A big dividend, wide moat, and compelling valuation. That's how we'd describe the stock we just purchased. We funded this purchase with the proceeds from our recent highly profitable sale of Caterpillar (we sold our CAT shares last Friday for a +110% gain after holding them for only 19-months). This article shares our thesis for why we just invested in this new highly attractive contrarian opportunity.

This company is hated. Its share price is way down because investors haven’t forgotten management’s big mistakes, and because many investors have given up hope and finally sold their shares. In our view, this has created an attractive long-term contrarian opportunity considering the company offers a big safe dividend, its business has an enviable wide moat, and its shares are trading at a compelling valuation, especially considering the inevitable long-term growth this company will experience.

Overview: Why the Trade

General Electric (GE), Yield: 3.96%

If General Electric (GE) sounds like a completely boring uninteresting company to you, you are not alone (many investors agree with you), and this is part of the reason why the big dividend and share price are so compelling, in our view. Yes management made big mistakes that investors have not forgotten (i.e. GE Capital and the dividend cut in 2009), and yes investors are frustrated and impatient with recent dispositions and acquisitions. However, the long-term investment opportunity presented by GE is compelling.

Our Thesis:

Our thesis for this trade is basically that GE offers a…

- Big Safe Dividend: Don’t be fooled by the misleading high payout ratio. Also, the high yield is an encouraging signal from management, in our view.

- Wide Moat: For example, enormous economies of scale, complimentary business units/segments, and high customer switching costs.

- Compelling Valuation: Near-term challenges and restructuring costs are masking tremendous long-term value and causing the stock to trade at an inappropriately low valuation, in our view.

Also worth mentioning, we are purchasing shares of GE using the proceeds from our recent sale of Caterpillar (another Industrial sector stock). We owned Caterpillar for 19-months and sold our shares last week for a +110% gain. You can read about that trade here.

Also important to mention, we are replacing one Industrials company (Caterpillar) with another Industrials company (GE) because we like to keep an adequate level of diversification (i.e. a level we are comfortable with) across sectors within our Blue Harbinger portfolios for risk management purposes.

Overview of GE’s Business:

General Electric has seven industrials manufacturing segments and a specialty financing unit, as shown in the following graphic.

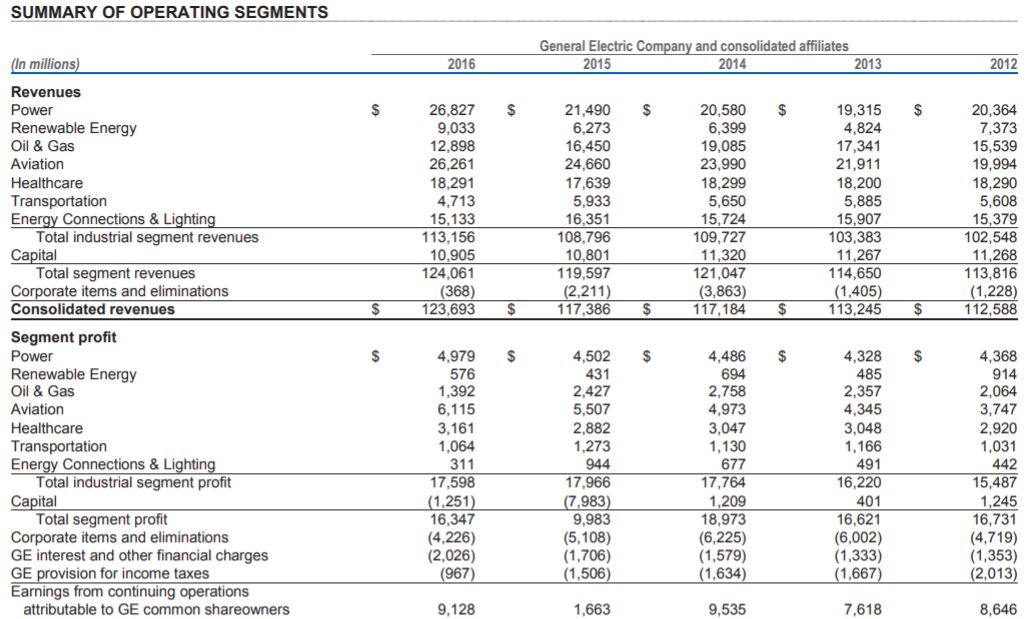

And for perspective, her is a look at which segments area generating the most revenues and profits.

Critically important to understand, over the last decade, management has dramatically transformed the GE portfolio. Specifically, earnings from industrials businesses has risen to about 90% of total earnings, whereas it was around only 45% a decade ago. Big changes have included the company’s nearly complete efforts to sell off most of it GE Capital assets (GE Capital is the segment that the company in trouble during the financial crisis, and was the biggest contributor to the 2009 dividend cut). The company is also merging its troubled Oil & Gas business with Baker Hughes (they’re trying to create a broad industry leader).

Further still, GE is attempting to invest in disruptive innovation that will drive industrial productivity in the future. For example, they’ve established two new businesses—GE Digital and GE Additive Manufacturing—that are in the early stages of value creation for GE investors.

We believe GE’s changes are good because they are focusing the company on what it does best (industrial manufacturing), and wisely positioning itself for new opportunities in the future (e.g. GE Digital and GE Additive Manufacturing). However, we believe many investors are simply fed up with GE’s failures, they’ve grown impatient with the reorganizations, and they’re simply not recognizing the powerful long-term growth potential this company has, especially considering its wide economic moats and the inevitable long-term global industrial growth drivers.

GE’s Wide Moat:

In our view, GE’s wide moat stems from three attractive qualities. First, GE has enormous scale. What would be considered major undertakings at other industrials companies, are easily accomplished at low costs for GE considering it can spread the cost across the organization. GE also has a large R&D budget, which makes accomplishing things easier than at other smaller firms.

Secondly, GE has complimentary business segments that allow expenses to be reduced by sourcing at low prices from its own internal business groups. For example, a deep water drilling project can source turbines from the power segment and imaging technology from the healthcare segment.

Thirdly, GE benefits from high customer switching costs. GE is able to service its products in a high quality and efficient manner that makes switching to another manufacturer too risky in terms of costs, efficiency and potential down time. Worth noting, GE also has a wide array of patents it has accumulated over the years that helps separate them from the competition.

GE’s Cash:

Dividends, Buybacks, and Business Investments

GE’s big dividend is very safe (it currently yields 3.9%). Many investors are leery of an investment in GE because its dividend payout ratio appears very high. However, we believe it appears high because of the restructuring and transitioning costs, and there is a lot more cushion than many investors realize.

As a general overview, here is a look at the company’s capital generation and allocation in 2016 – 2018.

And here is a look at how GE balances its capital allocation among dividends, share buybacks, acquisitions, divestitures and internal (organic) investments.

Important to consider, the following Q&A from GE’s most recent earnings call is very telling because it describes the near-term pressures on free cash flow (form which dividends are paid) and how those near-term pressures will dissipate. It’s a long excerpt, but worth the read:

“Julian Mitchell

My question would really be on the CFOA for the year coming in at the lower end of the $12 billion to $14 billion guidance, sounds like that’s mostly power, and oil and gas. So I wondered if you could give us some transparency around what is the cash conversion or free cash flow margin like in those two businesses in 2017. And when you think about their cash flow performance this year, how much do you think it’s weighed down by short-term one-time factors? In other words, how quickly do you think it can spring back to an acceptable level of cash flow in those two businesses?

Jeff Bornstein

Yes, Julian. So, we expect the power business to deliver a positive CFOA in the year for sure as well as oil and gas. And we actually oil and gas to have -- relative to the environment they are operating in and how do we see their second half, a reasonably good performance around CFOA for the year for oil and gas. So, the power business is going to be something like 50% to 60% conversion in the year; other businesses will be higher. Healthcare will be closer to 100%; aviation will be quite good. But I would guess that power is going to be somewhere between 50% to 60% conversion for the year.

Jeff Immelt

I would also add, Julian. We’re doing $2 billion of cash related to restructuring. A lot of that’s in the power sector. None of us expect that to repeat in 2018. So that’s a natural tailwind, let’s say in terms of CFOA in 2018.”

The point here is two-fold. First, there are near-term restructuring pressures and market challenges that make cash flows appear low and dividend payout appear high, but those challenges will dissipate going forward. And second, GE is a powerful wide moat business that generates enormous revenue. This company will continue to grow and find ways to return cash to shareholders. As outgoing CEO Jeff Immelt explains:

“I was here the day we cut the dividend, it was the worst day of my tenure as CEO and the dividend is really I think incredibly important for our investors and for the team.”

So while GE’s near-term cash flow from its industrials business looks ugly (as shown in the following graphic), it will improve as one-time events won’t have the same negative impacts in the future. Further still the company’s equipment and services orders have been increasing, and so has its valuable backlog.

GE's dividend yield is currently at approximately 4.0%...

Valuation:

Despite GE’s recent challenges, it generates an enormous amount of revenue and it remains profitable.

Further, we believe revenues will grow (from simply GDP growth, and GE’s competitive advantages, but also growing high margin digital and manufacturing services initiatives). Further still, the company has initiated a recent formal plan whereby management compensation is tied to the companywide goal of reducing structural costs by $1 billion in 2017 and 2018. These cost reduction initiatives combined with the rolling off of expensive one-time restructuring costs should noticeably increase margins and free cash flows.

GE’s current cost of capital is 5.75% (according to GuruFocus) and the company’s return on invested capital is over 12%. This means the company is creating value with every new dollar invested. Further, we expect the ROIC to increase considering higher margin initiatives, cost cutting initiatives and the reduction in unusual and one-time operating expenses.

From an industrial business segment standpoint, GE will continue to face near-term challenges in its Oil and Gas segment, but the Baker Hughs acquisition will help improve efficiency and scale. Also, margins will remain high and attractive in the large healthcare and especially aviation segments.

For further perspective, GE trades at an unusually low price to sales ratio relative to peers as shown in the following chart.

And considering the competitive and improving operating margins of GE’s industrials segments (see chart below), we believe it deserves and will trade at a higher multiple in the future.

For further perspective, here is a look at GE’s price-to-(forward)-earning ratio relative to peers.

GE has room for multiple expansion as well as earnings growth (as discussed earlier).

Risks:

Obviously GE faces a lot of significant risk factors, otherwise its price wouldn’t be so inexpensive relative to peers. Granted, we believe a very big part of the reason GE’s stock is inexpensive is because the market is overly fearful (and the negative narrative has gone too far), but there are risks nonetheless. Here are a few risks to consider (these are taken mainly from the company’s annual report, and we’ve only included the ones that we consider most important). Per GE, risks include:

- Our ability to complete incremental asset sales as we complete our announced plan to reduce the size of our financial services businesses and our ability to reduce costs as we execute that plan;

- Changes in law, economic and financial conditions, including interest and exchange rate volatility, commodity and equity prices and the value of financial assets.

- Our ability to maintain our current credit rating and the impact on our funding costs and competitive position if we do not do so;

- The amount and timing of our cash flows and earnings and other conditions, which may affect our ability to pay our quarterly dividend at the planned level or to repurchase shares at planned levels;

- GE Capital’s ability to pay dividends to GE at the planned level, which may be affected by GE Capital’s cash flows and earnings, financial services regulation and oversight, claims and investigations relating to WMC and other factors;

- Our ability to increase margins through restructuring and other cost reduction measures;

- Pension obligations: We expect operating pension cost to be approximately $1.4 billion in 2017. Any missteps by GE in terms of investment assumptions and/or risks can lead to significant negative impacts.

- Our capital allocation plans, as such plans may change including with respect to the timing and size of share repurchases, acquisitions, joint ventures, dispositions and other strategic actions;

Conclusion:

GE is hated. As a result, its stock price is too low compared to its tremendous long-term value, in our view. Specifically, restructuring and one-time expenses are causing common valuation metrics to be misleading. Further, many investors are fed up and impatient with GE’s mistakes and restructuring. In our view, GE’s big dividend is very safe, the business is powerful, growing and protected by a very wide moat. And it’s stock price is simply too low.

We have purchased shares of GE as a long-term investment. We expect GE’s shares to significantly outperform the market over the coming market cycle, and we also look forward to enjoying the big safe dividend payments (the yield is at 4% as of today).

For your reference, you can view all of our current holding here. Please note this GE purchase is Not yet reflected in the holdings table, but it will replace the Caterpillar shares we sold just last week.