If you manage a big-yield portfolio in a “taxable account,” this report is for you. Municipal bonds are often exempt fom paying federal income tax, which means you can divide their yields by “1 minus your tax rate” (such as 1 - 0.24, or .76) to calculate your tax equivalent yield (hint: the tax equivalent yield is higher). What’s more, certain well-managed and prudently-leveraged munipal bond CEFs trade at discounts to NAV and offer particularly compelling yields as management is taking actions to reduce the discounts (a good thing if you own them). In this report, we review two attractive big-yield muni bond CEFs that are worth considering for your taxable account.

Nuveen Muni Bond CEFs: 7.7% Yields (NEA) (NAD)

On June 3, the Board of Trustees of certain Nuveen closed-end funds declared distribution increases with the goal of delivering higher regular cash flows to investors, enhancing investor value and improving each fund’s discount to NAV. There were eight non-state-specific muni-bond CEFs (with a range of dividend increases, but two that standout are tickers NAD and NEA, both getting 45% distribution hikes, as you can see in the table below.

In particular, these funds are compelling because they now both offer 7.7% yields (higher on a tax-equivalent basis, depending on your federal tax rate) and both trade at compelling 10.0% and 9.7% discounts to NAV, respectively.

Investment Grade Safety:

Municipal bonds are typically investment grade (safer than non-investment grade) and these two funds in particular own overwhelmingly investment grade bonds (a good thing for safety). And adding to the safety, these two funds are diversified across many bond issues and states (thereby further increasing the safety of the funds).

Prudent Leverage

Leverage (or borrowed money) can help magnify returns and income in the good times, but leverage can also increases losses in the bad times. Fortunately for these funds, municipal bonds are considerably safer than many other bonds, and we believe the leverage used by these two funds (approx. 40%) to be prudent and attractive. We’d be uncomfortable with this much leverage if these were non-investment grade funds (or if they invested in volatile stocks), but considering the relative safety of municipal bonds—we view the leverage as a good thing.

Attractive Discounts to NAV

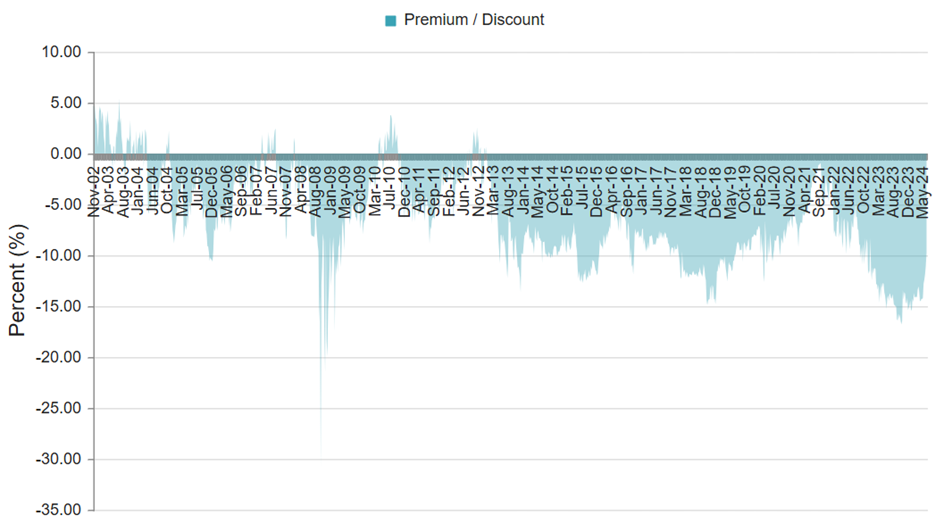

One of the unique characteristics of closed-end funds (such as NAD and NEA) as compared to mutual funds or ETFs, is that CEFs can trade at significant premiums and discounts to net asset value (NAV is the aggregate value of the underlying holdings in the fund), and this can create attractive “buy low” opportunities. Both funds currently trades at similar discounts to history (for example, see NEA below).

And what is particularly attractive is that management (Nuveen) is proactively working to reduce the discounts (a good thing for investors) as explained in the press release linked above. This makes these funds particularly compelling.

High Tax-Equivalent Yields:

As described earlier, municipal bonds are generally exempt from paying federal income taxes, so the tax equivalent yields of these two funds are even higher than 7.7% (paid monthly), especially depending on your tax bracket.

Important to keep in mind, you generally do NOT want to own muni bonds in a tax-advantaged account like a Roth or Traditional IRA becuase you don’t pay annual income taxes on those accounts anyway, so them non-taxable status of muni bonds is wasted in those types of funds. But in a taxable account, muni bonds can be extremely attractive.

Interest Rate Risk:

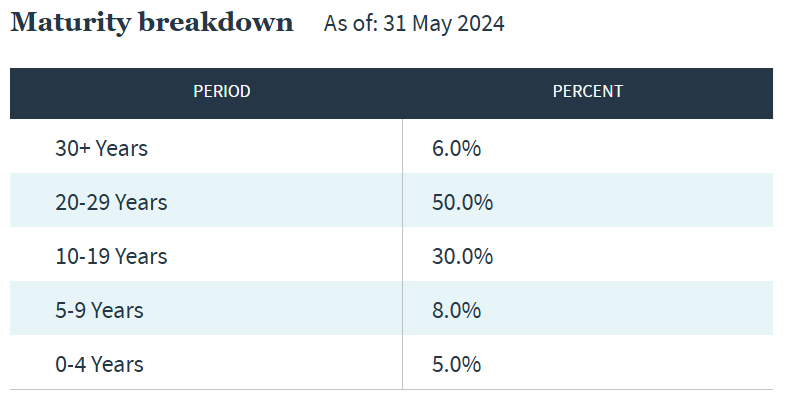

Worth mentioning, muni bonds are subject to interest rate risk. That means if interest rates rise, muni bond prices tend to fall (all else equal). And if rates fall, muni bond prices rise. You can see in the chart below (for NEA) the funds hedge some of the interest rate risk (NAD is similar) by owning bonds with varying maturities and durations (a good thing).

Distribution Sources:

Also worth highlighting, these funds tend to pay “interest only” (as you can see in the table below). This is a good things because it is the interest that is exempt from federal taxes, but not the price gains (i.e. if you buy low and sell high, you still have to pay capital gains taxes on the gains). Nonetheless, the “interest only” strategy is attractive.

The Bottom Line

If you are building a big-yield portfolio in your taxable account, you may want to consider owning NAD and/or NEA. These funds provide powerful monthly income and trade at attractively discounted prices while management is also actively working to reduce those discounts (a good thing if you own the funds). Further still, muni bonds can provide important diversification versus other categories of big-yield investments, thereby helping you to keep your income high and your overall risk lower. NAD and NEA are attractive and worth considering for your income-focused taxable account.