According to data from Morningstar, the average expense ratio among passively managed index funds and exchange traded funds (ETFs) is 0.69%, and for actively managed funds it is 1.21%. And while this level of expense may seem reasonable to some, we believe it is a complete and total rip-off that can cost the average investor hundreds of thousands of dollars over the course of an investment lifetime. Blue Harbinger’s passive “Lazy Person” ETF strategy and active “Blue Harbinger 15” strategy will show you how to be a better, smarter and more profitable investor. This week’s Blue Harbinger Weekly reviews specific holdings within each of these strategies.

The average expense ratio in our passive “Lazy Person” strategy is only 0.21% which is 0.48% less than the 0.69% average according to Morningstar. For reference, here is a breakdown of the fees for each of the ETF’s in our Lazy Person portfolio:

- 0.09% - S&P 500 ETF (ticker: SPY)

- 0.20% - Small Cap Russell 2000 ETF (ticker: IWM)

- 0.20% - Value Russell 1000 ETF (ticker: IWD)

- 0.33% - International ETF (ticker ACWX)

- 0.21% - Average Expense Ratio

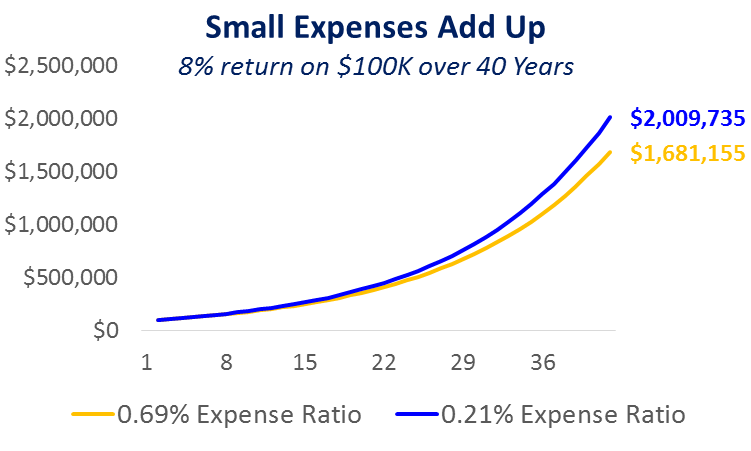

And while a difference of 0.48% per year doesn’t sound like much, it is actually HUGE! For example, if you were to invest $100,000 in the stock market for 40 years (assuming an 8% average annual return) you’d have $328,580 more dollars after 40 years if you saved 0.48% on expenses each year. That’s a very significant amount of money!

The Morningstar article we mentioned previously also points out that over the last 10 years, 73% of actively managed funds have underperformed their benchmark. This means that by investing in most active funds you would earn lower returns than passive funds and pay higher fees! This is horrible!

Prior to creating Blue Harbinger, I managed an $11 billion equity (stock) investment program for a pension fund, andI can tell you first hand that the reason so many active strategies underperform is because of the expenses, fees, and their lack of long-term strategy. Active funds not only charge higher fees, but they trade more frequently and the costs of trading add up and detract from performance. Additionally, the management teams of these active strategies have high turnover. Portfolio managers often leave, and when they do then the new portfolio manager generates a lot of additional trading costs repositioning the portfolio to his liking. It’s an expensive disaster!

Whether you are active or passive, you should always fight like mad to minimize all expenses and trading costs because it will save you an enormous amount of money over the long term. A little savings today adds up to a lot of money in the future because of the amazing power of compounding growth in your investments. And for the record, our active Blue Harbinger 15 strategy is significantly outperforming over the years since its inception because we invest in smart stocks for the long-term and we fight like mad to minimize all trading costs and expenses!

For added perspective, famous value investor and Warren Buffett’s mentor, Benjamin Graham described the difference between active and passive investing as follows:

The passive investor, often referred to as a defensive investor, invests cautiously, looks for value stocks, and buys for the long term. The active investor, on the other hand, is one who has more time, interest, and possibly more specialized knowledge to seek out exceptional buys in the market. (source: Benjamin Graham, The Intelligent Investor, 4th ed., 2003, Chapter 1).

Graham’s description of the passive investor is fitting for our Lazy Person strategy, and his description of the active investor is an appropriate description of our Blue Harbinger 15 strategy.

With regards to our passive Lazy Person strategy, one of the key components is to invest in value stocks. In this regard, our current position in value stocks via ticker IWD (Russell 1000 Value Index) represents a great value opportunity. As we described in detail in this recent note, value stocks are presenting a tremendous investment opportunity right now!

And with regards to our active Blue Harbinger 15 strategy, we believe ALL of the holdings represent exceptional opportunities right now. One name in particular that we especially like right now is Union Pacific Railroad (UNP). We’re up significantly in this position since first purchasing it in 2012, but the stock has underperformed significantly in 2015 because of the slump in energy markets (e.g. less demand for coal shipments that eventually end up in China, and less business in the oil related shipping business as a dramatic price decline has resulted in a significant slowdown). However, we believe we are approaching a low point in this cycle, and when prices and demand rebound, Union Pacific will recover swiftly and dramatically as it has in the past.

And importantly, as long-term investors, we are not trying to “bottom-tick” the stock price or time the recovery perfectly; rather, we know that minimizing trading costs (and expenses) and investing for the long-term saves an enormous amount of money.