How to use this report:

The articles below include tables filled with big-yield and high-dividend opportunities, sorted into various categories, such as REITs, BDCs, CEFs and more. New reports are added periodically. The idea is to share comparative data on big-dividend investments to help you identify exceptional opportunities.

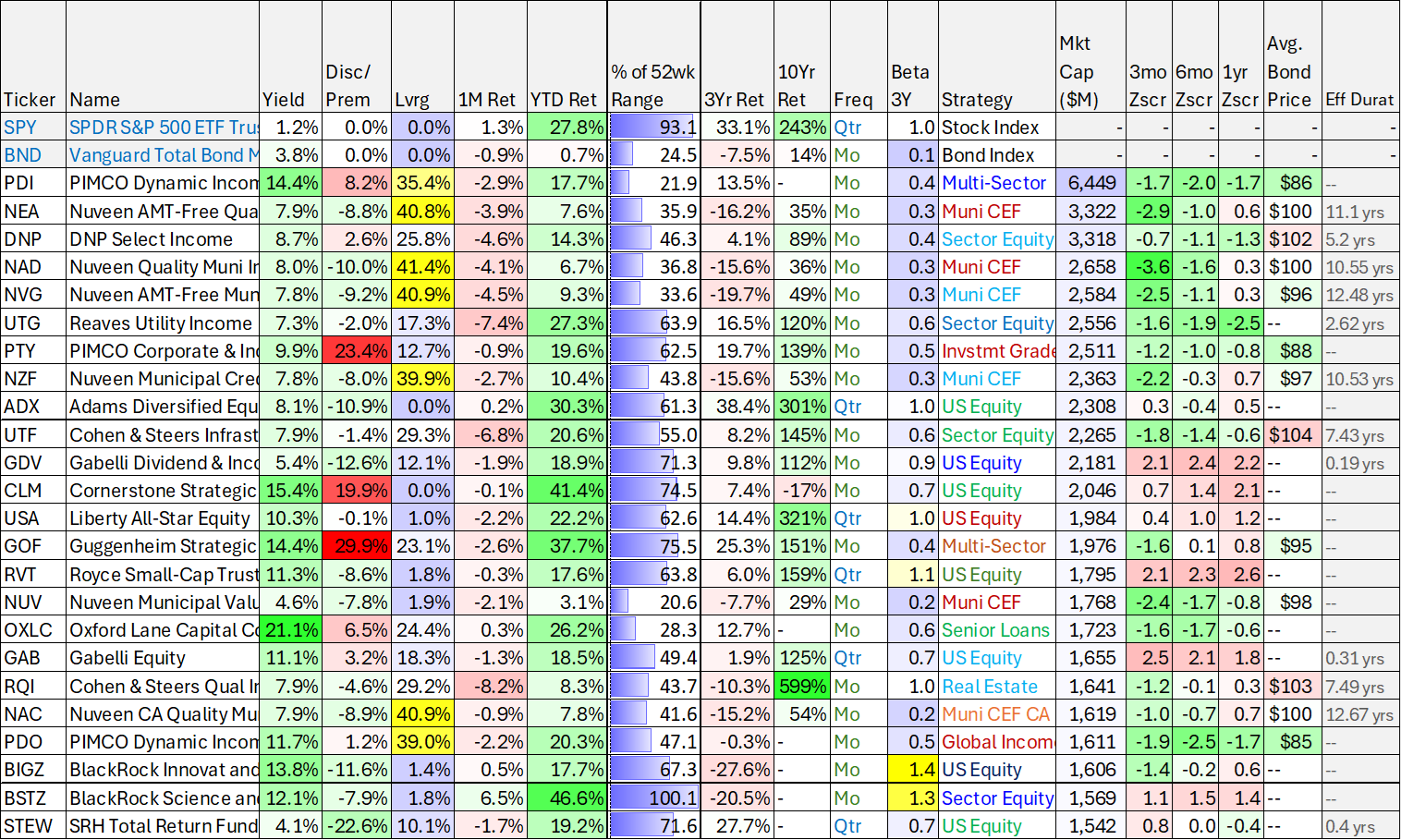

As you can see in the following table, PIMCO offers some compelling bond fund CEFs, yielding 10%+, paid monthly. However, you might also want to take a look at the current distribution coverage ratios, price premiums (versus NAV), and share prices (versus 5-year range) before investing, as you can see below.

Happy Holidays and Merry Christmas! Here is a look at big-yield CEF data for over 75 top funds. As you can see, the premiums have come down on several popular big-yield bond funds (attractive). Further still, municipal bond funds continue to be attractive, selectively.

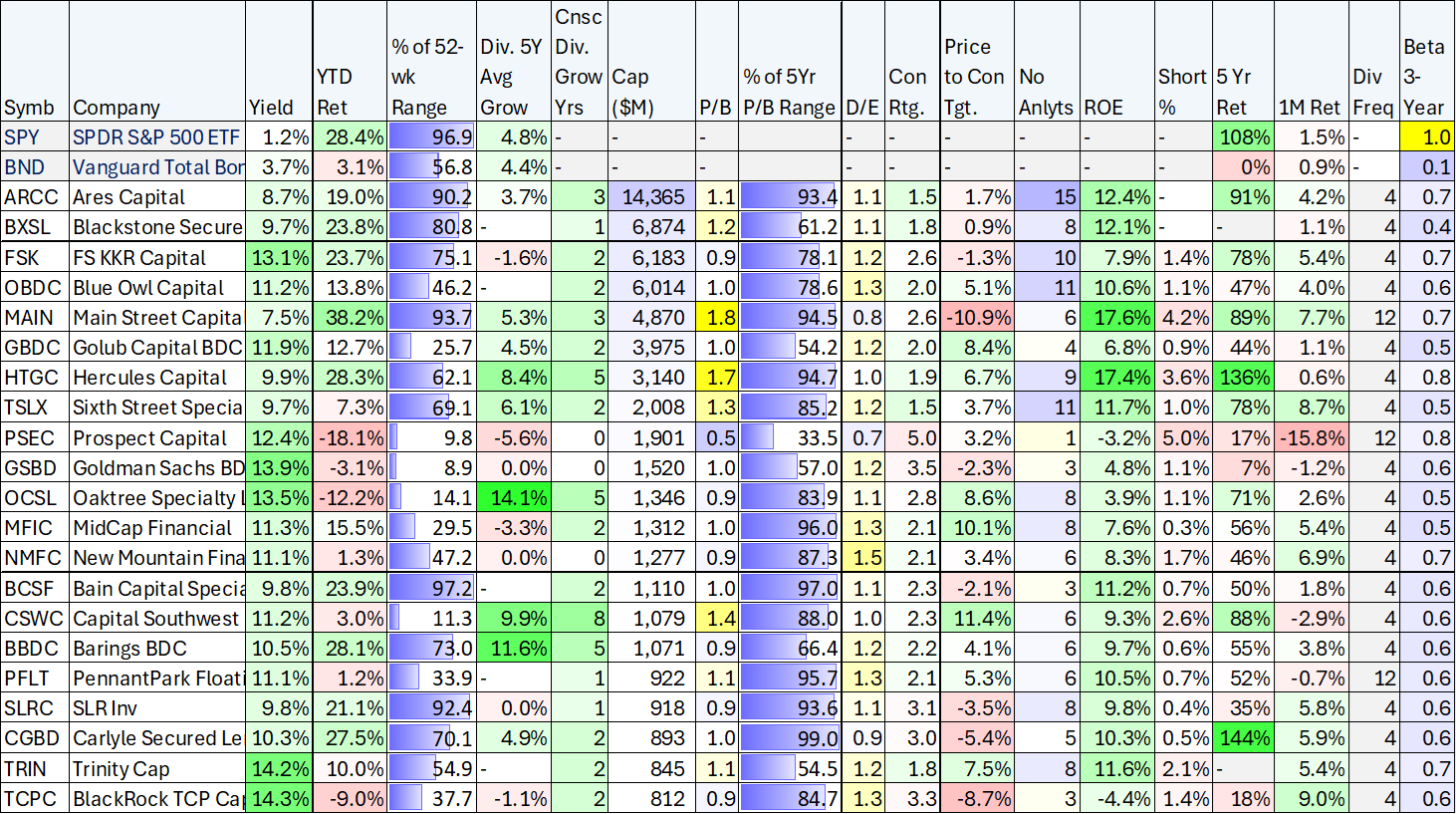

This note shares updated data on big-yield BDCs (including yield, P/B, recent performance, ROE, dividend growth and more). Performance has been mixed for the group this year, but select leaders remain particularly attractive. Yields range from 7% to over 15%. The list is sorted by market cap.

If you enjoy digging into the universe of data (to help yourself identify attractive opportunities for further research), this report shares updated data on over 200 big-dividend (technically “big-distribution”) Closed-End Funds (“CEFs”). The data includes a variety of CEFs (including taxable bond CEFs, non-taxable municipal bond CEFs, stock CEFs and more), and it is sorted by market cap (you likely recognize several of your favorites near the top). There is also a link to an Excel spreadsheet with all the data (for those of you who like to sort, slice and dice the data your own way). We own several CEFs on this list in our Blue Harbinger “High Income NOW” portfolio.

Despite macroeconomic concerns, the stock market has continued to post strong gains this year thereby leaving some investors wondering if it’s time to take some chips off the table. One popular approach is owning attractive big-yield investments (6% to over 10% yields) that will continue to pay high income regardless of what happens in the broader market. In this report, we provide an overview of “frothy” market conditions (e.g. valuation metrics) and then countdown our top 10 big-yields (including BDCs, stock and bond CEFs, REITs and more). We conclude with a critical takeaway that is sadly overlooked by many.

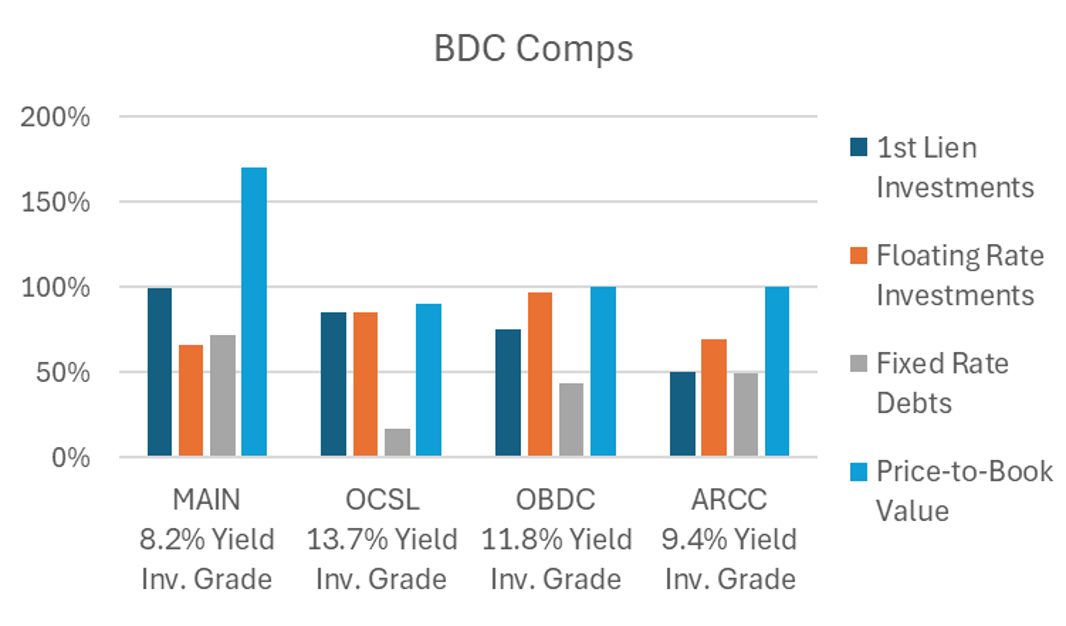

A lot of income-focused investors are attracted to BDCs for their large dividend yields. However, not all BDCs are created equally. In the following table you will see comparative data for top BDCs, including the percent of investments that have fixed-versus-floating rates, the percent of debt they have that is fixed-versus-floating rate, price-to-book value, current dividend yields and the percent of first lien loans they have made as investments.