All Blue Harbinger strategies continue to deliver strong positive returns without any of the full-service brokerage fees that “do-it-yourself investors” are trying to avoid. Our Disciplined Growth portfolio beat the S&P 500 during May, and our Income Equity strategy finished the month with a 5.4% yield, nearly 3.5% higher than the S&P 500. We’ve seen value stocks (as measured by the Russell 1000 Value Index) underperform growth stocks (as measured by the Russell 1000 Growth Index) this year, and as contrarians we like value stocks even more now.

Performance:

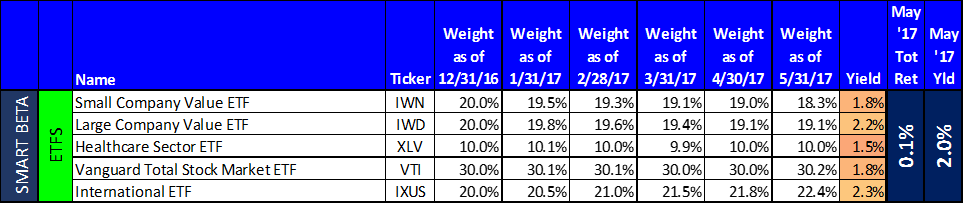

For starters, here is a look at the updated performance and current holdings lists for each of our main Blue Harbinger strategies.

Holdings:

Market Overview (Sectors and Styles):

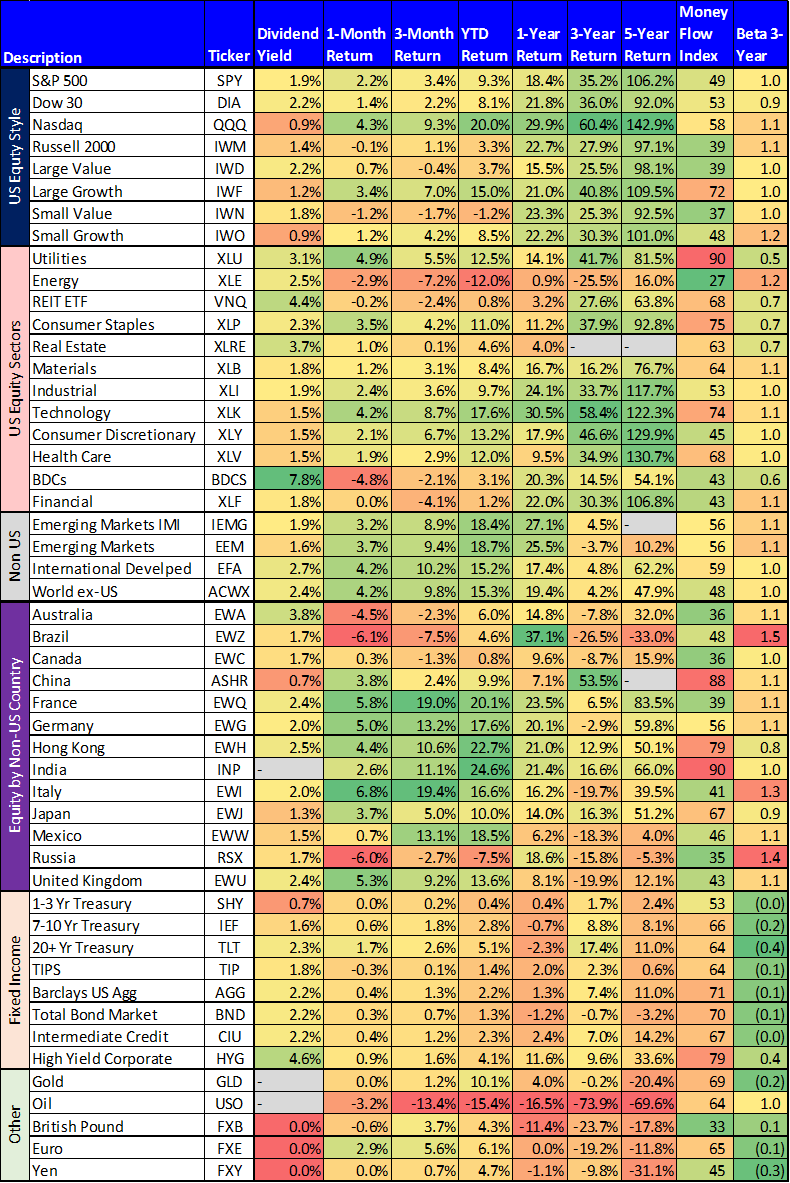

And as we mentioned earlier, the rally in large cap growth stocks has led the market so far this year as shown in the following table.

Yet, over market cycles, value stocks tend to significantly outperform growth stocks, and this is why, as contrarians, we like value stocks even more now than we did at the start of the year.

There’s no guarantee that value stocks will outperform this upcoming week, the month, or even this year. However, over the long-term, value stocks have consistently outperformed growth, and we believe they will again in the future.

Investment Idea:

An interesting growth idea...

Axon Enerprises (AAXN)

We want to share with you a brief, high-level, investment idea that we may be digging into deeper in the coming weeks. That idea is Axon Enterprises. Formerly known as TASER, Axon recently changed its name to recognize its growing business strategy. Specifically, instead of selling only Tasers (conducted electrical weapons), the company is expanding into wearable body cameras to help keep law enforcement officers and citizens safer.

We believe Axon could be an attractive investment opportunity because an enormous market opportunity exists in wearable body cameras (and related software) that Axon may be able to profit from significantly. Specifically, Axon generated around $65 million in 2016 revenue from body cameras (and related software solutions) but the company believes a $1 billion domestic market opportunity exists, and there is no formidable competition at this time (the competition is highly fragmented and very expensive).

Axon is currently offering free body cameras to all the members of any law enforcement agency that is interested, and a significant number of agencies are showing interest. Axon’s goal is to be the first mover in building out a significant user base thereby benefiting from significant network effect and long-term customers that will not stop using Axon products or switch to any new solution provider that may emerge.

There is currently significant social and political incentive for agencies to use body cameras, and if Axon can capitalize on this opportunity the profits could be huge for this tiny $1.3 billion market cap company. We’ll be digging deeper in the coming weeks, and we’ll let readers know if we decide to invest.

Importantly, if you are comfortable, you can avoid a lot of unnecessary fees and costs as a "do-it-yourself" investor. As Benjamin Franklin famously said: "A penny saved is a penny earned."