This week we review the performance and provide an outlook for our all-ETF portfolio, “Smart Beta.” This portfolio, as well as our two other portfolios (e.g. Income Equity and Disciplined Growth) have benefited from an intentional allocation to small cap stocks, particularly since the US election. We also cover growth/value tilts, sectors, non-US and fixed income allocations. However, the big question is “how should investors be tilting their allocations going forward?” We share our views.

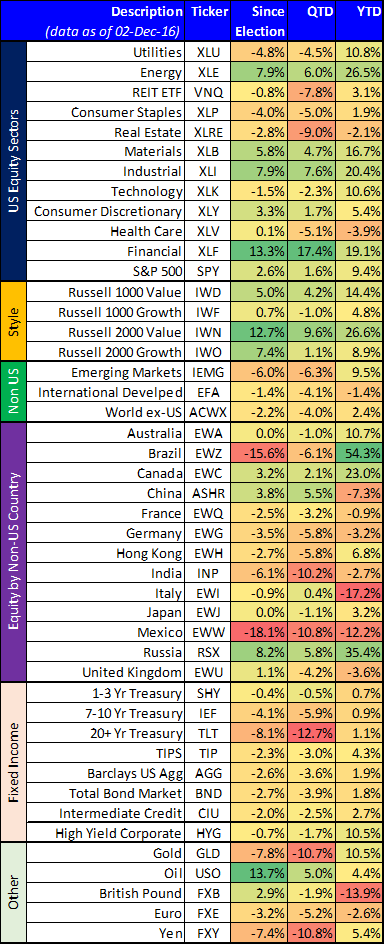

Before getting into the details, here is a chart providing the recent total returns (dividends plus price appreciation) of various market allocations.

As we mentioned in our intro, the holdings of all three of the Blue Harbinger strategies have benefited from an allocation to small cap stocks, which have outperformed as shown in the chart above. Specifically, see the relative performance of IWN and IWD in the "Style" section of our chart above. Also worth considering is style…

Style:

Small cap value stocks (as measured by IWN) have performed exceptionally well this year (particularly since the election) as these often riskier businesses are benefiting from Trump’s pro-growth perception. Additionally, small cap value is traditionally a strong outperforming category over the long-term (with a lot of volatility), but had been underperforming recently (as shown in the following charts) and was due for some mean reversion or “catch-up” in our view.

As the above chart shows, small cap value has been a very strong performer since Aug 2000 (as far back as this particular data source goes), which is what we expect for the category over the long-term.

However, this next chart shows small cap value has significantly UNDER-performed other categories over the last ten years, particularly as the broader economy reeled and recovered from the financial crisis.

And this next chart shows the strong small cap value performance since the elections. Specifically, the small-cap category tends to be highly domestically (US) based (compared to large cap which is more international) and risky. Both domestic and risk has benefitted from Trump’s pro-USA-growth message.

However, based on the ten year chart (shown previously), we believe the category still has more room to recover, and we also believe it will continue to outperform other categories over the long-term.

We invest in this category (Small Cap Value) in all three of our Blue Harbinger strategies with an allocation to the iShares Russell 2000 Value Index ETF (IWN). We like this ETF because it provides very low-cost and efficient exposure to the powerful small-cap-value category. We continue to own in because we believe it will continue to outperform other categories over the long-term. And just a small amount of outperformance on average each year compounds over time and contributes to big outperformance over the long-term.

Sectors:

From a sector standpoint, we are contrarians, and we like REITs and Consumer Staples because they have underperformed other categories this year, this quarter, and since the election (as shown in the chart near the start of this report). However, the sector ETFs for these categories are relatively expensive. For example, the Consumer Staples ETF (KXI) charges 0.47% per year which is too high for our taste, and we prefer to get our exposure to the sector more broadly through our allocations to ETFs IWN, IWD and SPY (S&P500), all of which have much lower expense ratios. Similarly, we prefer to get our exposure to REITs through the same ETFs for the same reason. Small expense differences compound over time, and we prefer to keep more money in our pocket.

However, if you are interested in these sectors on a stock specific basis (whereby you don’t have to pay any annual expense ratio fees) we like Procter & Gamble (PG), EastGroup Properties (EGP) and Omega Healthcare (OHI), all of which we own in our other strategies (see holdings).

Non-US Exposure:

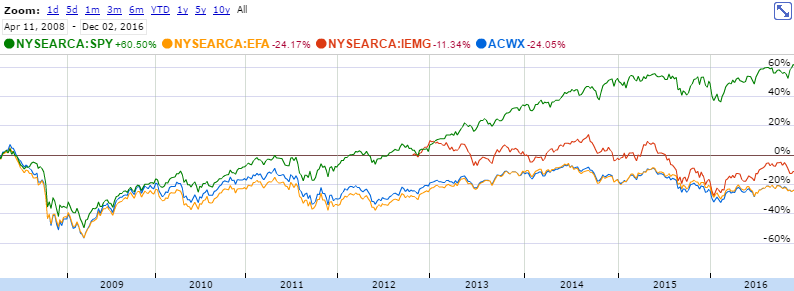

As contrarians, we consider non-US investments to be attractive currently. For example, US stocks (as measured by the S&P 500) have significantly outperformed international indexes as shown in the following chart.

(Note: SPY = S&P 500 ETF, EFA = iShares Developed International Market ETF, IEMG = iShares Emerging Markets ETF, and ACWX = iShares International Developed and Emerging Markets ETF).

And considering the strong outperformance of US stocks after the elections, we consider non-US equities even more attractive from a contrarian standpoint. Specifically, we like ETFs ACWX and IXUS. Both provide broadly diversified exposure to both emerging and developed international markets. And both have a very low expense ratio for this type of international exposure.

From a stock specific standpoint, we like Procter & Gamble right now because it has significant exposure to non-US developed and emerging markets, a categories we expect to rebound. Plus there is zero expense ratio for owning Procter & Gamble. Plus P&G's price has fallen over the last two months, and it's dividend yield has risen (3.3%), thus making for a more attractive contrarian opportunity.

Fixed Income (Bonds)

Fixed Income (bonds) continues to be challenged with rates expected to rise, especially since Trump won the election (i.e. as interest rates rise, the value of bonds fall). As our table (at the beginning of this article) shows, fixed income categories have underperformed equities (stocks) across the board this quarter and since the elections. However, we continue to maintain an allocation to fixed income in our smart beta strategy via ETF BND for income and diversification reasons. Specifically BND provides low-cost, diversified exposure to, and income from, bond investments. We don’t expect this category to perform as well as stocks over the long-term, but the diversification and income is important to many investors.

Rebalancing:

Another consideration is portfolio rebalancing. Over time, your best performers become the largest weights in your overall portfolio (because they’ve increased in value). We believe it’s prudent to rebalance, especially from a contrarian standpoint, because your best recent performers often become your relatively worst future performers and vice-versa. By rebalancing (i.e. bringing allocations back to their target weights) you are taking money away from what has already performed well and adding it to what we believe will likely perform relatively better in the future.

Conclusion:

Overall, there has been tremendous dislocation in the markets due to economic and political events around the world, and this has created attractive opportunities. We believe our Blue Harbinger Smart Beta portfolio is prudently allocated, and positioned for continued long-term outperformace.