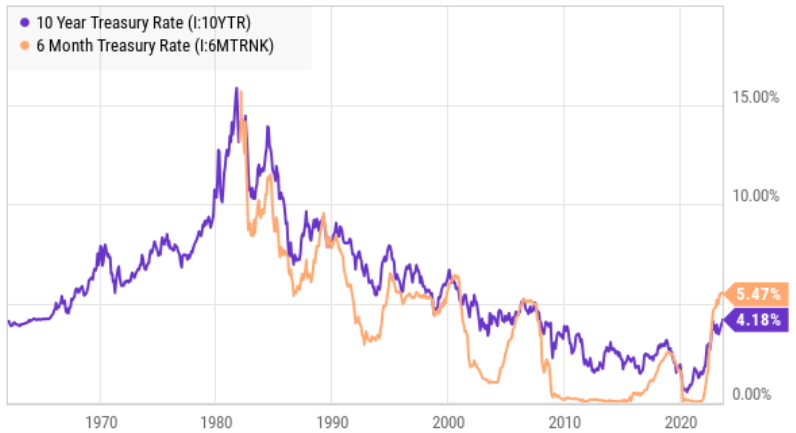

If you haven’t been paying attention, shorter-term interest rates have risen sharpy, and investments that seemed absurdly inappropriate just two years ago—are now worth considering. For example, a 6-month treasury bill (see chart below) now yields its highest rate in over 20 years! Specifically, it’ll pay you over 5.4%--whereas 2 years ago it was ~0.0%! And interestingly, short-term treasuries yield more than long-term treasuries (i.e. an inverted yield curve which some suggest is a sign of economic challenges on the horizon).

And aside from the utter stupidity of Congress debating the debt ceiling (and the negative impact that has had on US treasury ratings), treasuries are backed by the full faith and credit of the US government--which means they’re extremely unlikely to ever default (worst case scenario, payments could be delayed a few days/weeks in a government shutdown situation, but hopefully there is still enough common sense in Congress to avoid such an inappropriate debacle!).

The point is that since 2009 (see chart above), short-term rates have fairly consistently been ~0.0%, and this has prevented many investors from even considering them. Instead, many income-focused investors have moved into riskier dividend stocks and corporate bonds (or bond funds). And the price they have paid for this is more risk and volatility.

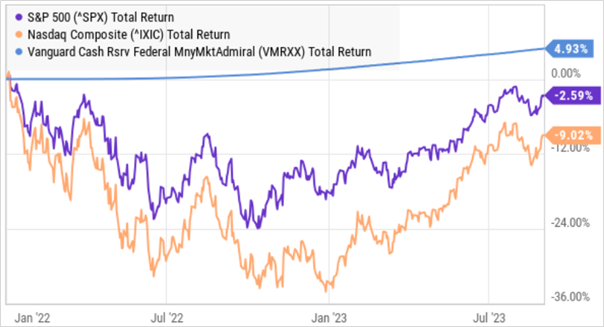

For example, the yield on Vanguard’s popular money market fund (VMRXX) is now 4.3%, and you can see in this next chart how steady that fund’s yield is compared to the S&P 500 or the Nasdaq (note: money market funds generally strike an NAV of $1.00 every day, after making any interest payments).

The increased yield combined with the steady price makes money market funds (and 6-month treasuries—as long as you hold them to maturity) a lot more compelling to investors than they were just a few years ago.

However, the risk of course is that you give up long-term price appreciation potential in exchange for the lower volatility. For example, here is a look at the same chart over a longer time period (below), and as you can see the stock market has performed a lot better (even though volatility has been a lot higher).

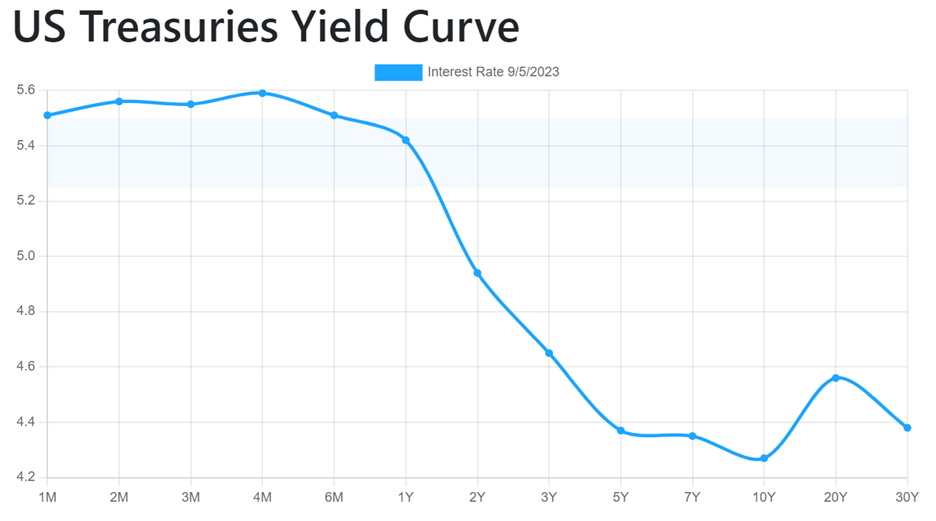

The point here is that if you are simply looking for safe income, you have a lot more options than just a few years ago. Specifically, money market funds are a lot more attractive (because of the higher interest rates), and so are US government treasuries (here is a look at the yield curve, below, so you can see the different rates available on treasuries with varying time to maturity).

Conclusion:

The bottom line here is that if you are an income-focused investor, you don’t have to put all your money into dividend stocks and bond funds just to earn some yield. Money market funds and US treasuries now pay 4-5% and up, and with a lot less volatility risk. Further, treasuries and money market funds can be appropriate for a portion of your nest egg, depending on your personal situation. And if you are looking for even higher yields for a portion of your investments (and willing to take on more price volatility risk) here is a link to our Top 10 Big-Yield Investment Opportunities.