If you have been invested heavily in the stock market for the last few years, congrats—you’ve made a lot of money. But if your stage in life suggests now is the time to “de-risk,” your options might seem limited. In particular, bonds (the traditonal de-risking methodology) currently offer low yields (for example Vanguard’s popular bond ETF (BND) only yields 3.4%) and rates may be about to go even lower (i.e. the fed seems ready to cut). One bond alternative that offers several unique advantages is PIMCO’s 13.9% yield Dynamic Income Fund (PDI). In this report, we review the advantages of bond closed-end funds with a detailed focus on PDI. We conclude with our strong opinion on current bond CEF opportunities and PDI in particular.

Interest Rates

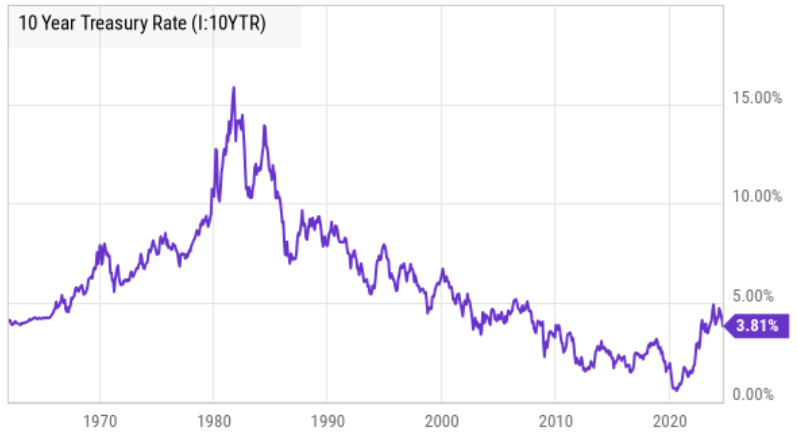

For starters (and to give you some high-level perspective on the bond market), here is a look at historical interest rates on a 10-year US treasury.

As you can see, there were times in history when you could buy a US treasury and get paid a 15%+ yield, every year until it matured (at which time you’d get 100% of your principal returned to you—guaranteed by the US government). Unfortunately, now is NOT one of those times. The current yield on a 10-year US treasury has falled further, now at 3.8% (particulary un-attractive by many investors’ standards).

Rather than buying individual bonds (such as the US treasury example above), some investors choose to buy bond funds, such as the popular Vanguard Total Market Bond ETF (BND). The advantage of BND is you immediately get a diversified portfolio of many bonds (it invests in investment-grade debt securities including government, corporate, international, mortgage and asset-backed securities with maturities of more than 1 year) and you don’t have to manually buy a new bond every time your existing bond matures (such as our US treasury example, above) because Vanguard does it for you.

However, one advantage of buying individual bonds (instead of an open-end bond fund like BND) is you can hold individual bonds until they mature and thereby reduce interest rate risks. For example, because BND is open-end, it has to deal with fund flows (i.e. creating and eliminating shares to deal with investors moving into and out of the fund—often at exactly the wrong times). For instance, when there is dislocation in the bond market (e.g. the bond market froze up right before covid and bond fund managers where sometimes forced to sell bonds at unattractive, firesale, prices just to meet fund flow liquidity needs); this is a bad thing for bond fund investors that invidual bond investors don’t have to deal with (because individual bond investors only buy and sell based on their own liquidity needs—not eveyone else’s).

And as a reminder, here is a look at the recent 3-year historical performance of BND (“ugly”), which also happens to be a very popular holding in Vanguard “Target Date Funds” (even after factoring in the interest income, the total return is still negative and only slightly better than the price return).

So even though Vanguard is famous for having really low expense ratios (such as only 0.03% on BND) there is more to investing than simply buying whatever has the lowest expense ratio (i.e. everyone’s individual situation and goals are different).

Bond CEFs

A third category of bond investing (besides individual bonds and open-end bond funds) is bond closed-end funds (“CEFs”). Bond CEFs come with a variety of distinct advantages versus the other categories.

For starters, because they are closed-end, bond CEFs don’t have to deal with the unique liquidity risks that open-end funds (like BND) have to deal with as a result of investor fund flows (i.e. buying and selling, often at the exact wrong time). Specifically, because they are “closed-end,” Bond CEFs have a set number of shares that trade in the market based on supply and demand. And for the bond CEFs that do have the ability to create and reduce the number of shares, it’s at their discretion (instead of being at the mercy of investor fund flows) which gives the bond CEF a distinct advantage in avoiding some of the liquidity and interest rate risks that open-end funds deal with.

Additionally, because bond CEF trade in the market based on supply and demand, they often trade at significant premiums or discounts versus the net asset value (“NAV”) of their underlying holdings (this doesn’t happen for bond ETFs, like BND, because there are mechanisms in place to prevent it). Premiums and discounts present unique risks and opportunities for bond CEF investors. For example, we greatly prefer to buy attractive bond CEFs when they trade at a discount to NAV (or at least a smaller premium than normal).

In addition to avoiding uncontrollable fund flows, and considering premiums versus discounts, here are 7 things to look for before you buy any closed-end fund.

As you can surmize (from the list above), bond CEFs (such as those offered by PIMCO) have unique advantages and opportunities versus open-end funds (which we will discuss in more detail throughout the remainder of this report).

PIMCO Dyamic Income Fund (PDI), Yield: 13.9%

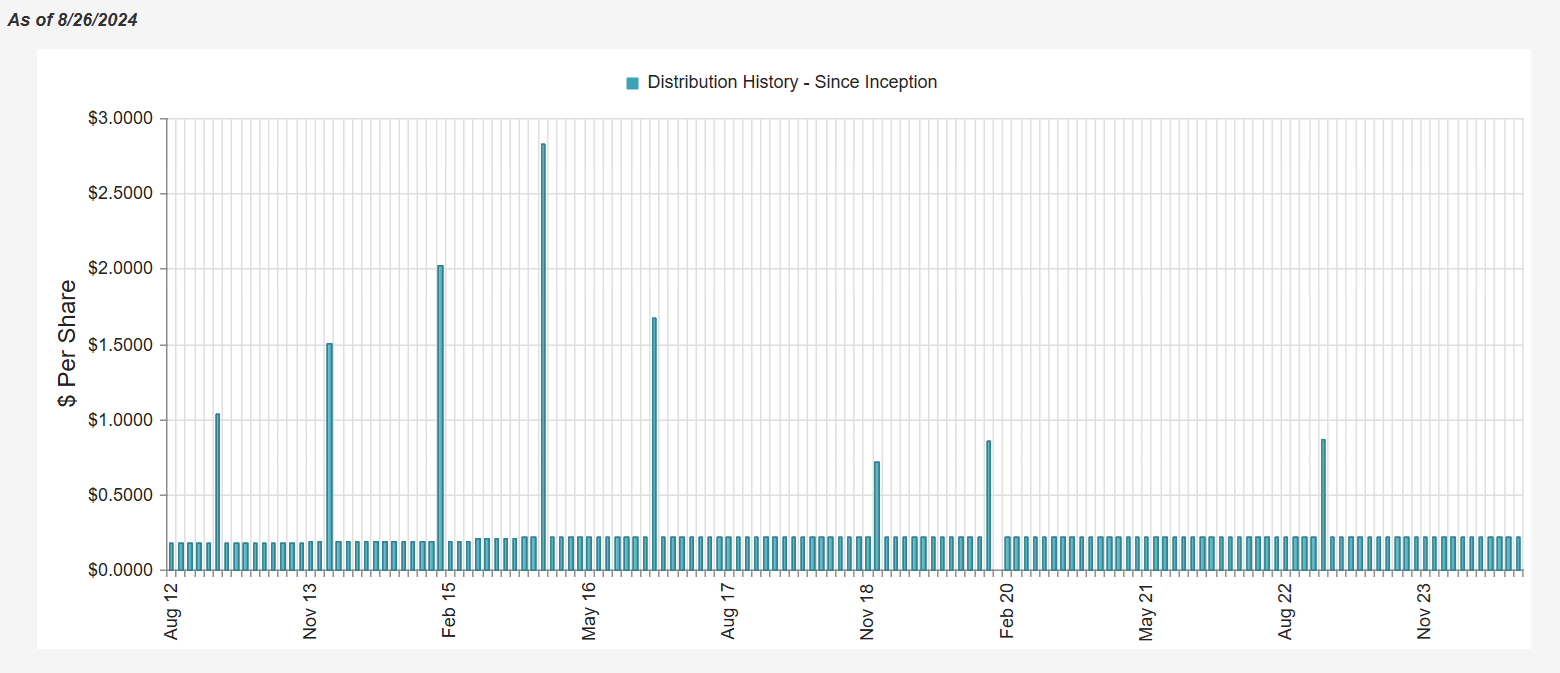

One of the most popular CEFs (and largest, with ~$5.5 billion in assets) is the PIMCO Dynamic Income Fund, currently offering a very large distribution yield (paid monthly). The fund has successfully navigated a variety of historical challenges (such as volatile interest rates and consolidations with other PIMCO funds), but it has managed to pay big-steady distributions to investors, throughout, as you can see below (the spikes are additional “special dividends” paid).

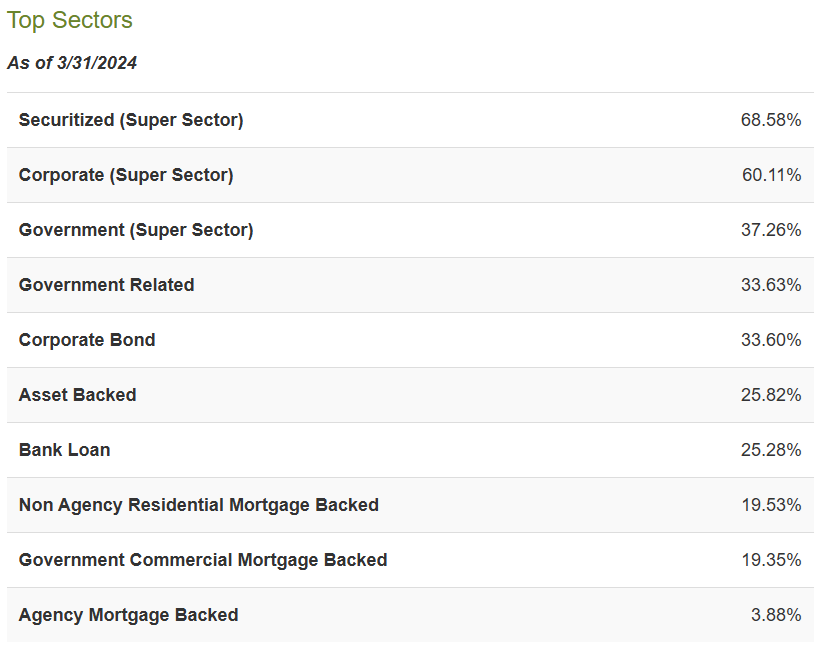

And for reference, this fund recently had 1,485 individual holdings (that’s a lot of individual bonds), diversified across multiple bond sectors (see table below).

PDI Advantages:

We already mentioned PDI’s CEF advantages versus open-end bond funds and buying individual bonds, such as control over liquidity (avoiding forced sales at inopportune times) and constant reinvestment (as an investor, you don’t have to buy more bonds when something matures, PIMCO does it for you). Not to mention PDI gives you instant diversification (i.e. the fund owns many bonds diversified across many bond sectors).

Management is another big advantage. Specifically, PIMCO is considered the premier bond fund manager, and for good reason. Not only does PIMCO have a long history of success, but the company also has access to resources, skill sets and bond asset classes that individual investors simply do not.

And of course that big monthly distribution payment to investors in another big advantage versus just about every other investment available in the public market today.

Risks:

However, PDI also faces a variety of risks that should be considered, such as the following.

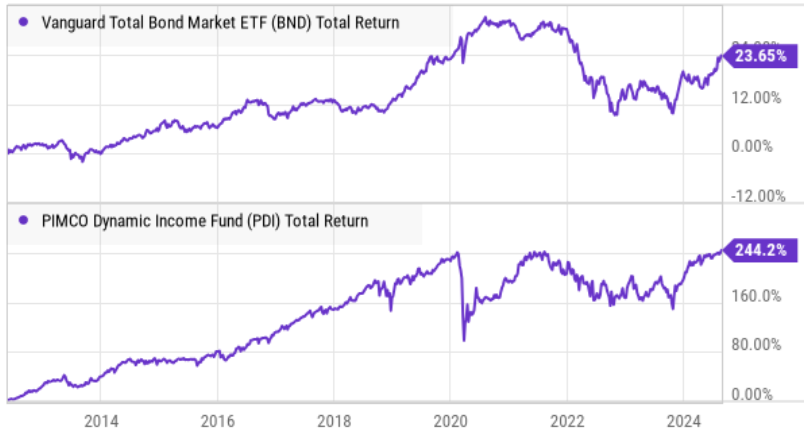

Interst Rate Risk: If you don’t know, when interest rates rise, bond prices fall, all esle equal. So when the fed hiked rates (after the covid pandemic) at a historically rapid pace (from near 0% to the ~5% fed funds rate today), bond prices (inlcuding PDI) fell shaply, as you can see in the chart below.

Some investors claim not to worry about the price, as long as the big monthly distribution income payments keep rolling in (which makes some sense). However, worth mentioning, if rates are about to fall then the price of PDI shares could be about to rise (and those price gains would be in addition to the big monthly distributions the fund pays).

High Yield Bonds: PDI invests in a wide variety of individual bods, and some of them are considered below investment grade or “high yield.” High yield bonds typically come with more risk than investment-grade bonds, but considering the fund is so well diversified (across so many bonds) and the default rate on high yield bonds (even during periods of market stress) is quite managable (especially considering the closed-end nature of PDI—i.e. no forece sales when credit spreads widen—PIMCO is positioned to hold until the elevated stress passes—i.e. a good thing).

Leverage: PDI uses signifcant leverage (borrowed money) recently ~37%. This helps to magnify (increase) the income payments to investors, but it can also magnify price volatility during periods of market stress. Additionally, the interest expense of borrowing can significantly increase the fund’s total expense ratio (especially as rates have risen in recent years). However, we view the leverage as prudent. Also, PDI can better manage the leverage simply because it is closed-end, and it won’t get hit with uncontrollable investor redemptions that would otherwise create problems (such as for open-end funds). Said differently, it’s much easier to manage leverage in a closed-end fund than in an open-end fund.

Return of Capital (ROC): There is much debate among some investors about the dreaded “ROC” which can act to reduce the fund’s NAV. In some scenearios, where the fund doesn’t have enough interest income and/or price gains to cover the large distribution, it can revert to returning a little bit if your own capital simply to maintain the large monthly distributions. We’ve written about ROC many times in the past, but a little ROC isn’t the end of the world, and if anyone can manage it—it’s PIMCO

Derivatives: You don’t want to see how the sausage is made. That saying makes sense here because on one hand many investors simply look to PDI for big steady monthly income, but on the other hand if you look under the hood to see how that monthly distribution is “made,” it can be a little much for some investors, especially considering the fund’s use of derivative instruments, such as interest rate swaps. In a nutshell, PIMCO has the advantage and skill to use interest rate swaps (one type of derivative) to support the distribution, delay (and potentially avoid) ROC, and maintain prudent bond market exposures given PDI’s objectives (primarily high income, seondarily price appreciation). We view derivatives as a risk, but also have confidence in PIMCO’s abilities, especially versus other bond fund managers.

Price Premium: PDI currently trades at an 11.5% premium price in the market versus the NAV of its underlying holdings. Premiums are normal for PIMCO bonds funds, but 11.5% is beginning to get a bit on the high side versus this fund’s history. The premium presents a risk simply because if it reverts lower then you could end up with negative price returns (although, many investors don’t mind as long as the big monthly distribution payments keep rolling in).

Conclusion:

Bond CEF are attractive because of their higher yields, but also because their unique structure allows them to better manage the risks. Furthermore, if rate cuts come—the prices could rise (this is the opposite of what happened a few years ago when rates were hiked rapidly), and any price gains would be an additonal source of return (i.e. in addition to distibution income).

PIMCO is the industry leader in bond CEFs, with deep resources and expertise that individual investors simply do not have. And even though PDI is not our single favorite bond CEF at the moment (i.e. growing premium, significant derivative usage), we do own some shares within our prudently-diversifed “High-Income NOW” portfolio.

At the end of the day, you need to do what is right for you, based on your own personal situation and goals. Disciplined goal-focused investing continues to be a winning strategy.