Nvidia is the dominant seminconductor leader powering explosive megatrend growth in the great cloud migration and now artificial intelligence. And these truly massive megatrends are not coming to an end anytime soon. However, there are multiple glaring “red flags” for Nvidia. In this report, we review the business, growth, market size, current valuation, moat and then four massive red flags investors need to consider. We conclude with our strong opinion on investing.

Nvidia Overview: The Leader in GPUs

Nvidia is the industry leader in graphics processing units (GPUs), a type of computer chip (semiconductor) that enables parallel processing. GPUs were orginally used for video gaming (because of their superiority versus traditional non-parallel processing computer processing units (CPUs)), but have proven invaluable in data centers now processing massive amounts of data from the cloud and recently accelerated dramatically by the compute demands of Artificial Intelligence (i.e. technological breakthroughs in large language models). When it comes to data centers and AI, Nvidia is the clear and dominant leader.

Business Segments and Growth

For perspective on Nvidia’s massive recent growth, here is a look at its revenue growth between fiscal year 2023 and 2024. And then compared to the continuing high growh so far in fiscal year 2025.

Nvidia’s high growth has been so impressive that the company’s valuation (market cap) has exploded to over $3 trillion dollars, ranking it among the top 3 US companies (Apple (AAPL) and Microsoft (MSFT) are the other two), and making Nvidia the single largest US company (depending on the day and stock price movements). Incredible, especially for a company that a lot of people on Main Steet that have just recently learned about the company for the first time.

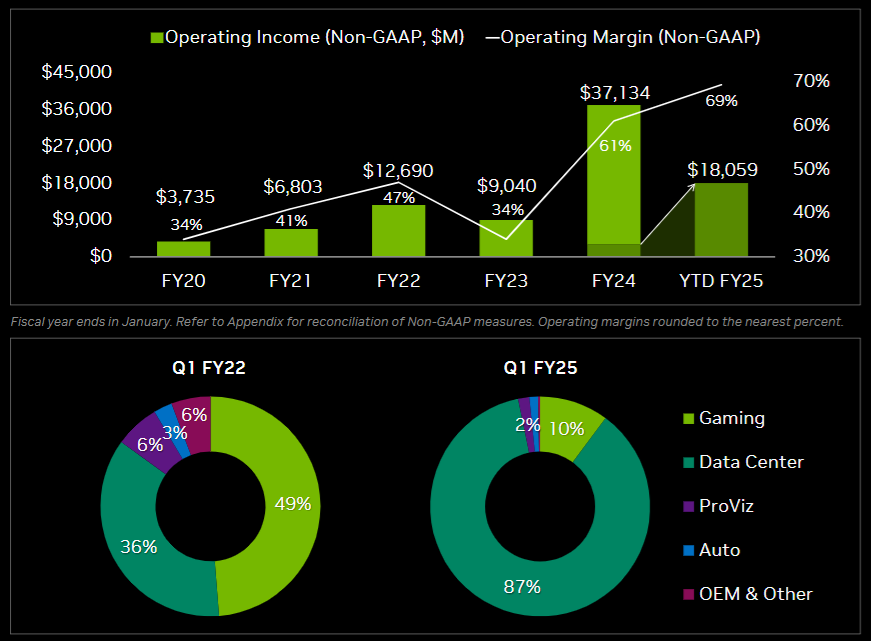

And to add a little more perspective to Nvidia’s growth, you can see operating income per its main business segments, below.

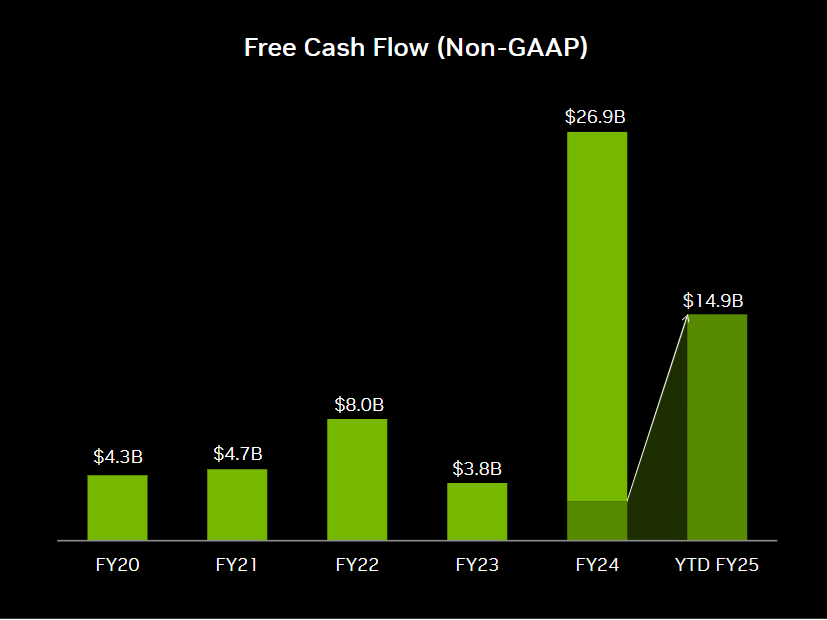

As you can see above, it is Nvidia’s Data Center segment (i.e. “the cloud”) that is the largest and that has grown the most rapidly since the first quarter of fiscal year 2022. And perhaps most jaw-dropping is Nvidia’s insane growth in free cash flow in the last two years (impressive).

Total Addressable Market (TAM):

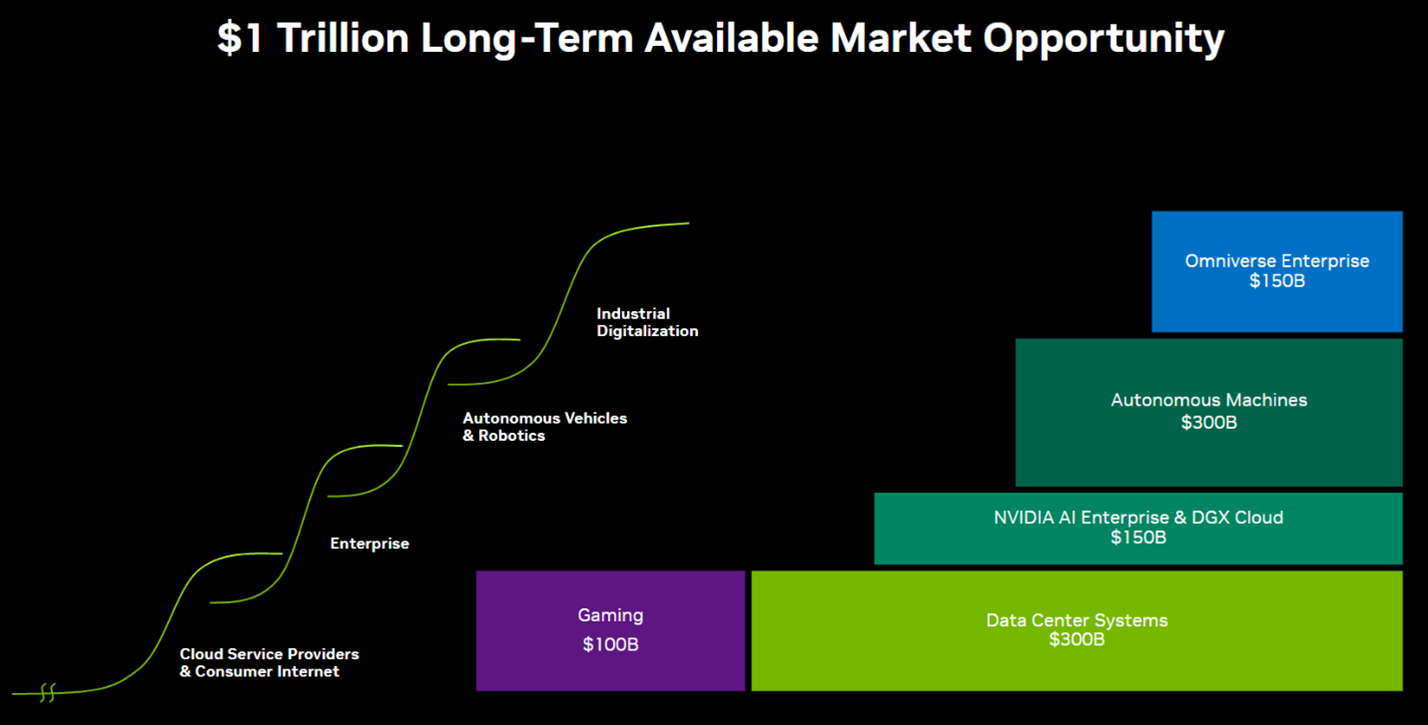

And if you are wondering whether or not Nvidia can keep growing (after its recent historic climb), the answer is a resounding long-term yes—as evidenced by the massive $1 trillion TAM oppotunity (see table below).

Nvidia’s total revenue for fiscal year 2024 was a whopping $60.9 billion (see earlier chart), but that amount is exceeded by the opportunity that exists in gaming alone (see chart above), as well as Data Center Systems, Enterprise Cloud, Autonomous Machines and more (all separately, and collectively the potential is even more). Nvidia has the potential to keep growing rapidly for many years into the future.

And as a side note worth mentioning, Nvidia’s parallel processing has also expanded into crypto mining (an industry that could have continued high growth), not to mention the potential for yet-to-be discovered future initiatives and use cases for Nvidia’s chips. The market opportunity is massive, growing and not going away.

Valuation

Just because Nvidia’s stock price is up so much, that doesn’t mean the growth is over. To the contrary, Nvidia still trades at a very low valuation, depending on what multiples you look at and who you talk to. For example, as you can see in the table below, Nvidia’s forward PEG ratio (price/earnings to growth) is even lower (more attractive) than other top companies, like Apple, Amazon (AMZN) Google (GOOGL) and Microsoft.

Some investors will argue Nvidia is simply too expensive on a traditonal price-to-earnings multiple (72.1x P/E, 45.6x Fwd P/E), but Nvidia isn’t exactly your grand dad’s blue-chip slow-growth dividend stock (we’re not talking about some boring utility stock here).

Nonetheless, Nvidia does have extraordinary financial health. For example, we saw the powerful free cash flow generation earlier, and the company held $31.4 billion in cash and investments as of last quarter (with only $9.7 billion in total debt (short and long term, combined). And its margins (see earlier chart) are astounding (i.e. a 43% net marging is extremely impressive).

Nvidia’s financial strength will allow it to fund growth, potential aquisitions and continuing shareholder cash returns (mainly through share repurchases, but the company does also maintain a very minimal dividend too).

Nvidia’s Competitive Advanges (Moat):

Superior GPUs: For starters, Nvidia’s competitive advantage stems from its superior GPUs. Others have attempted to compete on the GPU front (mainly AMD (AMD) as well as Intel (INTC)), but they have fallen short so far. Big Tech companies have also attempted to create in-house chips, but have not yet had much success as compared to Nvidia GPUs.

First-Mover Advantage: Nvidia also has a first mover advantage as developers are familiar with Nvidia making it harder for new entrants to compete. There are also switching costs associated with alternative chips. Nvidia chips are the gold standard (and bascially a necessity) for data centers and AI, and Nvidia chips remain in high demand from industry giants like Microsoft, Meta and Google (more on these customers later). Also, Tesla (TSLA) recently switched from its own internal chips to a massive cluster of Nvidia H100 AI chips for its autonomous-driving initiatives (in a sign of Nvidia’s strong competitive advantage).

Cuda Software: Nvidia developed its Cuda software platform early on which helps developers build with Nvidia chips. So even if AMD develops a competitive GPU, the switching costs (away from Cuda) for developers would be great and thereby widens Nvidia’s advantage (moat) over competitors.

Jensen Huang: Nvidia’s founder/CEO, Jensen Huang, has driven the company’s success. And he appears to have zero desire to step down (a good thing). According to a Business Insider article:

At an age when some billionaire tech founders step away from the stress of leading big companies, the 58-year-old Jensen Huang [he is now 61], Nvidia's CEO, isn't thinking about retirement anytime soon. Bill Gates left the day-to-day operations at Microsoft at 52, and Jeff Bezos just retired from atop Amazon at 57.

Jensen Huang is an absolute competitive advantage for Nvidia, but even if he were to step down the company has already built such a lead and competitive advantages that the high long-term growth trajectory would be hard to disrupt, especially considering the cloud and AI megarends have so much more room to run.

Red Flags (Big Risks):

Despite all of the truly impressive things Nividia has going, there are red flags that investors should consider.

Customer Concentration

Have you ever wondered who is spending all the money behind Nvidia’s massive revenue growth? The answer is the only entities that are capable of speding that much—Big Tech. Big Tech is building cloud and AI infrastructure to support the needs of its public and private (government) customers.

For example, a single customer made up 19% of its total revenue in fiscal year 2024. UBS says it’s Microsoft. And according to the same article, Bloomberg data estimates that is followed by Meta Platforms (META) at 13% of revenue, Amazon at 6% of revenue, and Alphabet at about 6% of revenue too.

Nvidia discloses in its annual report “risk factors”:

We receive a significant amount of our revenue from a limited number of customers…

One indirect customer which primarily purchases our products through system integrators and distributors, including through Customer A, is estimated to have represented approximately 19% of total revenue for fiscal year 2024, Compute & Networking segment.

If any large customers pullback significantly on chip spending, that can have a very negative impact on Nvidia’s business and share price.

Cyclicality: A History of Big Declines

Despite the market’s current love affair with Nvidia, chip stocks have a history of big price declines. For example, since 2000, Nvidia shares have declined more than 50% four times.

And this most recent upcycle has been driven by Big Tech customer speding. For example, Meta shares declied after its previous earnings announcement because the market was not pleased with CEO Mark Zuckerberg’s enormous spending on Nvidia chips. Zuckerberg is trying to get ahead of demand, and it seems unreasonable to believe he will continue this massive level of spending (on Nvidia chips) quarter after quarter.

And realistically, there aren’t any other large customers that can step in and fill the future chip purchasing void when Big Tech takes a break to implement strategies using the Nvidia chips they’ve already purchased. Generally speaking, even 100 large cap companies (say $12 billion market cap each) can’t make up for one Meta ($1.3 trillion market cap).

According to the risk disclosures (emphasis ours) in Nvidia’s annual report:

Failure to estimate customer demand accurately has led and could lead to mismatches between supply and demand. We use third parties to manufacture and assemble our products, and we have long manufacturing lead times. We are not provided guaranteed wafer, component and capacity supply, and our supply deliveries and production may be non-linear within a quarter or year. If our estimates of customer demand are inaccurate, as we have experienced in the past, there could be a significant mismatch between supply and demand. This mismatch has resulted in both product shortages and excess inventory, has varied across our market platforms, and has significantly harmed our financial results.

Tough Financial Comparisons & Growth Assumptions

When Wall Street analysts determine share price targets for high-growth companies, the most impactful factor is their future growth assumptions. Even a small change to these assumptions can have a dramatic impact on their company valuations. According to Nvidia’s annual report:

Our operating results have in the past fluctuated and may in the future fluctuate, and if our operating results are below the expectations of securities analysts or investors, our stock price could decline.

In the quarters ahead, Nvidia will face extremely difficult historical revenue comparisons. As a business, Nvidia still has massive long-term growth, but to believe they can maintain the recent high revenue growth numbers consistently, quarter after quarter, is unrealistic. Wall Street analysts can be pretty smart and clever, but they don’t have working crystal balls. And if Nvidia disappoints, even by just a small amount, as compared to recent historical comparison numbers and estimates, the shares can get very volatile (to the downside) fast.

Macroeconomic Risks:

Macroeconomic factors could have a significant negative impact on Nvidia. For example:

Third-Party Suppliers: Nvidia depends on third-party suppliers and manufacturers, and they cannot control their quantity, quality and delivery schedules. In fact, most of Nvidia’s chip production is completed by Taiwan Semiconductor (TSM) at their Taiwan-based factories.

Geopolitics: Nvidia chips are critically important to the functioning of the global economy (to the level that significant disruption poses a national security risk). And any geopolitical distruption (for example, tensions with China over Taiwan) could have a very negative impact on business. As another (smaller) example, recent export control measures blocked the passage of Nvidia products and services into Russia, Belarus and certain regions of Ukraine.

AI Restrictions: According to Nvidia’s annual report: “The increasing focus on the risks and strategic importance of AI technologies has resulted in regulatory restrictions that target products and services capable of enabling or facilitating AI and may in the future result in additional restrictions impacting some or all of our product and service offerings.” Potential AI restrictions pose a significant risk to Nvidia.

Conclusion

We believe Nvidia shares will be trading dramatically higher at some point in the future. Specifically, its leadership position is just too great, and the cloud and AI megatrends are just too powerful. Despite the risks, over the next decade, Nvidia shares are going much higher.

In the near-term, the shares are volatile. And depending on your personal situation, it could be in your best interest to stay the heck away. At the very least, now is a good time to consider rebalancing your portolio, especially if Nvidia’s weight has ballooned. And for some, the best option is to simply let your winners run.

At the end of the day, you need to do what is right for you, based on your own personal situation. Disciplined, goal-focused, long-term investing continues to be a winning strategy.