If you are like a lot of people: (a) you recognize stocks have been very strong and may be due for a pullback, and (b) you don’t need homeruns from your investments at this point in life, just steady high income and a lot less volatility than the overall market. In this report, we review an attractive 8.4% yield “balanced” CEF with a healthy dose of utilities stocks (known for steady dividends and lower volatility), plus a side helping of bonds (also known for steady income) and a prudent amount of leverage (~25%). It also trades at a significantly lower price premium that it has been (compelling entry point) and pays distributions monthly.

DNP Select Income Fund (DNP), yield: 8.4%

The DNP Select Income Fund (DNP) is a diversified closed-end fund (“CEF”) that first offered its common stock to the public in January 1987. Its primary investment objectives are current income and long-term growth of income. Capital appreciation is a secondary objective.

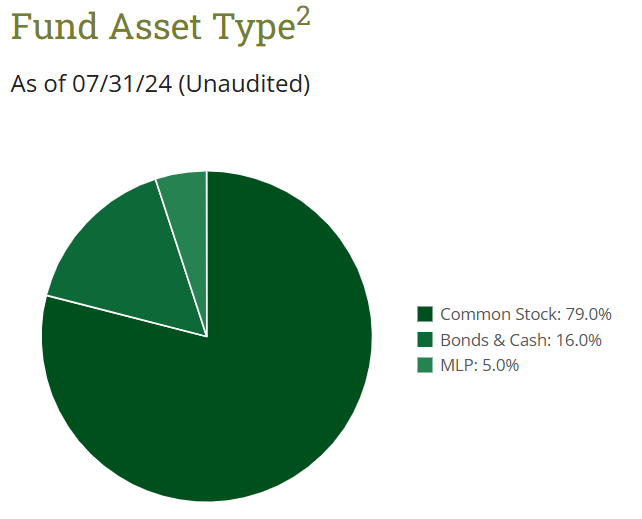

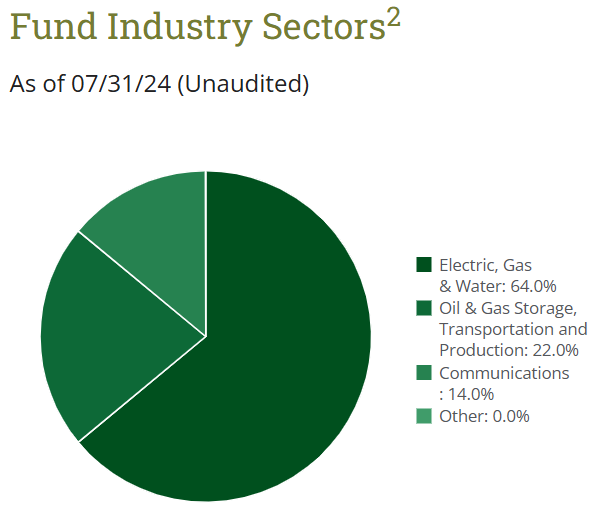

DNP seeks to achieve its investment objectives by investing primarily in a diversified portfolio of equity and fixed income securities of companies in the public utilities industry.

Under normal conditions, more than 65% of the Fund's total assets will be invested in securities of public utility companies engaged in the production, transmission or distribution of electric energy, gas or telephone services.

You can view the fund’s recent investment allocations, and top 10 holdings, below.

Why We Like DNP Now

From a high level, we like DNP for its high monthly income payments, diversified exposure to utility sector stocks and bonds, prudent use of leverage, and reasonable price premium (lower than normal).

But before investing in any CEF, there are seven critial questions we always consider (see graphic below).

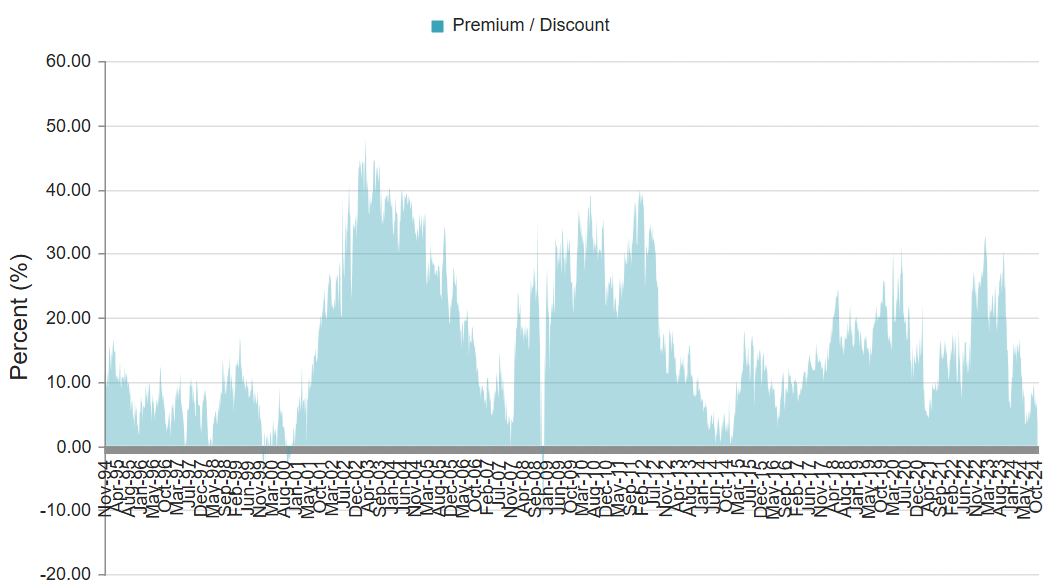

Reasonable Price Premium

To address one of the most interesting of the above questions, DNP currently trades at a small price premium relative to its own historical standards (a good thing) as you can see in the graphic below.

We view the current small premium (+2.77%) as a reasonable entry point for this strategy.

Reasonable Leverage

We view DNP’s current leverage ratio of 25.3% as quite reasonable for the strategy. In particular, utility stocks are less volatile than other sectors, and the combination of utility stocks with some fixed income securities (bonds) creates an attractive lower-volatility income stream that lends itself more prudently to leverage (for example, this much leverage would make us nervous if it was applied only to high-volatility semiconductor stocks). As such, the fund’s use of leverage prudently increases the income stream, and is quite attractive in our view.

Reasonable Expense Ratio

DNP’s management fee of 0.74% annually is reasonable for a CEF that provides exposure to utiltity stocks and bonds combined with a prudent use of leverage. Keep in mind there is an interest expense on the leverage (recently ~1.85%) and other expenses (~0.30%) which brings the total expense ratio closer to 2.88%, which is heafty but reaonable if you are going to hire someone (DNP, aka Duff & Phelps) to manage a CEF strategy for you, so you don’t have to do it yourself).

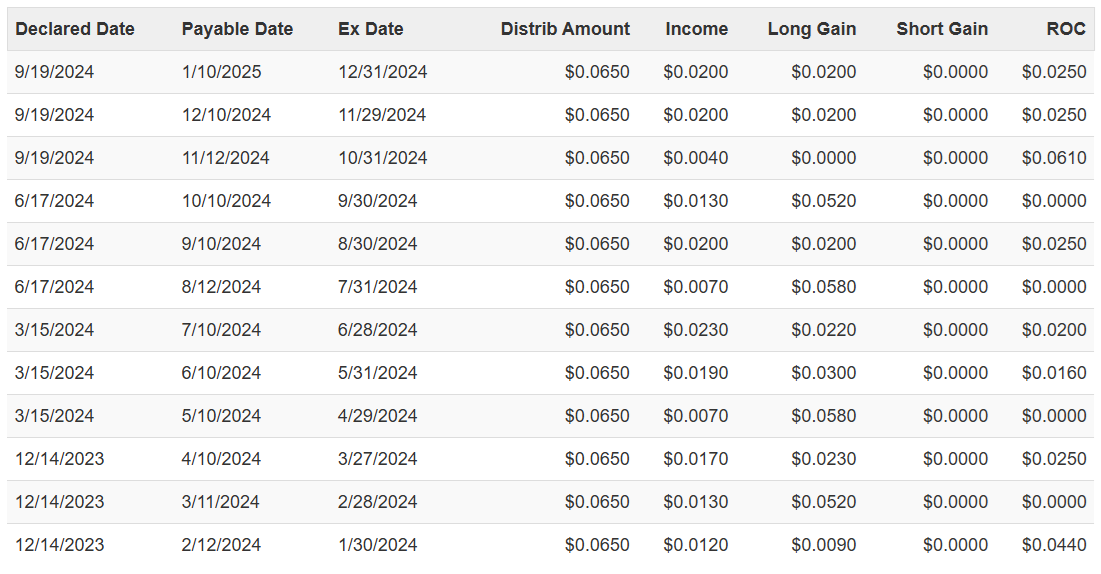

Return of Capital

Also important, the fund has been using a “return of capital” (“ROC”) to source part of the distributin in recent years. With the understanding that the fund’s underlying holdings (e.g. see top 10 list above) only yield around 5%, magnified a bit by the leverage, capital gains have not been enough to bridge the gap to the 8.4% total distibution yield, which means the fund has been returning some capital lately, as you can see in the chart below.

We view the ROC as acceptable considering it has been small, and considering the fixed income markets have been challenging in recent years. We’d like to see the ROC reduce (or go to zero) in the months and quarters ahead. But all things considered, we are comfortable with the level of ROC.

The Bottom Line

If you are looking for big steady monthly income, especially at a time when the more pure stock market has been precipitously strong, DNP is worth considering. It invests in lower volatility utility stocks and bonds and magnifies income prudently throught the use of leverage. The current premium to NAV is small and significantly lower than it has been historically (attractive). We are currently long shares of DNP in our Blue Harbinger “High Income NOW” Portfolio, and look forward to continuing high income in the months, quarters and years ahead.