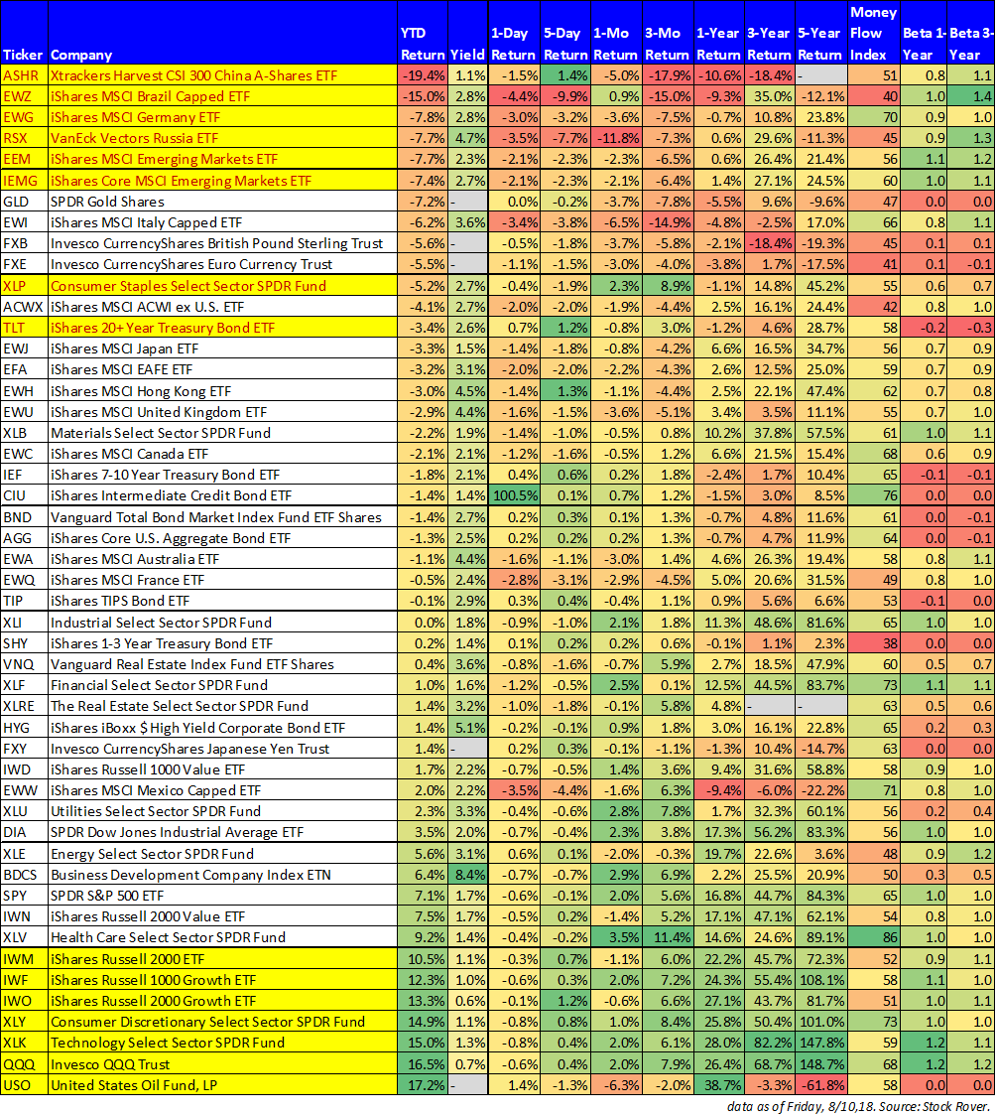

The following table shows performance (total returns) for various style, sector and asset class ETFs. It also tells a story about where we are in the current classic economic cycle (not early!), and has implications for investors (i.e. now may not be the right time to get greedy). In this report, we review the data, share a prominent “selective data driven narrative,” and share our own opinion, before concluding with our viewpoint on how to be prepared.

The Data:

A few things stand out about this data. First…

Non-US stocks have been terrible (particularly emerging markets). The six worst year-to-date performers are all non-US equities, and China is the worst. This is arguably a result of the markets interpretation of the future impacts of the current US administration’s “America First” policies (there is more information on currencies in the “The End Is Near” article later in this report. And also worth mentioning, one other side to this trade has been the strong performance of US small cap stocks (i.e. the Russell 2000) because small cap US companies have far less exposure to international markets than their large cap counterparts.

Growth, technology and the consumer have all been strong, as they represent 5 of the 6 best year-to-date performers. There is absolutely a cycle here whereby leadership changes overtime between growth versus value stocks, for example; and contrarians might consider lightening up on growth stocks and instead considering more staples, for example (staples have been underperforming this year).

From a yield standpoint, safe yield (e.g. staples and investment grade bonds) has been terrible, whereas riskier high yield (e.g. high-yield bonds and even high yield BDCs) has been stronger. But when the next batch of market volatility arises, we'll see a sell-off in the later and strength in the former. However, considering the long-term direction of interest rates (they’re low, likely continuing higher in the long-term) will put long-term pressure on investment grade bonds.

Lastly, energy has been strong. Both the price of oil and the energy sector have risen significantly this year, and this can be an idiosyncratic sector that can continue to be strong. Especially considering the continuing increases in US energy production, and, for better or worse, the White House’s protectionist viewpoints and the strong dollar.

The End is Near:

One of our members recently shared a detailed, data-rich, article that suggest we are rapidly nearing the end of our current long-term economic boom.

The article eloquently points out that economists have a positively terrible track record of predicting market cycles, but the extensive data make the article worth the read.

Is this the calm before the storm?

As we wrote earlier this week, despite the constant narrative that the “end is near” market conditions remain very strong, and stocks are actually cheaper now than they were at the start of this year on a forward price-to-earnings basis (i.e. stock prices have risen, but not as much as earnings). Here is a blurb from that write-up.

“You never know when opportunities or turmoil will arise in the market. Find the strategy that works for you, and stick with it. That doesn’t mean be complacent or stop learning. And it doesn’t mean never move outside your comfort zone either. Understand the risks and rewards, and ultimately cater your strategy to meet your own personal needs.”

Conclusion:

The point is simply that no one really knows when the market cycle will turn, and the best things you can do to be prepared are to cater your investments to meet your:

- Time horizon/liquidity needs (i.e. don’t by zero-yield, long-term, volatile investments if you need to generate income to cover living expenses and you’re not comfortable taking capital gains because you know (due to volatility) they may not be available when you need them the most).

- Volatility tolerance (i.e. don’t purchase volatile long-term investments if you are prone to panic and sell at the bottom).

- Pick good investments. Our investment portfolios are all constructed to avoid too much concentration risk in any one sector or style, and to meet the investment objectives of specific types of investors. You can view all of our current holdings within each portfolio strategy, here, and you can view our latest investment ideas here