With Nvidia shares now up more than 45% this year (and up over 1,870% in the last 5 years) some investors are again wondering if the stock is overpriced. On one hand, the semiconductor industry is notoriously cyclical, and big price pullbacks (60% to 80%) are not uncommon. On the other hand, Nvidia benefits enormously from two megatrends (artificial intelligence (“AI”) and the great cloud migration/ digitization), and the share price gains may still just be getting started. In this report, we take a closer look at Nvidia’s current valuation versus 40 other top chip stocks, share our views on what sets it apart, and then conclude with our strong opinion on investing.

40+ Top Chip Stocks Ranked

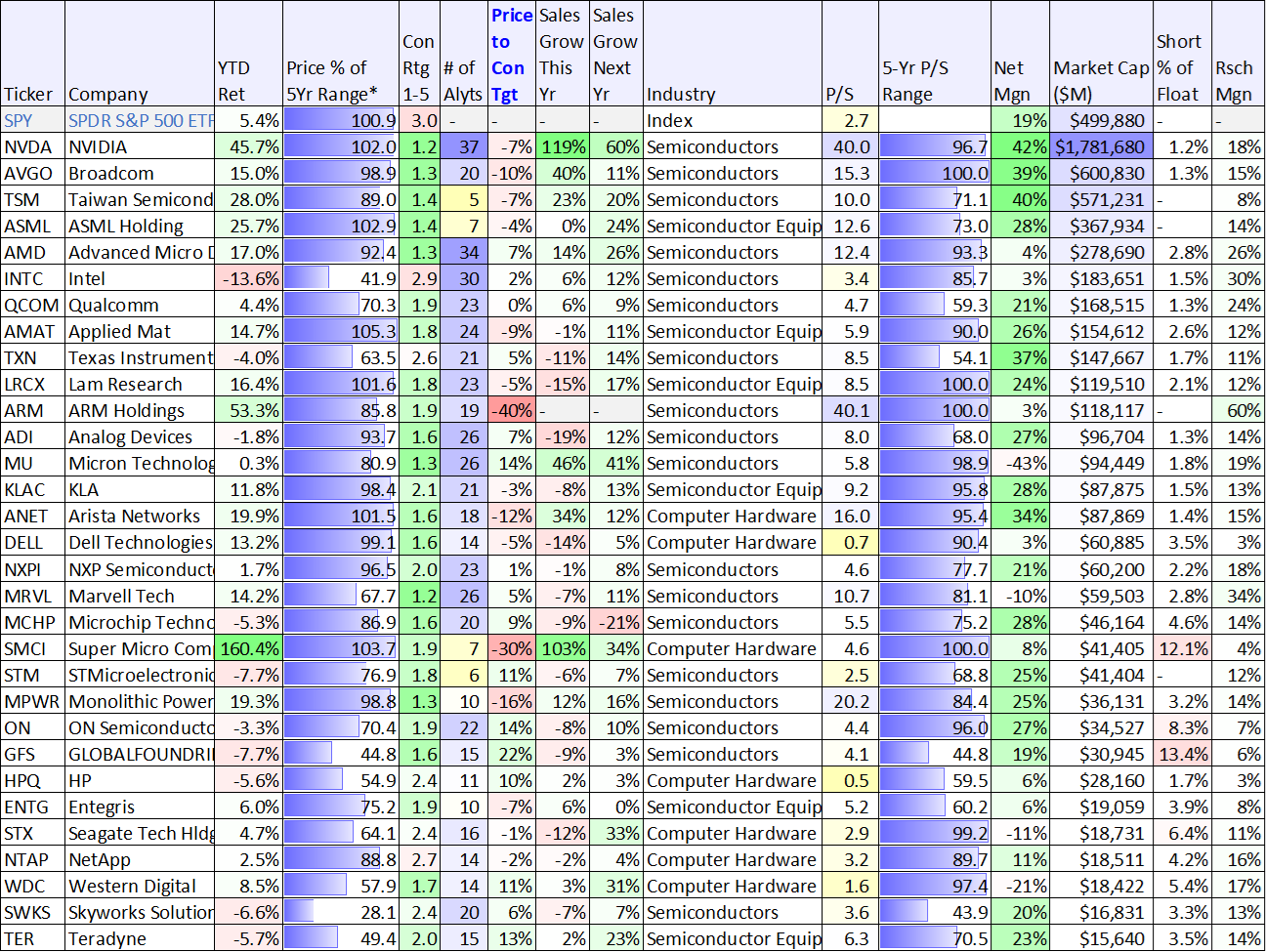

For starters, the following table ranks 40+ top chip stocks on various fundamental metrics, including market capitalization, net profit margins, expected growth rates, valuation metrics and more.

You likely recognize many of the popular chips stock names in the table above, and Nvidia clearly stands out for a variety of reasons (such as its enormous size, profits, revenue growth and valuation).

Obviously, semiconductor companies are widely different in terms of their capabilities and business strategies. Further, some large companies that don’t specialize in semiconductors (such as Meta Platforms) are increasingly making and developing some of their own chips in house.

So with that backdrop in mind, let’s take a closer look at Nvidia in particular.

Nvidia: Driven by two megatrends (AI and the cloud)

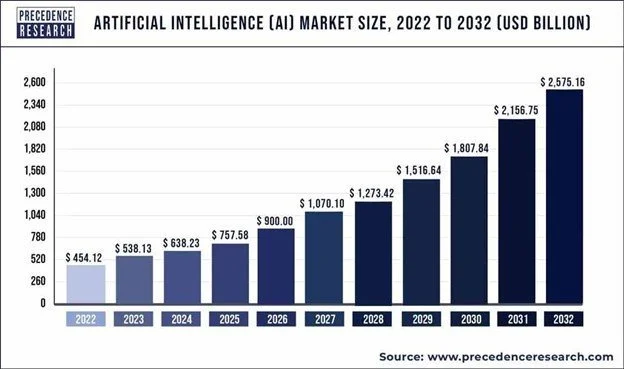

Nvidia is currently benefiting from not one, but two, megatrends in the market. First, it is benefiting from explosive growth in artificial intelligence. Specifically, Nvidia makes the leading-end graphical processing units (GPUs) that handle much of the enormous computing power behind artificial intelligence. For example, companies like Meta Platforms (META) are spending billions on Nvidia chips (that’s a lot, even for Meta). And for more perspective, here is a look at how much the AI market is expected to grow in the next decade.

However, it’s not just AI that is driving Nvidia’s massive growth. It’s also a second megatrend: the great cloud migration and digitization of everything. Nvidia GPUs have been replacing the competition in data centers (i.e. where cloud data is actually stored—massive server warehouses). For example, you can see (in the following graphic) how Nvidia has been displacing Intel (INTC) as the king of data center chips.

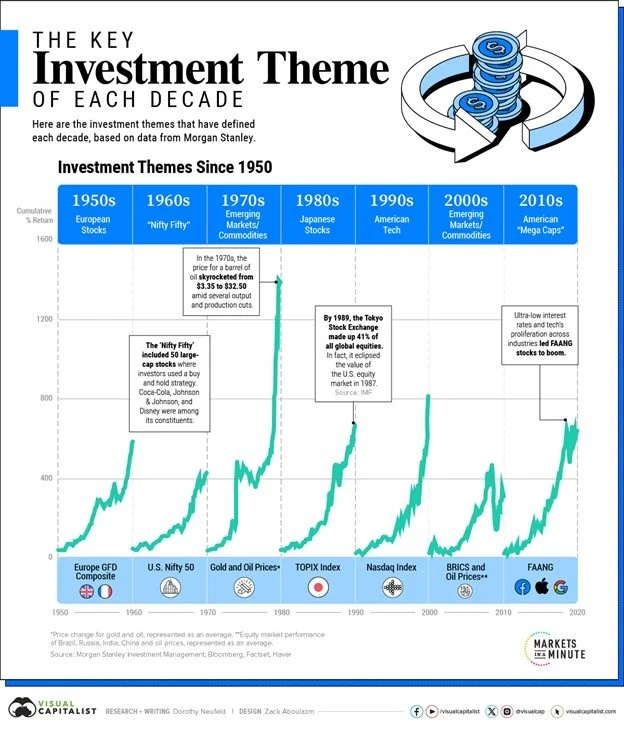

So when you think about Nvidia’s current valuation, just know it is experiencing massive growth thanks to these two huge megatrends. In fact, some investors believe that AI (in combination with “the cloud) is the key investment theme of the 2020s.

source: Visual Capitalist

Nvidia: Chips stocks are highly cyclical

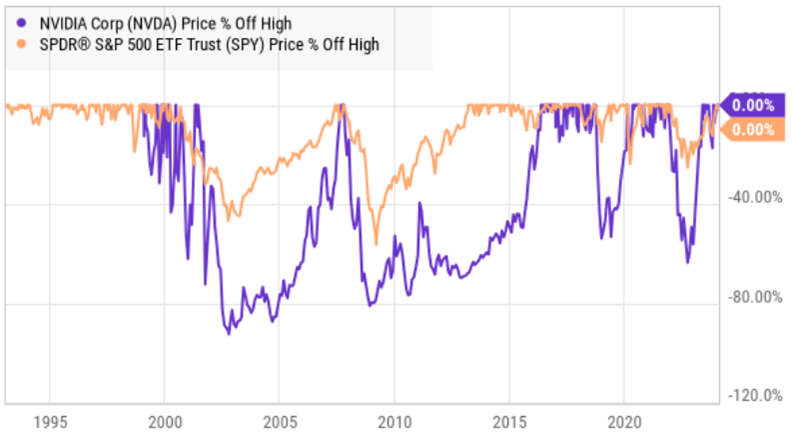

However, before you go dumping your life savings into Nvidia, just know that the semiconductor industry is highly cyclical. For example, you can see in the following chart that Nvidia shares have fallen more than 50% (from their all-time highs) four times in the last two decades (and twice the share price fell by 80% or more!). As you can see by comparing Nvidia to the S&P 500 (below), Nvidia shares have been dramatically more volatile.

So considering the recent strong performance (the shares currently sit at an all-time high) it makes sense that some investors are nervous.

Nvidia: current valuation versus history

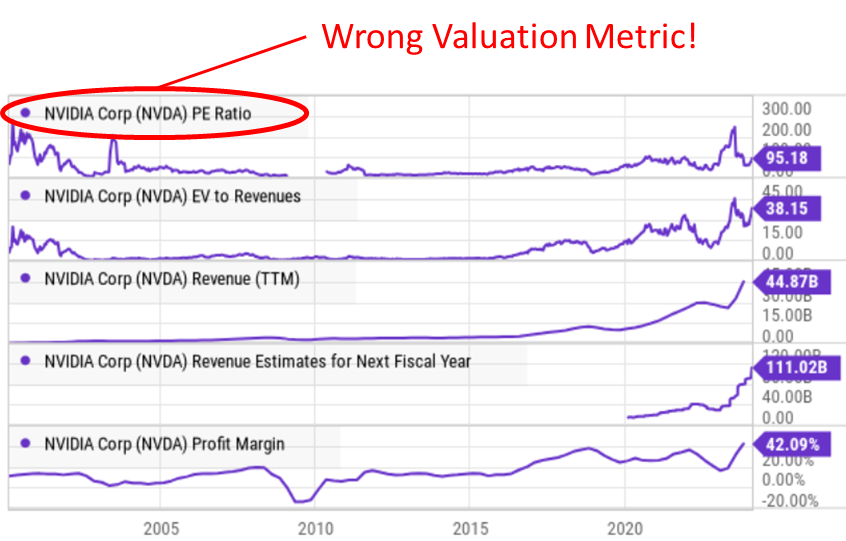

But before you start selling your current Nvidia holds, let’s consider the current valuation. A lot of investors are quick to point out that Nvidia’s current price-to-earnings ratio is absurdly high (over 95x, as you can see in the following graphic), however P/E ratio is the wrong valuation metric when considering a stock like Nvidia.

If you are going to attempt to appropriately value a disruptive growth stock like Nvidia, you need to first understand the businesses growth trajectory versus the total addressable market size (“TAM”). And as we saw earlier, the TAM is enormous (thanks to the megatrends: AI and the great cloud migration) and the growth trajectory is extraordinary (see in the graphic above: revenues are expected to grow from $44.87 billion (over the last 12 months) to over $111 billion in the next fiscal year. That is incredible growth for a mega-cap stock.

Nvidia is the absolute leader in the GPU space, it is growing extraordinarily rapidly, and the TAM is gigantic (so it can keep growing rapidly for many years). In our view, Nvidia is a business that is not going away (it is simply too critical to too many companies and to the economy in general).

Our bottom line on Nvidia: it comes down to timeframe

If you are a long-term investor (which we are), short-term share price volatility should NOT matter too much to you. As we saw earlier, Nvidia has suffered some massive price pullbacks in the past, but the trend has continued higher, and the business is supported over the long-term by AI and the ongoing digital revolution and migration to the cloud.

If you are a shorter-term trader (which we are NOT), you might consider selling some income-generating put options on Nvidia right now. For example, if you sell puts with a strike price around 20% below the current market price, you’ll collect some nice upfront premium income, and if/when the share price falls 20% or more, you have a chance at picking up Nvidia shares at a 20% discount to the current market price (plus you get to keep the upfront premium income no matter what). The big risk with this strategy is simply that Nvidia just keeps going higher, you never get the shares put to you, and you miss out on more long-term returns.

In our estimation, it is NOT a question of “if” but rather “when” Nvidia shares are going much higher. It’s also a question of how will you personally feel if the shares pullback 60% or 80% before rising to dramatic new all-time highs.

As disciplined long-term investors, we believe in letting your winners run, but we also are not afraid to rebalance and take a few shares off the table (Nvidia has had a great run and is now a very large position in a lot of investors’ portfolios, including our own). Nvidia is a great business, but it is not the only great business out there.

At the end of the day, the question is how much Nvidia do you personally want to own. Prudently concentrated long-term investing continues to be one of the most powerful wealth compounding strategies in the history of the world. Be smart. Do what’s right for you and your situation.