Vertiv Holdings (VRT) makes electrical components for data centers. The company has emerged as a leader in the ongoing (early inning) cloud migration and artificial intelligence (“AI”) megatrend. But the shares have recently pulled back hard (as part of a broader market selloff). This report reviews Vertiv’s business model, growth trajectory, valuation metrics and risks, and then concludes with a strong opinion on who might want to consider investing.

About Vertiv

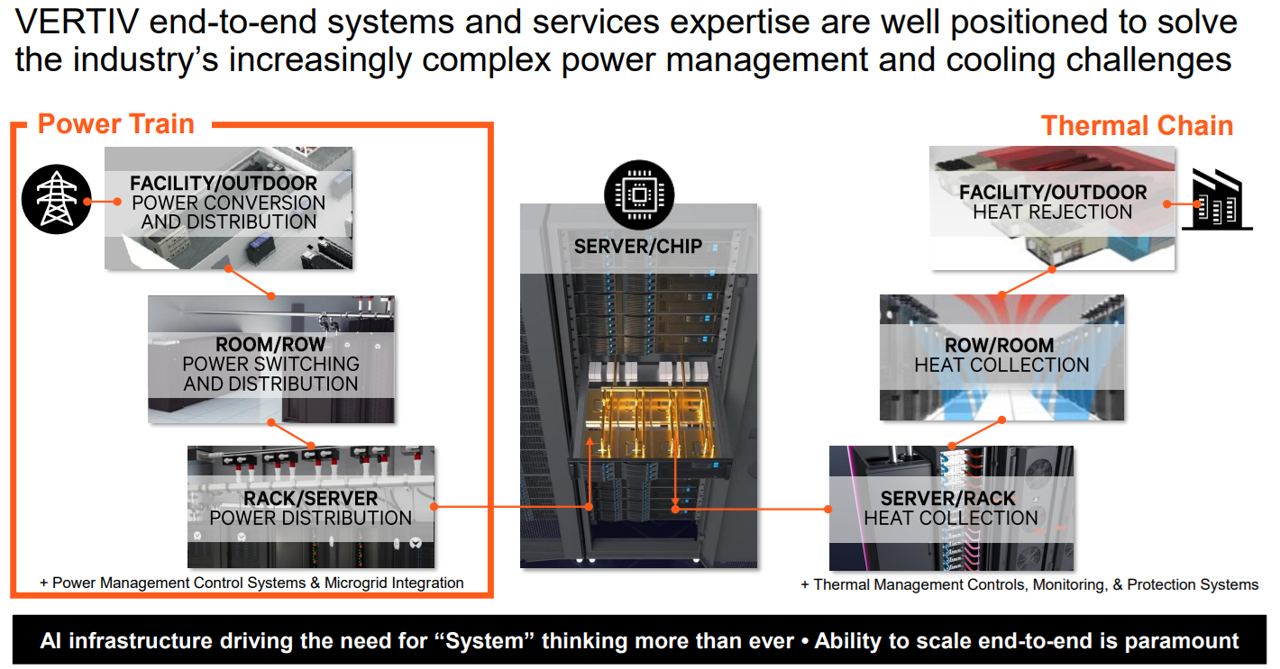

Vertiv designs, manufactures, and services critical digital infrastructure technologies and lifecycle services for data centers, communication networks, and commercial and industrial environments. And as you can see in the image below, the company is well positioned to benefit from the industry’s growing demand and challenges (more on growth later).

Headquartered in Westerville, Ohio, the company operates globally across the Americas, Asia Pacific, Europe, the Middle East, and Africa. Its product portfolio includes AC and DC power management systems, thermal management solutions, integrated rack systems, modular solutions, and management systems for monitoring and controlling digital infrastructure.

Vertiv is basically a big cloud/AI megatrend beneficiary, as its offerings are essential for supporting services such as e-commerce, online banking, video streaming, energy storage, wireless communications, and the Internet of Things (“IoT”), to name a few.

Vertiv’s brands—such as Liebert, NetSure, Geist, Energy Labs, and Avocent—are well-recognized in the industry, underscoring its legacy that dates back to 1946 (when founder Ralph Liebert pioneered air-cooling systems for mainframe data rooms). Today, Vertiv employs approximately 20,000 people and serves a diverse range of industries.

The company delivers its solutions through a robust network of direct sales professionals, independent representatives, channel partners, and original equipment manufacturers (OEMs). Its focus on continuity solutions (i.e. ensuring vital applications run uninterrupted) positions Vertiv as an critical building block in the digital economy.

Growth

For starters, Vertiv is growing significantly thanks to high demand for data center infrastructure fueled by the cloud and AI megatrends (as you can see in the graphic below).

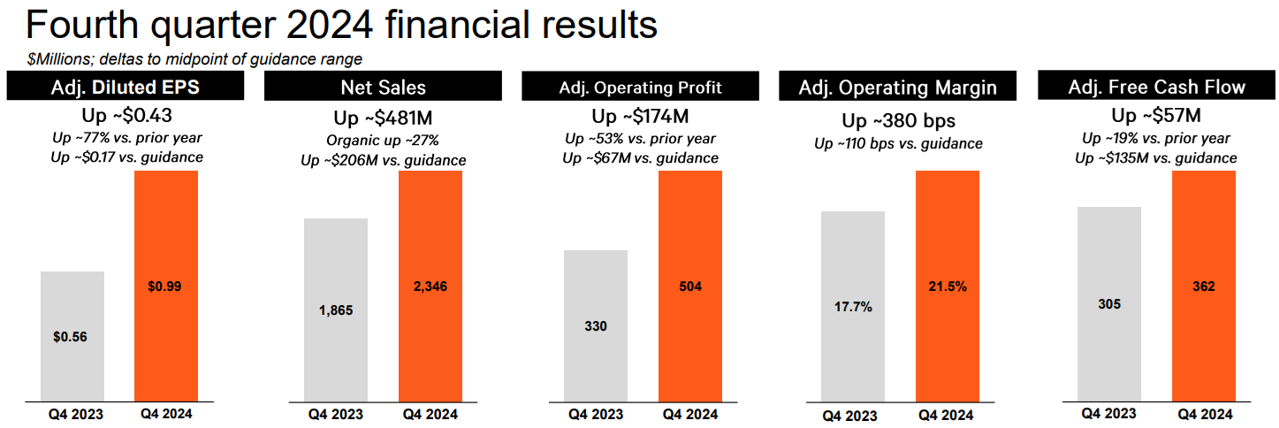

And to be more specific, in the most recent quarter (Q4 2024), Vertiv reported sales of $2.346 billion, a 26% increase from Q4 2023. And for the full year 2024, revenue reached $8.01 billion, up 16.74% from $6.86 billion in 2023.

Net income for 2024 also grew to $495.8 million, a 7.74% increase from the previous year. Importantly, the company’s trailing twelve-month organic orders rose ~30% compared to the prior year, with the Americas region leading the way at over 50% growth.

Looking ahead, Vertiv’s 2025 guidance is equally encouraging. The company projects organic sales growth of 16-18%, translating to revenues of approximately $9.2 billion at the midpoint (and another significant gain versus 2024).

Adjusted earnings per share (“EPS”) is expected to range between $3.55 and $3.60 (and reflecting strong margin expansion). This strong outlook is being driven by a record backlog and increasing demand for AI-driven data center solutions.

Vertiv has also invested $50 million in R&D to maintain its competitive edge, particularly in high-density cooling and power management systems tailored specifically for AI workloads (this is a big deal). Wall Street analysts are forecasting, in aggregate, a 12-month stock price target of $136.86, suggesting potential upside of over 54% (versus early 2025 levels) thereby reinforcing the strong growth trajectory.

Also worth mentioning, Vertiv’s performance is outpacing the broader U.S. electrical industry, and its strategic partnerships (and global footprint) further strengthen its ability to capitalize on secular megatrends in digital infrastructure. It’s a standout growth story in the industry.

Valuation

As you can see in the chart below, Vertiv shares have been strong in recent years (courtesy if the cloud and AI megatrend), but recently pulled back significantly (as broader market concerns have weighed down the entire stock market).

From a specific valuation metrics standpoint, for an electrical components company, Vertiv’s P/E (ttm) is a bit elevated at around 29.4x (as compared to the S&P 500, also arguably elevated, at around 23x). However, Wall Street analyst have an aggregate price target of $143, suggesting over 50% upside for the shares.

Vertiv’s price-to-sales (“P/S”) ratio is around 4.2x (based on 2024 revenues of $8.01 billion and a market cap of $34 billion), which is not too high as compared to other more popular (and well known) growth stocks, but is a bit high for the industry (if you don’t appreciate the high-growth trajectory).

However, the company’s adjusted operating margin improved to 21.5% in Q4 2024 (up 380 basis points from the prior year), and its adjusted free cash flow reached $362 million in the same quarter. These metrics highlight Vertiv’s profitability and cash generation, and support the case for its current valuation as attractive.

Important to note, historical volatility (13% weekly over the past year—higher than 75% of U.S. stocks) suggests Vertiv shares may fluctuate significantly, potentially offering buying opportunities during dips (although its is the long-term potential that remains most attractive). Fifteen out of 22 Wall Street analysts rate the shares a “Strong Buy.”

Risks

Despite strong fundamentals, Vertiv faces noteworthy risks:

Data center reliance: Vertiv’s reliance on the data center demand ties its performance to cyclical demand. Data centers are currently part of a broad megatrend, but a slowdown in AI adoption or cloud spending could reduce order growth and backlog (thereby pressuring revenues).

Macroeconomic factors, such as rising interest rates and inflation, could significantly increase the cost of raw materials and labor, thereby squeezing margins (despite Vertiv’s efforts to improve efficiency).

Competition is another concern. Vertiv operates in a crowded industry with rivals like Schneider Electric, Eaton, and smaller specialized firms competing for market share. Vertiv’s ability to maintain technological leadership and pricing power will be critical. Additionally, geopolitical tensions and supply chain disruptions—particularly in Asia, where Vertiv has a significant presence—could hinder production and delivery timelines.

Volatility: The stock’s volatility also poses a risk for investors. Its 71% price increase over the past year (as of early 2025) has outpaced the S&P 500 by 40%, but recent bearish periods following market shifts highlight its sensitivity to sentiment and pose a risk. Furthermore, its low dividend yield (0.18%) offers little cushion for income-focused investors if growth stalls, thereby amplifying downside risk in a correction.

What Type of Investor Should Consider Owning Vertiv Stock?

Growth investors are the primary candidate for investing, considering the company’s strong revenue and EPS growth, exposure to high-demand sectors like AI and data centers, and analyst-backed upside potential. These investors are typically comfortable with high-volatility in exchange for higher long-term capital appreciation potential.

Megatrend investors may find Vertiv attractive. It’s a critical enabler of cloud computing, edge computing, and AI (which are reshaping the economy). Such investors often prioritize companies with strong competitive moats and innovation pipelines, both of which Vertiv possesses (Vertiv’s competitive moat comes from its specialized expertise in cooling and power management, and its extensive global service network).

Also, while some aggressive retail investors may see Vertiv as a potential “dip-buying” opportunity, it’s mainly suitable as a long-term investment for those with a stomach for high volatility and an appetite for long-term capital appreciation potential.

The Bottom Line

Vertiv’s impressive growth trajectory demonstrates its important role in the ongoing (early inning) AI and data center megatrend. And while some investors are rightly scared off by its higher volatility, those with a long-term horizon (and a strong stomach for price swings) may want to consider the shares.

Wall Street analysts believe Vertiv shares have over 50% upside, but investors should know the potential gains will likely come with volatile price swings. If you are a disciplined, growth-focused, long-term investor, Vertiv is absolutely worth considering for a spot in your portfolio.