Gramercy Yields 5.0%: Buy This Dip or Abandon Ship?

Gramercy Property Trust (GPT) is a big-dividend (5.0% yield) REIT, and its share price has pulled back 7% since June, leaving investors wondering if it’s time to buy the dip or abandon ship. Contributing to investor uncertainty is GPT’s effort to shift its portfolio away from office properties and more heavily into industrial properties. In our view, the shares are attractive because they have inappropriately sold off and the industrial real estate space (GPT in particular) is compelling.

About Gramercy:

Gramercy is a real estate investment trust (REIT) that specializes in acquiring and managing single-tenant, net-leased industrial and office properties. And as the following graphic shows, the company is transitioning its portfolio away from office and more heavily into industrial properties.

This has created some angst for investors and some transitionary financial results for Gramercy (more on this later).

Additionally, Gramercy is well-diversified across tenants and geographies as shown in the following graphics.

Gramercy Shares Have Inappropriately Sold Off

Here is a look at the year-to-date performance of Gramercy shares.

The recent sell off came after the company’s Q2 earnings release on August 1st, and the sell off was inappropriate in our view. Specifically, the market misinterpreted the earnings announcement thereby creating a more attractive entry point.

For example, Gramercy missed the market’s expectations for Q2 Funds from Operations (“FFO”) by 2 cents, and the market seemed not to care that there was a very good reason they missed. Specifically, as Gramercy transitions from office to more industrial properties, the sales and acquisitions are lumpy. In fact Gramercy had more sales (because they were able to sell at attractive cap rates) than expected and less acquisitions than they expected (because the time to close the deals is taking slightly longer than expected). And very importantly, Gramercy expects a significant amount of acquisitions to close this quarter which will have a positive impact on FFO.

Also very important, Gramercy lowered FFO guidance, and the market didn’t like this, but management also acknowledged on the conference call that they lowered guidance to be more conservative after pressure from its board. The lower guidance is NOT because of any fundamental problems with the company. Here are the two relevant quotes from the conference call transcript:

“Question, any thoughts on maybe you’re being a little more conservative on your guidance assumption particularly regarding timing of acquisitions and dispositions going forward? Just given you guys are in a portfolio of repositioning.”

“You sound like you're on our board of directors. The answer is yes… The answer is capital Y, capital E, capital S.”

And regarding the portfolio:

“Was any of that guidance cut due to performance in the core portfolio?”

“The answer to the first question, Karin, is no. It was not at all due to performance in the core portfolio.”

So in our view, a big reason the shares sold off was because Gramercy missed Wall Street’s FFO expectations and lowered guidance, but in reality, the miss was temporary and due to lumpiness because the company is repositioning its portfolio (and they expect a big Q3), and because they lowered guidance just to be more conservative, not because of fundamental challenges.

Another thing Wall Street didn’t like about the recent earnings release was that occupancy ticked slightly lower (but still remains very high at 97.7%). However, management explained on the call they expect occupancy to remain around 97%-99%, and its just in the lower end of that range due to noise surrounding the portfolio transition from office to more predominantly industrial.

Further still, the company’s leverage was lower than its target 6x at the end of Q2 because of the lumpiness of the dispositions and acquisitions. Gramercy issued new shares this year to raise capital for net acquisitions (this is what REITs do) and those acquisitions will now be weighted heavily in the second half of this year, which will increase FFO. In fact, Gramercy expects adjusted FFO to increase to a run rate of $0.49 - $0.50 by the end of the year, as shown in the following graphic.

Industrial Real Estate (Gramercy in Particular) is Attractive:

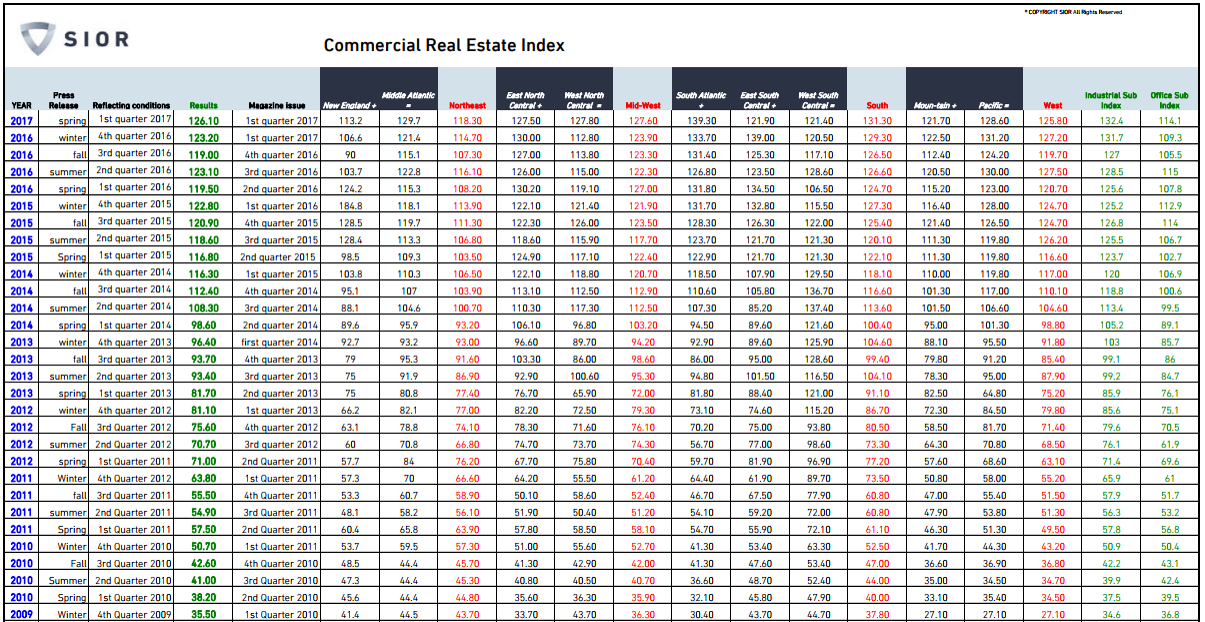

In our view, the Gramercy decision to transition away from Office and more heavily into Industrial properties is smart. For starters, Industrial properties generally require less capex to maintain. Also, as economic growth continues to ramp up there will be increased demand for industrial properties to house goods. In fact, the industrial real estate market is very strong according to the SIOR Commercial Real Estate Index. Specifically, the office property market is strong, but the industrial real estate market is even stronger and more attractive.

If you don’t know, members of the Society of Industrial and Office REALTORS (SIOR) participate in the Commercial Real Estate Index survey, supplying their knowledge of the industrial and office market conditions in the United States.

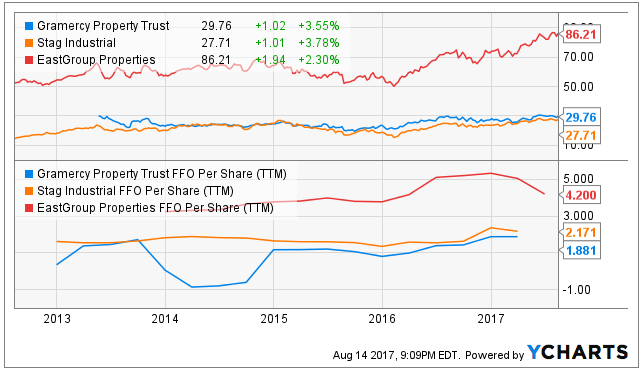

For further perspective, the following table shows comparative data for Gramercy versus some of its REIT peers.

Highlights from this table include Gramercy’s solid yield, relatively low (and attractive) price-to-book and low long-term debt to total capital ratio. Its returns have also been relatively lackluster (mainly because REITs in general have been underperforming the market) and this is an attractive contrarian opportunity, in our view.

Also worth considering, the following table shows Gramercy’s price to FFO (15.8x) versus higher risk industrial REIT Stag (12.8x), and lower risk industrial REIT EastGroup (20.5x).

Considering the high quality of Gramercy’s tenants (and the high quality locations) we believe it can easily trade up to a higher price-to-FFO ratio (i.e. GMT is undervalued and attractively priced). Also, based on Gramercy’s expected core quarterly future FFO run rate of $0.53 - $0.54 (as shown in our earlier graphic), it currently trades at only 12.5 times that amount, which is a very attractive price, in our view.

Risks:

Gramercy does face risks that should be considered by investors. For example, as we mentioned previously, the entire real estate sector has been underperforming the rest of the market over the last year as investors have favored the aggressive growth stocks of the “Trump Rally.” This creates an attractive contrarian opportunity in our view, however some of the concerns are somewhat warranted. In particular, investors are afraid that rising interest rates will have a negative impact on REITs because they rely on borrowing to fund growth. However, we believe the market is overly fearful for a couple reasons. First, if interest rates keep rising that means the economy is doing well, and that also likely means that industrial REITs are also doing very well. As interest rates go up, Gramercy will be able to raise rents. Further, we expect interest rates to rise in the coming years, but realistically interest rates aren’t going that much higher because as the US government struggles to balance its budget, a large interest rate hike would be crippling in the sense that the government would have to pay so much more on its outstanding debts in the form of interest on its treasury bonds. Interest payments are already a significant portion of the US budget, and the government simply cannot afford to raise rates to extreme levels.

Sticking with the interest rate theme, Gramercy does have a significant amount of debt (term loans) coming due in 2021, as shown in the following chart.

However, given the company’s relatively low level of debt, its strong funds from operations, and its high quality tenants (Gramercy is rated BBB/BBB-/BAA3), it should be able to refinance the debt easily.

Another risk to keep on the radar, as noted in Gramercy’s annual report:

“We have made capital commitments to joint ventures that target net leased assets across Europe. These investments may be affected by factors particular to the laws of the jurisdiction in which the property is located. These investments expose us to risks that are different from and in addition to those commonly found in the U.S.”

While Europe introduces unique risks for Gramercy, it also introduces more diversification and new opportunities as well.

Don’t Forget the DRIP

We’d be remiss not to mention, that if you plan on owning Gramercy and re-investing the dividends, the company offers a Dividend Reinvestment Plan that currently offers a 1% discount if you use your dividends to buy more shares. You can view the details on the company’s website at this link.

Conclusion:

We like industrial real estate, and we like Gramercy. The industrial real estate subsector is strong per our earlier SIOR data, and we also like it because it offers lower capex requirements and higher cap rates than office properties. We like Gramercy because it is transitioning to a heavier focus on industrial real estate (a smart move in our view), it is well-diversified, and it owns attractive properties with high quality tenants. We also like it because we believe the market misinterpreted its most recent earnings announcement thereby creating an attractive entry point based on its current valuation and more conservative future FFO guidance. If you are an income-focused investor, Gramercy is worth considering. In our view, it is NOT time to “abandon ship,” but rather it is time to consider buying this dip.

Worth noting, Gramercy also offers preferred shares (GPT-A) with a 7.125% yield. However, they’re redeemable at $25 in roughly 2 years on 8/15/2019. So considering they currently trade at $26.76, you’ll lose $1.67 per share over the next two years. Therefore your total return (dividends minus price depreciation) will be less than 4% per year for two years, assuming they are redeemed by the company.