EastGroup Properties (EGP), Yield: 2.9%

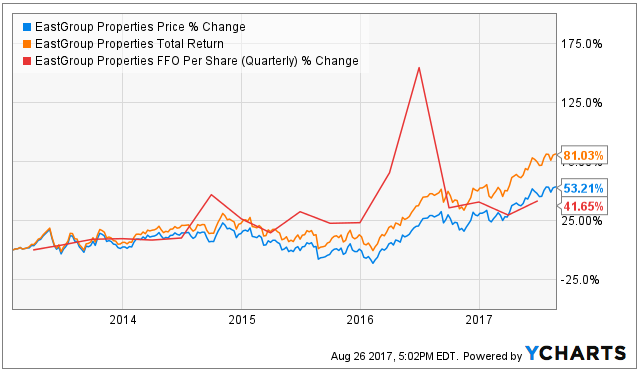

EastGroup Properties (EGP) has steadily gained over 55% since the start of 2016, a very impressive feat considering the real estate sector (XLRE) is up only 5%, and the S&P 500 (SPY) is up only 19%. We attribute the gains to a combination of factors including its attractive sub-industry (it’s an industrial REIT), in an attractive geography (the U.S. Sunbelt), with attractive properties (location, location, location), and an attractive strategy (flexible, multi-tenant properties). We have owned EGP in our Blue Harbinger Income Equity portfolio since January of 2016, and this article provides an update on EGP’s strategy, valuation and dividend. Importantly, we answer the question of whether it’s time to sell EGP (hint: we plan to keep owning our shares), and we also offer an interesting idea on how investors might want to “play” EGP (hint: we like the idea of selling “covered call options” on EGP).

About EGP and Its Strategy:

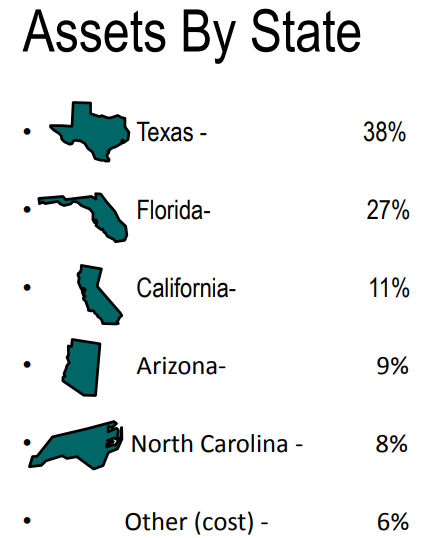

EastGroup Properties, Inc. is an equity real estate investment trust (REIT). The Company is focused on the development, acquisition and operation of industrial properties in various Sunbelt markets across the United States with an emphasis in the states of Florida, Texas, Arizona, California and North Carolina.

EastGroup’s property focus is multi-tenant business distribution buildings. This type of industrial building makes up 87% of the company’s portfolio and represents 88% of what EGP has developed internally. Because business distribution buildings are extremely flexible and offer an up-scale quality office/warehouse environment, they appeal to a wide range of users, many of whom operate their entire business in their space. In particular, this product works well for the customer in the 5,000 to 50,000 square foot range which is the part of the market where the largest job growth typically occurs.

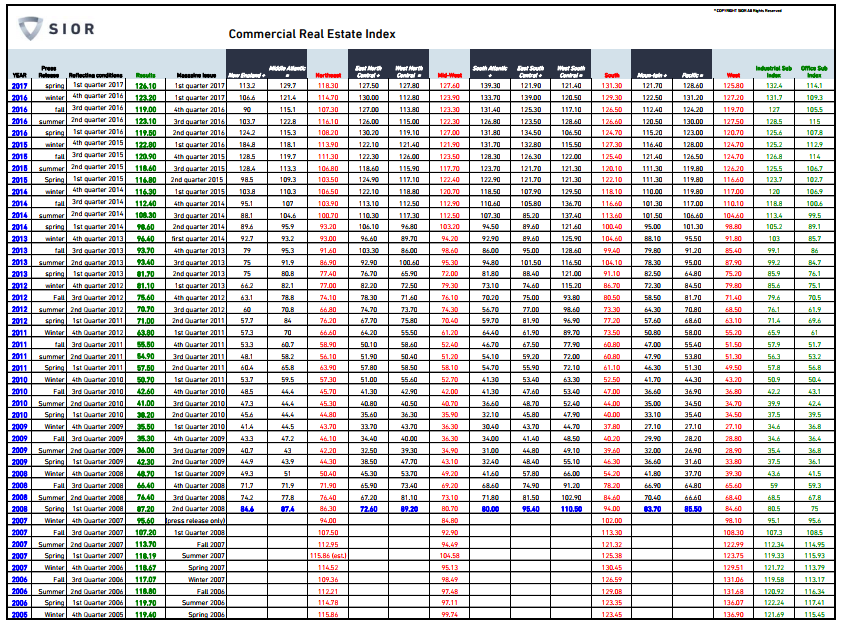

EGP has benefitted from the strong US economy and recovering jobs market since last November’s election, despite rising interest rate expectations (REITs rely on borrowing to grow) and underperformance by the REIT sector in general. However, the industrial real estate sector has been very strong (due to the strong economy) as shown in the following SIOR Commercial Real Estate Index table, industrial REITs are expected to remain strong.

Not only is the outlook for Industrial real estate particularly strong (EGP is an industrial REIT), but it is also particularly strong in the southern US where EGP operates.

E-commerce Considerations: Also important to note, EGP has been benefitting from the growing online retail industry. Specifically, where brick and mortar retail is struggling, online retailers are growing, and EGP is benefitting. EGP describes this trend well in the following paragraph.

E-commerce and the changing retail model is a new demand driver we see continuing and accelerating. We are seeing retailers place fewer stores in major markets and rely more heavily on nearby industrial buildings for inventory. One example within our portfolio is Mattress Firm, which is now a top five tenant. Other users we have include retailers with no brick and mortar presence, but merely industrial space and a website; retailers using our buildings as back of house with numerous daily pickups; and online pharmacy fulfillment to simply name a few. An even newer trend we are watching closely is the maturation of the e-commerce delivery model. As e-commerce delivery times become more critical to their business model, we believe the big box, edge of town fulfillment centers will require accompanying in-fill site business distribution centers. Simply put, the traffic congestion within major markets will necessitate close in, smaller distribution space to meet accelerated delivery times. It is within this niche that EastGroup is uniquely well positioned among our peers. The majority of our institutional industrial ownership peers have generally developed large, big box (250,000 square feet and above), more outlying projects. Our typical building is 80,000 –130,000 square feet in in-fill locations near transportation hubs, making them ideally suited for the prospective new and growing demand source. At 97.3% leased at year-end, we also have the luxury of patience as the supply chain evolution continues.

In our view, EGP has an attractive business model (flexible, multi-tenant properties) in an attractive industry (the south), with attractive locations (customers for EGP properties generally compete on location, not price).

Also worth noting, EGP holds its properties as long-term investments but may determine to sell certain properties that no longer meet its investment criteria. The company may provide financing in connection with such sales of property if market conditions require. In addition, the company may provide financing to a partner or co-owner in connection with an acquisition of real estate in certain situations.

EGP’s Dividend:

REITs are an income investor favorite because of their big dividend yields. Unfortunately, many income investors overlook attractive REITs when their yields are only good but not exceptional. We believe this is essentially the case with EGP because its current dividend yield is only 2.9% which is lower than other REITs which can pay higher yields (for example, industrial REIT STAG offers a dividend yield over 5%). However, EGP’s business is more attractive in our view (EGP has much better property locations) and EGP is a much safer investment with a safer dividend (and we expect the dividend to grow, more on this later). For starters, here is a look at EGP ‘s historical dividend growth.

EGP has now paid 151 consecutive quarterly cash dividends, they’ve increased or maintained the dividend for 24 consecutive years, and it has increased in 21 of the last 24 years (including each of the last 5 years). Also important, we believe EGP will announce a dividend increase again this year based on its strong and growing funds from operations (“FFO”) and its low dividend payout ratio. For reference, here is a look at EGP’s historical dividend FFO payout ratio (it currently sits at the very low end of the range… a good thing for stability, and it offers increased likelihood for another dividend increase soon).

EGP’s Valuation:

From a valuation standpoint, EGP is priced for continued growth. For example, the following chart shows that even though the stock price has been growing, the company’s FFO has been growing right along with it.

And for reference, here is another look at similar data on EGP’s price versus FFO.

Importantly, this next table shows EGP’s FFO per shares has been growing at a healthy clip in recent years.

In fact, the company’s, price to FFO multiple is at the high end of the range in recent years (as shown in the above table), but this is warranted given the company’s continued growth opportunities. For some near-term perspective on EGP’s near expectations, the following table shows the company’s FFO growth guidance for the current quarter and the full-year 2017. This is important because the growth warrants the valuation, especially considering the continuing growth prospects in the years ahead.

Risks:

Obviously, EGP faces risks that are worth considering. For example, if the market turns south, this will hurt EGP because as an industrial REIT it has a higher beta to the overall market than some other REIT sectors (according to Google Finance, EGP’s beta is 0.98). Another risk is simply that interest rates could rise much faster than expected, which would make growth for EGP much more expensive and challenging. However, in reality, we don’t expect rates to rise back to the historically more normal 4.0% anytime soon (i.e. rates will continue to remain “low for longer”). And realistically, if rates are rising that just means the economy is strong and that will benefit EGP by allowing for rent increases and more new business.

One thing worth considering is the diversification among EGP’s tenants. For example, even though they are focused on the southern portion of the U.S., EGP’s largest customer is only 1.2% of total rents. This helps reduce risks compared to other REITs where one customer can make up a large portion of total rents.

Another good risk management metric to consider is EGP’s laddered lease expiration schedule as shown in the following table.

This laddered schedule helps spread out the risk of too many properties becoming vacant at the same time. It allows EGP to find new tenants as property leases expire in an organized manner.

Conclusion:

REITs are an income investor favorite because of their big dividend yields. Unfortunately, many income investors overlook attractive REITs when their yields are only good but not exceptional. That was our thesis when we bought EGP in January of 2016, and it remains our thesis today. We believe EGP has more room for growth, rent increases and dividend increases, and for those reasons we believe its current price to expected FFO remains attractive.

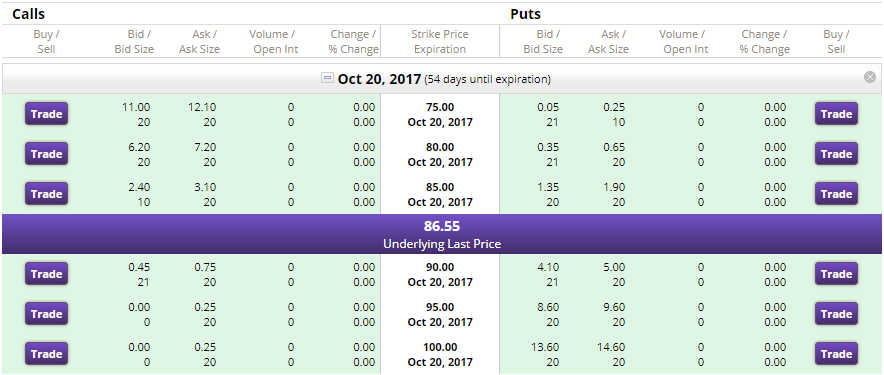

If you are uncomfortable with EGP’s current valuation, or its lower dividend yield compared to other REITs, then you might consider selling calls on EGP to generate additional income. We’ve been looking into this strategy, and from a risk-versus-reward perspective it’s attractive. The strategy entails owning shares of EGP (which we continue to believe is an attractive long-term investment), and then selling call options on the shares. For example, as the following table shows, you can generate $0.45 in income by selling the October 20, 2017 calls, which equates to 3.1% extra income on an annualized basis (i.e. $0.45 divided by the current price of $86.55, annualized).

If the shares get called away from you, you will have generated an attractive 4% price gain in just 2 months (this is 24%, annualized), and if they don’t get called away then you’re left owning shares of an attractive, high-quality industrial REIT (plus you get the dividend income, and you get to keep the premium for selling the calls).

We continue to own shares of EGP in our Blue Harbinger Income Equity portfolio. View all of our current holdings here.