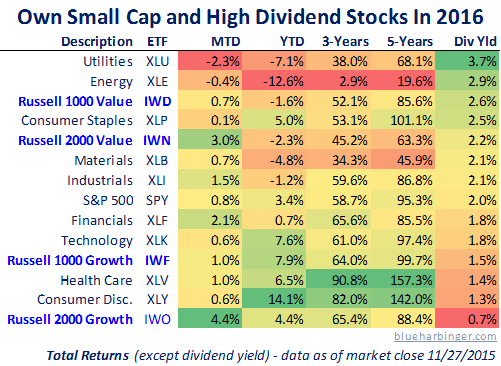

There is a long history of mean reversion in stock market performance. Recent examples include REITs under-performing by a lot in 2013 and then out-performing by a lot in 2014, and aggressive growth stock Amazon under-performing by a lot in 2014 and now outperforming by a lot in 2015. Interestingly, value stocks and dividend stocks are under-performing in 2015, and the table is set for them to out-perform by a lot in 2016 (especially considering the US Fed is about to get more hawkish on interest rates). Further, we may see small value dividend stocks perform best in 2016 considering they tend to have less international exposure and the European Central Bank will likely continue its very dovish monetary policy well into 2016.

Of course we’d never pour ALL of our money into a small cap dividend portfolio because that would be undiversified and too risky. However, we do have an allocation to a small cap ETF (ticker IWM) and a value ETF (ticker IWD) within our Blue Harbinger 15 and our Lazy Person Portfolio (they’re both very low cost ETFs too). We also own a small cap utility company with a high dividend yield (Westar Energy).

As mentioned last week, one of our actively selected stocks is McDonalds, and we have been giving some consideration to switching McDonalds out of the Blue Harbinger 15 and replacing it with Chipotle which has been very beat up recently. However, for the time being, we are sticking with McDonald’s because it’s not yet clear how negatively Chipotle will be impacted by the recent E. coli outbreak (i.e. this quarter’s sales could be absolutely horrendous if most people are too scared to eat at Chipotle). We are sticking with McDonalds for now, and you can read our McDonald’s thesis and recent McDonald’s updates here.

Another active stock position we have been considering is Caterpillar. This large cap value stock has been extremely beat up over the last year, and its dividend is very attractive right now at a 4.3% yield. Caterpillar may end up being our free stock of this week next week because it is becoming quite a compelling story for 2016. (There is no free stock of the week this week- we're taking this week off for Thanksgiving). Specifically, CAT is a value stock with a high dividend, and those are the types of stocks we like for 2016 based on our table above.

On a separate note, our Disney stock declined around 3% on Friday as it announced it lost around 3 million ESPN subscribers as many people are “cutting the cord” on cable. This is not new news as it’s a trend investors have feared for some time. Additionally, Disney is working to achieve more business with non-traditional content providers to replace lost business due to an evolving environment and consumer preferences. You can read our Disney thesis here, and you can read our other recent Disney updates here.

Lastly, at Blue Harbinger we believe one of the most common mistakes investors make is to chase whatever has been performing best and to sell whatever has been performing worst. This is often the exact wrong this to do. In fact, it is our contrarian belief that attracts us to small cap and high dividend stocks (as part of a diversified portfolio) in 2016.