In a continuation to part 1 of our free report (Ten Big Dividend Investments Worth Considering), this week's Blue Harbinger Weekly includes the remaining (top) five big dividend investments (we currently own three of them within our Blue Harbinger Income Equity portfolio). We also discuss the market's reaction to Fed Chair Janet Yellen's recent comments on interest rates, as well as the continued outperformance of all three Blue Harbinger members-only investment strategies through the end of the first quarter (3/31/2016).

Top 5 Big Dividend Investments to Consider (a continuation to our "Part 1" free article).

5. Procter & Gamble (Common Stock, 3.2%)

Procter & Gamble (PG) is a safe consumer staples company with an attractive dividend yield (3.2%). And while 3.2% is lower than the other companies on this list it is higher than the average S&P 500 dividend, and it is near the highest level in Procter & Gamble’s history. Further, it is extraordinarily safe, and the stock has significant price appreciation potential. We own Procter & Gamble in our Blue Harbinger Income Equity portfolio, and you can read our full P&G report here.

4. Liberty Property Trust (REIT, 5.7%)

Liberty Property Trust (LPT) is a real estate investment trust (REIT) with a healthy 5.7% dividend yield. The company has wisely been shifting its strategy in recent years to focus on industrial properties instead of suburban offices. However, because of this strategy shift, investors have been ignoring and undervaluing the security. We believe this is a REIT worth loving because its dividend is relatively safe, and we believe it offers a better total return opportunity than many of its peers. You can read our complete Liberty report here: Liberty Property Trust: Big Dividend, Safe and Unloved

3. Genesis Energy (MLP, 8.2%)

Genesis Energy (GEL) is a Master Limited Partnership (MLP) with an attractive 8.2% dividend yield. And similar to Enterprise Products (number 7 on this list), Genesis has unfairly sold off with other MLPs, and it has ample retained earnings to help support the dividend going forward. This is a high dividend MLP that we will be giving researching closely over the next week.

2. EastGroup Properties (REIT, 4.0%)

EastGroup Properties (EGP) is a well-managed, well-diversified, industrial Real Estate Investment Trust (REIT) with a healthy 4.0% dividend yield. We like EGP because it invests in attractive primary locations. Additionally, its price to FFO (funds from operations) and dividend to FFO are attractive relative to many of its peers. We believe it’s an attractive investment to own within a diversified portfolio (because of its big steady dividend yield and its price appreciation potential), and we own it in our Blue Harbinger Income Equity portfolio. You can read our complete, members-only, EGP report here.

1. Caterpillar (Common Stock, 4.0%)

Caterpillar (CAT) is a heavy machine manufacturer with a big 4.0% dividend yield. The dividend is near historical highs because Caterpillar stock has fallen significantly over the last 30 months. We believe the market is too bearish and too shortsighted in its view of Caterpillar. We’re at a low point in Caterpillar’s business cycle, but the dividend is still very safe. Plus the stock offers huge upside potential. We own Caterpillar in our Blue Harbinger Income Equity portfolio, and you can read our full Caterpillar report here.

Yellen's Comments this week:

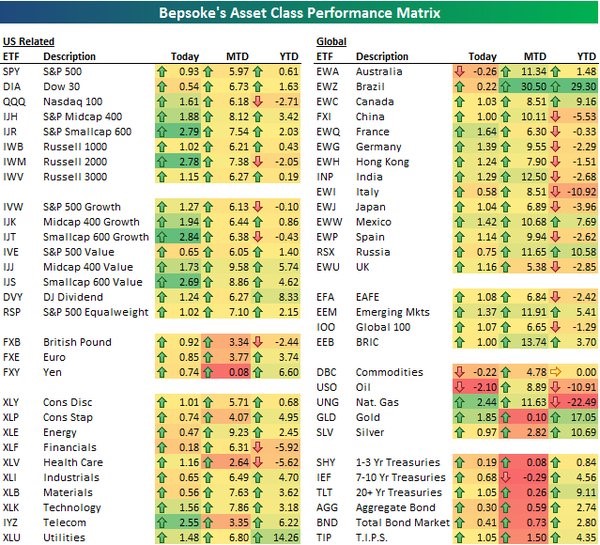

This week US Federal Reserve Chairperson Janet Yellen made it clear that she believes the market may need to remain "accomodative" (lower interest rates for longer) than previously expected, and the market reacted accordingly. Specifically, riskier assets (small cap and growth) immediately performed better as shown by the following Bespoke Investments chart:

In our view, this market reaction immediately make lower risk (value and some large cap) investments more attractive. In particular, all three of our members-only Blue Harbinger strategies are positioned to perform even better going forward (they're already all outperforming since their inception).

Performance Update: Blue Harbinger’s Members-Only Strategies:

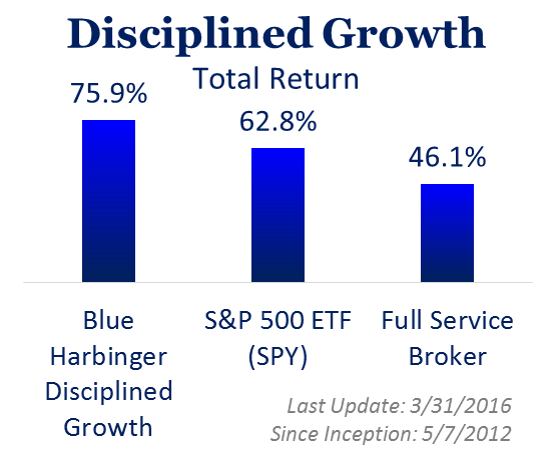

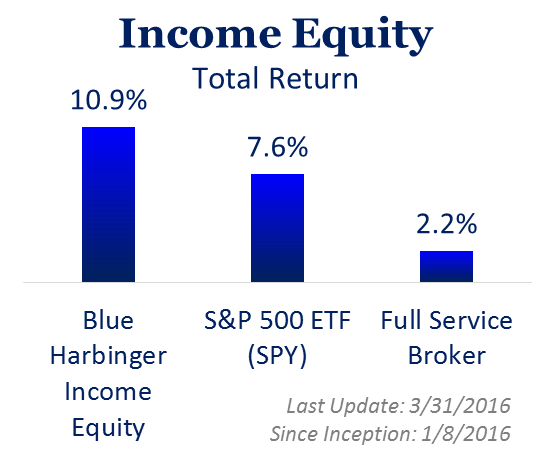

As mentioned above, all Blue Harbinger members-only investment strategies continue to outperform. For your reference we’ve included performance charts (through the end of the first quarter, 3/31/2016) below:

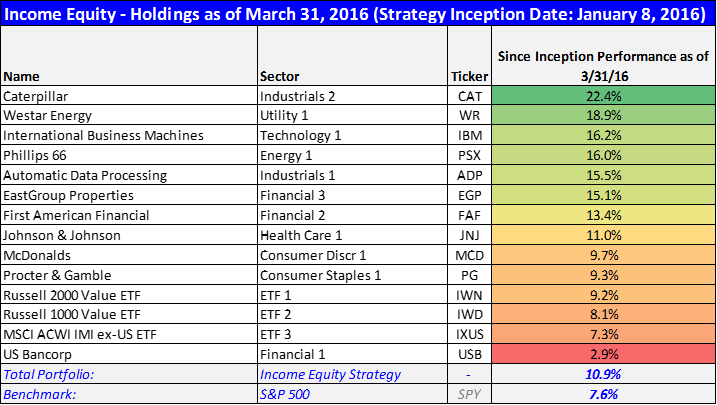

Top contributors to outperformance within our Income Equity strategy have been Caterpillar and Westar Energy. US Bancorp and the MSCI ACWI IMI ex-US ETF are the only two holdings that have underperformed the benchmark, which makes us like them even more going forward (we believe they have lots of upside!).

And within our Disciplined Growth strategy, Accenture (+10.4%) and Westar Energy (+18.0%) have been top performers year-to-date. Paylocity (-19.3%) and American Express (-11.3%) have been the worst performers this year, which makes us like them even more (they’re great companies, on sale!).be

Remember, in investing, be fearful when others are greedy, and be greedy when others are fearful!