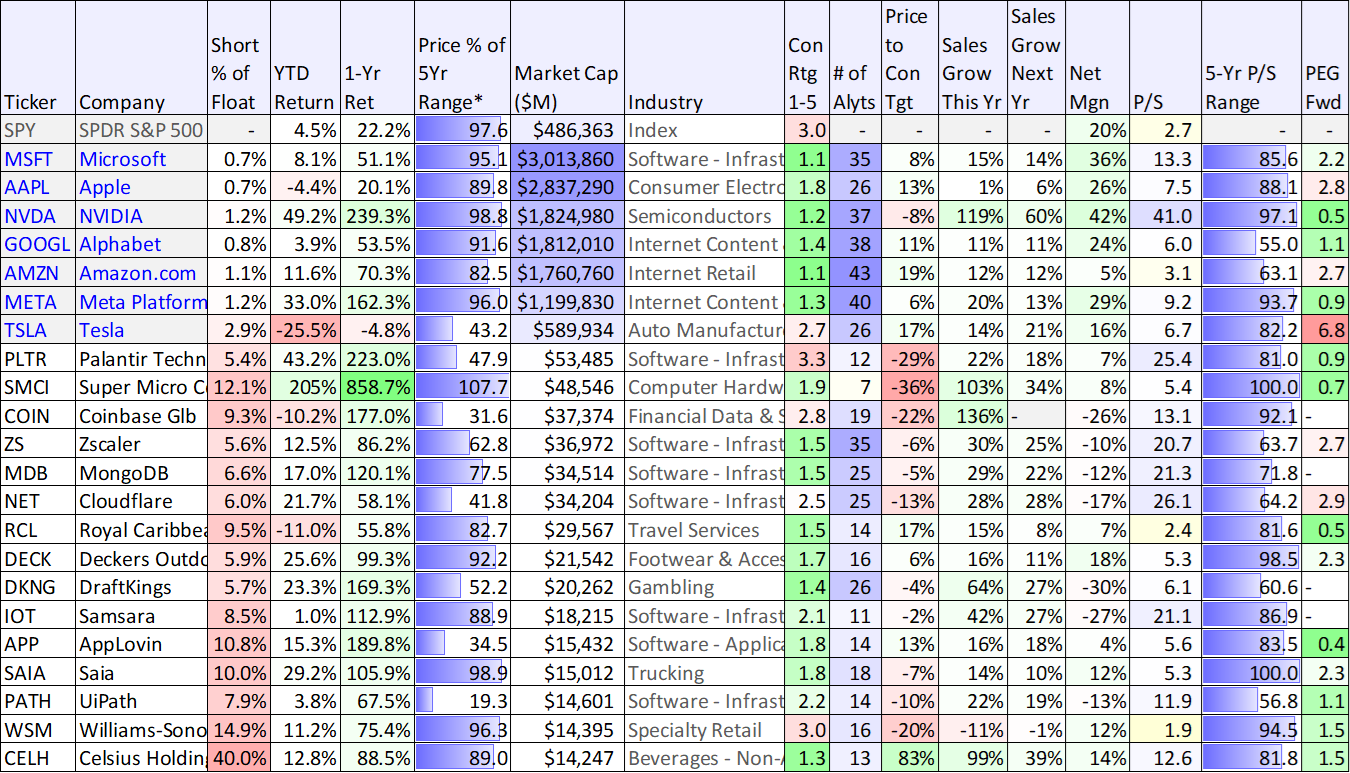

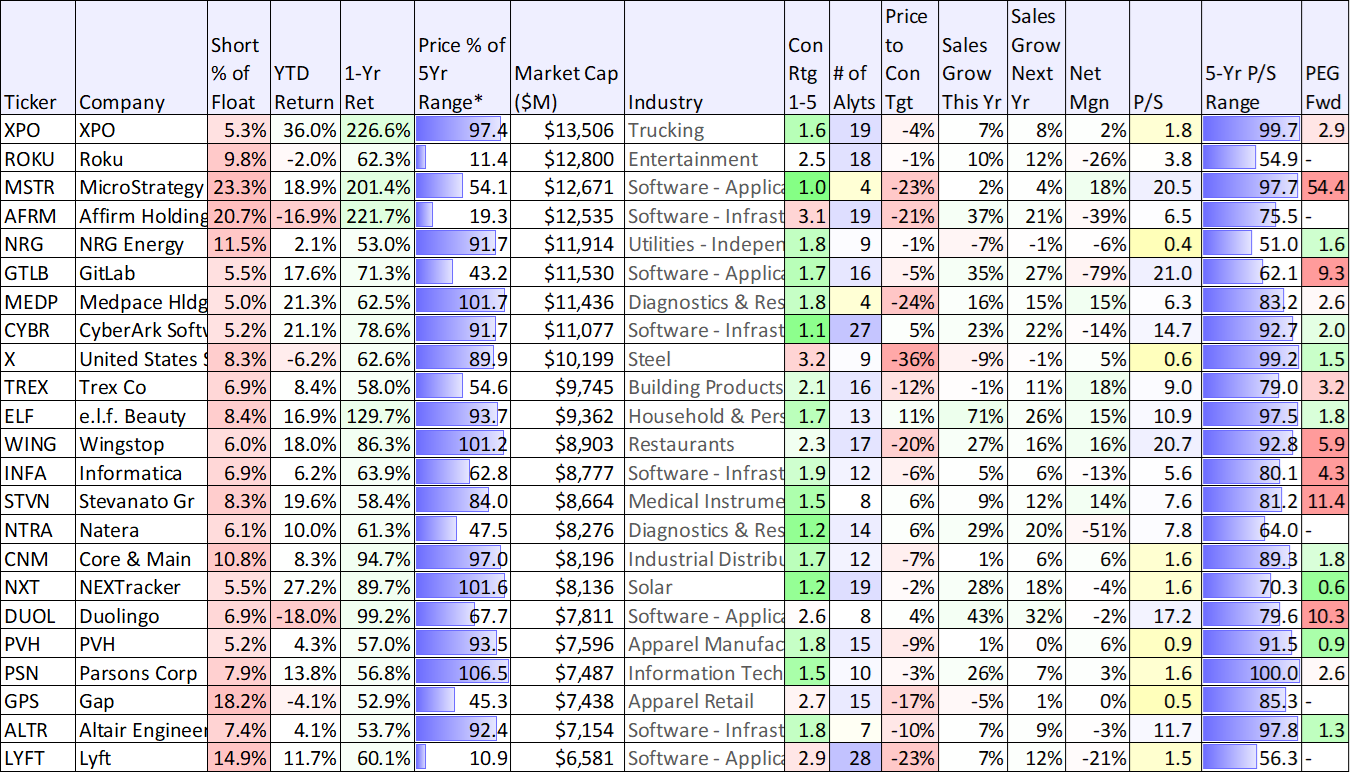

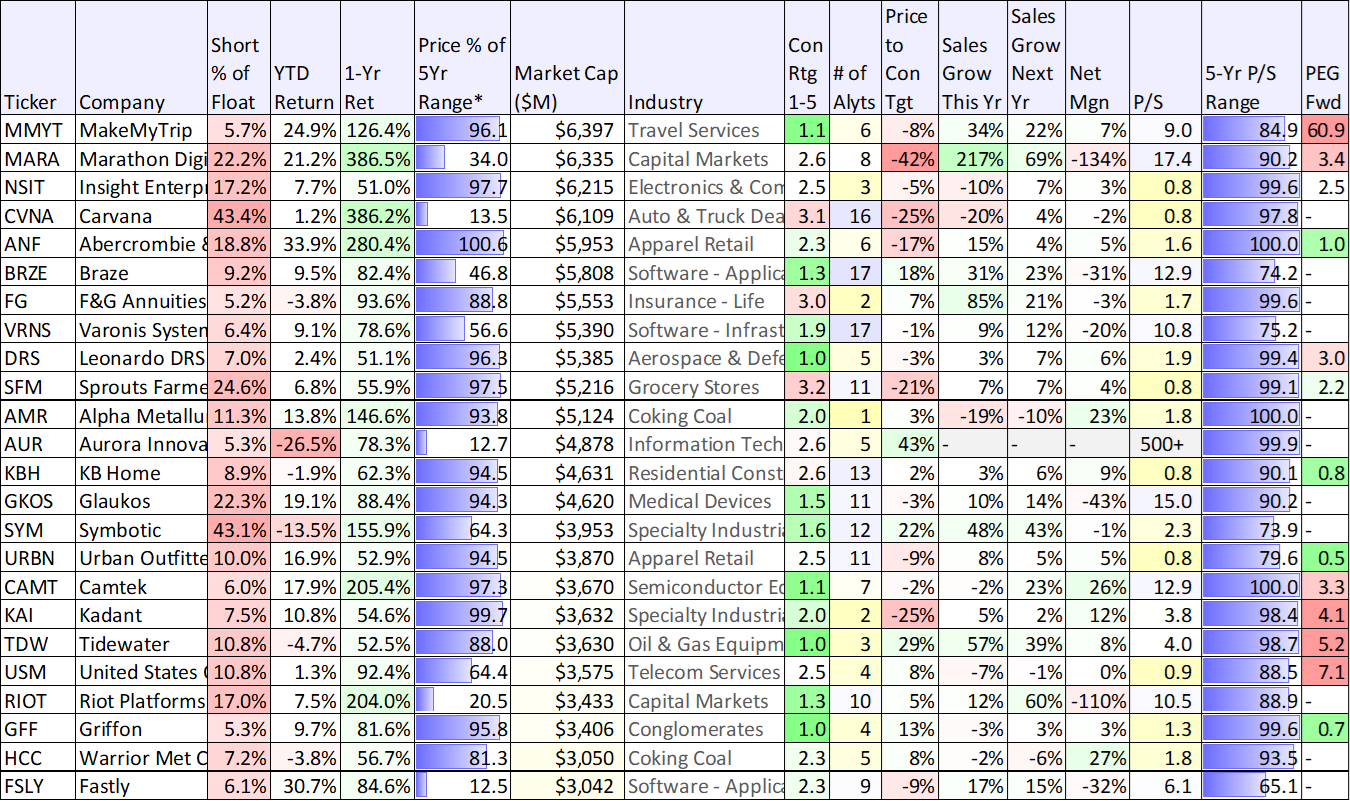

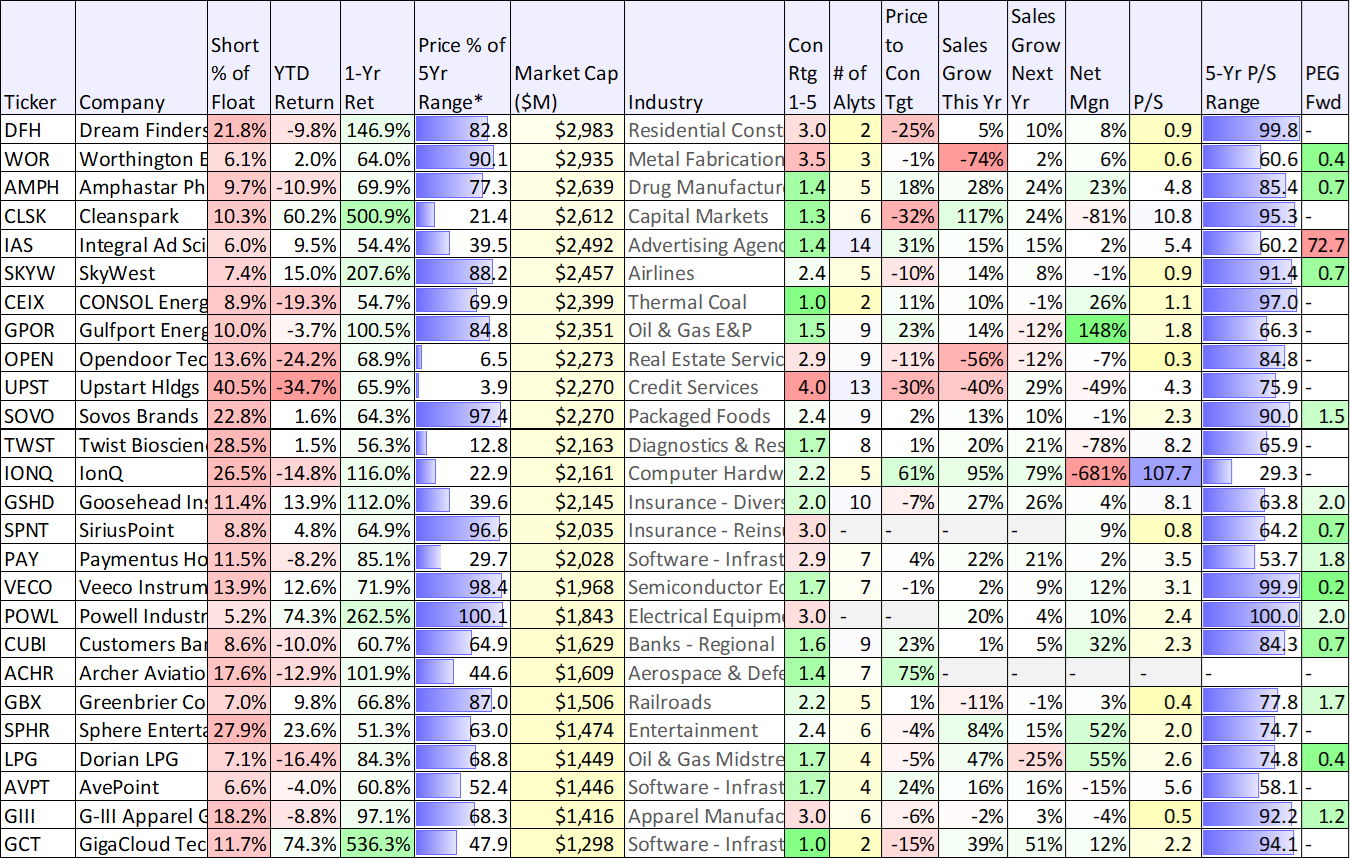

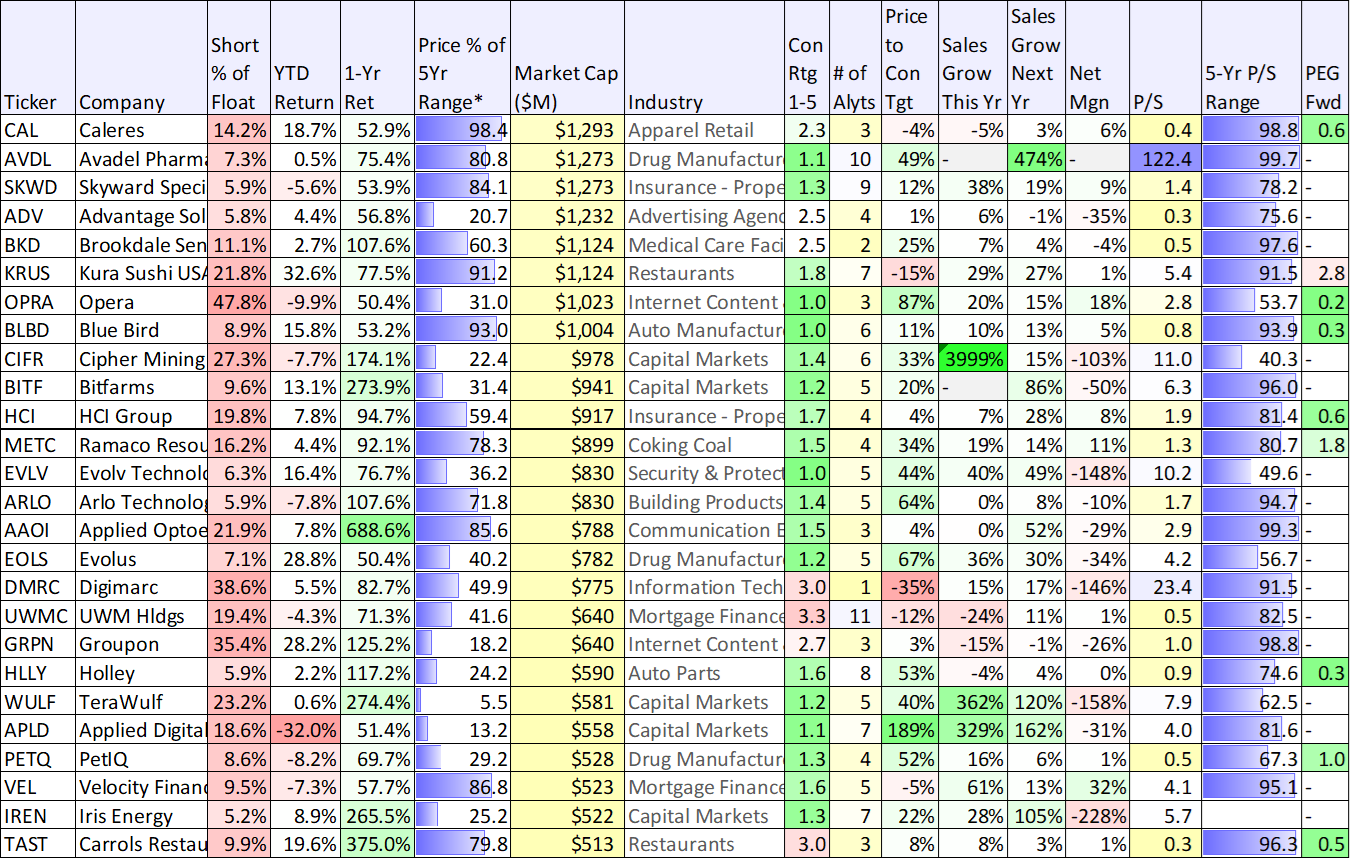

The following table shows stocks that have returned at least 50% over the last 1-year, but also have at least 5% short interest (i.e. people “betting against the shares”). The table is sorted by market cap, and we also included the “Magnificent 7” for comparison purposes. Lots of good data in the table, including analyst ratings, upside versus price targets and various valuation metrics, to name a few.

Some investors believe the market is overheating, and look for opportunities to sell income-generating put options on attractive businesses to generate upfront premium income, but also to provide the potential to pick up good businesses at a lower price (if the share price pulls back and the shares get put to them). This can be a good strategy for some investors, but as long-term investors (many years investment horizon) we simply look to buy (and hold) good businesses trading at attractive prices.

(Note: Data is as of Wednesday morning 2/14. Source is StockRover. Biotech stocks have been excluded from the table).