If you don’t like paying taxes, like most of us, you may have noticed that municipal bond closed-end funds are still trading at historically large (and very unusual—attractive!) discounts to NAV. The “magic” of a municipal bond, is that you generally don’t have to pay federal income tax on the income—so if you’re in a high tax bracket—munis can be quite lucrative (especially on a “tax-equivalent” yield basis). In this report, we share data on over 75 big-yield municipal bond CEFs, discuss the current historical opportunity (including how funds are actively working to reduce the discounts!), and then share a few thoughts on particular muni-bond CEFs that you may want to consider for investment.

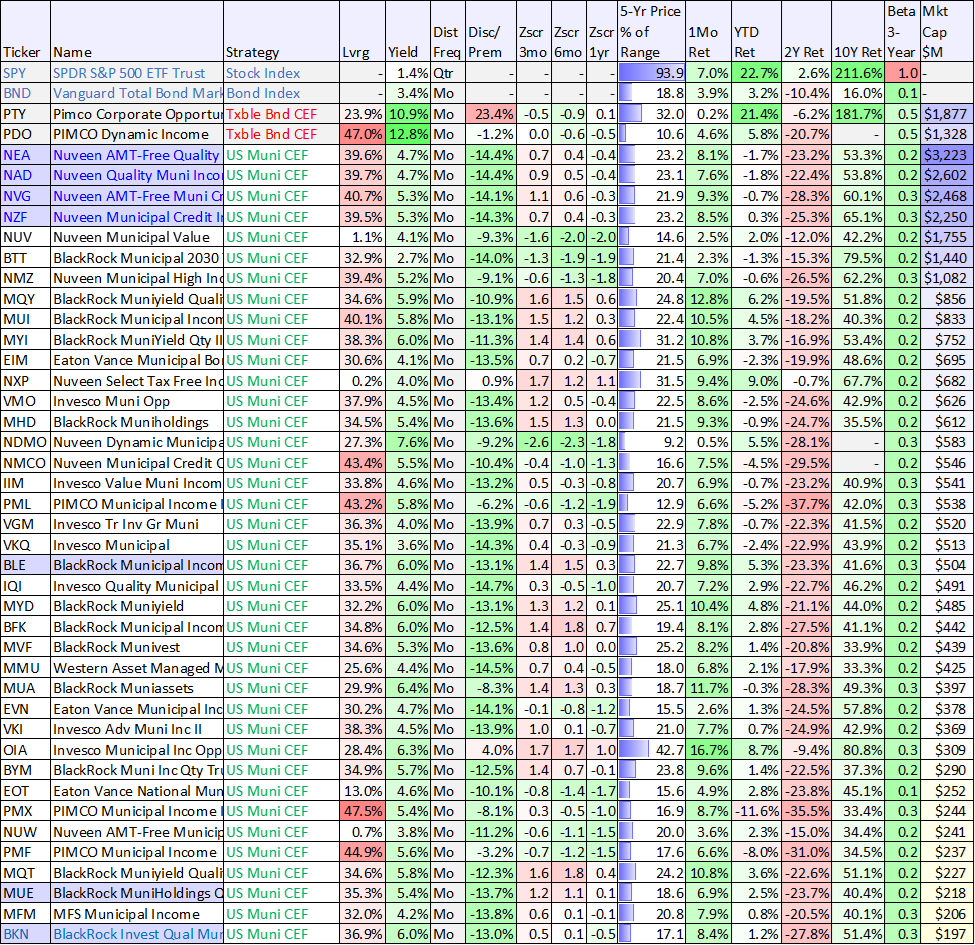

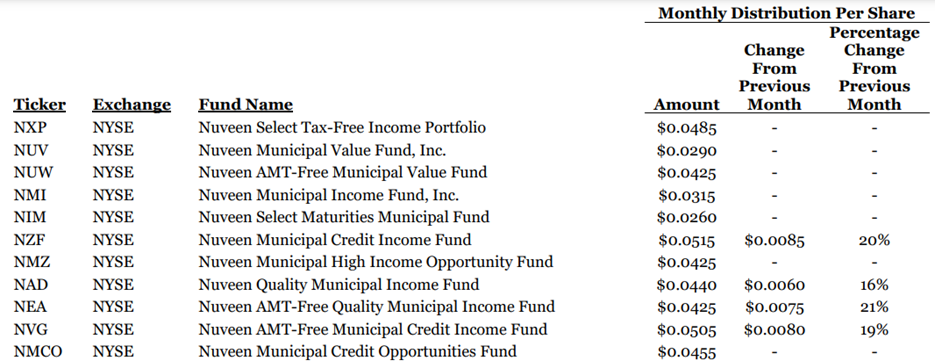

75 Big-Yield Muni-Bond CEFs

For starters, here is a look at recent performance data for 75 big-yield muni-bond CEFs (the data is as of 12-Dec-23). As you can see, the two year returns have been particularly ugly, and the reason is because as interest rates have risen—bond prices have fallen. And municipal bond funds often have more interest rate risk because they hold bonds with longer maturities and higher duration (more on this later).

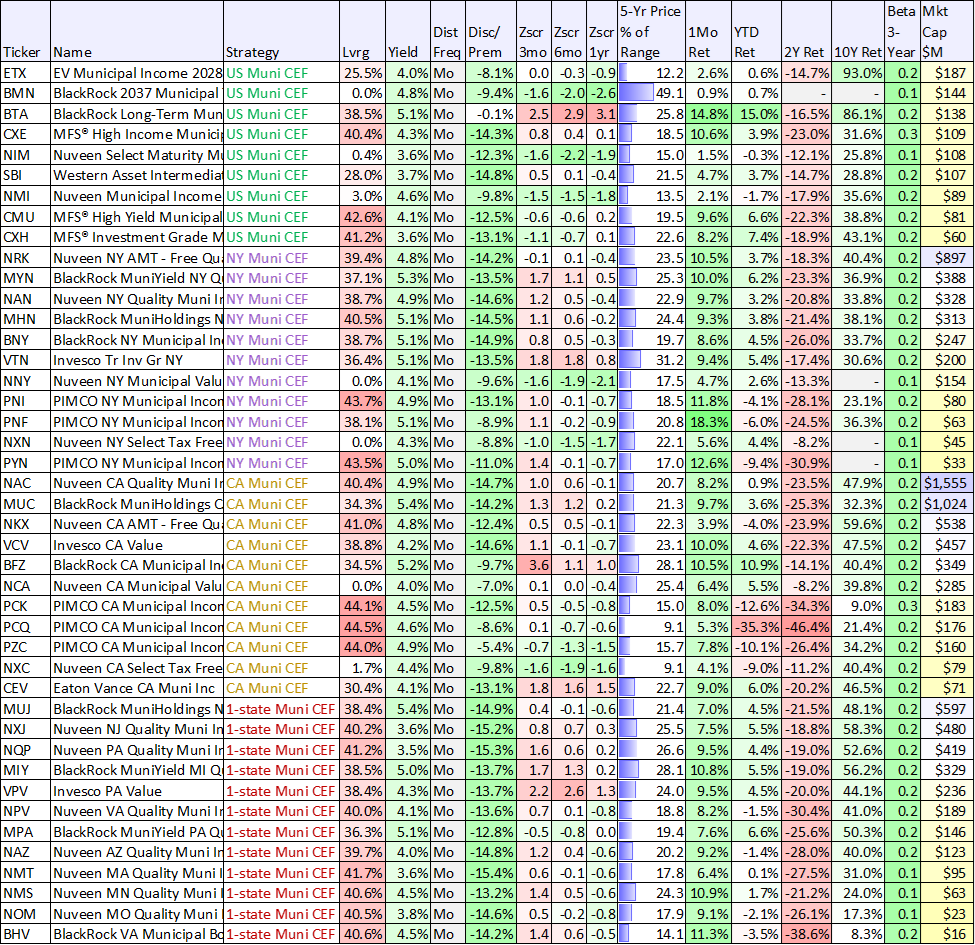

Historically Large Price Discounts:

Also worth noting, muni-bond CEFs curently trade at unusually large discounts versus net asset value (as you can see in the table above), and this may represent a compelling time to “buy low” as interest rate hikes are largely believed to be over and interest rate cuts may be coming in 2024 (as inflation appears increasingly under control). For a little perspective, here is a look at just how large the current muni-bond price discounts are versus the last 20 years.

The data above is from earlier this year, but it’s still relevant, and you can see in our earlier table just how big the discounts still are.

Further still, to hep summarize the situation, muni-bonds have been hit be three big negative forces:

Muni-bond funds tend to have longer duration holds (15-20 year maturities) which means they’ve been hit harder by rising interest rates.

Muni-bond funds tend to have high leverage, or borrowed money (see table above) to magnify interest income, but this has also magnified loses in the recent historically fast interest rate hike cycle.

The yield curve is inverted (short-term rates are higher than long-term rates) and this reduces the spread the funds can earn on their levered assets.

Fund Managers are Actively Trying to Reduce the Price Discounts

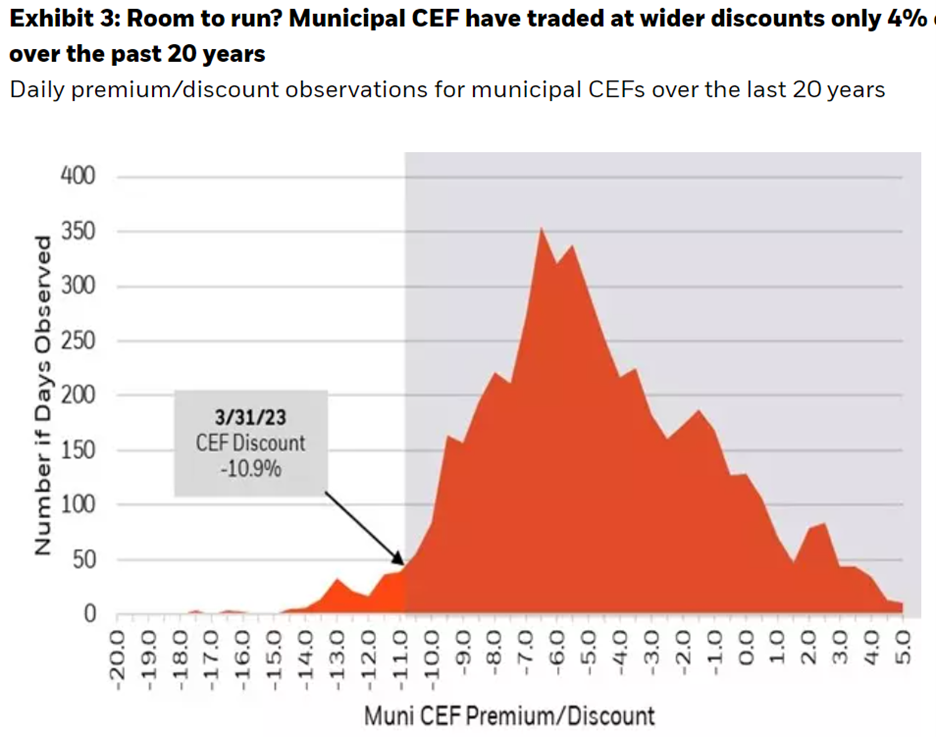

Some muni-bond CEF managers are actively working to reduce these big discounts (and this can be a good thing for investors who buy at a large discount). For example, according to an October 23 press release from Nuveen (a major muni-bond CEF manager), emphasis ours:

NEW YORK, October 23, 2023 –Today, the Board of Trustees of certain Nuveen municipal closed end funds declared regular monthly distribution rates and updated certain distribution policies. Additionally, several leveraged municipal closed-end funds have announced distribution rate increases of between 7% and 24% to deliver higher monthly cash flows to shareholders. These changes are intended to help support secondary market trading in fund shares and improve each fund’s discount to NAV. It is anticipated that to maintain the distribution amounts outlined below, certain funds may ultimately make distributions from sources other than the current net investment income of the funds. In this regard, the source of monthly distributions may include prior accumulated undistributed net investment income and, potentially, a return of capital.

So Nuveen is trying to help out investors by reducing the size of the discounts. Here are the specific Nuveen muni-bond CEFs that hiked their distributions:

Muni-Bond Funds are Poised for Big Gains:

According to a recent Bloomberg article, muni-bond funds are poised for big gains from interest rate stability (possibly even cuts), big discounts shrinking and management activism (as described earlier—Nuveen, for example, is trying to reduce the discounts).

Tax Equivalent Yields

One of the most important factors when considering investing in municipal bond CEFs in the “tax equivalent yield.” In particular, because you don’t pay federal income taxes on the interest payments, you can accept a lower yield (versus other bond categories) and still take home just as much “after tax” income. Tax equivalent yield is calculated as the “Tax Free Municipal Bond Rate” divided by “1 - Tax Rate,” as you can read about in this article. So depending on what federal income tax bracket you are in, all of the yields in our earlier table are actually higher on a “tax equivalent yield” basis.

According to a recent Barron’s article:

A 5% rate on munis is equivalent to a yield of about 7.7% on a taxable bond for an individual in a 35% federal tax bracket—not factoring state taxes, which can lift the taxable-equivalent yield to over 8%. That is close to the average yield on junk bonds.

You’ll also note in our earlier table that some of the muni-bond CEFs are California or New York state specific. This is because those states have particularly high state income tax that you may be able to avoid if you live in one of those states and invest in municipal bonds issued in that state.

Nuveen Muni-Bond Funds (NEA) (NAD) (NVG) (NZF), Yields: 4.7%, 4.7%, 5.3% and 5.3%

Nuveen is well know in the industry for being a leading muni-bond CEF manager, and you can see near the top of our earlier table (highlighted in blue), many Nuveen bond funds currently offer big price discounts to NAV and big yields (and the yields are even bigger on a tax equivalent basis, especially depending on your tax bracket). You can read more on the Nuveen website here.

Also, these are the 4 founds that just had distribution increases to help make the yields more attractive and because the management team is trying to reduce the big discounts (a good thing for current investors).

More Muni Considerations:

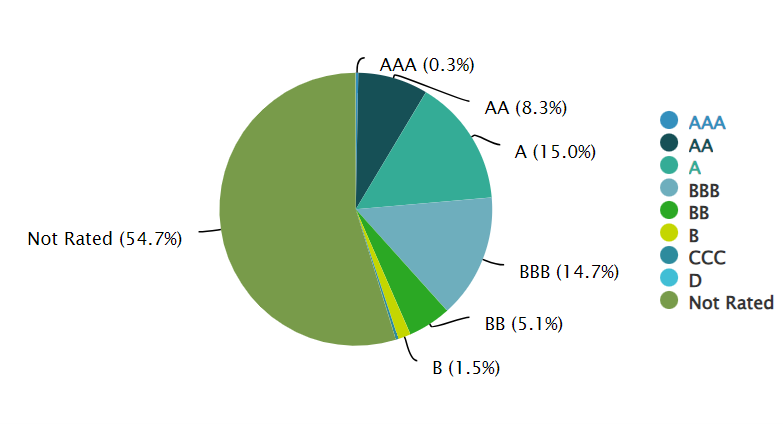

Credit Risk: For starters, municipal bonds are generally fairly safe (i.e. the default risk is fairly low). There are “general obligation” munis (basically backed by the credit of the municipality issue the bond) and revenue bonds (generally backed by the revenue of a municipal project—such as if your state’s baseball team issues a bond to build a new stadium and promises to use revenue from the stadium to pay back the bonds). However, some muni bond CEFs select riskier and safer types of muni bonds and that fact usually bears itself out in the yield (higher yields usually mean more risk, all else equal). For example, NMZ row 11 in our earlier table) is a Nuveen fund that has a slightly higher yield than many (but not the highest) and you can see some information on the credit quality of the bonds NMZ holds below (i.e. there is a significant amount of “investment and non-investment grade” bonds in this fund).

Leverage: Again, municipal bond CEFs also use leverage (or borrowed money), as you can see in our earlier table. This can magnify income and returns in the good times, but it can also magnify risks in the bad times. For example, as you can see in the 2-year return column (when interest rates were rising sharply) returns have been pretty bad over the last two years. Most bond CEFs are generally limited to a maximum of 50% leverage.

Interest Rate Risk: As mentioned, when rates rise, bond prices fall (all else equal), and in the case of municipal bond CEFs in general, interest rate risk is usually higher (because they hold longer maturity bonds). For example, NMZ has an average leverage adjusted effective duration of 18.07 years. This is a really long time for a bond fund, and it exposes NMZ to a lot of interest rate risk. If rates keep rising, this fund will continue to feel pain, but if rates fall then this fund will experience strong gains.

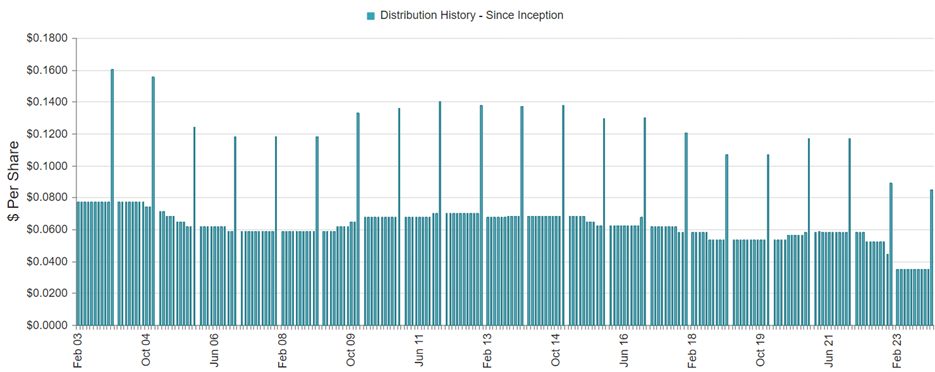

Distribution Consistency: A lot of municipal bond funds have been forced to reduce distributions over the last couple years as interest rates were closer to zero. However, again, a lot of market pundits believe the steep interest rate hikes are finally over (a good thing for bond funds). And some muni-bond CEFs have even started to hike distributions (such as Nuveen, as mentioned earlier). For example, you can view NEA’s distribution history below, which is fairly similar to a lot of other muni bond CEFs in terms of distribution volatility.

Our Bottom Line:

Our bottom line on municipal bond CEFs is that we are increasingly optimistic as the rebound that is just starting (see 1-month return column in our earlier table) will likely continue. The group as a whole has attractive income and price appreciation potential going forward.

In particular, we find the 5 Nuveen funds mentioned (NEA, NFZ, NAD, NVG and NMZ) interesting, and worth considering. We also like muni-bond funds with higher yields (such as those from BlackRock, highlighted in blue in our earlier table), depending on your unique situation.

Price discounts are historically large, and this may bode extremely well for price returns going forward, especially as interest rate hikes appear to be over (and we may even have some interest rate cuts in 2024—a good thing for bonds, including munis).

Even though some munis face default risk, that risk is very low and it is currently at historically low levels as you can read about in this article).

At the end of the day, muni-bond CEFs appear particularly attractive now, especially if you are in a higher tax bracket. However, as always, their attractiveness depends on your own personal situation and needs, and muni-bond CEFs should be considered as one part of a prudently diversified portfolio.