We continue to own shares of this disruptive specialty chemicals company (thermal barrier materials) as growth continues to accelerate courtesy of government regulations forcing electric vehicle growth.

Aspen Aerogels (ASPN):

Aspen Aerogels designs, develops, manufactures, and sells aerogel insulation products. Specifically, the company offers PyroThin thermal barriers for use in lithium-ion batteries in electric vehicles and energy storage industries. The company operates in two segments, Energy Industrial and Thermal Barrier.

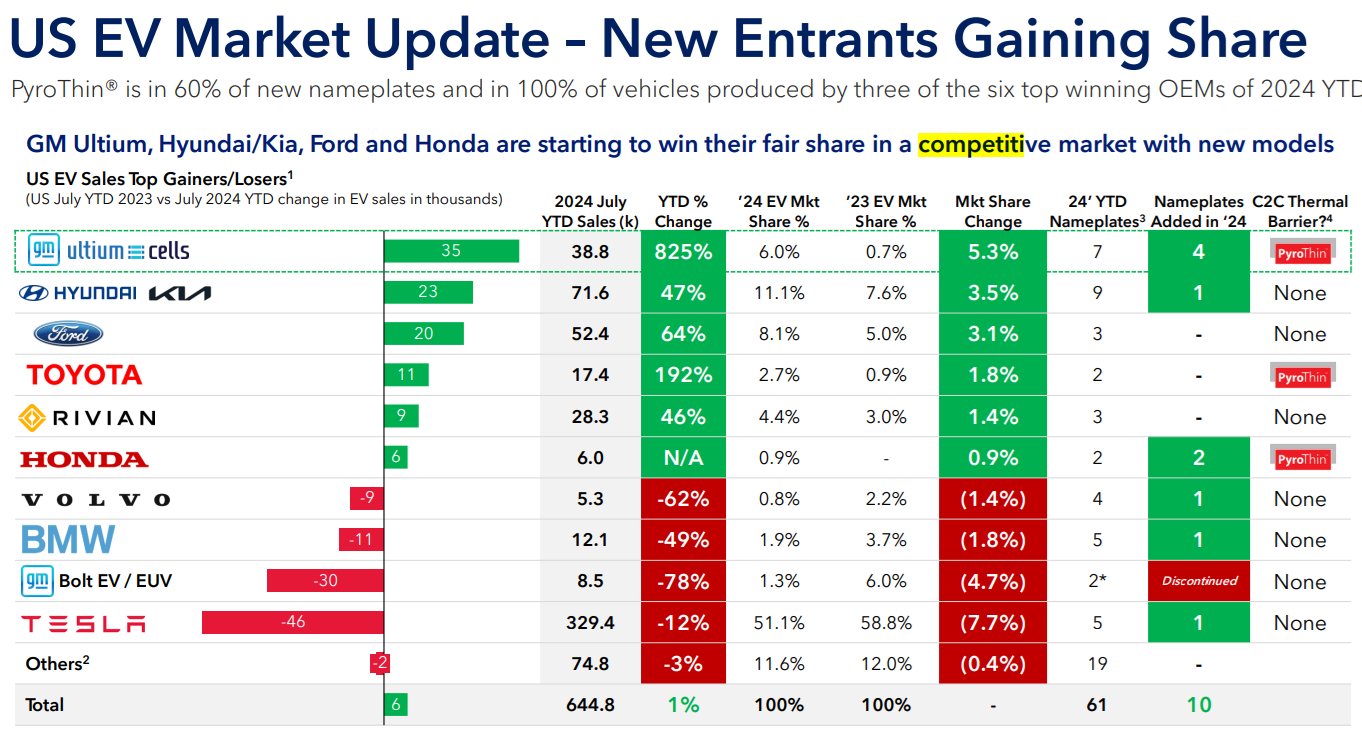

And it it the Thermal Barriers (electric vehicles) segment that is growing rapidly, now having captured six of the 10 major US Original Equipiment Manufacturers (“OEMs”):

And the company believes it should/would be in more OEMs if Aspen’s business wasn’t so new:

When we look at the U.S. market and we see that we're on six of the 10 new nameplates that have been introduced, we can't help but wonder why are we not on the other four? And the reason is because we were nowhere when those four vehicles were being developed.

Accelerating Growth:

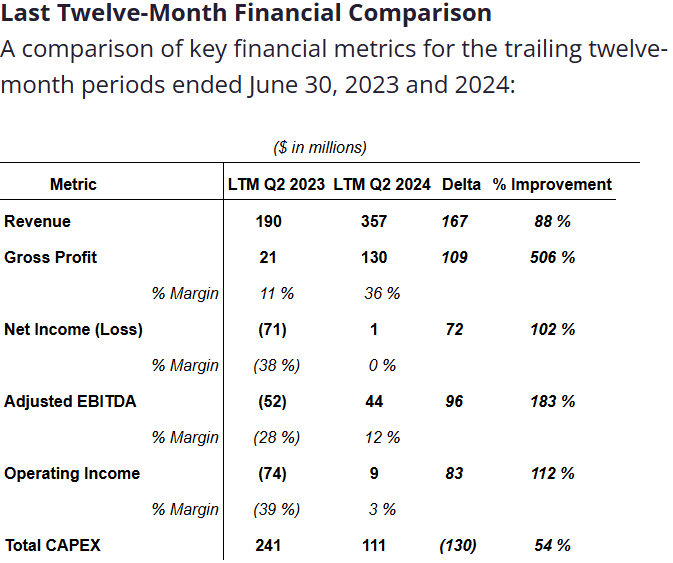

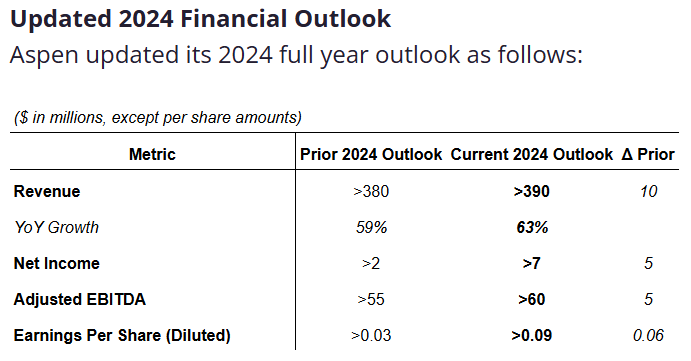

As you can see in the graphics below, revenue growth is high and accelerating, plus the company recently increased guidance.

Beneficial Regulatory Environment:

Furthermore, the company argues that regulatory demand for a higher percentage of new cars to be EVs dictates more business ahead for Aspen:

Focusing on the EPA, when looking at 2026 to be minimum compliant with these regulations, the industry would need to reach roughly 15% EV sales mix, up about 7 percentage points from the current penetration or more than doubling. This includes the exhaustion and rollover of emissions credits purchased or generated from the sale of EVs in prior years.

General Motors, for example, would need to quadruple the CV penetration from 4% in July of 2024 to around 16% by 2026 to be barely compliant. It is estimated that Ford would need to triple its CD mix from its current levels also barely comply with the EPA submissions regulations.

If we go to what will be our next most important market after the US, Europe, the CO2 emissions there get even more stringent for OEMs, and that is why we see a lot of new programs from those OEMs in our core pipeline.

Futhermore, the fines for non-compliance can be expensive.

These agencies [such as the EPA] can enforce fines, sue or enforce penalties on OEMs who do not comply with their standards, and, therefore, impact the profit potential of currently lucrative sales.

No Competition:

As per the company:

But as we look ahead, it's not that competitive. I mean there isn't another material that we know of that can deliver the three requirements that OEMs keep asking us to deliver, right? So, the fireproofing within the thinnest profile possible, the thermal isolation within the thinnest profile possible and then the mechanical properties, which are everybody else is a [indiscernible], including the thickness, right?

Profitability and Operating Leverage:

As as you can see in our earlier table, Aspen just turned net income positive, which gives the company increasing operating leverage (a good thing) as it continues to grow.

Valuation:

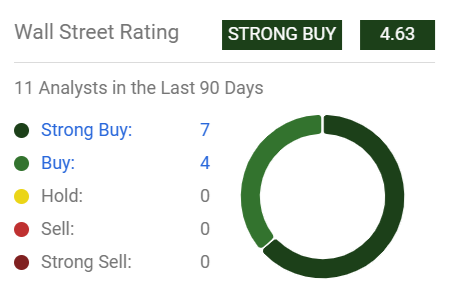

From a valuation standpoint, Aspen trades at 5.5x forward sales, which may seem low as compared to tech company valuation, but as a materials company that is higher than most, but still very reasonable considering the high growth. Of the 11 Wall Street analysts covering the shares, most of them rate it a “Strong Buy.”

Risks:

As a disruptive high-growth business, shares of Aspen can be volatile. We believe the shares will continue to be volatile with an upward trajectory, but recognize that if/when growth starts to decelerate, the shares can fall quickly. Specifically, even though the business would likely still be growing rapidly and with a significant degree of stability (because automanufacturers keep making new cars/EVs and competition is basically non-existent), the market can be very unkind when growth rates begin to slow.

Bottom Line

We continue to own shares of Aspen, and expect the business and the share price to continue with an upward trajectory. We are long Aspen in our Blue Harbinger Disciplined Growth Portfoliio.