PIMCO’s big-yield bond CEFs are perennial favorites, however underdog BlackRock has been outperforming in some cases over the last 3-5 years. For example, BlackRock’s 9.8% yield bond CEF (BIT) is posting better total returns than PIMCO’s widely popular PDI. In this report, I explain why (including comparative metrics on distributions, leverage, potential return of capital and more), and then conclude with my opinion on how income-focused investors may want to consider allocating their income-focused investment dollars (i.e. PIMCO or BlackRock).

Bond CEF Overview:

Briefly, a bond CEF is basically a pooled investment vehicle that gives you instant exposure to a variety of individual bonds. However, unlike Exchange Traded Funds (ETFs) and mutual funds (which trade in the market at a value very close to their net asset value, i.e. the aggregate value of all of the individual underlying bond holdings), CEFs are closed-end and therefore can trade at wide premiums and discounts to NAV based on supply and demand.

PIMCO and BlackRock are both leaders in the bond closed-end fund (CEF) space, although PIMCO is the clear leader (in many investors’ minds). Both firms have vast resources and talent to support the funds in achieving their high-income objectives, but PIMCO’s funds are bigger and often trade at a bigger price premium as compared to BlackRock funds (because investors prefer PIMCO). For example:

BlackRock Multi-Sector Income Trust (BIT):

Total Assets: $0.5B

Current premium to NAV: 6.2%

Current Yield: 9.8%

Current Leverage: 34%

Objective: To achieve high current income with capital appreciation through investment across multiple sectors of the fixed income securities market.

PIMCO Dynamic Income Fund (PDI):

Total Assets: $5.1B

Current premium to NAV: 11.3%

Current Yield: 14.0%

Current Leverage: 39%

Objective: The primary investment objective of the Fund is to seek current income, and capital appreciation is a secondary objective.

Recent Performance:

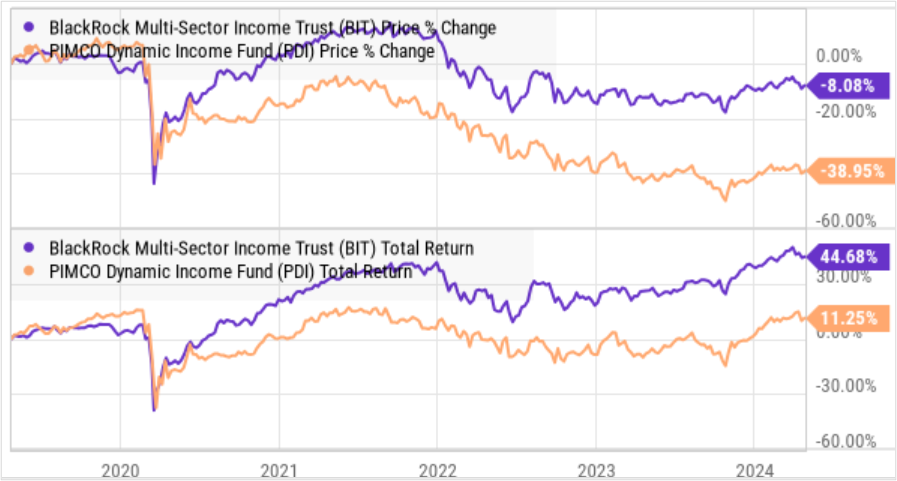

The BlackRock fund (BIT) is down only 8% over the last 5 years, whereas the popular PIMCO fund (PDI) is down ~39.%. That is a big difference, but when you factor in the distribuion payments, both are up (i.e. positive total returns) and BlackRock is beating PIMCO by more than 33% (a lot!).

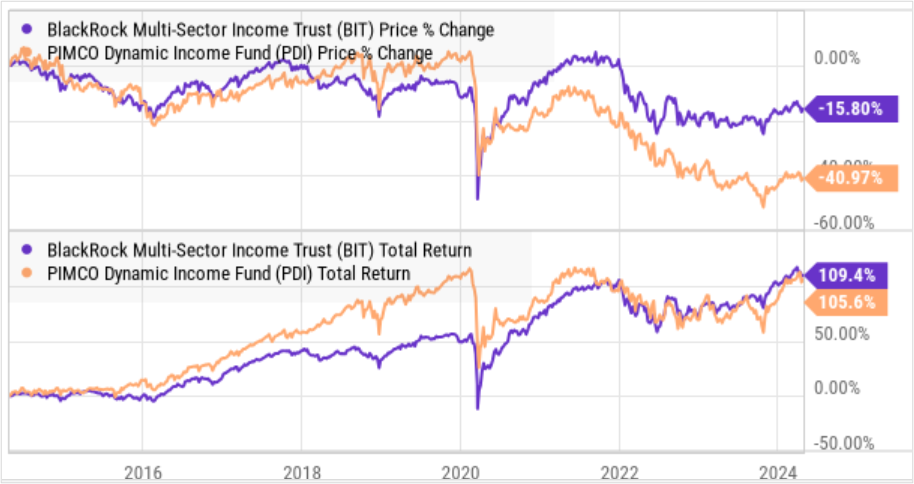

And if we zoom out to the 10 year view, the price of both funds are down (again, PIMCO is down more), but the total returns are very similar (with BlackRock’s total return just slightly better than PIMCO’s).

So what happened? Interest rate volatility happened. And as you can see (based on the charts), PIMCO had a huge total return lead on BlackRock heading into the interest rate volatility around the pandemic (their total return was way ahead), but they gave it all up when interest rate volatility hit.

And BlackRock (BIT) was in a much better position to handle the unprecedented interest rate volatility simply because it uses less leverage (or borrowed money) to magnifiy their returns. Leverage can magnify price gains and distribution income in the good times, but it can hurt them badly in the bad times. Specifically, the BlackRock fund historically maintains around 30% leverage (more conservative) whereas the PIMCO fund maintains around 40% (more aggressive). And when rate volatility hit, PIMCO faced bigger challenges.

Return of Capital

BlackRock is fairly transparent about Return of Capital (ROC), Specifically, when a portion of the monthly distribution payment does NOT come from interest income on the underlying bonds, and its NOT from capital gains (short-term and/or long-term) then it’s likely a return of capital (as BlackRock regularly discloses through section 19a notices—i.e. they’ve been using ROC to help source the distributions).

A lof of investors don’t like ROC because it can weaken a fund’s ability to generate as much income in the future, whereas other investors don’t mind at all (as long as the big distribution payments keep rolling in).

In contrast, PIMCO’s distirbuion sources are a little more opaque due to the fund’s use of derivative instruments (such as interest rate swaps) which can delay the recognition of ROC to a later date, postpone the need for Section 19a disclosures and make things a bit less transparent to investors.

For example, in this recent PIMCO disclosure they describe “Paid in Surplus or Other Capital sources” as “similar to a return of capital.”

Although accounted for in the Fund’s internal tax accounting records as income, certain gains from paired swap transactions are included within Paid-in Surplus or Other Capital Sources in the table above in light of the corresponding capital losses associated with such transactions as described above. Consequently, common shareholders may receive distributions and owe tax at a time when their investment in the Fund has declined in value, which tax may be at ordinary income rates and which may be economically similar to a taxable return of capital. The tax treatment of certain derivatives may be open to different interpretations. Any recharacterization of payments made or received by a Fund pursuant to derivatives potentially could affect the amount, timing or character of Fund distributions. In addition, the tax treatment of such investment strategies may be changed by regulation or otherwise. Source.

Distribution Sources:

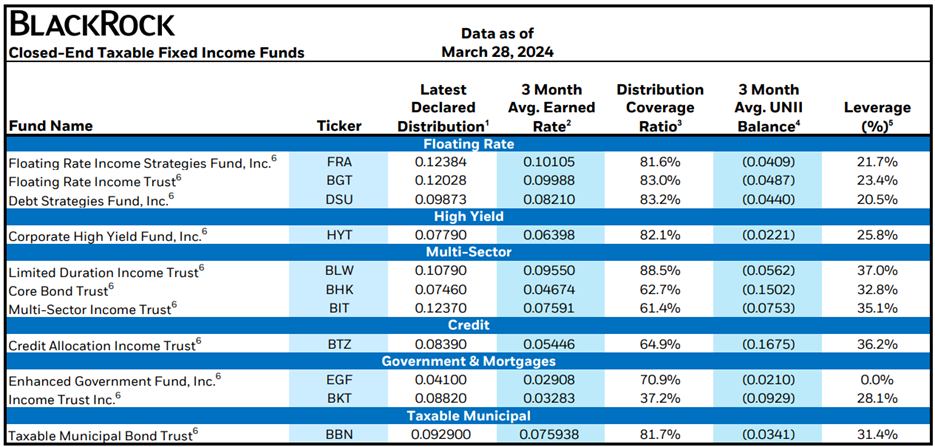

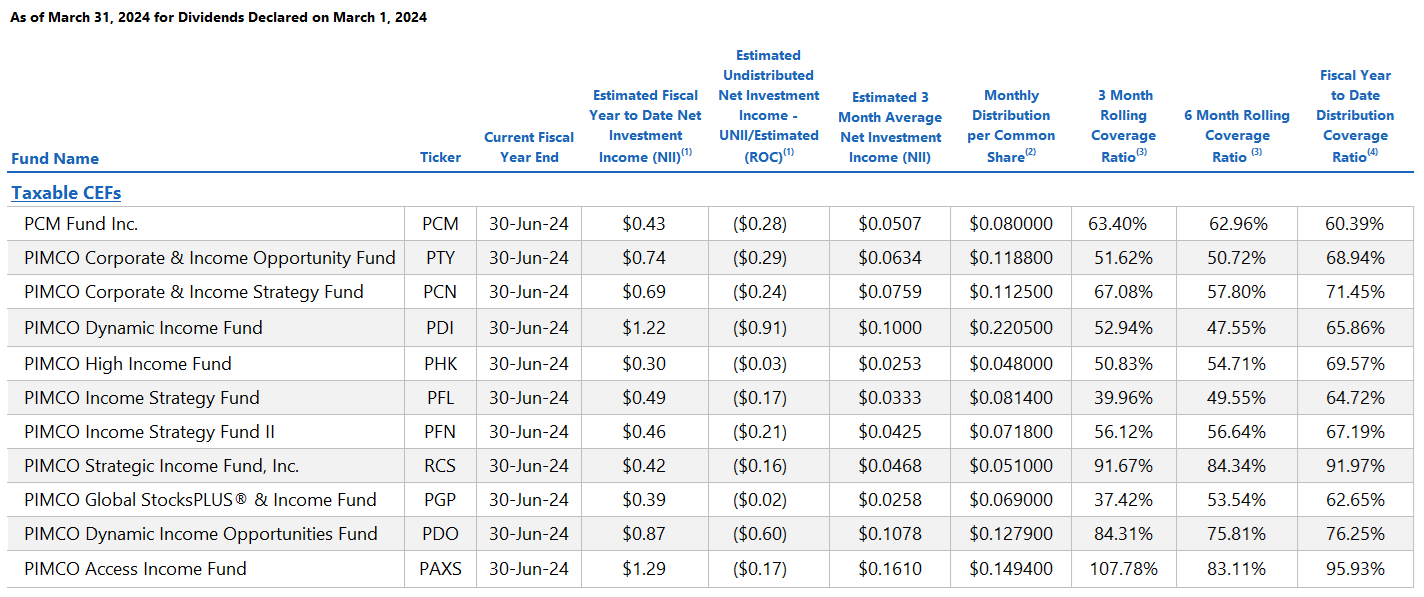

But to be clear, as you can see in these next two tables, neither PIMCO or BlackRock has enough “net investment income” (or NII) to cover all of their distribution payments (i.e. they’re paying out more in distributions than the funds are actually earning).

This distribution shortfall may be temporary, as the funds continue to adjust to our new higher-for-longer interest rate environment. But there is a distribution shortfall for both funds, nonetheless.

Other Fund Considerations

Of course there are a variety of other factors investors should consider before investing in any closed-end fund. And I have highlighted seven of them (for your reference) in the following graphic.

The Bottom Line:

Both BlackRock and PIMCO are worldclass CEF managers, and I have every confidence that they will continue to act with prudence and expertise in the management of these funds. And I believe they will both continue to pay big distribution payments that income investors want and need.

However, a lot of investor don’t want to see how the sausage is made (because if they saw all the moving parts, behind the scenes, that go into the generation of these funds’ big yields—they’d probably be disgusted and/or frightened!).

In particular, PIMCO (who is typically considered the premier bond CEF manager) uses a lot of complex derivatives and distribution reporting techniques (such as “paid in surplus” and things that are not ROC, but are “economically similar to a taxable return of capital” that may be misleading to some investors (i.e. some investors don’t believe there is any ROC for PIMCO, when it may in fact be recognized retroactively years into the future—and with tax consequences)).

Due to the “behind the scenes” risks to these funds (such as leverage, derivatives and interest rate volatility), I am not willing to put all my eggs into one single bond CEF or even one single bond CEF manager.

As such, I invest in PIMCO bond CEFs (I am long PDI, PDO, PAXS and PTY) as well as BlackRock bond CEFs (I am long BIT and BTZ) within my diversified “High Income NOW” potfolio (which you can view here).

Be smart people. Invest in what is right for you, based on your own individual situation.