Realty Income (O) pays a big monthly dividend (+4.7%), but its price is down, and many investors are not happy. The company has a strong track record of success since it was first listed on the NYSE in 1994, but what has Realty Income done lately? Considering the horrible 1-year performance for the Real Estate sector, we intend for this to be the first in a series of REIT articles in the coming weeks. This article reviews Realty Income’s financial position, its current valuation, and our outlook for its future performance.

Thesis:

Our basic thesis on Realty Income is that despite its recent poor performance relative to the market, as measured by the S&P 500 (SPY), Realty Income remains a financial powerhouse, with an attractive valuation (it’s trading at a compelling price), a big safe dividend yield (+4.7%), and like other REITs—we expect Realty Income’s price to eventually come soaring back. More specifically, when the “growth/momentum trade” that’s been working so well lately—eventually breaks (and it will), REITs like Realty Income will come soaring back—and in the meantime—Realty Income’s big monthly dividend is very attractive

Overview:

If you don’t know, Realty Income purchases commercial real estate leased to tenants under long-term net lease agreements, generally 10-20 years. The lease payments generated each month are used to support predictable monthly dividend payments (currently 4.7% yield) to shareholders.

Past Performance:

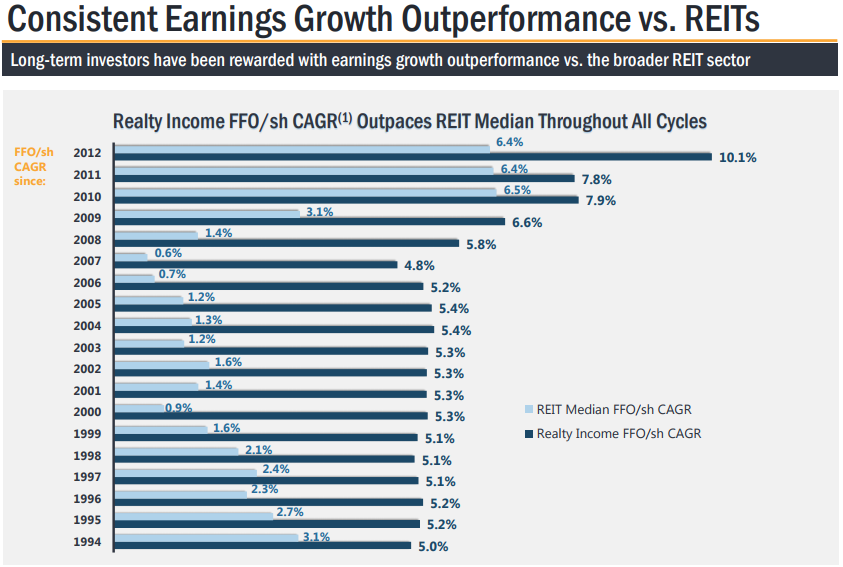

A glance through a Realty Income investor presentation, shows that this is a company that likes to brag about its past successes. For example, the following three graphics show the company bragging about its performance since it was first listed on the NYSE in 1994…

Certainly, these (above) are impressive stats about Realty Income’s historical performance, but past performance is certainly no guarantee of future success. And considering the company has already grown to a large $15 billion market cap, and the REIT competition has intensified, future growth will be more challenging to achieve, in our view. Nonetheless, Realty Income does still have a variety of important financial strengths that will help it succeed going forward.

Financial Strengths:

In additional to Realty Income’s past successes, the company has some current financial strengths. For example, Realty Income has a…

1. Strong Balance Sheet: this is very important for a REIT because they rely on new capital for growth. For example here is a look at the company’s strong investment grade credit ratings:

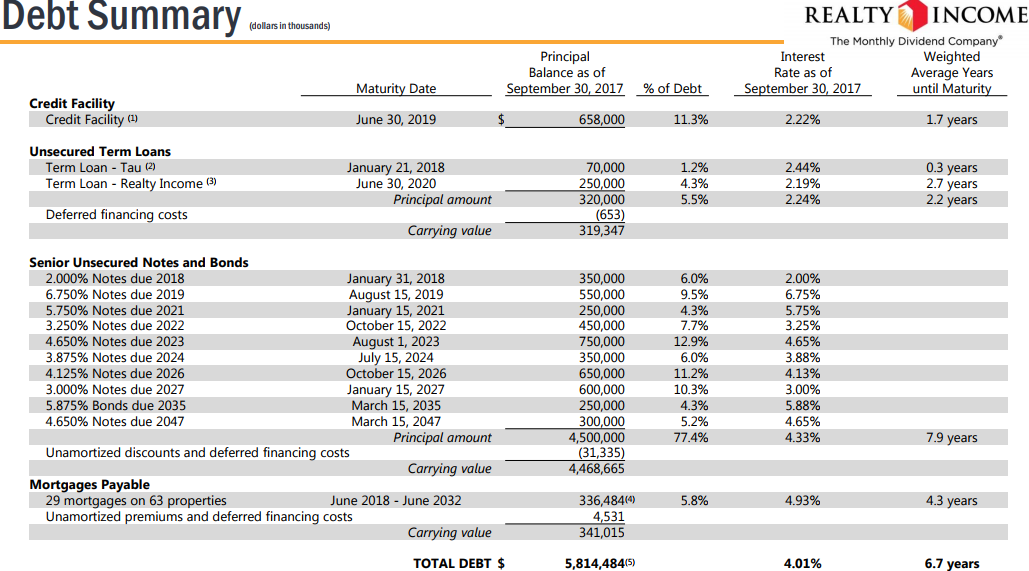

Further still, this next graphic provides a summary of Realty Income's outstanding debts, and the interest rates are not particularly high (a good thing) and the maturities are spread out over the coming years (also a good thing).

Additionally, Realty Income is not even close to violating any of its debt covenants (as shown in the following graphic) which is also important for the company’s future growth considerations.

2. Strong Pipeline: Because of its strong balance sheet, Realty Income continues to be able to pursue attractive growth opportunities. For example, here is a look at O’s current development pipeline, which remains healthy.

However, more significant is Realty Income’s strong investment activity. Here is a look at O’s recent investment and disposition summary:

3. Strong Diversification: Realty Income also has very strong diversification among its properties, as shown in the following graphics:

Valuation:

Before sharing details on Realty Income’s current valuation, it’s worth considering the REITs strong same store revenues and high occupancy rates, as shown in the following graphics.

Also, the company maintains attractive growth guidance for future funds from operations (“FFO”) adjusted (“AFFO”).

And importantly, here is a look at Realty Income’s historical price to AFFO ratios, including its current price versus management’s full year 2017 AFFO guidance.

And as the chart shows, Realty Income is currently trading at an attractive valuation multiple versus its own history. And for further perspective, here is its historical price chart over the same time period.

Our Outlook:

From a “state of the market” perspective, Realty Income has a lot of good things going for it, especially if you are a contrarian “value” investor. For example, the market has been in a pro-growth, “pro-growth stock” mode since the 2016 election where growth stocks (like FANG stocks) have been significantly outperforming value stocks like Realty Income (and REITs in general), as shown in the following chart.

Further, there has been this false narrative that the internet (e.g. Amazon) is going to put all “brick and mortar” retail stores (e.g. Realty Income’s tenants) out of business. However, in realty, Realty Income’s business and its diversified tenant base are doing very well, and the decline in price is simply creating a more attractive entry point, in our view. Further, as we mentioned above, growth stocks have been performing extremely well, but eventually, the “FANG trade” will reverse, and when it does, value stocks (including REITs) will likely come screaming back, significantly outperforming the rest of the market. And in the meantime, owning Realty Income for its big 4.7% dividend yield, makes waiting patiently for the price rebound much more palatable.

Worth mentioning, many investors also fear that rising interest rates will hurt REITs like Realty Income because they rely on the capital markets (including the debt market) for capital to grow, and the fear is that capital will become more expensive with rising rates. However, as we saw earlier, Realty Income’s strong credit rating keeps the interest rates on its debt relatively low. Plus, if rates are rising, that means the economy is strong and Realty Income can raise rents (for example, we did see rising same store revenues earlier in this report).

Conclusion:

The aggressive growth “FANG” trade will eventually break, and when it does value stocks (including REITs like Realty Income) will come screaming back. Not only is Realty Income trading at an attractive valuation right now, but it is very financially strong, it has attractive continuing growth prospects, and its big well-covered dividend is attractive. We don’t currently own Realty Income, but it is on our “watch list,” and we do consider it a very attractive retail REIT, with a big dividend, that pays monthly, and it is worth considering.