month, exactly as it is designed to do. As a reminder, this is a low “beta” portfolio, and you can see that in the last column of the holdings table (i.e. the beta column). Beta is a measure of the extent to which an asset tends to be volatile and co-vary with the overall market (e.g. the S&P 500). This portfolio strategy continues to be attractive for income investors (it yields 7.7%) who don’t like stock market volatility. However, if you notice in the year-to-date column, the holdings in this strategy have had an unusually good year for these types of holdings (they’re usually up over any given year, just not usually as much as this year). Keep in mind, a lot of things were “rebounding” at the start of this year after a very volatile fourth quarter in 2018. But the point is just that we expect this strategy too keep paying a big yield, and keep delivering powerful total returns, it’s just that 2019 has been a strong year.

Teekay Offshore Preferreds (TOO-B):

We recently wrong in great detail about these big dividend preferred shares, and right after September ended, these shares were up big time, as you can see in the 5-day return column. The company declared its next dividend, which reminded many investors not to lose confidence in these shares. Be sure to check out our write-up (an “Investment Idea” from last week) for more information.

The Bottom Line:

Don’t put all your eggs in one basket. Select attractive securities from across diversified industries and styles to construct your investment portfolio, as we have done with ours. You’re too darned old to hold too much of any one stock, industry or style. Prudently diversified, goal focused, long-term investing, has proven to be a winning strategy over and over again throughout history.