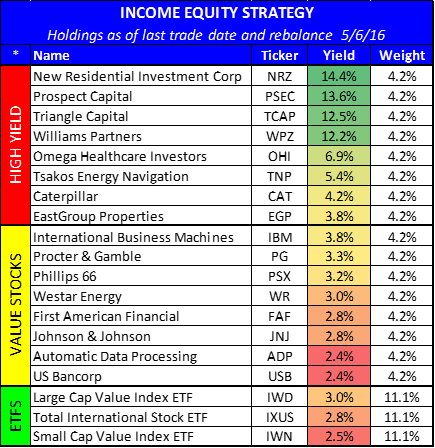

We have multiple exciting updates in this week’s Blue Harbinger Weekly. First, we’ve placed several new trades in the Blue Harbinger Income Equity strategy bringing the portfolio's aggregate dividend yield to over 5.0%. Second, in a continuation to our public report Nine Big Dividend Stocks Worth Considering we have included detailed reports for each of the Top Five Big Dividend Stocks (and yes, we do own all five in in the Blue Harbinger Income Equity strategy).

5. New Residential Investment Corp (mREIT, 14.4%)

We’ve initiated a position in New Residential Investment Corp (NRZ) within our Blue Harbinger Income Equity portfolio. We believe this high dividend yield (+14.4%) Mortgage Real Estate Investment Trust (mREIT) is currently trading at a significant discount to its value (we value it with a dividend discount model assuming a conservative zero percent growth rate and an 11.39% cost of equity).

NRZ emerged in the mortgage servicing space following the financial crisis as banks had to shed risk and the mortgage markets became more complex. Even though the unique circumstances that existed following the financial crisis are fading, we believe this company has the ability to continue delivering big returns for many years to come. You can read our full report on NRZ here.

4. Omega Healthcare Investors (REIT, 6.9%)

We’ve added shares of Omega Healthcare Investors (OHI) to the Blue Harbinger Income Equity portfolio as its price has pulled back 6% in the last two weeks. Omega is a Real Estate Investment Trust (REIT) with a high 6.9% dividend yield. We believe it offers attractive price appreciation opportunities considering its leadership position in the high growth Skilled Nursing Facilities (SNF) industry. Further, a variety of valuation and risk metrics suggest the dividend is relatively safe and likely to grow. You can view our full writeup on Omega here.

3. Tsakos Energy Navigation (Shipping Company, 5.4%)

We have initiated a position in Tsakos Energy Navigation (TNP) as the shares have declined 9.1% in the last two weeks. Tsakos is a Greek company (Athens) that trades on the New York Stock Exchange. It is a provider of international seaborne crude oil and petroleum product transportation services. Tsakos makes more money when oil prices are low (as they are now), it pays a big dividend (currently 5.4%), and it has a lot of upside potential considering the market is not yet giving it nearly enough credit for its rapidly growing net income. We value Tsakos using a very conservative 6x earnings multiple. You can read our full Tsakos report here.

2. Williams Partners (MLP, 12.2%)

We have added shares of Williams Partners (WPZ) to the Blue Harbinger Income Equity portfolio. The price of WPZ continues to be extremely volatile as the market adjusts to oil price dynamics and management challenges at Williams. We took advantage of Friday’s price decline to add shares.

In a nutshell, Williams Partners (WPZ) is a high-yield (12.1%) Master Limited Partnership (MLP) that has declined more than 50% since the second half of 2014. A basic distribution discount model suggests the market has already priced in zero growth and a significant distribution cut. We believe the market has overreacted to the challenges Williams faces (e.g. low energy prices, counterparty credit/default risk, management reorganization, and rising interest rates), under-reacted to the value it creates (e.g. energy price agnostic fee business, the value of its assets, and its future growth potential). We believe it is a valuable addition to the higher risk portion of our diversified, Income Equity portfolio. You can read our full Williams Partners write-up here.

*One additional word of caution. Because Williams in an MLP it can trigger unexpected tax consequences. If held in an ordinary brokerage account you’ll likely get a K1 statement shortly after year end that will detail unrealated business taxable income that you’ll need to report on your tax return. Please contact your stock broker before holding this one in an Individual Retirement Account (IRA). If the position and income are too large it could cause your IRA to lose certain tax benefits.

1. Triangle Capital Corporation (BDC, 12.5%)

We have added shares of Triangle Capital (TCAP) to the Blue Harbinger Income Equity portfolio. We believe the market dramatically overreacted to last week’s dividend cut, thus creating an extremely attractive buying opportunity.

Triangle is a Business Development Company (BDC) and its business is focused on generating current income (for dividend payments) by providing customized financing to lower middle market companies located in the United States. Specifically, the company's investment objective is to seek returns by generating current income from its debt investments and capital appreciation from its equity related investments.

In a nutshell, we bought Triangle because of its attractive cash flows, its big dividend yield (it’s still 12.5%), its strong internal management team, and its multiple layers of diversification benefits within the Blue Harbinger Income Equity portfolio. You can read our complete Triangle write-up here.

Blue Harbinger Income Equity Update: If you haven’t already seen this on the members-only landing page, here are the updated holdings within the Blue Harbinger Income Equity strategy:

*Aggregate Dividend Yield: 5.02%