CBL and Tanger are two very hated retail REITs right now considering 40.3% and 53.0% of their shares (respectively) were recently sold short and 0.0% of the Wall Street analysts covering them have a “buy” recommendation. Conversely, one of the big-dividend REITs we like and own has a negligible amount of short interest, and 100% of the Wall Street analysts covering it rate it a “buy,” as shown in the green bar chart. This note shares performance metrics on over 100 big dividend REITs, makes a few observations, and then highlights a couple of our favorites.

New Residential (NRZ), Yield: 11.0%:

The green bar chart above is for Mortgage REIT, New Residential (NRZ); we own shares of this REIT, and we wrote about it in detail last month. NRZ announced earnings on July 27, whereby they exceeded expectations, but apparently the market was expecting more as the shares sold off 5%. They’ve since been recovering, and the most notable news from the quarter was that NRZ closed its acquisition of mortgage servicer, Shellpoint Partners, which was already well-publicized and not a surprise.

For reference, you can view more data on NRZ (and over 100 additional big-dividend REITS), in the following table:

CBL & Associates (CBL), Yield: 17.4%:

We don’t like the equity shares of this retail REIT (CBL), and neither does the street considering the high short interest and the horrible one year performance. However, as we recently wrote in detail, CBL’s high yield bonds continue to be attractive to us. Part of the reason CBL sold off over the last month is because management mentioned they may have to reduce the dividend next year. And while that is bad for the equity holders, it’s good for the bonds because it frees up more cash to support them (bonds are higher in the capital structure than equities).

Worth mentioning, the recent small rebound for CBL over the last 3-months, is consistent with the entire retail REIT industry in general, at it’s likely a temporary phenomenon, before these retail REITs continue their move lower. We’re simply “over shopping mall-ed” in our view, and the B-Class properties like CBL and Tanger (SKT) may well die a slow drawn out death. Specifically, they’re not going to die overnight, and that’s part of the reason we like the bonds, as described in our CBL bond article linked above.

Healthcare REITs:

Unlike retail REITs, healthcare REITs have performed better (not good, just better than retail REITs), and they have a lot less short interest too (see the healthcare sector of our earlier big-yield REIT table). Despite government regulators attempts to slow the rate of reimbursement for healthcare, the industry benefits from a large demographic wave as the population ages.

Omega Healthcare (OHI), Yield: 8.1%:

We continue to own shares of big-dividend, skilled nursing facilities REIT, Omega Healthcare. We wrote about this one in detail a couple weeks ago, and the shares recently rallied hard after the company’s last earnings announcement. In our view, healthcare REITs in general are a safer bet than retail REITs (although Omega is more risky than others considering many of its cash strapped healthcare operators).

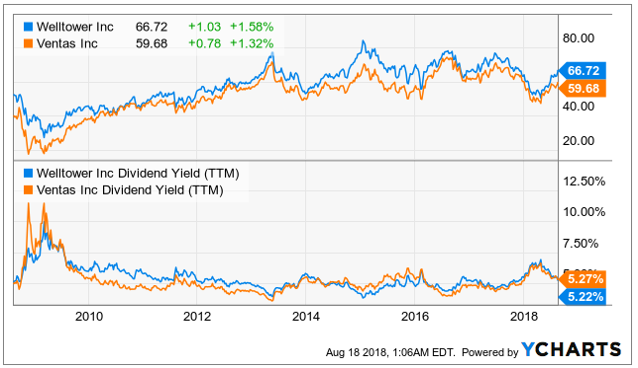

Also worth mentioning, we like blue chip healthcare REITs Ventas (VTR) and Welltower (WELL) because their low volatility businesses allow them to keep paying big steady dividends, as shown in our earlier color coded table.

Nuveen Real Estate Income Fund (JRS), Yield: 8.3%

As we wrote about last month, if you like high-income and less downside risk, the Nuveen Real Estate Income Fund is worth considering. It's a closed-end fund holdings a variety of REIT securities, it offers a higher yield, and it trades at an attractrive discount to its net asset value. You can read our full write-up here.

Conclusion:

REITs are often an income-investor favorite because of their high yields, but not all REITs are created equally. In our view, some REITs are very unattractive such as the B-class retail property REITs, particularly CBL (CBL) and Tanger (SKT), which will slowly bleed to death over the coming years if something dramatic doesn't happen to change the market. However, we do like CBL bonds (as described in this article) because while the equity slowly declines in the years ahead, the company will continue to have the wherewithal to support its bonds. We also like big-dividend skilled nursing facilities REIT Omega Healthcare (OHI) even though it faces significant challenges. And for less risky healthcare REITs, we like both Welltower (WELL) and Ventas (VTR). Finally, we believe in the importance of diversifying your income-focused investment portfolio across not only multiple REITs, but also across many other sectors. For reference, you can view our current holdings here.