This article highlights five strong buys to capture 6% to 9% yields. And because these five attractive income opportunities are all CEFs, they offer investors a little something extra in terms of their currently discounted prices versus their NAVs (i.e. you’re getting more than you pay for in terms of both yield and capital appreciation potential). CEFs are one of the few inefficient areas of the market that still offer out-sized profit opportunities for smart investors.

1. BlackRock Credit Allocation Fund (BTZ)

Yield 6.1% (paid monthly)

If it is safe steady income you seek, the BlackRock Credit Allocation CEF (BTZ) is worth considering. This is a portfolio of carefully selected fixed income securities (bonds), it offers a steady 6.1% yield (paid monthly) and it trades at an attractively discounted price versus its net asset value (“NAV”). Two more things that we really like about this fund is that it is a closed end fund (which means it can avoid the dangerous “forced-selling” situation that can be so damaging to bond mutual funds and bond exchange traded funds), and it is able to get low institutional borrowing rates for the small, conservative and prudent amount of leverage this fund uses (currently 21.8%).

For reference, this fund invests in mostly investment grade debt (this is safer than non-investment grade debt) as shown in the following graphic.

We like this investment grade allocation because marketwide credit spreads are currently low (which means the market is highly confident that nothing “bad” is going to happen, and as contrarians we know overconfidence can be a bad thing. Considering that risk and volatility may pop back up at any time, we’d rather be holdings more, safer, investment grade debt, such as the mix of bonds in this fund.

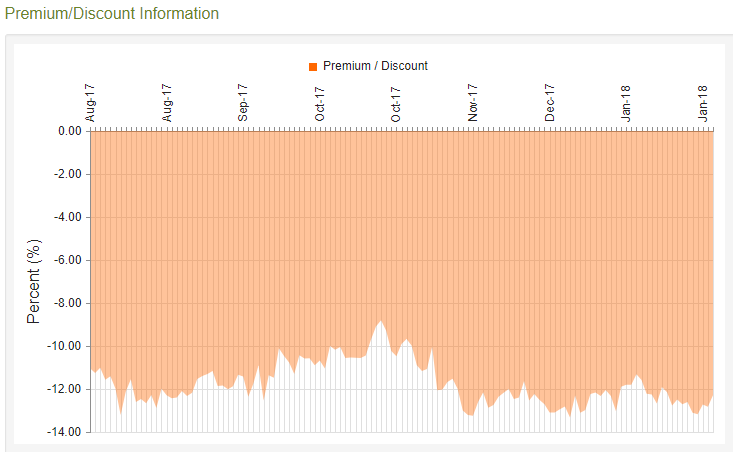

Also, the current discount versus NAV that is available for purchasing this fund is a highly attractive 11.18%. For reference, this discount is relatively large compared to recent historical standards, as shown in the following chart.

The amazing thing about purchasing this CEF at a discounted price is that you are getting more yield for your buck. Given the low level of risk, you could not purchase safe yields this high in the open market (because you’d have to pay full price). Because they are “closed end,” CEFs trade at premiums and discounts to their NAVs based on market purchasing and selling forces. We greatly prefer to buy low.

Overall, if you are looking for safe high income (paid monthly), the BlackRock Credit Allocation Fund (BTZ) is worth considering because of its attractive qualities and its discounted priced. If you have specific questions or concerns about this fund, please share them in the comments section below.

2. Adams Diversified Equity Fund (ADX), Yield: 9.8%

This next attractive high-income CEF is an equity CEF that pays a 9.8% distribution. It’s one of our personal favorites, and we’ve owned it for a little over a year now (although the fund has been around since 1929!). This fund “flies under the radar” and often gets overlooked by income-investors and that’s partly why it trades at such a big attractive discount.

For starters, this fund pays income only quarterly (a lot of investors prefer monthly), and the way the yield is usually reported is misleading. Specifically, this fund pays three small distributions in quarters one through three, followed by a large year-end distribution in Q4. However, when you look this fund up on most financial websites, they show it as paying only the small quarterly distributions, so the yield looks much lower than it really is. For these reasons, investors often ignore ADX, and that’s why it trades at an amazingly attractive discount versus NAV whereas other equity CEFs often trade at a premium.

For reference, this fund is committed to paying at leas 6% in total distributions (depending on market performance), but in most years it’s higher (for 2017 the fund yield was 9.8%).

Also for reference, the current discount to NAV is 15.3%, which is not only large and attractive, but also relatively attractive compared to its own historical standards as shown in the following chart.

Importantly, by purchasing ADX, your buying its income and capital appreciation potential at a 15.3% discount to market prices. This is a very attractive opportunity.

Another reason we like this fund is because of its specific holdings. The fund is actively managed by a highly qualified team, and we like the current large cap core/growth tilted holdings.

Here is a look at some of the fund's current top holdings…

We like the holdings and style because we believe in the management team, but also because many income-focused investors tend to restrict themselves to only owning value stocks (because they tend to pay the biggest dividends) which can cause them to miss out on growth stock opportunities. This fund allows investors to own some growth stocks, while still generating high income. An attractive compliment to many investors portfolios.

We also believe it is important to note this fund uses no leverage, and the fees are relatively low for a closed-end fund (currently only 0.64%). These characteristics, combined with the attractive qualities as described above, make the Adams Diversified Equity Fund (ADX) highly attractive and worth considering if you are an income focused investor.

Note: Generally speaking, when we look for attractive closed-end funds, we like to see the following:

Attractively-priced, compelling strategies

Attractive discounts versus Net Asset Value (“NAV”)

Healthy yields

Conservative leverage ratios

Prudent management

We believe both BTZ and ADX (and the 3 additional funds listed below) meet and exceed these criteria, and depending on your personal investment needs (bond CEF versus stock CEF), all are highly attractive income investments that are worth considering, especially at their current prices.

Real Estate CEFs (#3 and #4)...

Our next two “strong buy” ideas are real estate focused CEFs. We like them both for a variety of security-specific and macroeconomic reasons. From a security specific standpoint, they both offer high income distributions, discounted prices versus NAV (i.e. you’re paying below market rates for the high yield) and prudent use of leverage. And from a macroeconomic standpoint, real estate has underperformed the S&P 500 recently (on overblown interest rate fears, and on the false narrative that income investing is going out of style), but it has still delivered strong financial performance, high income, and it is attractive going forward from a contrarian standpoint.

For some perspective, here is a look at the recent performance of traditionally lower risk, higher-yield sectors (Real Estate and Utilities) versus high growth sectors as measured by the “growthy” Nasdaq (QQQ) and the Large Cap Growth Index (IWF).

You’re probably already aware that the economy has been booming (low unemployment, high GDP), and growth stocks have been leading the market higher. If you open a financial newspaper, turn on CNBC, or read about the stock market online, you’ve likely been inundated with the false narrative that growth stocks (Facebook, Amazon, Netflix) are taking over the world, and income-investing is going out of style. Obviously this isn’t true—income investors are alive and well, and all the hype for growth stocks has created an attractive contrarian opportunity in high-income value stocks.

Further, fears of rising interest rates have put even more downward pressure on income investments such as REITs (REITs rely on borrowing to fund growth, and rising interest rates makes growth more expensive). However, this fear is largely already baked into REIT prices, and that’s why they’re trading at lower prices as shown in our earlier chart. And realistically, if interest rates are rising that means the economy is strong and REITs can likely push a lot of the higher costs through to their tenants eventually anyway.

3. Cohen & Steers Quality Income Realty Fund (RQI), Yield: 8.1%

This is an example of a "strong buy" real estate CEF that is worth considering. The fund seeks high current income and capital appreciation through investment in common and preferred stocks issued by REITs. Its total adjusted expense ratio (1.22%) is reasonable for a CEF, it trades at an attractively discounted price (-8.35% versus NAV), we like the top holdings in the fund (such as Simon Property Group (SPG), Equinix (EQIX) and Prologis (PLD)), and we believe the leverage ratio (24.6%) is prudent. Further, as described above, we believe the entire REIT sector is very attractive for low-risk income investors from a contrarian standpoint.

As a reminder, the discount versus NAV means you’re buying high yield at a discounted price (i.e. you’d have to pay more in the open market for this much income)

For more perspective, one of this fund's top holdings is Digital Realty Trust (DLR), a data center REIT we like and we wrote about extensively here:

If you are looking for attractive yield at a discounted price, RQI is absolutely worth considering. For reference, you can read more about RQI (from Morningstar) here.

4. CBRE Clarion Global Real Estate Income Fund (IGR), Yield: 7.6%

This fund also seeks high current income with capital appreciation through investments in income producing real estate equity securities. And like RQI, IGR’s total adjusted expense ratio (1.09%) is reasonable for a CEF, it trades at an attractively discounted price of -12.3% versus its NAV (this means you’re getting more income and capital appreciation potential than you’re paying for), we like the top holdings in the fund too (e.g. GGP, EPR, SPG), and we believe the leverage ratio (12.7%) is prudent.

Worth noting, IGR’s discount to NAV has widened since the start of this year (as the growth stock rally rages on), and this makes for an even more attractive entry point, in our view.

More information about IGR is available from Morningstar here.

5. PIMCO Dynamic Credit and Mortgage Income Fund (PCI), Yield: 8.8%

There are a lot of good things about this fund. For example, its safe 8.8% yield, its discounted price, the fact that there is no dangerous forced selling (it’s a closed end fund), management is able to select from a wide range of fixed income opportunities, the distributions are income-based, and the net investment income coverage ratio is attractive. Further still, its risks are actually good things, including it’s prudent use of leverage, it’s expense ratio, and its interest rate and credit risk exposures. We wrote a detailed report about this opportunity (PCI) last week, and you can read that report here:

Importantly, this fund's opportunity set, discount to NAV, and safe high income all remain compelling. If you’re looking for safe high-income, PCI is absolutely worth considering.

Final Thoughts:

Income investing is often an underappreciated endeavor, but its value cannot be understated. When much of the market is focused on generating the biggest flashiest returns, attractive safe income investments are often overlooked. This article highlights five "strong buy" high income investments that we believe are worth considering.