If you like to invest in high-growth megatrend companies, then big-data and AI software leader, Palantir, is hard to ignore. And considering the shares are down more than 30% (from fresh all-time highs) in recent weeks (on AI market fears), investing in Palantir just got a lot more tempting (especially considering the AI megatrend is still in its early innings). After reviewing what Palantir does (and why the business is so attractive), this report discusses 3 major risk factors, and then concludes with a strong opinion on investing.

About Palantir

Palantir is a big data analytics company that has been experiencing accelerating growth thanks largely to AI. Its two main software platforms, Gotham and Foundry, help government agencies and non-government enterprises turn massive raw data sets into actionable insights. And the successes are being accelerated by Palantir’s relatively new Artificial Intelligence Platform (“AIP”).

High Revenue Growth

What makes Palantir particularly interesting is its dramatically increasing revenue in recent years (see below).

The revenue growth is driven by existing government business (which is hard to break into, but very sticky and lucrative once you get it) and accelerating commercial revenue growth (which continues to thrive in the face of naysayers). And of course the growth is also driven by the ongoing (early inning) AI megatrend. Specifically, Palantir is successfully integrating advanced AI capabilities into its platforms, thereby allowing clients to automate and improve decision-making quickly.

And here is what CEO Alex Karp had to say about it in the first sentence of his latest shareholder letter:

“We are still in the earliest stages, the beginning of the first act, of a revolution that will play out over years and decades.”

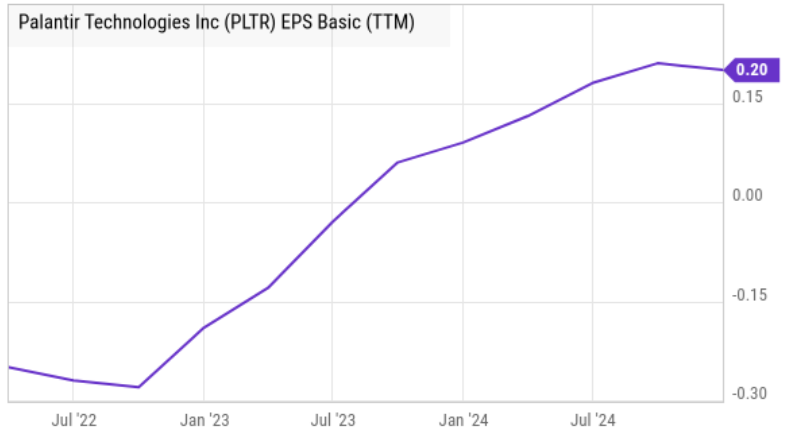

Palantir Earnings Growth:

And importantly, all this rapid revenue growth is helping the company turn the corner from negative earnings per share (“EPS”) to positive EPS, as you can see in the chart below (this is a good thing).

Palantir now has impressive operating leverage to continue growing earnings, considering it is starting off a low EPS basis. Specifically, earnings was 20 cents per share over the last 12 months, versus a recent share price of $84 (especially considering revenue per share over the last twelve months was $1.17, and it’s accelerating).

Risk 1: Palantir’s Valuation

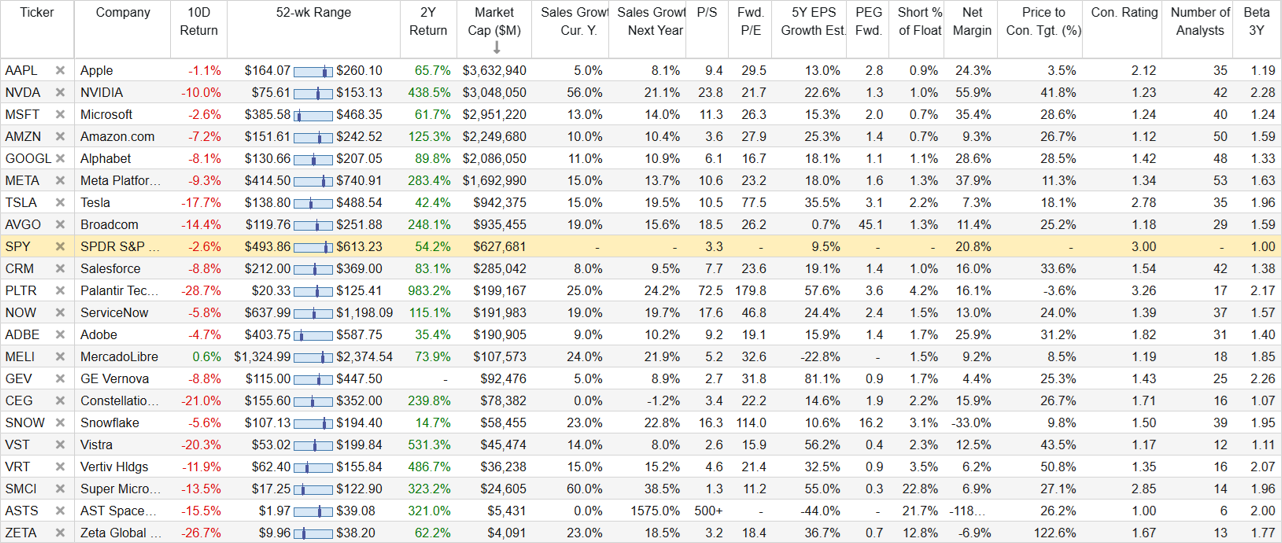

Here is a look at Palantir’s current valuation, in terms of price-to-sales, forward price-to-earnings and PEG ratio (plus a variety of additional metrics) versus other top AI stocks. As you can see, Palantir is NOT cheap.

For example, at 72.5x sales, 179.8x forward earnings and with a forward PEG ratio of 3.6x, Palantir is one of the most expensive AI stocks in the table.

Business Fundamentals versus Valuation

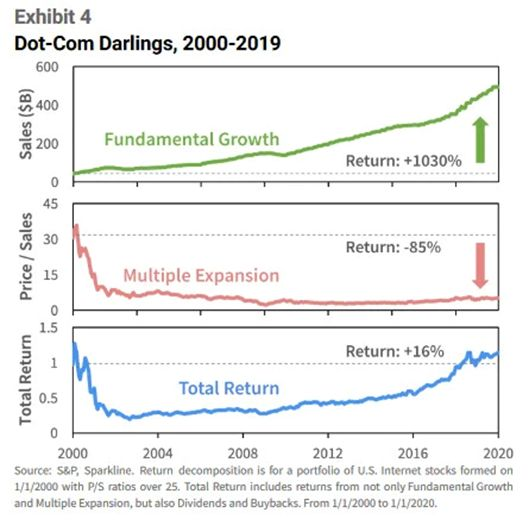

Clearly, Palantir’s business has been strong and it continues to be on a strong growth trajectory. However, there is a big difference between fundamental growth and valuation multiples, as many people learned during the dot com bubble (when many “dot-come darlings” had dramatically overstretched valuations) as you can see in the chart below:

The point is that even if Palantir’s business remains fundamentally strong (which it likely will) the valuation is already stretched (its already pricing in many years of growth as if it already happened) and the for returns to Palantir shareholders may lag the business ongoing fundamental growth.

Just as dividend investors often make the the mistake of investing based only on a stock’s current dividend yield (instead of also considering the total return potential, i.e. dividend income plus price appreciation potential), growth investors often make the mistake of investing based only on fundamental business growth (nistead of also considering the current valuation—and Palantir’s is still relatively high).

However, in Palantir’s defense, the company’s earnings just recently turned GAAP positive, and it is working off a very small EPS base and thereby leaving lots of room for earnings growth (for example, you can see in the earlier table that Palantir has a much higher 5-year EPS growth estimate than most of the other companies—a good thing!).

Risk 2: Stock-Based Compensation

Also worth considering, Palantir’s earnings have been hamstrung by very high stock-based compensation (see chart below).

However, stock-based compensation has been slowing (as a percent of revenues) and this is a good thing going forward (relative to Palantir’s history).

Risk 3: Government Spending Cuts

Another big risk factor for Palantir is recent news of government spending cuts, particularly related to defense. According to NPR:

“The Pentagon has proposed cutting 8% of its budget in each of the next five years — amounting to some $50 billion each year — but prioritized 17 areas from drones and submarines to military assistance for the southern border as well as increased funding for the U.S. command that focuses on China.”

On the surface, this appears to be very bad news for Palantir, considering its significant reliance on government contracts. However, it may also be a boon as expensive government consultants may be cut and replaced by AI software, such as Palantir.

Remember, Palantir’s AI Platform (“AIP”) integrates AI with big data analytics, thereby allowing organizations to build and deploy custom AI models for decision-making and operational efficiency. Nonetheless, government spending cuts are a risk factor that investors need to consider.

The Bottom Line

Palantir remains one of the most fundamentally-attractive, high-growth, disruptive business models in a while—thanks in large part to high revenue growth being accelerated by the AI megatrend. However, it also faces significant risk factors (including a high valuation, stock-based compensation and government spending cuts).

I recently sold 100% of my Palantir shares (at $101) after owning them for some time (cost basis was in the $20’s). But given the recent steep price decline, I am increasingly tempted to buy them back.

A decade from now, Palantir will likely be a dramatically larger business, and the shares will likely be trading at a much higher price. And given the recent volatility and steep share price decline, I am increasingly tempted to buy.