September was another healthy month for all Blue Harbinger strategies, with disruptive growth companies continuing to climb significantly, while high-income payers continued to pay high-income. This report reviews our current holdings, including the big movers during September, as well as what looks most attractive on a go-forward basis.

For starters, and as a backdrop to our own performance, here is a look at how various styles and sectors have performed year-to-date and more recently:

Notice momentum and growth stocks continue to dominate, but value and income strategies continue to hang in there and deliver.

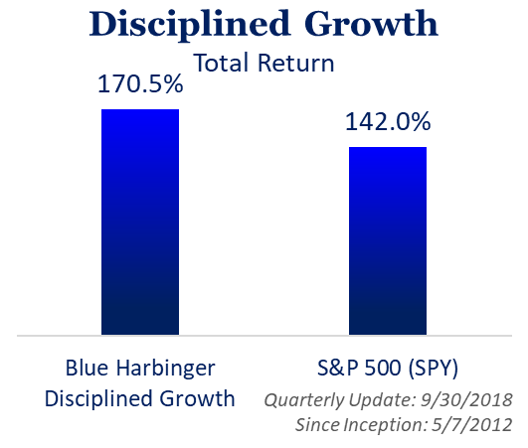

And here is a look at the monthly (September) performance of our strategies, as well as their since-inception long-term performance (Note: long-term performance is what we’re pursuing, and a little monthly volatility is healthy and expected).

What Has Been Working?…

Disruptive growth stocks continue to be strong, and continue to have room for a lot more growth, in our view. For example…

Shopify (SHOP):

We recently added shares of Shopify, and these shares delivered in September, gaining 12.9%. This company has all the necessary ingredients to keep disrupting and to keep growing, such as a very large total addressable market, strong leadership, a competitive advantage, and it’s misunderstood by Wall Street. For more information, here is a recent update we wrote about this powerful stock that continues to be a very attractive “buy” in our view:

Square (SQ):

Similar to Shopify, Square is a powerful disruptor, and the shares were also up big (again) in September (they were up 11.7%). We believe these shares continue to be an outstanding buying opportunity (even after the recent gains), and we wrote in detail about Square earlier this year. The company continues to grow rapidly, especially via smart acquisitions, as this company’s powerful ecosystem continues to grow.

Zillow Group (ZG):

We purchased shares of Zillow in September, and even though they’ve not yet posted huge returns, we believe they will soon. Zillow also has all the main ingredients of a powerful disruptive growth stock (i.e. large total addressable market, competitive advantage, strong leadership, and Wall Street is misunderstanding the business). You can read more about our views on Zillow here.

These Shares Sold-Off In September

General Electric (GE):

GE is one of our deep value plays, and the shares sold off 11.7% in September. However, within the last 24 hours, GE announced a new CEO, and the shares are up double digits so far today. Apparently the old CEO was not making improvements fast enough for the new board (he’d been in the role for just over 1 year). Additionally, the company announced a big write-down hit in their power business, and this may be the final kitchen sink write-off that finally positions GE so investors can start looking at opportunities ahead instead of challenges of the past decade.

Digital Realty (DLR), Yield: 4.04%

Digital Realty is a very healthy, dividend-paying (+4% yield), data center REIT with plenty of growing business in the years ahead as nearly the entire corporate world continues to move data offsite and into the cloud (Digital Realty owns the properties on which data centers are built and managed). We view DLR as an attractive, long-term, income play, trading at a compelling price.

Triton International (TRTN), Yield: 6.24%

Triton is an intermodal shipping container company that has been trading WAY to cheap for most of this year, in our view. However, in August, Barron’s came out with an article that agreed with us (Barron’s said Triton is trading at way too low of a price). Shares of Triton soared in August after the positive Barron’s article, but they gave up some of those gains in September (shares were down 11.9% in September) in what we consider a “mean-reversion” price move. The underlying fundamentals remain attractive, and we view this recent sell-off as another buying opportunity. We’re long Triton.

Bond Updates:

We purchase attractive individual bonds that pay healthy yields and trade below par. Our expectation for all of these bonds is that we’ll continue to receive the attractive coupon (income) payments, plus price appreciation as the bonds eventually rise in price back to par. For your reference, here is a look at the prices (and price history) for the individual bonds we own:

Conclusion:

No matter what your goals, there are many attractive investment opportunities in the market currently. We often hear of how the current bull market is more than 9-years old—arguably the longest in modern history. However, bull markets don’t die of age, they die from something else such as valuation or macroeconomic black swans. Despite the rising stock market, valuations remain reasonable because earnings numbers have been growing as fast as securities prices. Importantly, despite market-wide conditions, unique stock-specific opportunities remain. We’ve highlighted opportunities across growth, income and value, in our Blue Harbinger portfolios (see above). We are pleased with our current holdings, and believe we are well positioned for additional long-term gains and income in the quarters and years ahead.