The following tables rank the constituents of the Dow Jones by yield, list the 30 highest-yield stocks in the S&P500, and provide performance details for 50 different sector, style and asset class ETFs. We use this information to provide an overview of the current state of the market, and we highlight several attractive investment opportunities.

Dogs of the Dow:

According to Wikipedia:

“The Dogs of the Dow is an investment strategy popularized by Michael B. O'Higgins in 1991, which proposes that an investor annually select for investment the ten Dow Jones Industrial Average (DJIA) stocks whose dividend is the highest fraction of their price.”

Further…

“Proponents of the Dogs of the Dow strategy argue that blue-chip companies do not alter their dividend to reflect trading conditions and, therefore, the dividend is a measure of the average worth of the company; the stock price, in contrast, fluctuates through the business cycle. This should mean that companies with a high yield, with a high dividend relative to stock price, are near the bottom of their business cycle and are likely to see their stock price increase faster than low-yield companies.”

The Dogs of the Dow strategy is basically a contrarian strategy, and we like it. We’re not currently at the start of a new year, but for your reference, here is a look at the members of the Dow sorted by Dividend yield as of the close on Friday…

And as we mentioned above, we like the general contrarian concept behind the strategy, but we are not blind followers of the strategy. We prefer to dig deeper, do our homework, and make more educated selections. After all, we still believe some of the Dogs of the Dow are great value opportunities and some are dangerous value traps. For example, Coca-Cola is a company with an amazing franchise but we honestly believe it is a bit of a value trap that will deliver long-term returns lower than the rest of the market. We wrote a somewhat controversial article about this back in November of 2015: Coca-Cola: A Truly Horrible Investment for Most. And so far our view is playing out exactly as expected (i.e. Coke keeps delivering positive returns, just less positive that the rest of the market.

On the other hand, we do like another Dog of the Dow, IBM (IBM). We bought more shares of this one earlier this year, and now own it in both our Income Equity and Discipline Growth portfolios (Taking Profits: Selling an "Aristocrat," Buying a "Dog of the Dow").

We also continue to own Johnson & Johnson (JNJ), Procter & Gamble (PG), and American Express (AXP). These Dow Jones components may seem boring to some investors, but they are very attractive companies, and slow and steady will win in this case.

We also see a lot of attractive non-Dow Jones stocks too. For example, here is a look at the highest yielding stocks in the S&P 500, followed by a list of a few we like.

Highest Yield S&P 500 Stocks:

Specifically, we like Ventas (VTR), Welltower (HCN), HCP (HCP), and Simon Property Group (SPG), as described in the following articles…

- Despite the Big Safe Yield, Simon Property Group is Hated

- An Attractive, Big-Dividend, Contrarian Opportunity with Significant Upside (SPG)

- 10 Reasons Ventas Is Better Than Welltower

- Top 5 Big-Dividend Healthcare REITs

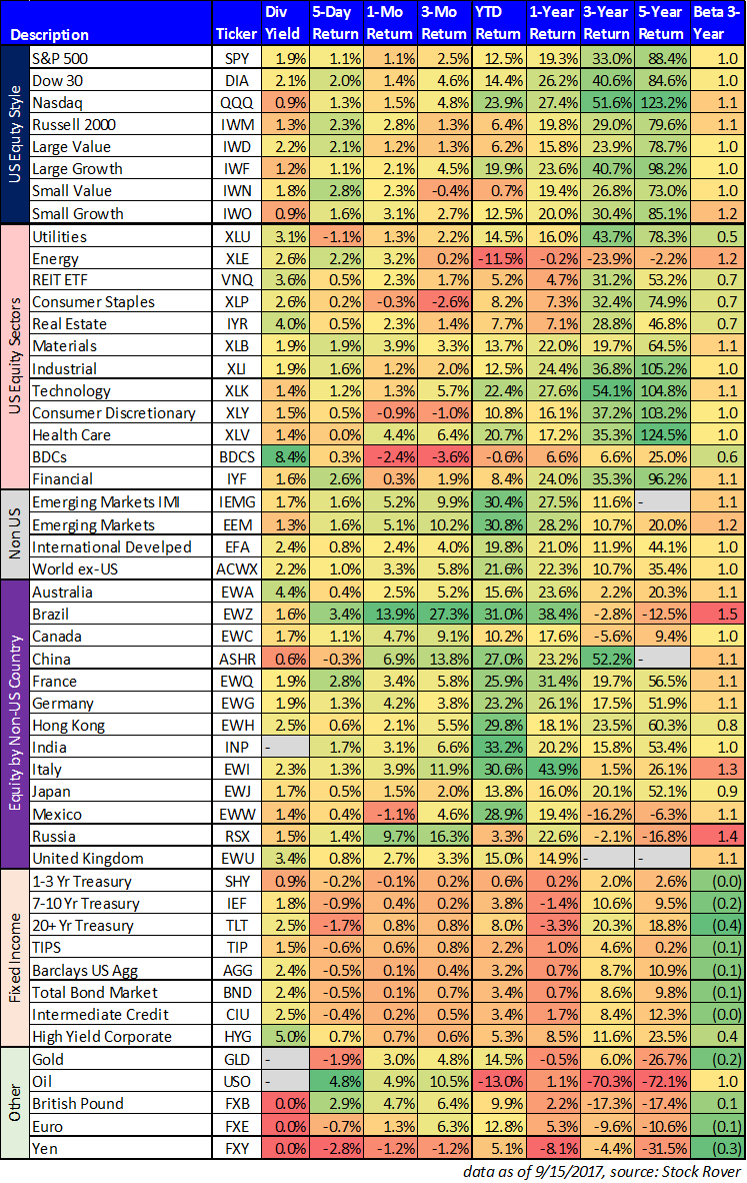

Also, while we’re sharing these recent performance tables, here is a look at data for 50 different ETF representing market sectors, styles, and asset classes (the data is up to date as of the close on Friday)…

Heat Map: ETF Sectors, Styles and Asset Classes:

A few things worth noting about these various ETFs…

1. The Tech heavy Nasdaq (QQQ) continues to put up big numbers this relative to the rest of the market. We certainly NOT calling another Tech Bubble, but we do get a little nervous when top performing companies like Amazon (AMZN) start looking for growth by expanding into different businesses (e.g. Whole Foods (WFM)) and opening new headquarters.

2. Energy (XLE) has been terrible this year (and over the last 5-years). We continue to maintain expose to the sector via specific attractive names, but prices likely aren’t going back above $100 anytime soon (and maybe never?).

3. Value Stocks (IWD) and especially small cap value (IWD) continue to underperform the rest of the market this year (and over the last 5-years, really). This is not usually the case. Value stocks (especially small cap value stocks) tend to outperform the market over market cycles, and we continue to expect a strong snapback from these categories in the future… we don’t know when it’s coming, but it I coming.

4. Emerging Markets (EEM) have performed very strong this year. A lot of this has been due to weakness in the US dollar. We continue to maintain non-us and emerging market exposure across our strategies through ETFs (IXUS) and via individual names with significant non-US and emerging market exposure (for example, Procter & Gamble).

Overall...

We continue to like the positioning of our portfolio going forward. We believe we have diversified exposure to the right sectors and styles, and we also believe the individual names we own are set to significantly outperform in aggregate, while also delivering strong income (from many of the holdings) as well. You can view all of our current holdings here.