All three Blue Harbinger strategies delivered positive total returns in June, and the yields are attractive too. This report provides details on performance and holdings, and provides updates on the biggest movers over the last month. We continue to believe these strategies are attractively positioned for continuing long-term market out performance (income and price appreciation).

It’s been a month since our last update, and performance has been strong (our long-term holdings have posted healthy gains). In particular, some of our under priced securities started to post the big gains we believe they're overdue for.

All of our strategies posted positive gains in June (+1.1%, +1.0% and +0.4%, versus +0.6% for the S&P 500). Here is a look at where we're at with our current holdings.

Income Equity Portfolio:

Disciplined Growth Portfolio:

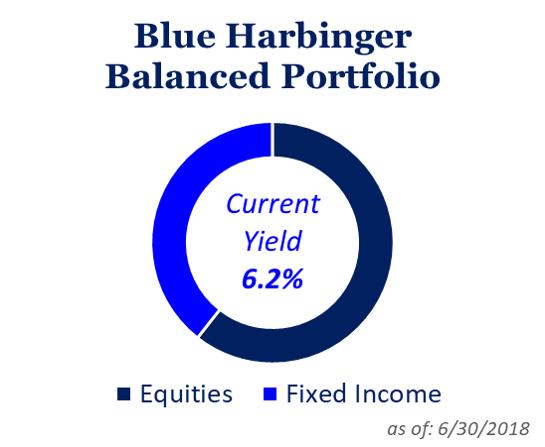

Balanced Portfolio:

And here are the updates on the biggest movers over the last month...

Procter & Gamble (PG)...

...was up 6.7% during June, after having sold-off significantly in prior months, as shown in the following chart.

P&G had been suffering this year for two reasons. First, it's a Consumer Staples stock, and that entire sector has sold off because the market has been favoring more aggressive growth companies, especially as interest rates risk there is a narrative that the sector will be more challenged going forward. And second, a significant portion of P&G's sales come from emerging markets. Emerging markets have struggled relative to US markets as President Trump beats the "America First" drum, and as the US dollar has strengthened. Nonetheless, P&G's business is not going away (people aren't going to stop using PG toilet paper, toothpaste, etc), and in fact P&G will likely continue to be a steady grower over the long-term as the global economy grows. We expect the dividend will also keep being raised as the price increases.

Walt Disney (DIS)...

...was up 5.4% during June as the market continues to consider how the future of this company will change.

Specifically, at the end of June, the Justice Department officially signed-off on Disney's enormous $71.3 billion acquisition of media assets from 21st Century Fox. Disney generates powerful earnings, has a powerful growing dividend, it owns many timeless brands, and it continue to trade at an attractive valuation as the market's uncertainty about its future has kept the share price from rising more over the last year.

Square (SQ)...

...gained 5.8% during June as this company's rapid upward trajectory continues.

The valuation on Square is very high, but its potential growth potential is even higher, in our view. Square is operating in the rapidly evolving Fin Tech space, and it has lots of opportunities for very significant growth and profitability. We wrote about Square in more detail in this report:

Evergy Inc (EVRG)...

Worth mentioning, our shares of utility company, Westar Energy (formerly WR), finally completed its merger with Great Plains, and has been renamed Evergy.

The transaction resulted in an increase to Evergy's credit rating (a good thing). Also EVRG has plans to rebalance its capital structure by repurchasing ~60 million shares, or 22%, of EVRG common stock by mid-year 2020.

Other Names to Watch...,

Triton International (TRNT)...

...declined 11.9% during June, and in our opinion, this is a buying opportunity.

Triton in the leader in intermodal shipping containers (i.e. the ubiquitous steel boxes on boats, trains and trucks), and the shares have sold-off on uncertainly about global trade. The company remains profitable, it has clear economy-of-scale advantages over its smaller competitors, and the dividend is attractive. Plus, in our view, global trade is going much higher over the long-term, despite near-term uncertainties. You can view our previous write-up on Triton here:

Enbridge Energy Partners (EEP)...

...was up nearly 11% in June as the shares continued to rise following a May announcement that it will be rolled-up into parent company, Enbridge, Inc (ENB) in a simplification transaction.

The roll-up has multiple benefits for EEP, including a simplified corporate and capital structure, and an enhanced credit profile. Not to mention it creates an increasingly attractive dividend growth opportunity for investors.

Pag Seguro Digital (PAGS)

PAGS is an attractive Brazilian online payment processing company, and the shares get increasingly attractive as they continue to sell-off.

PAGS has many similarities to Square (mentioned earlier) except PAGS operates in Barzil. We wrote in detail about this one here...

Conclusion:

As a reminder, the three strategies described above have different objectives. For example, the Income Equity strategy is designed to deliver high-income, while also delivering long-term price gains via a prudently diversified portfolio. The Disciplined Growth strategy is focused on long-term capital appreciation via an appropriately diversified portfolio (i.e. not over- or under-diversified). Finally, the Balanced Portfolio uses a variety of stocks and bonds to deliver more balanced income and price appreciation. We continue to believe all three strategies are attractively positioned for continuing strong long-term performance.