As a follow up to “part I” in this series, this “part II” article highlights more attractive healthy-dividend companies. We’re sticking with the theme that investors should NOT blindly chase after the highest yielding securities, but rather focus on those with the healthiest yields. We highlight a handful of healthy yielders including one that we own in our Blue Harbinger Disciplined Growth portfolio.

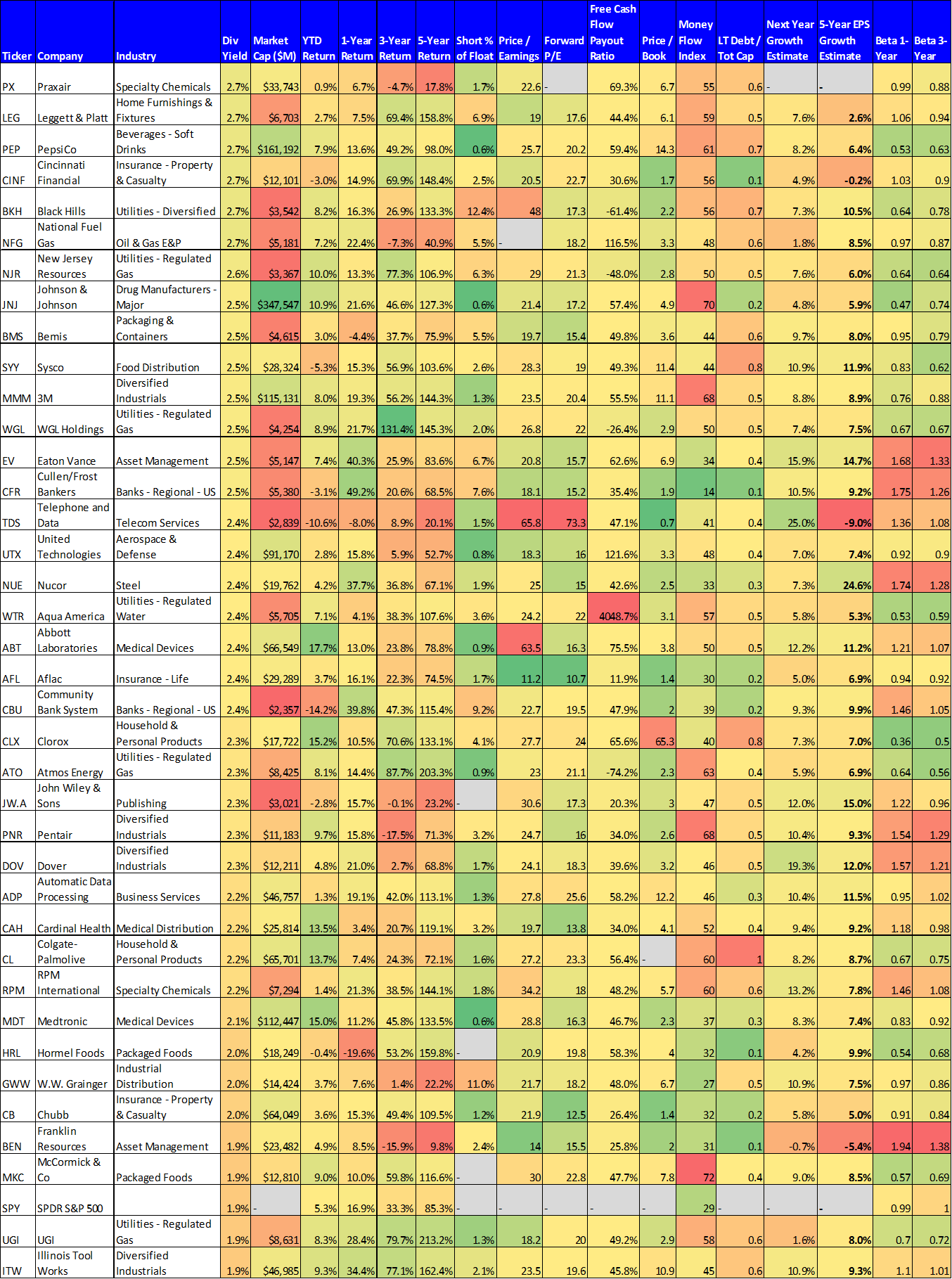

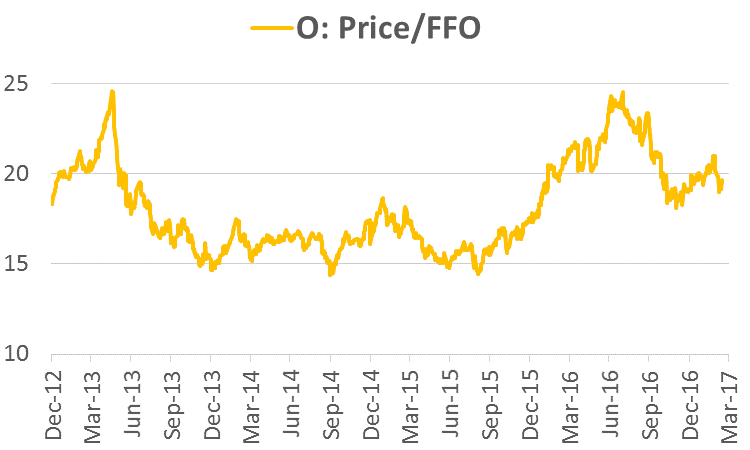

As a reminder, we’re focusing on Dividend Aristocrats in this series. These are companies that have raised their dividends for at least twenty years in a row. There are currently 108 of them in the S&P High Yield Dividend Aristocrat Index, and we’ve listed all of them below.

Next we highlight six of the dividend aristocrats that we believe are particularly attractive right now (including one that we own in our Blue Harbinger Disciplined Growth portfolio)...

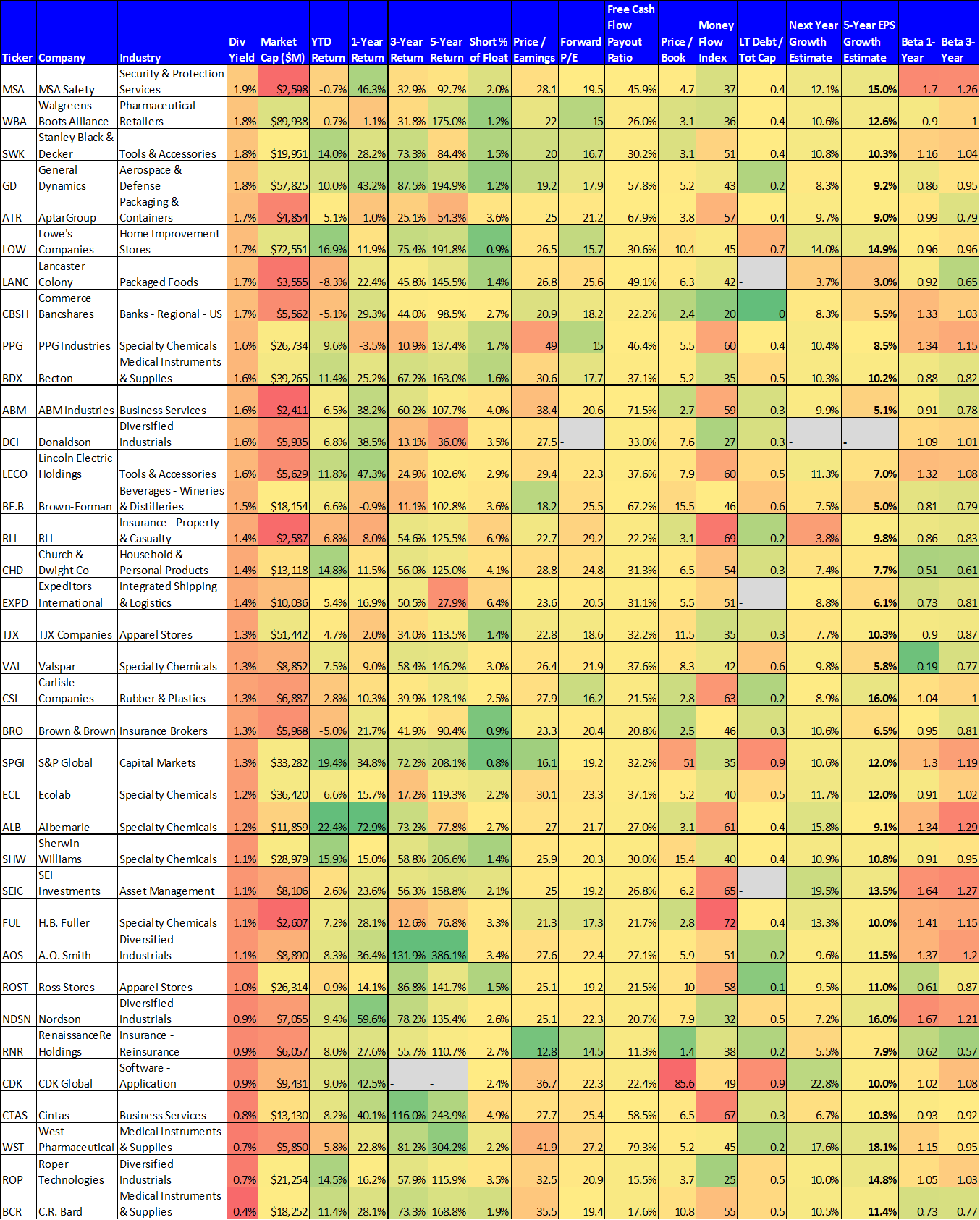

6. Realty Income (O)

Realty Income is an income-investor favorite because it pays big safe monthly dividends. Additionally, the dividend payment has increased for 77 consecutive quarters. We believe O is worth considering now because its business remains strong but its valuation has come down. Specifically, the following chart shows that Realty Income's price versus its Funds From Operations (FFO) has come down significantly since last summer (i.e. the shares are on sale).

If you are not aware, Realty Income is a large REIT that invests in commercial/retail properties spread across the US. And it has a reputation as an attractive safe blue chip REIT, and it only expects to payout ~83% of its adjusted FFO as dividends in 2017, which is a healthy margin of safety for this low beta company. Investors have been afraid of how rising rates will impact REIT, and the whole group has sold off. However, we believe the fear is already baked in, and Realty Income’s dividend is very safe. And if you are a long-term, income-focused, value investor, Realty Income is worth considering.

5. Automatic Data Processing (ADP)

ADP is a boring, safe, company with an above average dividend that has grown for 40 years in a row. If you are not aware, ADP is a provider of human capital management solutions including payroll services, benefits administration, time and attendance management, and others. It’s basically a permanent fixture at literally hundreds of thousands of companies because once ADP solutions are in place it’s far easier for a company to keep them than to replace them. It only pays out around 58% of its free cash flow as dividends, and analysts are forecasting its EPS to grow significantly over the next year (+10.4%) and over the next five years (+11.5%). It also has low debt, and its price-to-earnings ratio can go higher, as shown in the following chart.

If you are looking for a very healthy safe dividend and a company with continued long-term growth potential, ADP is worth considering for an allocation with your diversified investment portfolio.

4. Old Republic (ORI)

If you are looking for a big growing dividend, from a company with a differentiated earnings stream then Old Republic may be worth considering. This insurance underwriting company has been growing its dividend for over twenty years, and it has been generating the cash flow to make this possible from a diversified base of fees across industries as shown in the following graphic.

Warren Buffett’s mentor, Benjamin Graham, was a big advocate of using book value in valuating stocks, and by that measure (as shown in the following chart) Old Republic has done very well over the long-term as shown in the following chart.

This company is not flashy, but it is a well-managed dividend aristocrat worth considering if you are a long-term income-focused investor.

4. United Technologies (UTX)

In addition to the big growing dividend payments, we like United Technologies because the business is set to benefit from global economic growth. If you are not aware, UTX is a diversified industrial conglomerate that sells aerospace and building components and systems. It will continue to benefit from increasing urbanization and growth in emerging markets. In fact, analysts expect the company to deliver 7.4% annual growth over the next five years (this is according to our dividend aristocrat table provided earlier).

We also like UTX because it is an efficient allocator of capital. For example, it has continued to buy back its own shares while keeping a steady and healthy balance sheet as shown in the following charts.

Also, UTX expects additional share repurchases of $3.5 billion in 2017. Also worth noting, UTX’s return on capital (according to GuruFocus) is 13.81% which exceeds its 8.95% cost of capital. This means it is creating value for every new dollar it invests (a good thing). And as the following chart shows, UTX has been increasing its dividend for over 20 years.

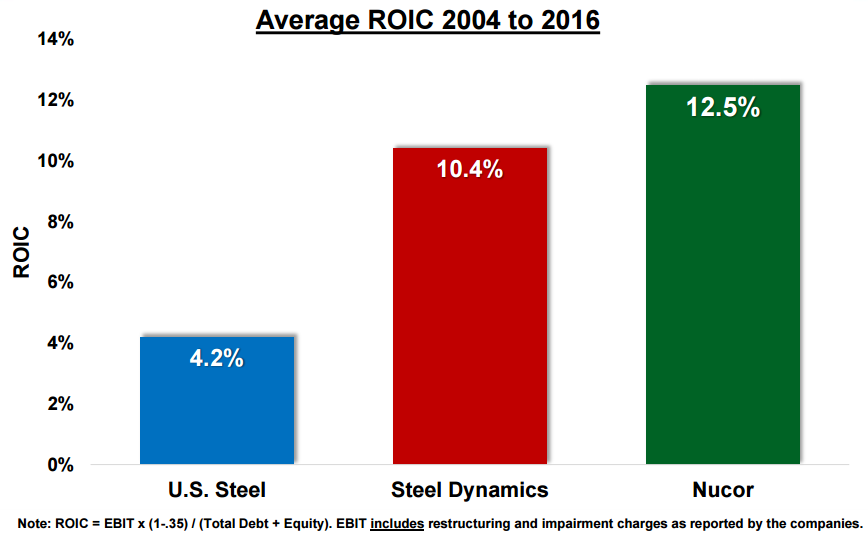

3. Nucor (NUE)

If you believe in the United States infrastructure growth story (and you like big growing dividends) Nucor is worth considering. Nucor uses electric arc furnaces (EAF), which are significantly more efficient than the blast furnaces used by most of the global steel industry, thereby giving Nucor a cost advantage.

And according to analysts covering the company (see our earlier dividend aristocrats data table), Nucor has very high earnings per share growth expectations over the next one (+7.3%) and five years (24.6% annually). Also, the company’s price to (forward) earnings ratio has recently come down (a good thing) as shown in the following chart.

Further, the company has an impressive history of prudently returning capital to shareholders, as shown in the following graphic.

Overall, if you believe that the infrastructure growth cycle is turning up in the US, and you like big growing dividends, Nucor could be a very powerful addition to your investment portfolio.

2. Exxon Mobil (XOM)

Exxon Mobil is a dividend aristocrat with a lot of good things going for it. For starters, it is an integrated oil and gas company that will continue to benefit from economies of scale. Also its integrated upstream and downstream businesses will help it achieve a high level of efficiency and value. And from a price standpoint, it continues to be an attractive contrarian play, in our view.

We also like that the companies dividend yield has been increasing (as shown in the following chart), and we believe it should deliver growing free cash flow that will support (and grow) the dividend (and allow more share repurchases) going forward.

We also consider its low debt and low price-to-(forward)-earnings ratio attractive, as shown in the following to charts.

Also very important, we believe Exxon Mobil has a pro-business friend in the White House (as opposed to the previous guy), and we believe President Trump’s appointment of former XOM CEO, Rex Tillerson, as Secretary of State will certainly not hurt the company.

In our view, Exxon Mobil is a free cash flow machine, that will support a health growing dividend as well as considerable upside in the stock price. If you are interested in big steadily-growing dividends as well as price appreciation potential, Exxon Mobile is worth considering.

1. Emerson Electric (EMR)

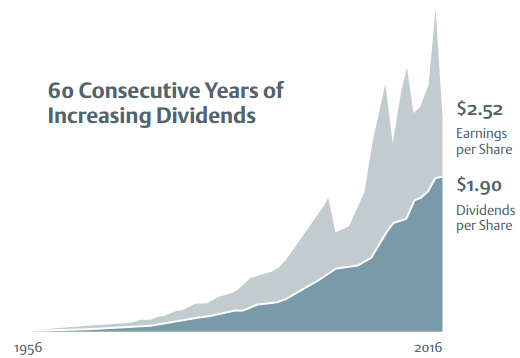

We own Emerson Electric in our Blue Harbinger Disciplined Growth portfolio. EMR is a diversified global manufacturing company with a history of delivering total shareholder return and 60 consecutive years of increasing dividends.

If you are a contrarian investor like we are, now is an outstanding time to buy the shares as the company has underperformed the S&P 500 due largely to its recent “streamlining” of its business as shown in the following graphic.

We believe Emerson‘s newly streamlined business will help it focus on its most profitable areas thereby allowing it to deliver strong returns for years to come. Specifically, the company boasts a very strong 17.38% return on invested capital versus only a 9.81% cost of capital (according to Guru Focus). This is an enviable metric that most companies cannot achieve. Additionally, Emerson is committed to significant emerging market opportunities, an area that will provide significant growth opportunities. One area of caution is that a significant portfioon of the business is tied to energy markets, which can contribute to some stock price volatility (it has a beta of over one, for example). However, despite the recent challenges, the company continues to pay out only 56% of free cash flows as dividends which makes the dividend very safe, and allows the company plenty of cash flow to fund its continued growth. If you are a long-term income-focused, value-inestor, Emersion Electric is worth considering.

Conclusion:

Overall, if you are looking for steady dividend growth, consider the Dividend Aristocrats. We believe the six we've highlighted in this article are particularly attractive. You can view all of our current holdings here.