There seems to be no shortage of big-yield investment ideas on the internet. However, any discussion of the associated tax consequences seems sparse. And despite this spareness, taxes have a major impact on your bottom line and should absolutely be a major consideration before investing. In this report, we first review important details on PTY’s big 10.1% yield, and then dig deeper into three big tax risks (including your account type, your personal tax rates, and the tax inefficiency of PTY versus compelling big-yield alternatives). We conclude with our strong opinion on investing in PTY and some general (but very important) advice on building a big-yield investment portfolio to optimize your after-tax bottom-line income.

About PTY

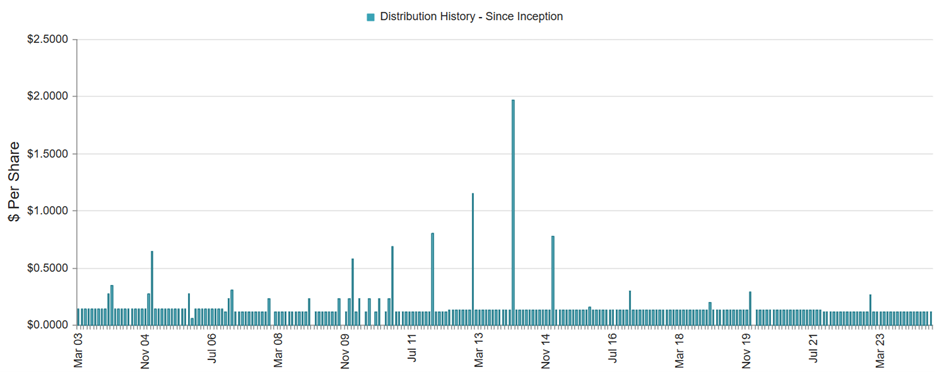

The PIMCO Corporate and Income Opportunity Fund (PTY) is a closed-end fund (“CEF”) and it has been an income-investor favorite for years (thanks to its big monthly distribution payments, as you can see in the chart below).

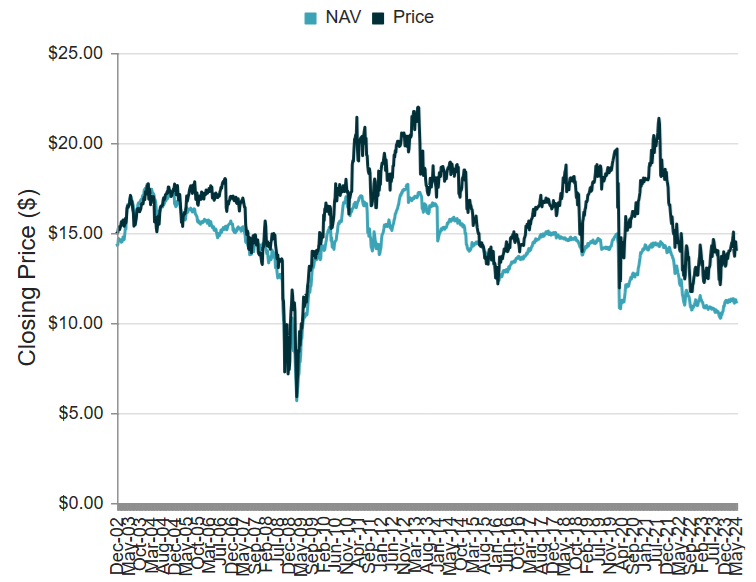

And one thing that makes this fund particularly compelling (asided from those big distributions) is the price has been fairly steady (aside from a few “blips” over time) as compared to other big yielders (many have experienced more significant price declines over time).

Specifically, some investors don’t even mind the current price premium (relative to net asset value) because the price is still fairly close to the same $15 it traded at way back in 2002 (and as long as those big distributions keep rolling in).

PTY Objective:

And consistent with the income and price strength over time, PTY’s investment objective is:

PIMCO Corporate & Income Opportunity Fund’s investment objective is to seek maximum total return through a combination of current income and capital appreciation. The Fund seeks to achieve its investment objective by utilizing a dynamic asset allocation strategy among multiple fixed income sectors in the global credit markets, including corporate debt, mortgage-related and other asset-backed securities, government and sovereign debt, taxable municipal bonds and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers.

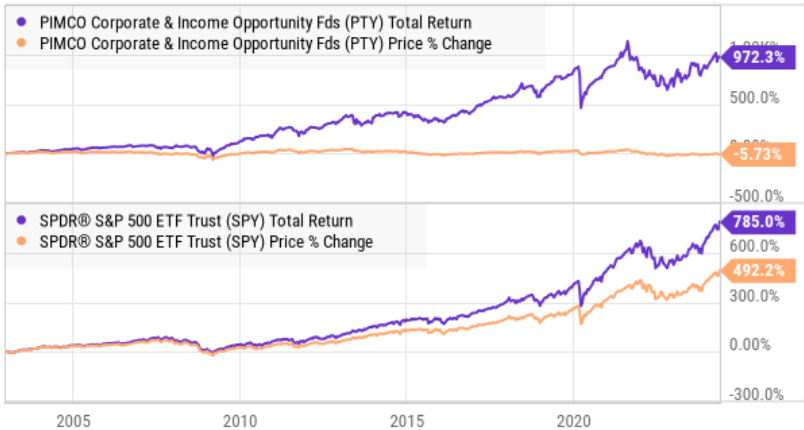

And as you can see in our earlier charts, this fund has done a decent job of achieving its objective over time. Here is another look at the price return and total return (i.e. price gains plus distributions as if they were reinvested in the fund), as compared to the S&P 500.

As you can see above, the fund’s total return has outpaced the S&P 500, and the price a remained fairly steady. If you are an income-focused investor, PTY’s track record has been excellent.

Important CEF Considerations:

Before investing in any CEF, there are a handful of very important things you should consider, as we have described in the following graphic.

So let’s quickly run through these questions.

We’ve already covered the objective, but if you are looking for big income and a fairly steady price over the long-term, PTY has done an excellent job of achieving this goal by investing in a variety of big-yield bonds from across varying market sectors.

As you can see in our earlier chart, yes—the distribution has been fairly consistent (with a little volatility), plus an occasional special dividend too.

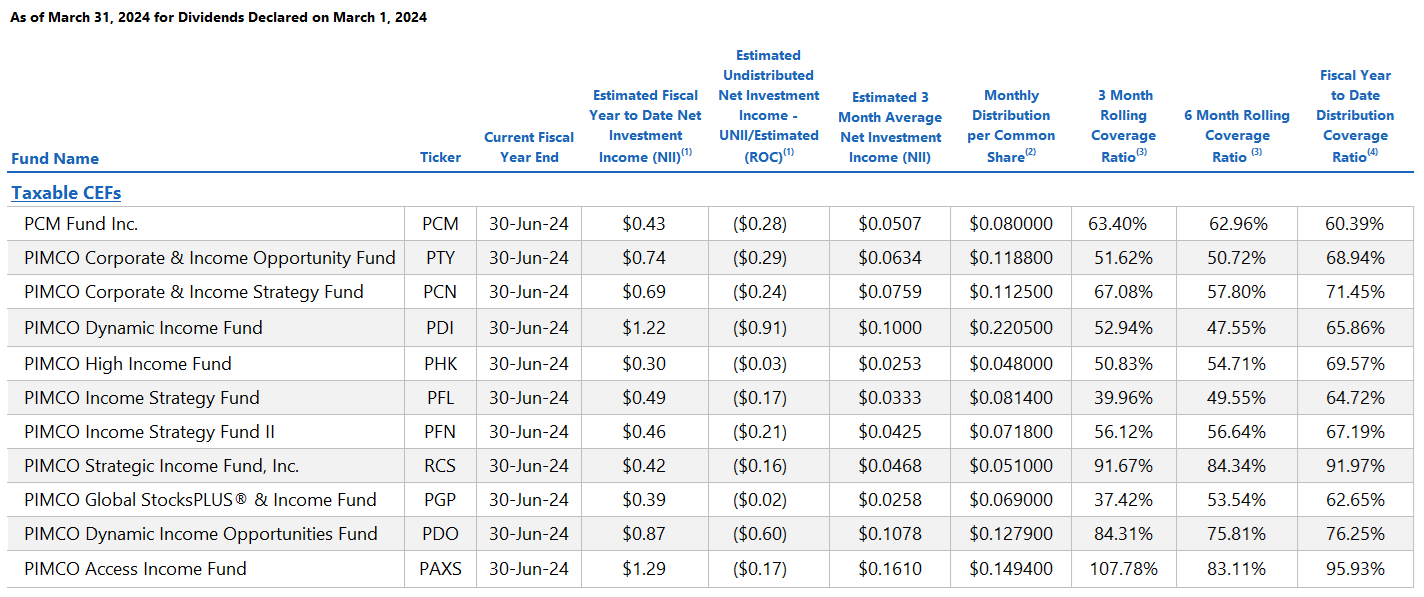

The distribution source is an important concept, and as you can see in the table below, the income on PTY’s investments has not been fully covering the distribution lately (which means PTY has been sourcing at least part of the distribution form price appreciation (short and long-term capital gains) as well as a potential return of capital. Capital gains are fine, but return of capital is not a sustainable strategy over the long-term because it reduces the NAV and thereby reduces the fund’s earnings power, but it’s okay from time to time in order to maintain the big distributions, and as you saw in our earlier chart NAV has been somewhat fairly steady over time—a good thing).

Importanly, PTY does use leverage (or borrowed money). Leverage can magnify income and price appreciation in the good times, but also magnify losses in the bad times. Leverage is a risk factor, but considering the lower volatility of the bonds PTY invests in (versus the stock market) a little leverage (recently 21.7%) is prudent and highly beneficial for this fund.

PTY does trade at a large premium to NAV (recently 25.9%). This is a risk that some investors don’t mind as long as the big monthly distribution payments keep rolling in. And for what it’s worth, PTY often trades at a large premium (as you can see in our earlier price versus NAV chart).

The expenses on this fund are significant, but reasonable for a PIMCO fund. The management fee was recently 0.75% per year and the cost of leverage (i.e. the interest expense on borrowing) was recently 1.45%. These expenses detract from your returns, but again as long as the big income keeps rolling in—many investors don’t mind a bit.

PIMCO is the best in the business when it comes to bond CEFs. The company has deep resources and experience that allows them to effectively invest in bonds that ordinary investors don’t have access to, and they can apply leverage more effectively than the typical investor can too.

3 Big Tax Risk

The above review indicates that PTY may be worth considering for a lot of income-focused investors. However, much of the analysis on the internet stops at this point, without ever considering taxation consequences and risks (which we cover in the next section).

Tax Risk 1: Account Type (IRA vs. Taxable)

As an investor, there are non-taxable accounts (such as Individual Retirement Accounts and Roth IRAs) and taxable brokerage accounts. And your bottom line is impacted dramatically depending on which type of account you own PTY in.

For example, if you own PTY in an IRA then those big monthly distributions aren’t taxed at all, but if you own PTY in a taxable brokerage account then each monthly distribution gets hit with a tax bill. Keep that in mind because if you own 0% dividend yield investments instead—they can appreciate over time with no annual tax consequences (unless you sell at a gain—then you get hit with capital gains tax—but that is under your control and at your discretion—PTY distributions are not).

Tax Risk 2: Your Tax Rate (Income vs. Qualified)

Your personal income tax rate impacts the bottom line for PTY investors if you own it in a taxable account, and to a lessor extent if you own it in an IRA.

Not a Qualified Dividend: PTY distributions are generally not “qualified” meaning they don’t qualify for the lower qualified dividend tax rate (15% for most people, but depending on your tax bracket, as you can see in this report). Rather, PTY distributions are generally taxed at your ordinary income tax rate, so if you are in a higher tax bracket, PTY pays you even less bottom line income. And if you live in a state with a high state tax rate then you get even less bottom line income from PTY.

Also, keep your tax rate in mind if you own PTY in an IRA because when you do finally start taking distributions from your IRA you are taxed on that income at your ordinary income tax rate (unless you own it in a Roth IRA, in which case you paid taxes on the money before you put it in the account so you’re not taxed on withdrawals). There is a whole science around which types of investments you should hold in which types of accounts to minimize the tax consequences effectively.

Tax Risk 3: Less-Taxable Alternatives (Opportunity Costs)

The third big risk of investing in PTY is the opportunity cost (i.e. the sometimes better alternatives you forgo to own PTY). For example:

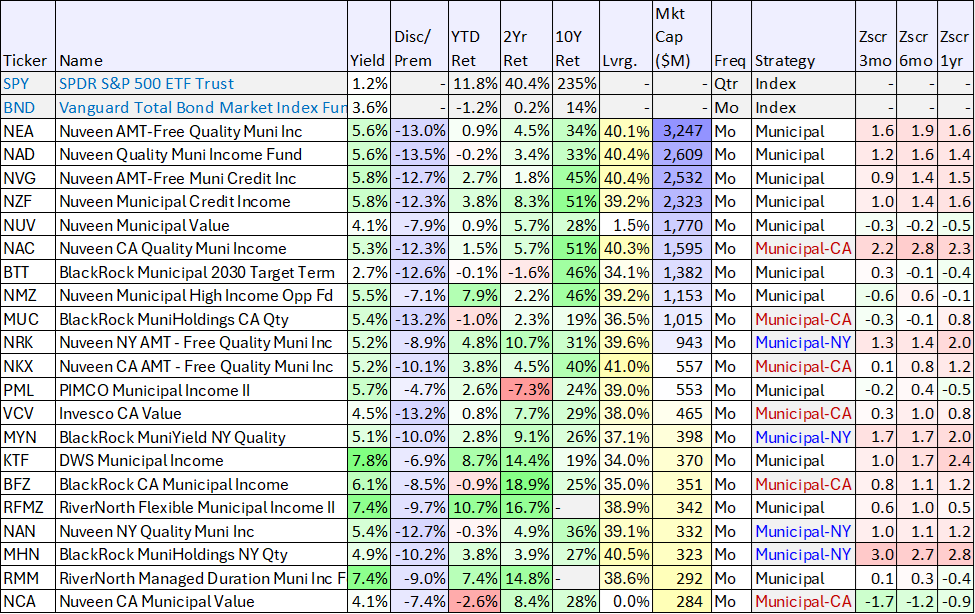

Tax Free Muni Bond CEFs: There are tax free municipal bond CEFs available that offer lower yields than PTY, but after adjusting for the tax consequences the muni-bond CEF can be more compelling (strong bottom line net of tax returns with arguably much less risk) for some investors. For example, if you live in a state with a high state income tax (such as California) and you are in a high income tax bracket, you may actually be better off investing in municipal bonds because of the potentially huge tax savings. Be sure to consider the “tax equivalent yield” when comparing non-taxable versus taxable big-yield investments.

Qualified Dividends: Investments that pay qualified dividends are taxed at a lower rate (15% for most people, but less if you are in a lower tax bracket). PTY distributions are generally not qualified, so you pay taxes on them at your ordinary income tax rate (which is typically higher than 15% for most people). There are not a ton of qualified dividends that yield anywhere near PTY (cigarette and tobacco companies may be one example worth considering).

Using long-term gains for spending cash: Companies that pay qualified dividends (i.e. taxed at a lower rate) frequently have much higher long-term price gains than PTY (recall our earlier chart of PTY’s price—which remained relatively flat, versus the S&P 500—which offered a lower yield but much higher price returns). And long-term capital gains are also taxed at a lower rate (15% for most people, sometimes less if you’re in a lower tax bracket). So if you can handle generating some of your spending cash from long-term capital gains, you can potentially save a ton on money in taxes. For example, you might want to brush up on “the 4% rule” (i.e. this gives you an idea of how much of your nest egg you can safely spend each year, assuming it will be more than replenished over time through price gains).

Data as of Wed 5/22/24 close, source: StockRover, CEF Connect

The Bottom Line:

PTY is an attractive big-yield investment. However, investors should be careful to pay close attention to their own personal tax situation before investing in PTY. Sometimes the biggest yield isn’t the best yield after taxes.

If you own PTY as one investment within a prudently-diversified non-taxable IRA—congrats, you are potentially a genius. And if you own it as one investment within a prudently-diversified taxable account (and your personal tax rate is low)—congrats, you may still potentially be a genius. But if you own PTY in a taxable account, and your personal tax rate is high—you may want to consider some alternatives (such as tax-free municipal bond CEFs, qualified dividends and potentially generating some of your spending cash from long-term capital gains (which are also taxed at a lower rate for most people).

The bottom line is you need to do what is right for you, based on your own personal situaion. We currently own shares of PTY in our prudently diversified “High Income NOW” Portfolio, but it’s not the only position and it’s not even one of the largest positions. Be smart people. Do what is right for you.