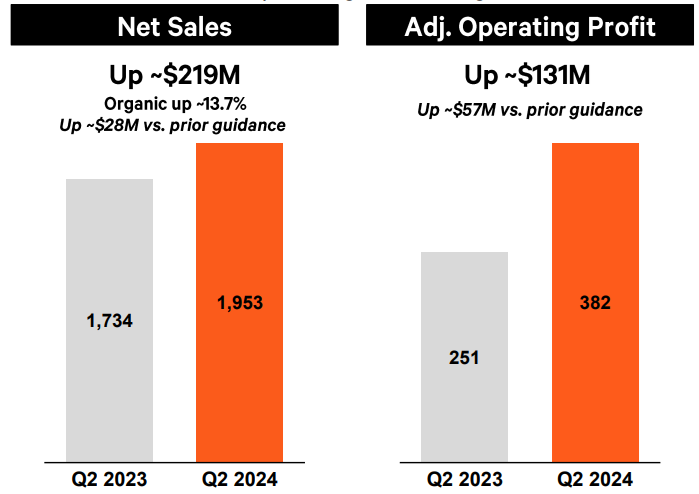

Quick Note: Datacenter components company Vertiv (VRT) has experienced incredible growth over the past year, but the shares are down 11% on earnings. The company beat expectations on sales and earnings, and it raised guidance as operating margins and organice growth momentum continues.

We have no position in these shares, but we are watching closely as the comany continues to benefit from the Ai data megatrend.

The shares are selling off hard as part of this current marketwide selloff episode (particularly for high growth and technology stocks).

There could be significantly more downside ahead for this highly-rated (by Wall Street) company. We’re not buying yet, but we continue to watch for an entry point (perhaps even significantly lower than today’s sharp selloff price).